The Dark Side of the 9-9-6 Work Culture⏰, AI's Impact on SaaS Growth🤖, VCs Are Rethinking Deal Sourcing🔍

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, and the hottest deals—here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Delve: SOC 2 killing your deals?

Delve gets you compliant in 15 hours, not 6 months.

SOC 2, HIPAA, GDPR—AI agents do the heavy lifting, even join sales calls.

▫️ Lovable: SOC 2 in days

▫️ 11x: Saved 143 hours, unlocked $1.2M ARR

▫️ Bland: Switched, closed $500K in 7 days

They’ll even migrate you from your current platform.

VC Corner readers get $1,000 off + free AirPods Pro with code VC1KOFF.

Book your demo → Compliance in days, not quarters.

In-Depth Insights 🔍

Seed Investors Are Shifting to Quicker Exits: Here’s Why 💸

Venture returns are down, and seed investors are adjusting accordingly. To meet limited partner demands for faster liquidity, they’re opting for earlier exits. This shift is shaking up how smaller funds manage their early-stage investments. [TechCrunch]

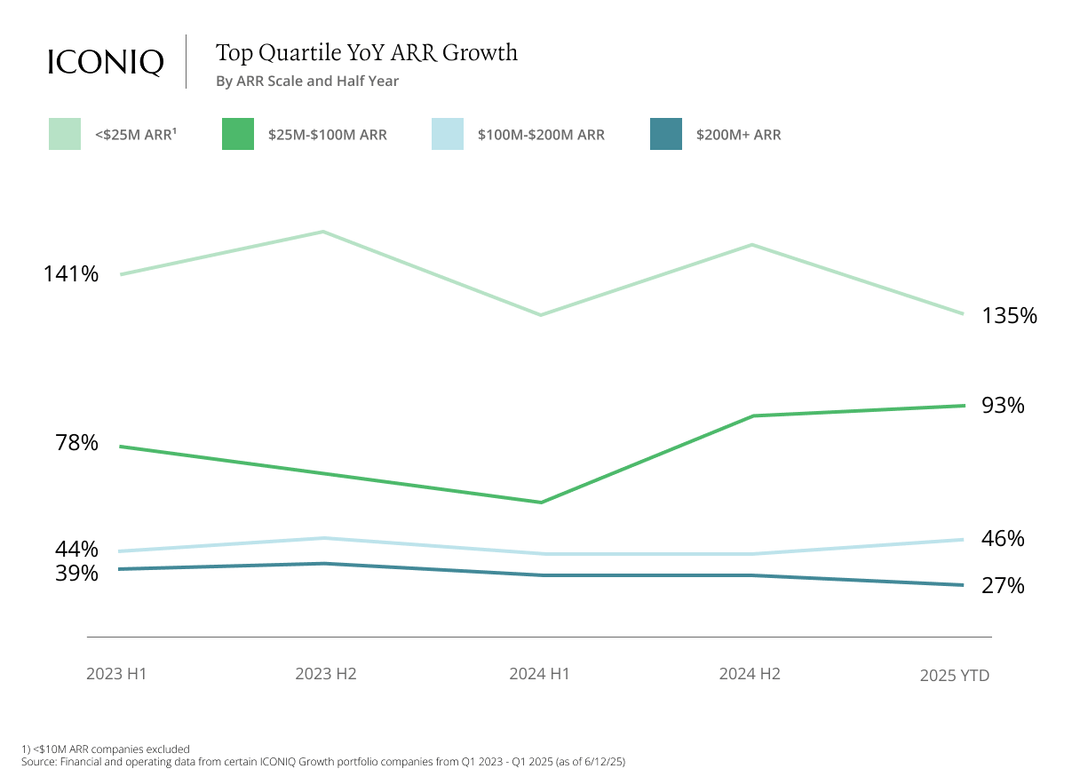

AI's Impact on SaaS Growth: The Shift From Process to Intelligence 🤖

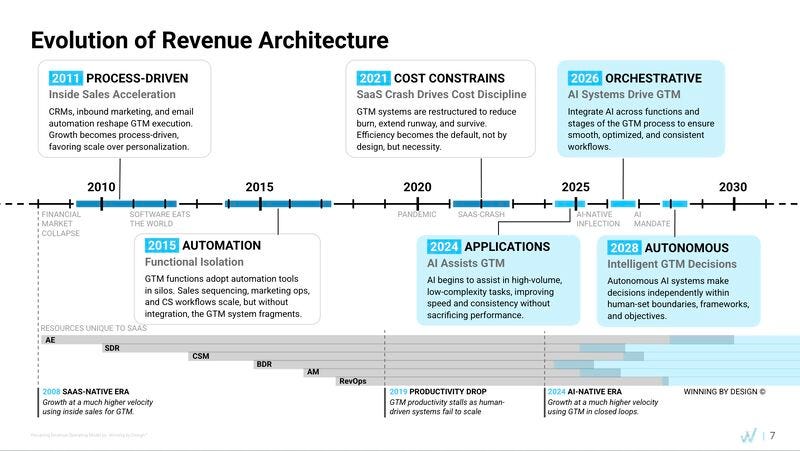

Jacco van der Kooij lays it out: AI is replacing traditional, process-driven SaaS growth strategies with intelligent, self-compounding systems. The result? Greater efficiency and scalability that’s changing the game.

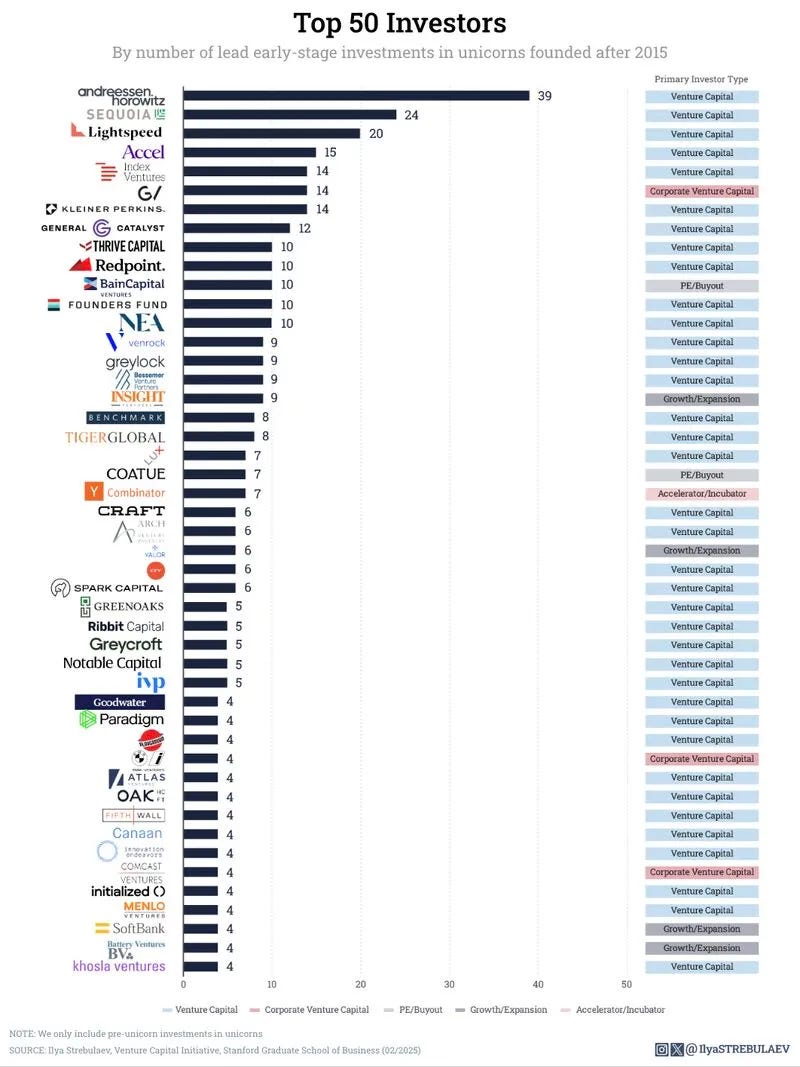

Not All Unicorns Stay $1B: A Stanford Study Unpacks the Risks 🦄

Stanford’s latest research exposes the risk in chasing unicorns: many $1B+ startups lose their valuation due to overvaluation. Andreessen Horowitz may be excellent at spotting them, but it’s clear that being early doesn’t guarantee success. [Doug Dyer]

VCs Are Rethinking Deal Sourcing: Here’s the New Approach 🔍

Sharon Vosmek shares the scoop on Astia Fund’s ‘sift’ strategy - an innovative deal sourcing method designed to lower failure rates by making smarter startup selections. It’s a new era in VC with more precision in backing. [Venture Capital Journal]

Space-Tech Funding Set for Record-Breaking Year 🚀

2025 is shaping up to be a blockbuster year for space-tech investments. Late-stage deals are pouring into established players, especially in defense and space exploration technologies. [PitchBook]

The Dark Side of the 9-9-6 Work Culture in Startups ⏰

The grueling 996 work culture - 12-hour days, 6 days a week - might be a startup’s shortcut to growth. But the price? Burnout and mental health breakdowns that threaten long-term sustainability. [PitchBook]

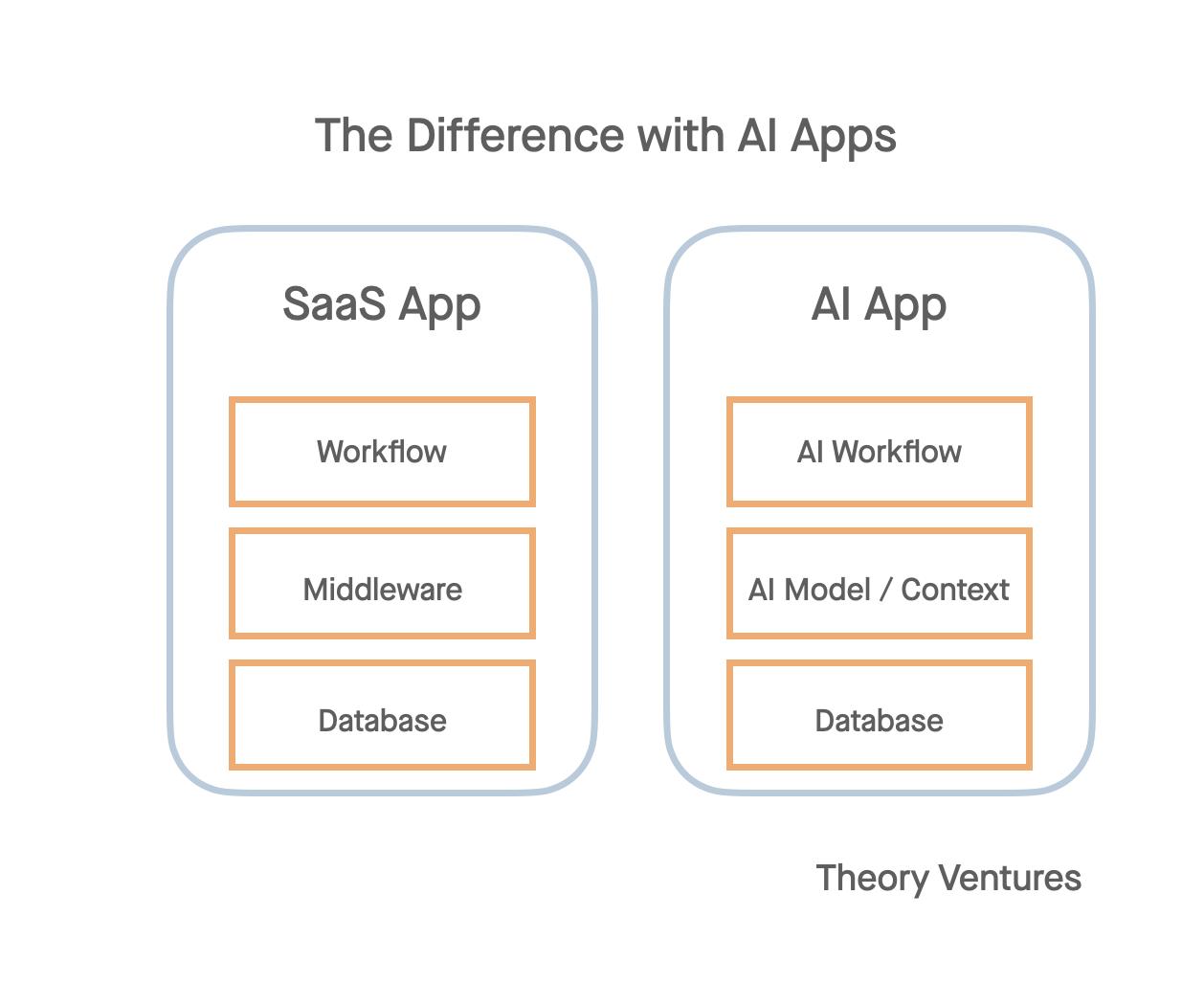

Why Data Is the New Code in the AI Era 💾

In AI-driven SaaS, data has eclipsed code as the true kingmaker. The right data architecture is what drives workflow efficiency and competitive advantage - making data a core differentiator in the industry’s evolution. [Tomasz Tunguz]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and my other media assets, email: rdominguezibar@gmail.com

Interesting Reports 📊

VC Landscape Shifts: Midyear Analysis 💡

Global tariffs are slowing IPO momentum, but AI startups are leading the charge in M&A activity. The big pivot? Innovation is now the name of the game. The second half of 2025 will separate the adaptable from the obsolete.

Spain’s Tech Boom: The €110B Surge 📈

Spain’s startup ecosystem just hit €110B, and AI, biotech, and climate tech are the front-runners. Despite growing pains, the AI boom is solidifying Spain’s place as one of Europe’s hottest tech hubs.

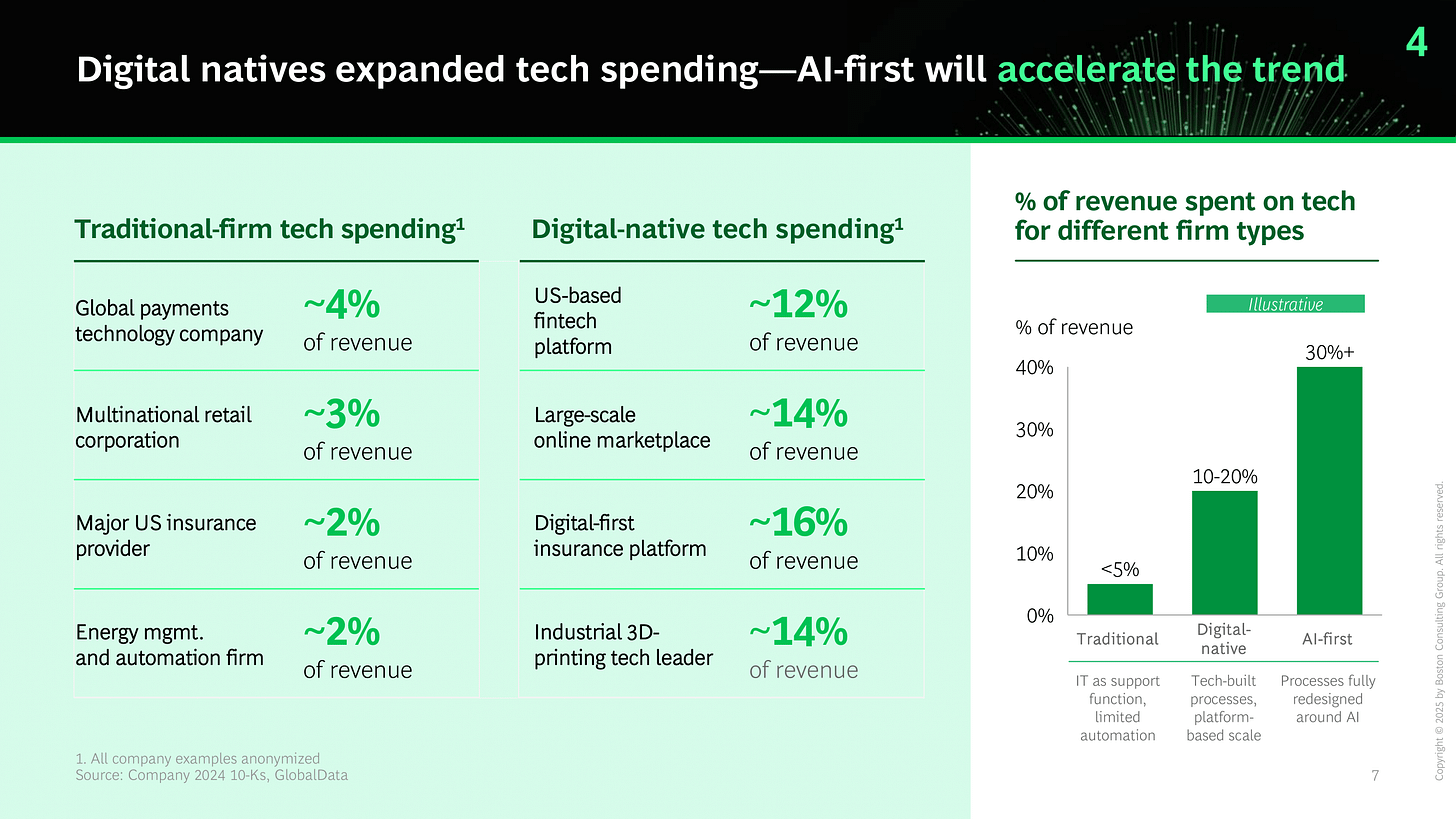

BCG’s new playbook reveals the hard truth: AI isn’t just a competitive edge anymore - it’s a core business necessity. Executives who fail to integrate AI will fall behind as the landscape shifts towards smarter operations.

2025’s GTM Revolution: AI’s Dominance 🤖

AI is rewriting Go-To-Market playbooks, with AI-native companies outpacing their peers. From pricing models to role redefinitions, this seismic shift is setting the stage for the next frontier in market dominance.

Recently Launched Funds 💸

Galaxy Ventures Fund I raised over $175M for its inaugural fund, focusing on early-stage investments in tech-driven ventures.

Wisdom Ventures Fund II secured a $16M first close for its second fund, aimed at scaling transformative startups in emerging markets.

Quantonation II raised €30M from EIF to support its quantum technology-focused investment strategy.

Spice VC completed a third investor payout, demonstrating its strong returns and active fund management.

Traction Capital Fund II announced Fund II to invest in growth-stage companies with a focus on sustainable business models.

Kiara Capital held its first close for a fintech-focused fund, targeting emerging financial services startups.

Sentinel Global Fund closed its maiden fund at $213.5M, investing in global high-growth technology ventures.

Project A Fund V raised $278M for Fund V, focusing on scaling tech companies at the intersection of AI and sustainability.

Znext Fund launched with €60M to focus on investments in next-gen AI and robotics startups.

Movens Capital Fund raised €60M to back innovative deep-tech ventures in Europe and beyond.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup enthusiasts. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Greycroft (New York City, NY): VC Associate (apply here)

Camber Partners (San Francisco, CA): VC Analyst (apply here)

Suffolk Ventures (Boston, MA): VC Associate (apply here)

New Catalyst Strategic Partners (Washington, DC): VC Investor (apply here)

Arc Capital Partners (Los Angeles, CA): VC Associate (apply here)

Good People Ventures (Remote): VC Partner (apply here)

Essence VC (Remote): VC Internship (apply here)

Blackfin Capital Partners (London, England): VC Internship (apply here)

YZR Capital (Munich, Germany): VC Internship (apply here)

Speedinvest (Berlin, Germany): VC Analyst (apply here)

Hottest Deals 💥

Niural raised $31M in Series A to push forward brain-computer interfaces. (read more)

HandsSpring raised $12M to scale its wellness tech solutions. (read more)

Wispr secured $30M in Series A to expand its encrypted messaging platform. (read more)

Beep raised $52.7M to scale its autonomous shuttle tech. (read more)

Sibill raised €12M in Series A to grow its AI-driven retail solutions. (read more)

Bruce Markets closed a funding round to boost its trading platform. (read more)

Takanock secured a $500M commitment to grow its fintech services. (read more)

Zama raised $57M in Series B to scale its privacy-first encryption tech. (read more)

Effect Photonics raised $24M in Series D, bringing total round to $62M, to advance optical tech. (read more)

Idea L raised $1M in pre-seed funding to scale its AI logistics platform. (read more)

Claira secured $7M in seed funding for its AI-driven mental health tools. (read more)

Kognitos raised $25M in Series B to expand its AI automation platform. (read more)

PhysicsX raised $135M in Series B to advance quantum computing tech. (read more)

BlueRedGold raised €2.73M to support its environmental solutions. (read more)

CubeNexus secured $650K in pre-seed funding to develop blockchain-based supply chain solutions. (read more)

RESOURCES 🛠️

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth? Startups

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

As always enjoy the newsletters Ruben 👏.

Let’s be clear: 9-9-6 isn’t “hustle culture”—it’s exploitation, plain and simple.

No product, no growth curve, no investor pressure justifies burning out your people. Especially in startups, your core team is your moat. Lose them to exhaustion, and you lose everything you’re trying to build.

The Dollar’s Delicate Dance: As Europe Arms Up and America Cuts Back, Investors Rethink the World’s Safe Haven https://open.substack.com/pub/cashflowcollective/p/the-dollars-delicate-dance