Startup Location Strategy in 2025: Does It Still Matter Where You Build?

A practical deep dive into how startup location strategy is evolving in 2025. What still matters, what doesn’t, and how to design for global scale

There was a time your startup’s address was your first hiring decision. When being in Silicon Valley or London meant that you were serious, while anywhere else meant you were either brave or foolish.

Zip code alone could get you in the room with investors, talent, even customers. “Location, location, location” was treated as startup gospel.

But in 2025, things have changed drastically.

Brought to you by Vanta: 🚀 Streamline AI Risk Reviews

Free Template Included

Having trouble assessing AI tools for risk and compliance? Vanta’s AI Security Assessment Template empowers IT and governance teams to accelerate approvals while maintaining robust security and accountability.

✅ Evaluate AI tools before implementation

✅ Stay aligned with GRC best practices

✅ Standardize your internal risk review process

Designed for dynamic security, privacy, and risk teams—scale your AI oversight with confidence.

Table of Contents

1. Why Startup Location Strategy No Longer Defines Success

2. The Rise and Fall of Geographic Startup Moats

3. Capital Is No Longer Bound by Geography

4. The Value of Proximity to Resources, Not Investors

5. Emerging Ecosystems Are Quietly Winning

6. Why Geographic Flexibility Is a Startup Superpower

7. The Modern Founder’s Playbook for Location Strategy

8. Geography Isn’t Dead, But It’s Been Demoted

1. Why Startup Location Strategy is No Longer the Defining Factor for Success

Founders no longer ask where to build first. They ask what to build; and who to build it with.

Think about some of the world’s most interesting companies that are emerging from anywhere. Shopify dominates e-commerce from Ottawa. Atlassian built a $50 billion empire from Sydney. Wise dominates e-banking having started from Tallinn.

Remote-first teams stretch across continents. Global users are acquired without ever boarding a plane. Capital flows wherever the next breakout story is brewing.

So, how should you think about your startup location strategy?

This piece is a practical guide to rethinking your startup location strategy. When proximity still matters and when it's just expensive nostalgia.

Along the way, you’ll see how global-first companies are raising capital, reaching customers, hiring talent, and even moving headquarters to gain leverage.

Because the real paradigm shift is that we’re no longer building companies tied to cities. We’re building companies for a world without borders.

2. The Rise and Fall of Geographic Startup Moats

Back in the day, location used to be everything. If your startup wasn’t born in a major tech or business hub, your odds of success shrank fast. Cities like Silicon Valley, London, and New York offered more than just glamor, they provided access.

Access to capital. To talent. To early adopters. To belief.

Need funding? It helped to be a short drive from your investor’s office. Hiring a team? The best engineers, marketers, and operators already lived in the city. Even finding your first customers was easier when everyone you needed to pitch was at the same conference or coffee shop.

Location used to be your moat. If you weren’t in the right city, you were swimming upstream.

But that edge is no longer universal.

Bernhard Schroeder famously said, “Location still matters, but not in the same way.”

He points to factors like talent density, proximity to universities, and investor presence as meaningful, but not mandatory. You can still benefit from being in a city like Austin or Berlin. But the need to relocate to one of five “power zip codes” has evaporated.

Business location once defined your entire brand. A company based in SoHo or Palo Alto was perceived differently than one in Boise or Bratislava. But perception has shifted. Customers care more about product quality and support than your HQ. And investors now hunt for deals in unexpected places, especially if the burn rate is lower and the talent pool untapped.

The reality is that founders aren’t defaulting to big cities anymore. They’re building around what they need. And what they really need are cost efficiency, remote talent, and a global customer base.

3. Capital Is No Longer Bound by Geography

There was a time when where you pitched mattered as much as what you pitched. Founders chased funding by chasing geography, moving to where the money lived. If you weren’t near Sand Hill Road or inside the M25, good luck getting a term sheet.

That world is fading fast.

Venture capital today has shifted from local to sectoral. Investors are optimizing for markets, models, and execution instead of location. A great team solving a real problem will get funded whether they’re in Brooklyn, Boise, or Bengaluru.

As startup mentor Brad Treat puts it, “Investors care about the talent and the team, not the ZIP code.”

He’s seen it firsthand. Over the past 15 years, startups in upstate New York, far from the traditional tech corridors, have raised funding from more than 75 different investors across the U.S. and globally. Boston, New York, San Francisco, Los Angeles, Houston. Even Ireland and Saudi Arabia. The capital flowed because the ideas were good, the teams were strong, and the pitch was tight.

Modern tools have made this easier. Zoom revolutionized the boardroom. Notion, Slack, and Loom let startups tell their story with clarity and context, without the need for in-person meetings. Async memos now travel faster than cross-country flights ever did.

So if you’re building something real, something resonant, capital will find you, as long as you’re talking to VCs the right way.

Geography may have once filtered access. Today, it just filters excuses.4. You Don’t Need to Be Where Your Customers Are

The handshake used to be the ultimate closing tool. Founders needed to live where their buyers lived and attend the same events, knock on their doors, and host dinners. Proximity was currency.

Now a well-placed email, a tight demo, and the right support tools can move more pipeline than a cross-country trip ever could.

Let’s use Prezi as an example, a small startup born in Budapest. Although it did not launch in Silicon Valley or New York, its early adoption came from U.S. educators, speakers and marketers who were tired of PowerPoint and carved something more visual and dynamic.

Prezi was on the other side of the world, but American demand alone pulled the company into the U.S. market. They now have offices in San Francisco, they landed marquee clients globally, and are now a stable in classrooms and boardrooms. The lesson is that Prezi didn’t just move closer to the market, they built for it.

This is the new playbook. As one founder put it: “Build in one country, sell in another. Geography is strategy, not a restriction.”

The key isn’t where you sit, it’s how well you understand your customer. Cultural fluency. Smart channels. Strong onboarding. A support model that doesn’t sleep when you do.

Remote tools have changed the game, but the mindset shift is bigger: you no longer have to chase your market physically. You just have to reach it meaningfully.5. When Location Still Matters and Why

Let’s not overcorrect. While startups today have more geographic flexibility than ever, there are still categories where location creates a real edge, and sometimes, a hard requirement.

If you’re running a brick-and-mortar business, like a restaurant, a retail store, salon, or a fitness studio, then location is the business. Foot traffic, parking access, zoning laws, and visibility can make or break your margins.

You don’t open a bakery where no one walks by. You don’t open a gym in a third-floor walk-up. In these cases, success still lives on the map.

Building breakthrough science however, isn't something that can be done anywhere. The success of deeptech startups often depends on proximity to research hubs, universities, or specialized infrastructure. Some industries depend on resources and proximity to those is everything. Additionally, hiring niche scientific talent is much easier when you’re near the institutions that produce it.

In compliance-heavy sectors like fintech or healthtech, being close to regulators, legacy institutions, or legal experts can accelerate partnerships and shorten feedback loops. A startup navigating financial licensing or clinical approvals may benefit from embedding in ecosystems that already understand the terrain.

Even in sales-led B2B models, where relationship-building is core, being near your clients, or their trade shows, associations, and events, can give you signal and speed that async comms can’t always match.

So yes, location still matters. Just not for everyone. Not for every stage. And not in the same way it used to.

It’s not obsolete. It’s contextual.

4. The Value of Proximity to Resources, Not Investors

Back in the day, founders were told to move where the money was. The logic was simple: investors invest close to home. Be near the capital, or be invisible.

But that logic is outdated.

What matters now isn’t proximity to investors, it’s proximity to resources that accelerate your specific business. The capital will come if the inputs are strong.

A startup mentor once pointed out that Silicon Valley didn’t rise because of VCs alone. It started with Stanford, federal research money, and a critical mass of chip manufacturers. The valley was built around invention first, capital followed.

That’s the better blueprint today.

If you’re building deep tech, being near a university lab or research institute still matters. If you’re building hardware, proximity to factories, prototyping facilities, or a skilled manufacturing workforce can give you leverage.

If you’re in climate tech or agritech, being close to natural environments, supply chains, or field partners makes a difference. Even in software, some startups benefit from sitting near sector-specific accelerators or workforce clusters.

This isn’t about prestige zip codes. It’s about input advantage. That means locating near the people, tools, and knowledge that speed you up.

Investors are now global and remote. But talent, infrastructure, and strategic partners are still grounded somewhere.

So pick your place not for who funds you, but for what fuels you.

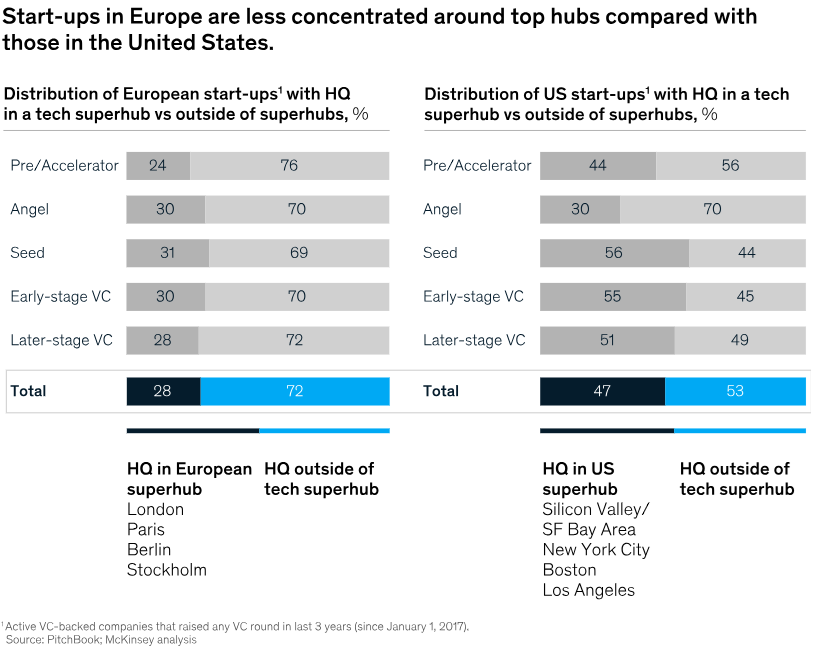

5. Emerging Ecosystems Are Quietly Winning

Not long ago, building outside a top-tier startup city felt like playing the game on hard mode. Today, it’s often the advantage.

From Salt Lake City to Gdańsk, Amsterdam to San Diego, second-tier ecosystems are punching above their weight and doing it with focus, cost-efficiency, and community momentum.

In 2013, only four ecosystems globally had produced unicorns or billion-dollar exits. By 2020, that number had exploded to over 80 distinct regions. The old idea that innovation only happened in a handful of cities is now data-dead.

What’s driving this evolution?

Lower burn. Less competition for talent. Local governments eager to support startups. And a new generation of founders who don’t need permission to build where they are.

Develocraft, a software company based in Gdańsk, didn’t just grow quietly in the background. It helped catalyze an entire local ecosystem. The company launched a regional tech conference, started a coding academy, and actively attracted outside talent to the city. Instead of chasing gravity elsewhere, they created it at home.

This is the quiet power of emerging hubs: you don’t just join an ecosystem, you become one.

So if the pond you’re in feels small, don’t swim harder. Build the next pond.

6. Why Geographic Flexibility Is a Startup Superpower

Geography used to be fixed. You picked a city, planted your HQ, and scaled from there.

Today, founders treat geography like product: iterated, optimized, and redeployed as needed.

The idea of being default global, that means building with a global footprint from day one, is no longer radical. It’s strategic. Geographic diversification acts as a hedge against macro risk: economic slowdowns, regulatory shifts, funding droughts, or even war. It also accelerates learning.

Startups that test in multiple markets early uncover patterns faster, and avoid the trap of building for just one archetype.

Relocating headquarters is no longer considered dramatic. It’s now seen as the smartest move a founder can make.

And some of the below examples you will convince you of the same.

UiPath started in Bucharest, but relocated its HQ to New York to get closer to enterprise customers, deepen investor relationships, and prepare for IPO. Engineering stayed in Romania, creating a capital-market front end with a cost-efficient back end.

Typeform, born in Barcelona, established a strong U.S. presence, especially in San Francisco and New York, to better serve American B2B customers. This dual footprint helped them grow while keeping cultural and design roots in Europe.

Revolut, originally headquartered in London, opened a parallel HQ in Lithuania post-Brexit to retain EU banking access. Fast-track licensing and a central regulatory hub made it the right call. Offices in New York and Singapore followed, each serving specific strategic roles.

Just Eat, founded in Denmark, moved its HQ to London to access a larger market and more active investor ecosystem. That shift unlocked expansion and, eventually, a massive public exit.

Zendesk, started in Copenhagen, relocated to San Francisco to tap into the U.S. SaaS ecosystem and VC network, fueling hypergrowth and IPO readiness.

Hopin, a virtual events platform, was technically UK-founded but built with a remote-first team across Europe, the U.S., and Asia from the outset. It scaled to unicorn status in record time with a borderless operating model.

Each move was context-specific. Some were driven by regulation, others by customer proximity, investor access, or talent strategy. But the pattern is clear: the smartest founders design for geographic flexibility, not geographic permanence.

Simply put, relocation is synonymous to reinvention.

In 2025, the most resilient startups treat geography as a lever. When the game changes, they change the map.

7. The Modern Founder’s Playbook for Location Strategy

If the last decade taught us anything, it’s this: great startups aren’t defined by where they are, but how they build.

Still, geography isn’t irrelevant. In 2025, smart founders treat location like any other variable. Strategically chosen, dynamically adjusted, and optimized for advantage.

Here’s how that plays out in practice:

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.