What Top VCs Check in Due Diligence Before Writing Checks (+ Excel Template Inside)

Get funded faster with this one-page framework that shows investors you're investment-ready. Ideal for founders, angels, and VCs to streamline startup diligence and avoid costly misses.

Most early-stage diligence cycles are one broken Google Drive folder away from chaos. You’ve got half a cap table in Excel, founder bios in a pitch deck, financials buried in a PDF, and someone asking, “Did we ever get their IP assignments?”

If you’re an investor, you’ve seen it; and If you’re a founder, you’ve lived it.

Early-stage investor due diligence goes deeper than numbers. It’s about people, pace, and precision.

But small oversights turn into deal-killers faster than most realize. A missing contract today becomes a lawsuit tomorrow. A fuzzy cap table becomes months of dilution drama.

And VCs know that good diligence isn’t about finding reasons to say no. It’s about asking smarter questions so you can say yes; faster, cleaner, with conviction.

This guide gives you a battle-tested, single-sheet due diligence checklist used by real VCs, angels, and founders. It’s not a theoretical doc. It’s a usable, shareable, real-time tool that has flagged risks before term sheets, saved investor hours, and helped founders prep data rooms without the hand-wringing.

You’ll find the full due diligence template downloadable below. And in the rest of this article, we’ll walk you through every section of the model. What’s inside, how to use it, and how to make your next startup due diligence checklist the cleanest, fastest one yet.

Table of Contents

1. Inside the Due Diligence Checklist for Early-Stage Investors

2. Why This Model Matters

3. What’s Inside (The Tabs & KPIs)

4. How to Use It (3-Step Workflow)

5. Who Should Use It and When

6. Download the Due Diligence Checklist – Early-Stage Investors model 👇

7. Frequently Asked Questions (FAQs)

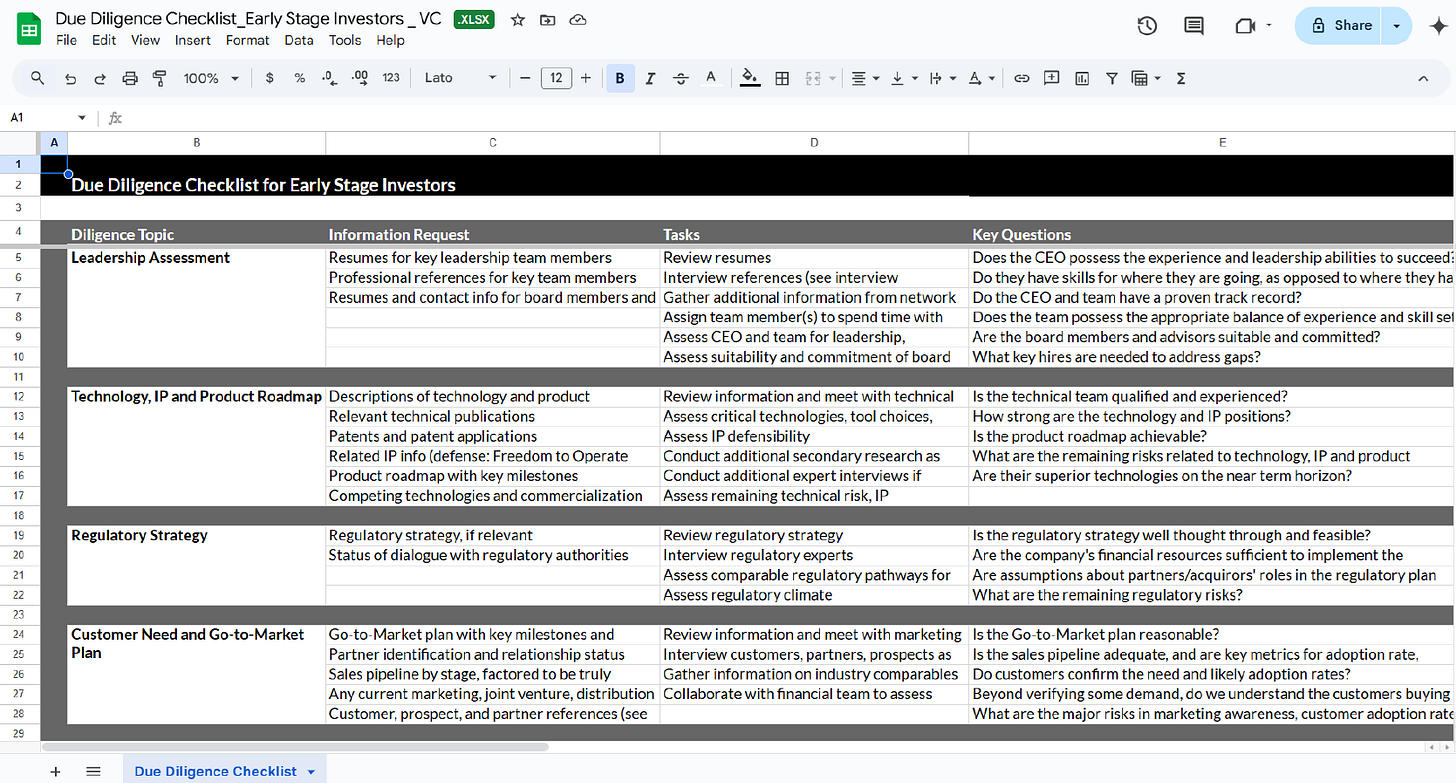

1. Inside the Due Diligence Checklist for Early-Stage Investors

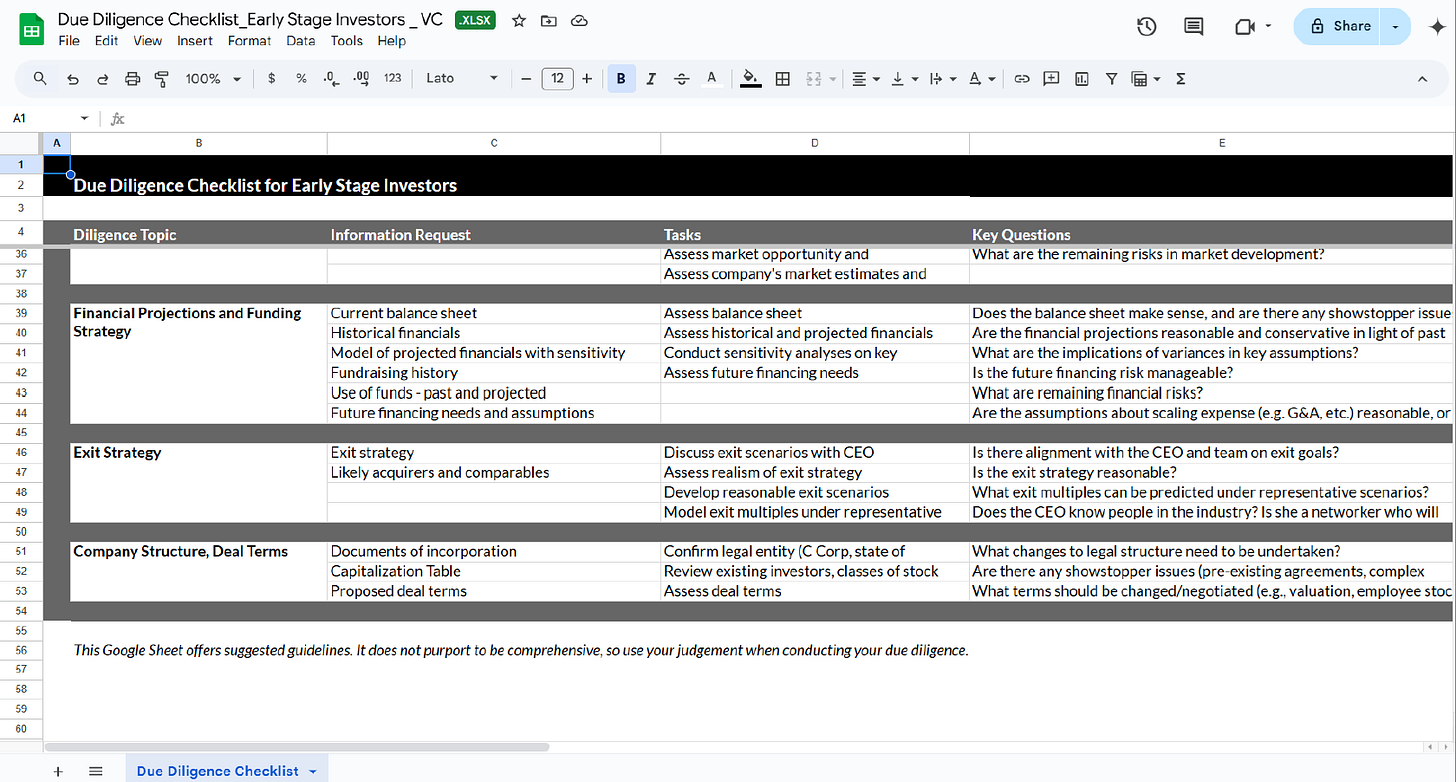

This isn’t a bloated 50-tab workbook or some abstract VC memo template. It’s a single-sheet Excel file, that is tight, clean, and actually usable in the heat of an early-stage deal.

Whether you're a solo GP vetting a first-time founder or a seed fund polishing a deal before it hits the investment committee, this tool is built for speed, clarity, and smart decision-making.

Here’s how the checklist’s structure makes it stand out:

Designed for Seed to Series A rounds: Lightweight but rigorous enough to catch critical issues before a term sheet goes out.

Action-driven, not legalese-heavy: It tracks real-world tasks, founder deliverables, and investor must-knows, without spiraling into jargon.

Four-column layout:

Diligence Topic: Thematic areas like team, tech, market, legal.

Information Request: What to ask for (e.g. docs, data, access).

Task Owner & Deadline: Who’s responsible for what, and by when.

Key Questions: What you should be asking, and what answers should raise eyebrows.

Built for flexibility: Use it as a personal tracker, share it across a fund team, or drop it straight into a founder’s inbox.

The reality is this: most startup due diligence checklists are scattered across email threads, shared Notion docs, or mental notes. That’s how things slip.

This model turns scattered thinking into shared processes, so founders know exactly what to prepare for, and investors can run a tight process without starting from scratch every time.

If you’re tired of reinventing your early stage investor due diligence flow on every deal, this is the checklist you’ll want to duplicate and deploy today.

2. Why This Model Matters

Early-stage investing doesn’t fail because of bad intentions. It usually fails because someone forgot to ask the hard questions soon enough.

This due diligence checklist exists to stop that from happening. Its purpose is to protect your upside, avoid preventable disasters, and close with speed and conviction.

Missed Red Flags Cost More Than You Think

In seed-stage investing, the smallest cracks become the biggest regrets. A missing IP assignment can unravel your Series A funding round. A misclassified contractor turns into a six-figure labor lawsuit. A vague data policy gets you explaining privacy violations to counsel, and to your LPs.

This is not just in theory. Cap table confusion, regulatory non-compliance, and overlooked founder disputes kill deals every year. And worse, they kill them after the term sheet.

This startup due diligence checklist flags those risks early, when they’re fixable.

It’s Not About Saying No. It’s About Closing Smarter.

Contrary to what most investors believe, early stage investor due diligence isn’t a red-pen exercise. It’s a confidence engine. It gives you the insight you need to say yes faster, without getting burned later.

And it helps founders, too. Most don’t know exactly what to prep. They spend hours chasing vague requests or trying to decode a Notion doc from another fund. This checklist solves both sides of the equation: VCs run a tighter process, and founders get a clear playbook.

Most Diligence Workflows Are Broken

Let’s be real: most diligence still lives in someone’s inbox, Notion board, or “mental checklist.” That leads to:

Repeated info requests that frustrate founders

Missed documents buried in data rooms

Post-term-sheet surprises that throw off closing timelines

This due diligence template for investors brings structure to the mess. It reduces rework, standardizes expectations, and makes your process look polished to co-investors, LPs, and Investor Committees (ICs).

Because at the end of the day, the best deals go to the teams that move fast and ask the right questions. This tool helps you do both.

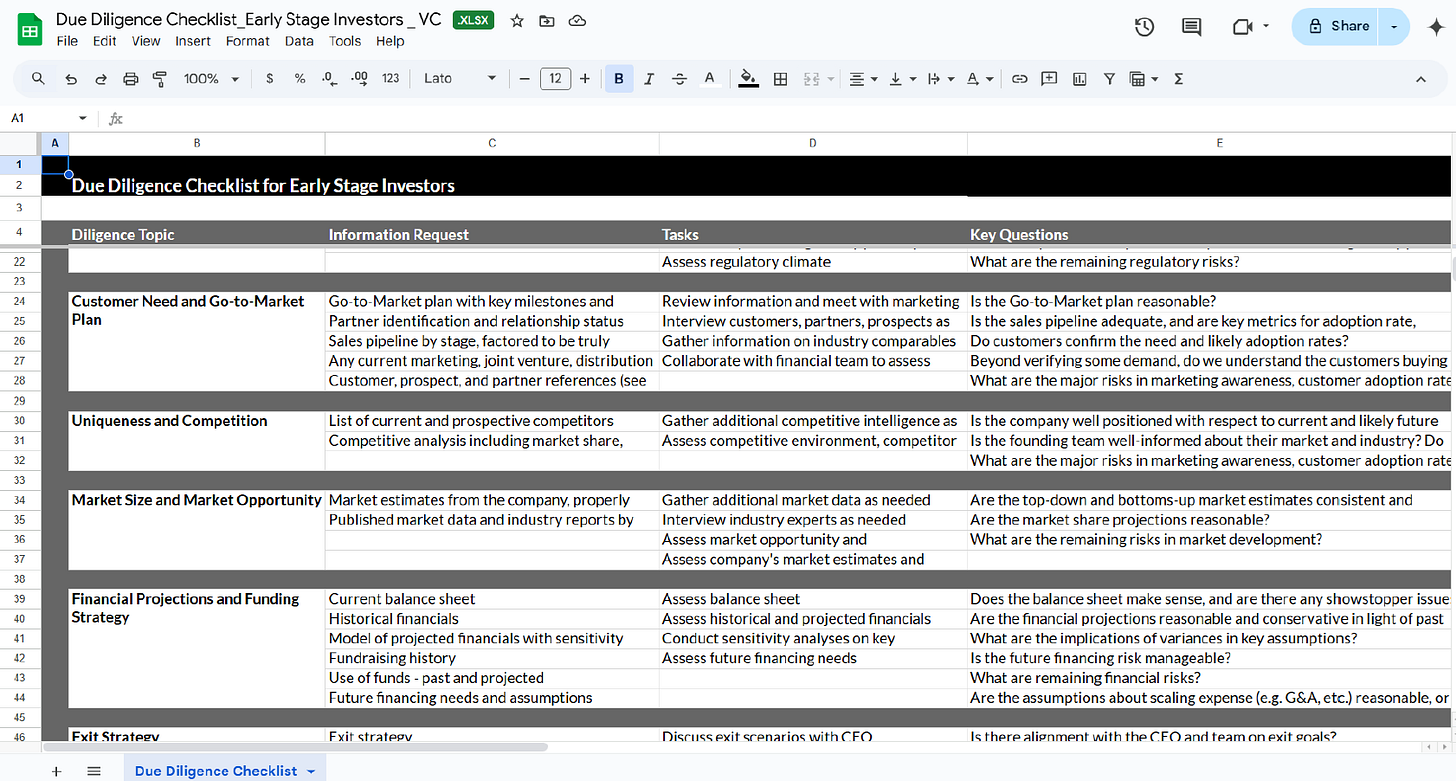

3. What’s Inside (The Tabs & KPIs)

This isn’t just a list, it’s a full framework. The Excel-based due diligence checklist is structured to mirror the actual rhythm of a deal, with built-in prompts, accountability, and clarity baked in.

Here’s how the tool works column by column:

Diligence Topic

These are the major categories that shape every high-quality startup due diligence checklist. Think of them as your zoomed-out map: from founder background to market sizing to legal exposure. Each one anchors a theme of investigation.

Information Request

This column lists the actual artifacts you need to collect, like team resumes and references, IP assignment documents, GTM slides broken down by stage, regulatory filings, cap table snapshots, and even exit comps.

Clear, specific asks, no guesswork or vague “can you send me what you have?” nonsense.

Tasks

This is where you assign responsibility. Who’s gathering what? When’s it due?

Whether you’re solo or working with analysts, this column eliminates “who’s on this?” confusion that derails most early-stage diligence efforts.

Key Questions

This is the heartbeat of the model. These aren’t filler questions, they’re the sharp, direct prompts that surface misalignments, risk areas, and truths founders may not volunteer.

They include prompts like: “Is the CEO truly backable?” “Are your GTM adoption assumptions validated?” “What are the implications of scaling G&A expenses?”

The kinds of queries that tease out real risk. Used well, they can reshape term sheets or flag walk-away moments before they become regrets.

Now let’s walk through the nine core diligence areas the template covers, each one mapped to real-world KPIs and deal risks:

Leadership Assessment

Is this the team? Look for founder integrity, execution history, team dynamics, and backchannel references.

Technology, IP & Product Roadmap

What’s been built already? What’s owned? This covers codebase quality, scalability, tech stack defensibility, and IP rights.

Regulatory Strategy

Especially important in fintech, health, or data-driven startups. Are all licenses and permissions in place? Are there known compliance gaps?

Customer Need & Go-to-Market Plan

How sharp is the ICP? Which channels are working? What does traction actually look like beyond the top-line number?

Uniqueness & Competition

What’s the moat? Who’s chasing them? This section flags copycat risks and checks whether the pitch actually stands out in-market.

Market Size & Opportunity

Is the TAM real or a Google slide? Break down the growth narrative and whether there’s a plausible path to 10x investor upside.

Financial Projections & Funding Strategy

What’s the burn? How long is the runway? Does the raise amount align with the plan, and are the assumptions credible?

Exit Strategy

Who could potentially buyout this company, and why? VCs don’t need a guaranteed exit, but they do need a clear line of sight to one.

The checklist also encourages teams to develop representative exit scenarios and assess the CEO’s industry network in order to understand realistic pathways to acquisition.

Company Structure & Deal Terms

Includes cap table sanity checks, SAFE/note review, option pool clarity, and early board composition.

It also flags critical clean-up tasks like verifying C-Corp status, reviewing classes of stock, and catching legacy shareholder issues or convertible notes that could derail the deal post-term sheet.

This structure is meant to guide, not overwhelm. Whether you're doing early stage investor due diligence for a $500K seed check or prepping for a $5M Series A, this template helps you ask smarter, faster questions in all the right places.

4. How to Use It (3-Step Workflow)

This due diligence template for investors is designed to move with the pace of your deal. No matter if you’re running diligence alone or leading it for a fund, this workflow makes the process as clean as it should be.

Here’s how to use the checklist in three steps:

Step 1: Drop Your Data

Start by duplicating the Excel file into your own workspace.

Add the startup’s name to the top and start populating the Information Request and Tasks columns.

Assign who’s responsible for each item - your analyst, the founder, legal counsel—and set internal deadlines.

This kicks off a shared process, so everyone knows who’s chasing what and by when. No more repeated asks or scattered requests across Slack, Notion, and email.

Step 2: Review Auto-Metrics

As information gets filled in, the template visually flags which sections are complete, in progress, or stalled. You’ll also see which tasks are overdue, assigned, or in progress, helping your team triage bottlenecks before they snowball.

It’s color-coded and intuitive, so at a glance, you know if legal’s done but financials are lagging.

This is what most early stage investor due diligence lacks: real-time clarity. You can use this dashboard view to run weekly standups, prep for IC, or simply avoid dropped balls.

Step 3: Make Decisions & Share

Once the checklist is filled, export the sheet (or just the relevant sections) to PDF for Investment Committee memos, co-investor updates, or LP briefings.

Use it during Zoom calls with founders to walk them through open items. It turns hard conversations into structured, transparent ones.

Share with outside counsel or a startup’s CFO to prep final legal docs or data room audits.

This isn’t about collecting documents for the sake of it. This startup due diligence checklist exists to accelerate clarity, reduce friction, and help you make better investment decisions with full conviction.

Speed and rigor don’t have to be opposites; this workflow lets you have both.

5. Who Should Use It and When

The beauty of this due diligence checklist is that it’s not just for investors, it’s for anyone navigating early-stage dealmaking with precision.

Here’s how different players can use it:

Angel Investors & Solo GPs

Running solo means no back office, no analysts. Just your gut, your notes, and your calendar. This template gives you structure without the overhead. It helps you ask the right questions, avoid critical misses, and look organized when collaborating with larger syndicates.

You’ll come across as buttoned-up, not bootstrapped.

Micro-VCs or Seed Funds

When you're managing multiple deals across a lean team, consistency is gold. This checklist acts as your internal operating system for early stage investor due diligence, keeping everyone aligned on what’s been asked, what’s pending, and what’s missing.

It scales with your fund, even when your headcount doesn’t.

Startup Founders or CFOs

Flip the script: use the checklist to think like an investor before they ever ask. Pre-populate your data room, prep answers to key questions, and walk into diligence looking sharp. Founders who anticipate the process often close faster and with fewer surprises.

Plus, CFOs can use it to audit readiness before a raise.

Legal or Finance Advisors

If you’re working with a startup preparing to fundraise, this template is the ideal first-pass tool. Help your clients organize critical documents, address gaps early, and avoid last-minute scrambles that derail deals.

It also saves you time on back-and-forth emails later.

When to Use the Template

Immediately after a signed term sheet - streamline confirmatory diligence and close faster.

During Investment Committee prep - organize your memo around real data, not assumptions.

As part of onboarding a new deal - kick off with clarity and shared expectations.

Right before uploading to the data room - sanity-check for completeness and polish.

This is the one startup due diligence checklist that works whether you're raising, reviewing, or ramping up a deal.

6. Download the Due Diligence Checklist – Early Stage Investors model 👇

As a premium subscriber (free trial available), you will also get access to the full library of resources (+50)

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.