Why the Venture Capital Secondary Market Is Booming in 2025

As IPOs stall and private equity stays locked up, secondaries are becoming the fastest-growing exit path in VC

The venture capital machine was designed to be simple: fund startups, help them grow, then cash out through IPOs or acquisitions. But in 2025, that engine is sputtering. IPOs are scarce, M&A has slowed to a crawl, and billions in paper gains are stuck inside private portfolios.

LPs are getting restless. GPs are looking for ways to return capital. Founders are watching their equity collect dust instead of liquidity…

Brought to you by Vanta: ✅ SOC 2 without the chaos

SOC 2 is one of the first things customers ask for—but it doesn’t have to slow you down.

Vanta’s checklist gives you a clear, startup-friendly path so you can get compliant fast, even without a security team.

While everyone’s waiting for the IPO window to reopen, a different market is quietly surging: venture secondaries. In 2024, the buying and selling of existing stakes in startups and VC funds hit $152 billion, up 39% year over year. What used to be a backroom liquidity hack is now essential infrastructure, and it’s rewriting how venture capital works from the inside out:

Table of Contents

The Exit Problem: Why Traditional VC Liquidity Is Broken

Secondaries Explained: Liquidity in Venture Capital in a Frozen Market

The Numbers Don’t Lie: VC Secondaries Are Booming

Continuation Funds: VC Exit Without Actually Exiting

VC Secondary Market: Rise of Retail Capital and Evergreen Funds

Secondaries Come With Trade-Offs: What to Watch Out For

Why This Isn’t a Fad: Secondaries Are Now Core to VC Fundraising

VC Liquidity Isn’t a Bonus, It’s the New Benchmark

1. The Exit Problem: Why Traditional VC Liquidity Is Broken

The venture capital machine thrives on the promise of liquidity, turning patient capital into realized returns. But in 2024, that engine stalled. VC exits remained muted on both sides of the Atlantic. IPOs were rare, M&A activity stayed shallow, and liquidity in venture capital, the lifeblood of the asset class, was hard to come by.

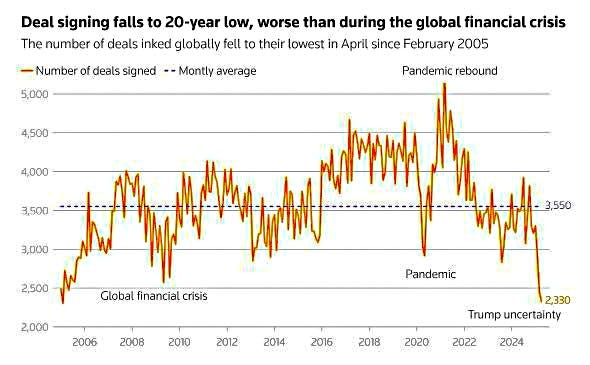

According to KPMG’s Q1 2025 global M&A and IPO report, the IPO market in 2025 remains sluggish. U.S. listings have barely moved the needle, while Europe accounted for nearly half of global IPOs, a sign of just how constrained the U.S. market continues to be. M&A didn’t fare much better.

Global deal volumes ticked up by about 12%, but that was largely a technical rebound from the 2022–2023 trough. For most venture-backed startups, traditional exits are either unavailable or unattractive.

This prolonged stagnation has stretched hold periods well past the norms that most funds were built around. Venture capital firms that raised money in the mid-2010s are now nearing or exceeding their end-of-life dates, with few liquid wins to show for it.

According to Preqin, global venture capital AUM hit $3.1 trillion in 2024, fueled by years of fundraising and paper markups. But real cash distributions haven’t kept pace. DPI in venture capital (Distributions to Paid-In capital) has lagged significantly. Many funds are still sitting below 1x DPI, with exits delayed far beyond the expected 7–10 year window.

Europe mirrors the trend. BVK’s 2024 global venture report noted that median time to exit across European portfolios now exceeds 11 years. With the VC exit slowdown dragging on, even mature startups are trapped, ready for a liquidity event, but with no viable route.

This gridlock has broader implications. LPs, starved for distributions, hesitate to re-up. GPs face pressure to extend funds, mark down valuations, and justify delayed realizations. And founders, stuck in a holding pattern, face talent retention challenges as equity remains illiquid.

Against this backdrop, a clear solution has emerged - secondaries. With traditional exits bottlenecked, the venture capital secondary market has stepped in as the system’s pressure valve, offering flexible, often faster paths to liquidity when IPOs and M&A can’t deliver.

2. Secondaries Explained: Liquidity in Venture Capital in a Frozen Market

In a market where traditional exits are on pause, secondaries have stepped in as a vital workaround. The venture capital secondary market refers to the buying and selling of existing stakes in startups or VC funds, unlocking liquidity without waiting for an IPO or acquisition. It’s no longer a niche corner of the industry. Secondaries have become a core pillar of modern venture strategy.

There are three primary types of secondary transactions, each serving a different pain point in the venture ecosystem:

1. LP-Led Deals:

These are initiated by limited partners looking to sell their stake in a venture fund. Instead of waiting another five years for DPI to materialize, an LP offloads its interest to a secondary buyer, who steps into the fund and assumes the LP’s share of future distributions.

LP-led deals have surged in popularity as institutions rebalance portfolios amid prolonged illiquidity. According to Lazard, they made up over half of secondary volume in 2024, particularly in older vintage funds where returns have stalled.

2. Direct Secondaries:

In these deals, shareholders - often early investors, founders, or employees - sell their actual equity in a private startup. This could happen through a one-off transaction or a broader tender offer.

Direct secondaries help companies reward long-time team members, give early backers an exit, or clean up their cap table ahead of a future round. They’ve become more common as startups linger in the private markets far longer than expected.

3. GP-Led Continuation Vehicles:

This is where the fund manager, or general partner (GP), leads the transaction. Typically, the GP spins out one or more portfolio companies from an aging fund into a new vehicle, which is then capitalized by secondary buyers. LPs in the original fund can either cash out or roll their exposure into the new vehicle.

These VC secondaries in 2025 are often built around “trophy” assets, companies that are thriving but not yet ready for public markets.

For the GP, it’s a way to hold winners longer while giving LPs optional liquidity. For new investors, it’s a chance to buy into high-performing startups at negotiated terms.

Together, these transaction types solve a critical challenge - secondary liquidity in VC. When traditional exits stall, secondaries let capital keep moving. LPs can rebalance. Founders and employees can partially cash out.

GPs can reset the clock on high-conviction companies. And secondary investors get access to late-stage growth at a discount, often with less risk than early-stage bets.

That’s why secondaries are now actively planned for. Top-tier funds are integrating secondary options into their lifecycle. Startup boards are getting comfortable with structured liquidity events. And allocators are increasingly viewing secondaries as a standard mechanism to manage duration and risk.

In a frozen market, secondaries offer flexibility, speed, and strategic control. They’ve gone from being a workaround to becoming a feature of how venture capital really works today.

3. The Numbers Don’t Lie: VC Secondaries Are Booming

The data tells a clear story - secondaries are no longer a backup plan, they’re a growth engine. In 2024, the private secondary market hit an all-time high of $152 billion in transaction volume, up nearly 39% from 2023.

That’s not just a recovery. It’s an inflection point. By mid-2025, the market is on pace to break that record, fueled by pent-up demand from LPs and fund managers alike.

Venture Is No Longer a Niche

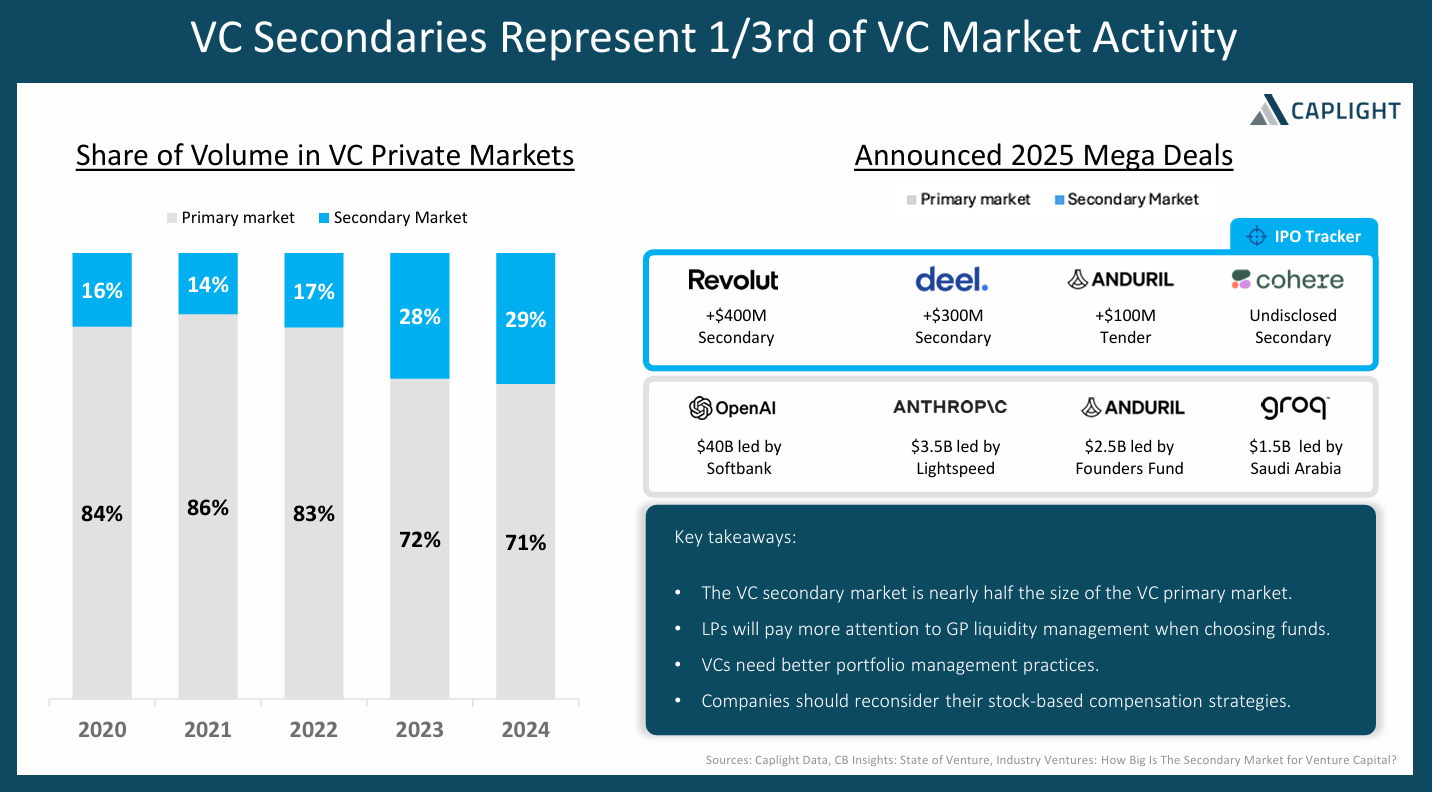

What’s changed is how much of that activity now involves venture. VC secondaries, once a quiet backwater of the market, have moved into double-digit shares in both deal volume and strategy.

On the GP-led side, continuation vehicles centered on venture-backed companies are now a critical part of the VC fund liquidity stack. Single-asset CVs, often built around breakout companies that aren’t ready for IPO, are becoming the preferred way to reset timelines and give LPs optionality.

A More Competitive, Mature Market

Several key shifts have pushed secondaries into the mainstream:

Higher pricing: The average discount for venture assets has narrowed to ~75% of NAV in 2025, up from the high 60s in 2023.

Bigger buyers: Firms like StepStone, BlackRock, and Coller Capital are raising multi-billion-dollar vehicles focused on secondaries.

More participants: Wealth platforms and evergreen funds are adding new capital sources, making the secondary market data in 2025 more robust than ever.

Faster execution: Institutional buyers are moving faster, with shorter diligence cycles and greater comfort underwriting venture positions.

This isn’t just opportunism, it’s a sign of the growth of secondaries as a reliable and repeatable strategy in the VC playbook.

From Relief Valve to Strategic Lever

The secondary market has evolved from a liquidity lifeline into a strategic lever. Today, GPs use secondaries not just to clean up cap tables, but to hold onto winners, manage risk, and align incentives. LPs use them to actively manage exposure, free up capital, or rebalance portfolios, all without waiting for a formal exit.

In other words, secondaries have gone from being a temporary workaround to a permanent fixture of the VC fund liquidity ecosystem. The growth of secondaries is no longer reactive. It’s structural, deliberate, and built for scale.

4. Continuation Funds: VC Exit Without Actually Exiting

When liquidity dries up, GPs still need ways to generate outcomes. That’s where GP-led secondaries, and especially continuation vehicles, have become the go-to play.

In simple terms, a continuation fund is a new vehicle created by the general partner (GP) to hold one or more portfolio companies from an existing fund. The original fund sells those assets to the new vehicle, and the capital for that purchase comes from secondary buyers. Existing LPs can either cash out or roll their interest into the continuation vehicle.

Why Single-Asset CVs Are Gaining Ground

While multi-asset deals still exist, the market is clearly tilting toward single-asset CVs. These structures are typically used for high-performing companies that are still growing but face delayed public exits. Instead of forcing a sale in a soft market, the GP moves the asset into a dedicated vehicle and brings in new investors to fund the next phase of growth.

There are clear benefits:

Liquidity for LPs who’ve waited years for an exit

Extended upside for the GP and rollover LPs in a company they still believe in

Fresh capital to support the company without triggering dilution or external pressure

It’s a strategic reset; GPs get to retain their best assets and double down, while LPs finally see some movement on DPI.

GP-led secondaries made up nearly half of all secondary market volume in 2024, with single-asset CVs comprising 48% of that. The model is especially popular with venture and growth funds holding mature breakout companies. Firms like Insight Partners, NEA, and Lightspeed have all used continuation vehicles to keep holding winners while giving LPs options.

Changing the GP–LP Relationship

This trend is also reshaping the power dynamics between fund managers and their investors. GPs are no longer just stewards of closed-end funds, they’re becoming architects of flexible liquidity strategies. And LPs, in turn, are demanding more transparency, cleaner economics, and fairness around the process.

Done well, a GP-led secondary builds trust and alignment. Done poorly, it can raise eyebrows.

Risks Still Linger

Despite the upside, continuation vehicles come with real challenges:

Valuation risk: The GP sets the price, so fairness must be independently validated to avoid conflicts of interest.

Governance complexity: The same firm is on both sides of the deal, seller and buyer, raising questions around fiduciary duty.

Execution burden: These are complex, multi-party transactions that require time, capital, and legal choreography.

Regulatory scrutiny: As these deals grow in size and frequency, regulators are beginning to push for stronger safeguards, especially in the U.S.

Still, as the IPO window remains slow, single-asset CVs offer a path forward, blending continuity with optional liquidity.

In 2025, GP-led secondaries are being seen as more than clever solutions. They’re a fundamental evolution in how venture firms create outcomes and how LPs experience liquidity.

5. VC Secondary Market: Rise of Retail Capital and Evergreen Funds

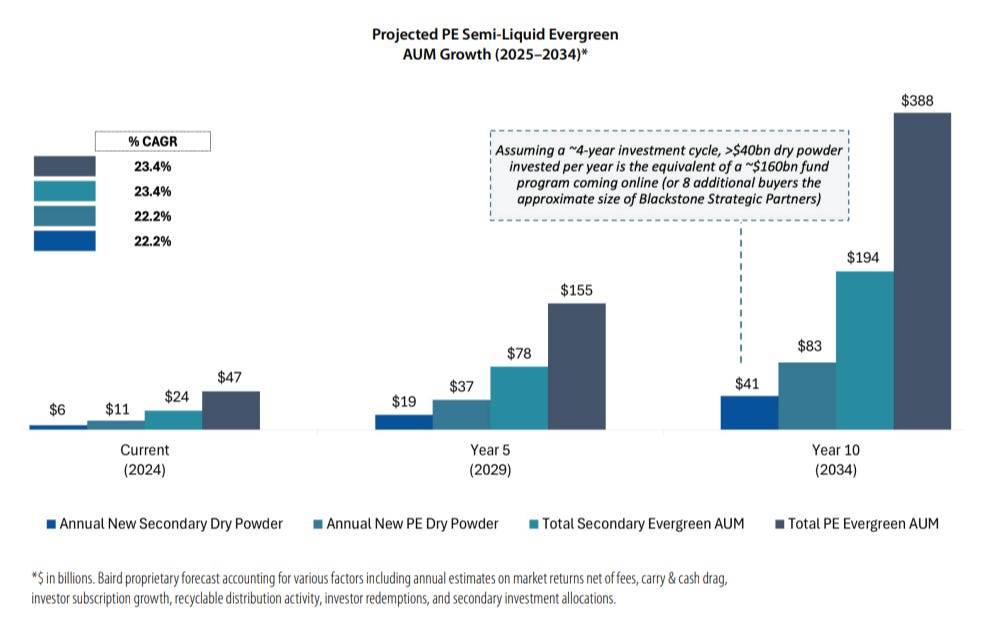

The secondary market is evolving. One of the biggest shifts in 2025 is who’s buying. While traditional secondary players still dominate, retail investors and wealth managers, often via evergreen private equity funds, are becoming a powerful force in the market.

The Rise of Evergreen Funds in Secondaries

Unlike traditional closed-end funds, evergreen funds are designed for ongoing capital raising and redemption.

They allow new investors to come in and existing ones to exit on a rolling basis, often quarterly, making them well-suited for investors who want exposure to private markets without a 10-year lockup.

To meet these redemption cycles, evergreen funds need steady access to liquid or semi-liquid assets. That’s where secondaries come in. These funds actively acquire stakes in later-stage private companies or mature fund positions with clear exit timelines. In doing so, they provide secondary liquidity to sellers and create portfolio turnover for themselves.

Platforms like StepStone and Hamilton Lane have led the way. Hamilton Lane’s evergreen product, for instance, gives accredited investors access to diversified private equity exposure, including evergreen funds secondaries, with relatively low minimums and periodic redemption windows.

Others have followed, creating a fast-growing retail channel that was almost nonexistent five years ago.

Retail Demand Is Changing Pricing Dynamics

This influx of retail investors in VC via evergreen vehicles has real pricing power. Unlike some institutional buyers who demand steep discounts, evergreen funds are often willing to pay closer to NAV. Their goal is stable access, not bargain hunting. And they’re deploying capital quickly, especially when public markets are volatile and traditional fund flows slow down.

As a result, secondary market premiums, or at least tighter discounts, are becoming more common, especially for high-quality venture assets. According to Private Equity International, evergreen-driven demand was a key reason that average pricing for diversified secondaries improved in late 2024 and early 2025, with top-tier venture portfolios trading near 85–90% of NAV.

The impact is twofold:

a) Sellers are getting better outcomes, even in a soft exit market.

b) Buyers, particularly in evergreen structures, are helping normalize secondaries as a routine part of portfolio strategy.

From Institutional to Individual: The Broader Implications

The entrance of retail capital is expanding the definition of what the secondary market looks like. What used to be negotiated between a few large LPs and specialist funds is now influenced by a wider set of actors, some of whom are tapping into retail wealth at scale.

This doesn’t just change who participates. It changes how secondaries behave. Faster timelines, more competitive bids, and a wider range of exit options mean that evergreen private equity funds aren’t just adding volume, they’re reshaping expectations.

6. Secondaries Come With Trade-Offs: What to Watch Out For

The secondary market may be booming, but it's far from frictionless. Beneath the growing volumes and rising institutional interest lie real risks, especially in venture. For all their benefits, secondaries carry trade-offs that demand sharp diligence and structural care.

Discounts Are Deep, and Sometimes Distorted

Perhaps the most widely cited issue in VC secondaries is the discount to reported valuations. In 2024, many venture portfolios changed hands at 40–60% discounts to NAV, reflecting both market uncertainty and skepticism toward inflated 2021-era marks.

While pricing has narrowed somewhat in 2025, the average NAV discount in VC remains steep, particularly for companies in sectors that have yet to reprice through new funding rounds.

These discounts can cut both ways. For sellers, they may feel punitive, especially when the underlying company hasn’t actually deteriorated. For buyers, they’re a hedge against opacity. Either way, they distort the value transfer and highlight just how murky valuation has become in the absence of real-time benchmarks.

Pricing Transparency Remains a Challenge

One of the defining secondary market risks is valuation opacity. Unlike public markets, there’s no open order book or daily mark-to-market.

Pricing is often pegged to outdated financing rounds or GP-supplied NAVs. This creates wide bid-ask spreads, especially in direct secondaries and continuation vehicles where no third-party validation exists.

When data is stale or governance is unclear, it's not uncommon for buyers to walk, or for sellers to hold off. The result is more friction, longer timelines, and a growing need for fairness opinions and independent pricing mechanisms.

Rights of First Refusal Can Derail Deals

In the secondary market for startups, structural blockers like rights of first refusal (ROFRs) often stall deals before they start. ROFRs, common in startup shareholder agreements, give existing investors or the company itself the right to match any offer made by an outside buyer.

While designed to protect cap tables, ROFRs have become a major hurdle to liquidity. They inject uncertainty into deal timelines, complicate negotiations, and in some cases, prevent entirely valid transactions from closing. For employees or early angels hoping to partially cash out, ROFRs can turn liquidity into a waiting game.

Regulatory and Process Risk Is Growing

As GP-led secondaries and continuation vehicles become more common, regulators are starting to look more closely at process integrity. The SEC has proposed new disclosure rules aimed at reducing conflicts of interest when GPs orchestrate sales between their own funds. The concern is clear - when the same party sets the price and benefits from the upside, the potential for misalignment with LPs is high.

LPs themselves are getting more vocal. They’re asking for third-party valuations, opt-in structures, and better information rights. And in Europe, regulatory bodies are watching how these transactions are being executed, especially where retail capital is involved.

Secondaries are solving the liquidity puzzle, but they’re not without sharp edges. As they become core to the venture capital toolkit, the market must mature not just in volume, but in standards. Price, process, and fairness will define who earns trust in the years ahead.

7. Why This Isn’t a Fad: Secondaries Are Now Core to VC Fundraising

What began as a workaround for a frozen IPO market has become something much larger. In 2025, secondaries are evolving into a defining feature of modern VC fund strategy, a structural tool to manage timelines, rebalance portfolios, and meet shifting investor expectations.

A Permanent Shift in How VC Gets Built and Managed

Venture capital has historically been an asset class of long horizons and limited liquidity. But as funds age, startups stay private longer, and LPs grow more demanding, that playbook has changed. Today’s leading firms aren’t just picking startups, they’re architecting liquidity.

Top-tier managers are now proactively building secondary paths into their fund lifecycle. Whether through continuation vehicles, structured tenders, or LP-led transfers, secondaries are now baked into how funds are managed, not just when things go wrong, but as a feature of responsible capital stewardship.

According to BlackRock’s 2025 outlook, the market is moving toward more structured deals, improved pricing clarity, and broader acceptance of secondaries as a permanent liquidity layer across portfolios. In other words, secondaries are gaining both traction and trust.

Founders and LPs Are Adjusting Too

It’s not just GPs driving this shift. Founders, too, have embraced secondaries as a legitimate way to retain talent, realign cap tables, or extend private growth periods without pressure to rush to IPO. In a world where exit timelines exceed a decade, partial liquidity isn’t seen as a weakness, it’s viewed as a smart strategy.

LPs, for their part, are now underwriting venture funds with an expectation of built-in liquidity options. Many are explicitly negotiating transfer rights, liquidity windows, and opt-in secondary mechanics during fund formation. The idea that liquidity in venture capital only arrives at the end of a fund’s life is officially outdated.

What was once viewed as a deviation from the norm is now core infrastructure. Firms that integrate secondaries smartly signal maturity to LPs. Founders who participate in well-structured secondaries gain retention and strategic breathing room. And investors increasingly expect that funds will actively manage liquidity, not just wait for it.

The Future of Secondaries Looks Even More Central

Looking ahead, the future of secondaries is only getting more institutionalized. Dedicated secondary funds focused solely on venture are on the rise. Hybrid strategies are blurring the lines between primary and secondary capital, and evergreen platforms are becoming permanent sources of demand. Many LPs are now betting that secondary exposure could outperform traditional buy-and-hold strategies over the next decade.

For venture capital, that means secondaries aren’t a reaction to dysfunction. They’re an evolution of the model. A way to build more resilient funds, reduce blind-pool risk, and serve a more sophisticated base of stakeholders.

8. VC Liquidity Isn’t a Bonus, It’s the New Benchmark

The surge in VC secondaries in 2025 isn’t driven by optionality. It’s driven by necessity. Venture firms, founders, and LPs aren’t embracing secondaries because it’s fashionable; they’re doing it because the old playbook no longer works on its own.

With IPOs slow, M&A selective, and fund timelines stretching beyond a decade, venture capital liquidity solutions have become a structural requirement. The market has evolved, not just in how capital is deployed, but in how and when it returns. That means liquidity isn’t a “nice to have” anymore. It’s a baseline expectation.

In today’s environment, success isn’t measured only by IRR on a spreadsheet. It’s judged by actual cash distributions. The DPI vs IRR debate has taken center stage, and LPs are increasingly focused on realized returns, not just paper marks. That shift in mindset is forcing GPs to build smarter, more flexible VC exit strategies, and secondaries are right at the heart of that.

Whether through LP-led transfers, GP-led continuation vehicles, or retail-fueled evergreen demand, secondaries are reshaping what it means to win in venture. They’ve redefined liquidity as a strategic tool, not the end of the journey, but a core part of managing the journey itself.

The message is clear - in this market, if you’re not planning for secondaries, you’re not planning for reality.

Startup Resources 🛠️

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox