Spray & Pray vs. High-Conviction🤔, Peter Thiel: AI or Bust🧨, Global VC Pulse Check🌍

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

🚀Are you ready for the EU AI act?

Vanta’s EU AI Act Checklist helps startups cut through the noise and stay compliant without slowing down.

✅ Understand how the Act impacts your product

✅ Get clear, actionable steps for compliance

✅ Avoid common pitfalls early

Stay ahead—download the checklist now.

In-Depth Insights 🔍

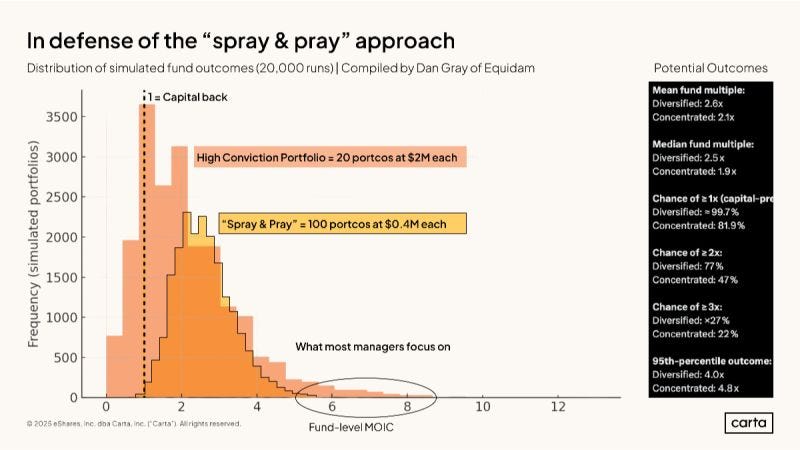

Spray & Pray vs. High-Conviction: What LPs Really Need to Know 🤔

Arjun Dev Arora unpacks why diversified portfolios aren’t lazy - they’re the only sane play when 90% of startups crash. Conviction is cool, but survival pays.

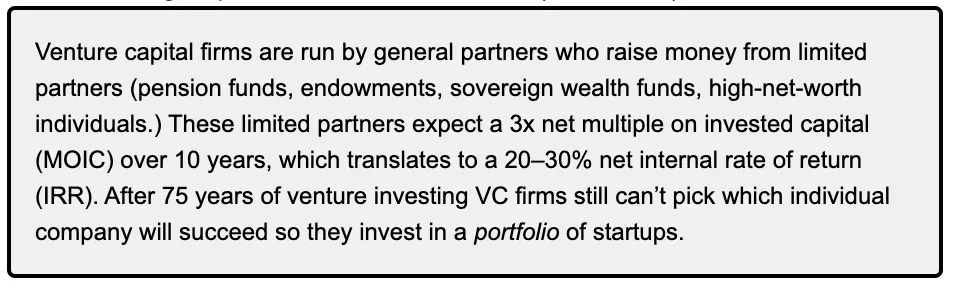

Why VCs Don’t Care About Your “Good” Business 💼

Steve Blank drops a hard truth: Investors aren’t here for your steady SaaS. They want 100x rockets, driven by hype cycles, FOMO, and fast exits. [Steve Blank]

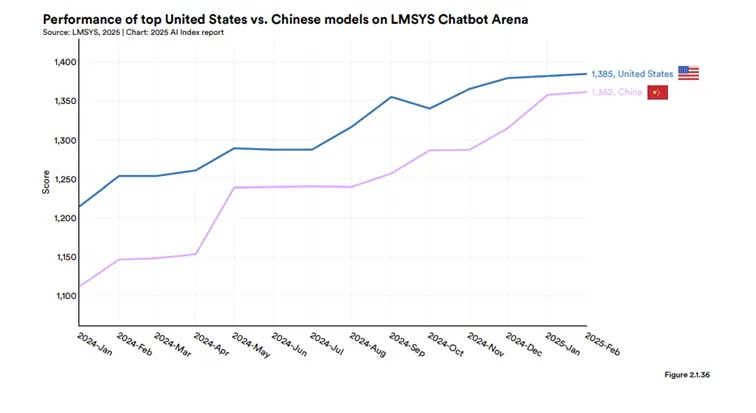

From Sputnik to Supply Chains: China's AI Vision 🧠

Axel Badalian explains how China’s AI strategy is less about winning Nobel Prizes and more about mass-producing “good enough” intelligence across supply chains, factories, and cities. [Axel Badalian]

Rob May Thinks Sequoia’s Wrong About AI 🧱

Forget the app layer - too crowded, too commoditized. Rob May says the real goldmine is AI infrastructure. Think shovels, not gold dust. [Rob May]144 Family Offices That Write Pre-Seed Checks 🔍

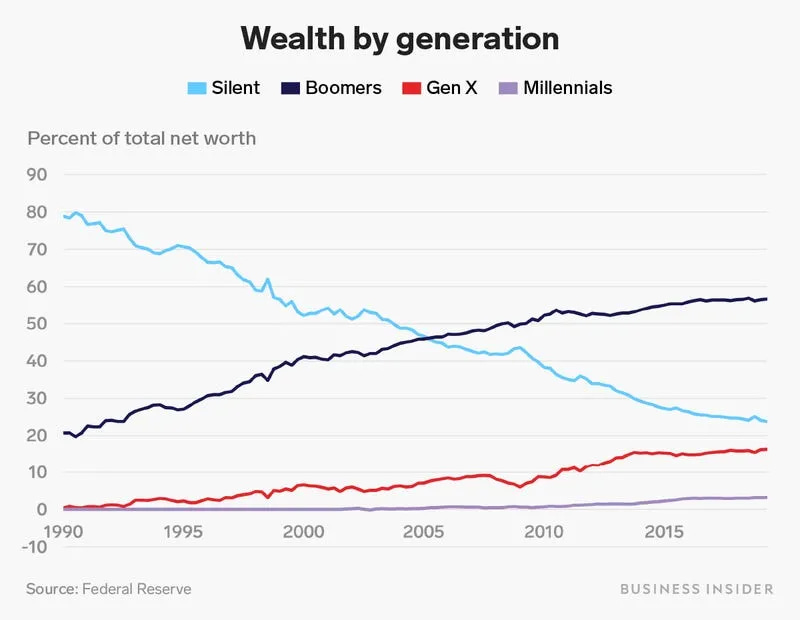

Ruben Dominguez Ibar breaks down why family offices are early-stage founders’ secret weapon - fast-moving, flexible, and check-ready without the VC baggage.Peter Thiel: AI or Bust 🧨

Guillermo Flor breaks down Thiel’s bleakest take yet: AI is our last shot at progress before we spiral into global sameness and soft-tech tyranny. [Guillermo Flor]

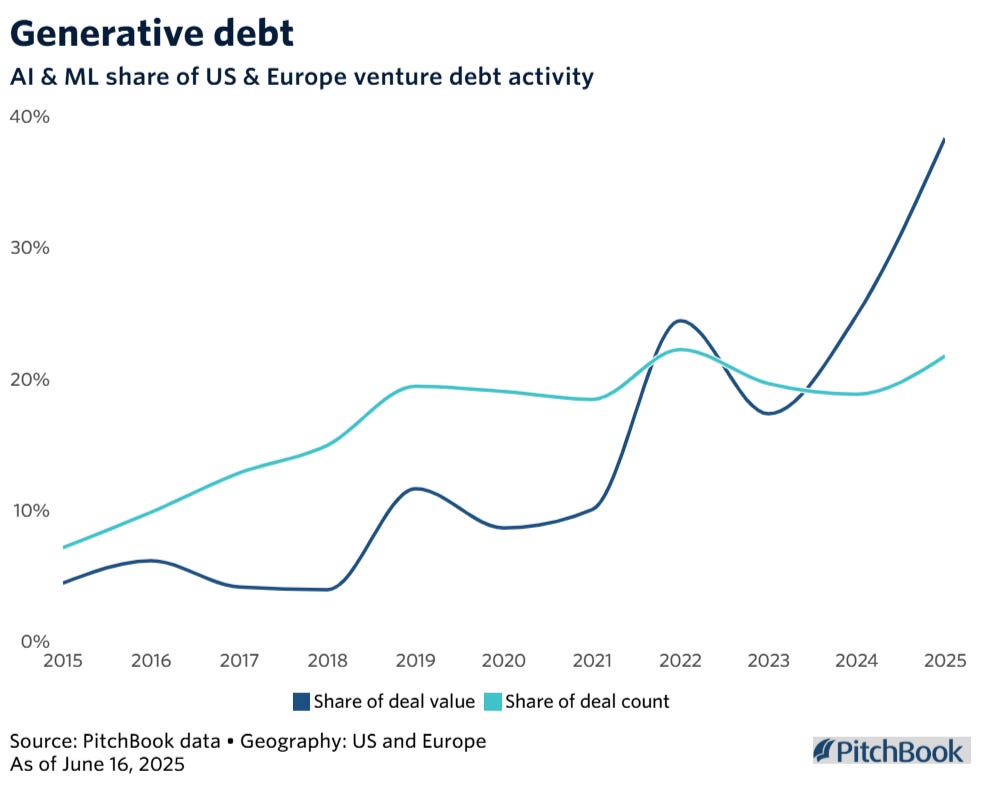

AI Startups Are Hoovering Up Venture Debt 💸🧠

38.4% of all venture debt this year is flowing into AI startups. Why? Sky-high compute costs, big valuations, and pressure to deliver yesterday. Revenue optional.

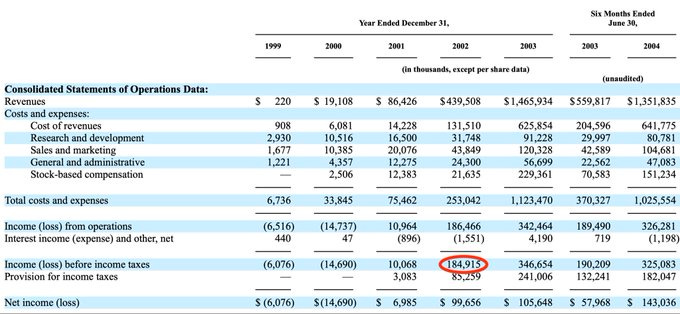

Google Made $185M in Year 4. Insane. 💰

Ben Gilbert drops a stat that feels illegal: four years in, Google was already printing $185M in pretax income. Who’s even come close since? (Seriously, we’ll wait.)

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

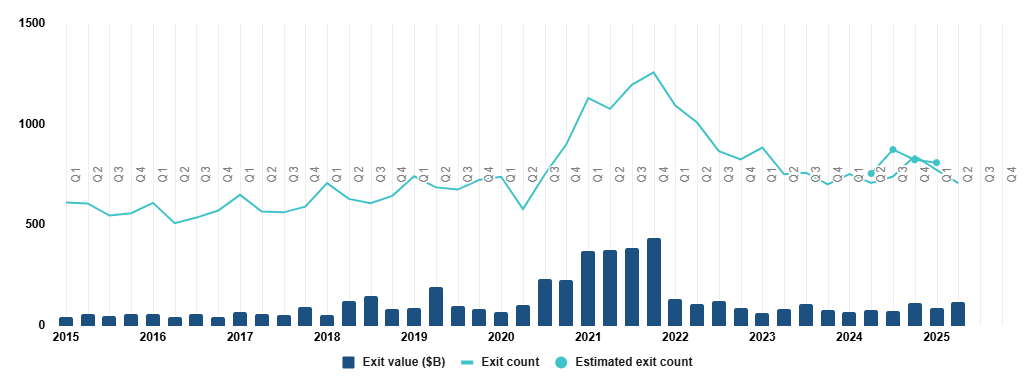

Global VC Pulse Check - Q2 2025 🌍

VC is still stuck in a liquidity chokehold. IPOs? Quiet. Exits? Rare. But AI? Still printing crazy valuations, dragging the market back to 2021 vibes - for better or worse.

What Healthcare Could Look Like in 2035 🏥

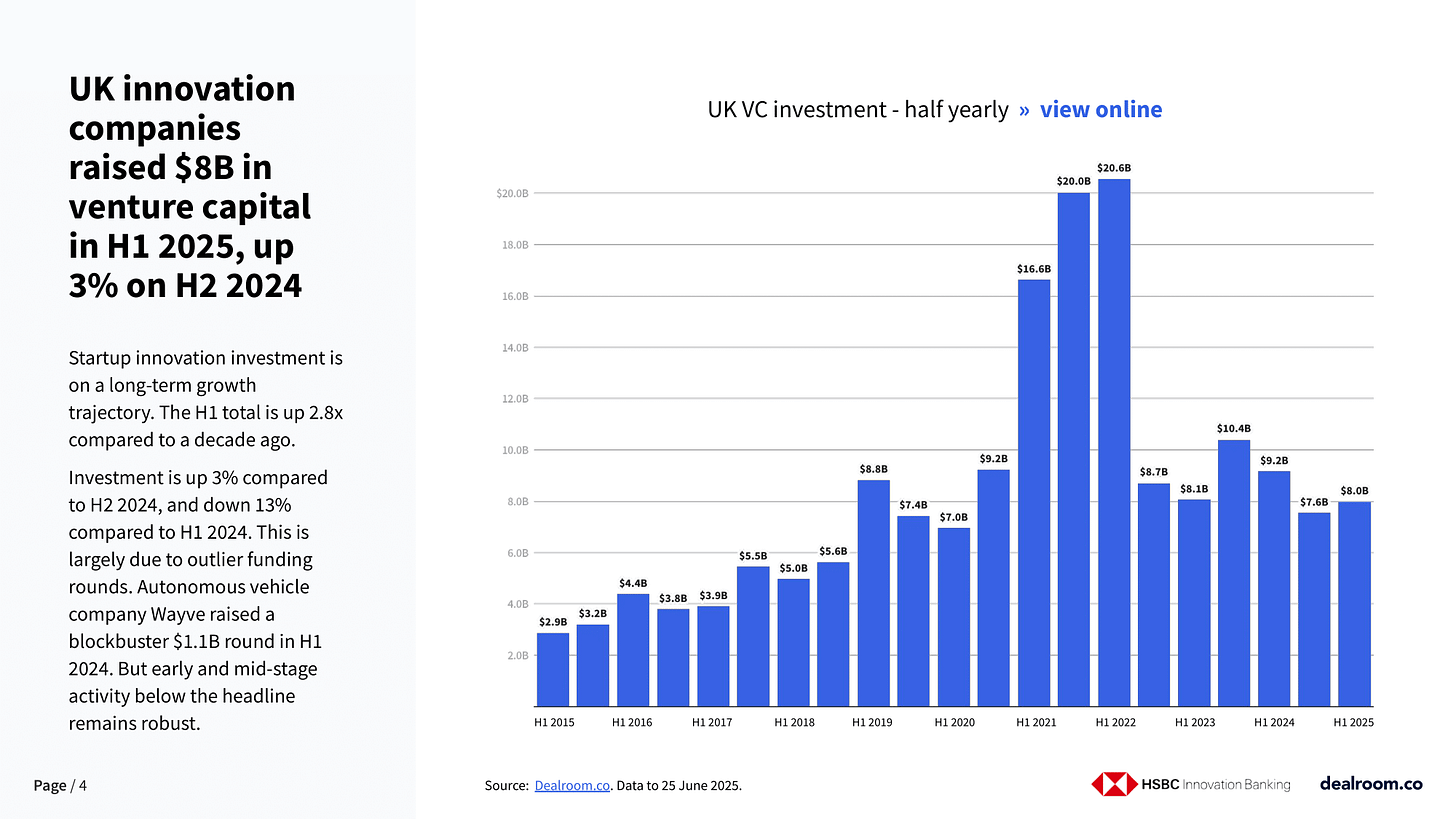

Imperial College (with NHS backing) lays out a bold 10-year vision - GLP-1s, AI, wearables, remote care, and more. It’s less hospitals, more data. Less waiting, more predicting.UK Innovation Snapshot - Q2 2025 📊

The UK is holding strong at #3 globally for innovation. Q2 numbers reveal key VC flows, hot sectors, and why the UK’s startup engine still has momentum despite macro headwinds.

Recently Launched Funds 💸

Arāya Ventures dropped a $26.3M debut fund to back up to 60 pre-seed and seed startups shaping fintech, health, commerce, and the future of work.

Catalio Capital Management secured $400M+ for Fund IV, doubling down on cutting-edge biomedical breakthroughs.

AN Venture Partners landed $200M for its first fund, bridging U.S.–Japan biotech innovation at scale.

Alliance VC hit a €40M first close for its Nordic AI fund - eyes set on €100M to fuel the region’s deep tech scene.

Halogen Ventures closed Fund III at $30M to back women-led startups reinventing family, childcare, and everyday life.

Iron Key Capital rolled out a Web3-native investment club, tapping Nikolas Casagrande to chart the DeFi course.

Chang Robotics Fund quietly deployed capital into five robotics plays - think automation, sustainability, and health.

Recognize Partners closed a massive $1.7B Fund II to reshape tech services - AI in, legacy out.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

LvlUp Ventures (New York City, NY): VC Scout (apply here)

Founders Future (San Francisco, CA): VC Investor (apply here)

Energy Impact Partners (Washington, DC): VC Associate (apply here)

Everywhere Ventures (Remote): VC Analyst (apply here)

Coinbase Ventures (Remote): VC Associate (apply here)

Everywhere Ventures (Remote): VC Analyst (apply here)

Arc Capital Partners (Los Angeles, CA): VC Associate (apply here)

Zero Prime Ventures (San Francisco, CA): Operations Manager (apply here)

Kinetic (London, England): VC Associate (apply here)

Cherry Ventures (Berlin, Germany): VC Internship (apply here)

Hottest Deals 💥

Field Medical, raised $35M Series B for its surgical robotics platform. (read more)

Deeto, landed $12.5M Series A to expand its customer intelligence platform. (read more)

Syntis Bio, raised $38M Series A for synthetic biology therapies. (read more)

Nexqloud, closed $2.3M pre-seed for its cloud database launch. (read more)

Icogz, raised $1.4M pre-seed for its AI business dashboard. (read more)

Feliqs, secured $9M Series A to build enterprise risk management tools. (read more)

Genesis AI, raised $105M to scale its decentralized AI marketplace. (read more)

Emerald AI, raised $24.5M to grow its vertical-specific LLMs. (read more)

SkyDrive, raised ¥8.3B (~$55M) in Pre-Series D to scale its eVTOL business. (read more)

Qedma, raised $26M Series A for quantum error-resilience tech. (read more)

Chai AI, topped $55M to scale its conversational AI platform. (read more)

Terrana Biosciences, raised $50M from Flagship Pioneering to build its biotech pipeline. (read more)

Circulate Health, raised $12M seed to reshape preventive care with analytics. (read more)

Wonderful, grabbed $34M seed to launch its AI wellness app. (read more)

Tailor, extended Series A to $22M to scale its legal AI platform. (read more)

RESOURCES 🛠️

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth? Startups

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Huge fan of Rob May’s article on AI investment - 👏 Finally, someone naming what most don’t want to admit.

The app layer’s running on borrowed time — orchestration hacks, webhook glue, and brittle integrations that won’t survive the move to autonomous execution.

The real investable bet isn’t another interface — it’s rebuilding the infrastructure layer AI will actually demand. Event-native, identity-resilient, and built to coordinate—not just compute.