Return Analysis: How Top VCs Turn Forecasts Into Fund-Making Outcomes (+ Excel Template)

A single Excel sheet that links P&L, dilution, and exit multiples, so you can price rounds, size checks, and see fund-level impact in minutes.

Big wins don’t happen by accident. They are the result of great modelling.

Too many startups show up to first meetings with a great deck but zero clarity on what their numbers mean for investor returns. And too many VCs walk into investment committees with a hunch instead of a framework.

And that’s exactly why great tools are needed.

This single-tab return analysis links startup P&L projections, funding rounds, and pre-money valuation to calculate VC multiple on invested capital (MOIC), cash-on-cash multiple, and real fund-level impact. And all of it can be done in just minutes.

Precision is the name of the game. And precision is what will stop you from overpaying, overfunding, or overpromising.

brought to you by Vanta

🚀 Streamline AI Risk Reviews – Free Template Included

Having trouble assessing AI tools for risk and compliance? Vanta’s AI Security Assessment Template empowers teams to accelerate approvals while maintaining robust security and accountability.

✅ Evaluate AI tools before implementation

✅ Stay aligned with security best practices

✅ Standardize your internal risk review process

Designed for dynamic security, privacy, and risk teams—scale your AI oversight with confidence.

Table of Contents

1. Why Every VC (and Founder) Needs a One-Tab Return Model

2. What is the Return Analysis Model?

3. Why This Model Matters

4. Inside the Sheet: The Single Tab & Its KPIs

5. How to Use It (3-Step Workflow)

6. Who Should Use It and When

7. Download the Excel Template That Turns Forecasts Into Fund-Makers

8. Frequently Asked Questions

1. Why Every VC (and Founder) Needs a One-Tab Return Model

Most pitch conversations are high on narrative and low on math. The founder walks in with vision and conviction. Investors nods along. But somewhere between projected revenue and the next term sheet, things start to get blurry.

What does this deal actually return? What happens if the exit multiple shrinks or the raise bloats?

That’s the reality most decks avoid, and most models overcomplicate.

The Problem with Multi-Tab Spreadsheets

Traditional models try to do everything: revenue builds, hiring plans, cash flows, cap tables, IRR waterfall gymnastics. The result is sprawling files that break under pressure. Formulas reference the wrong cells. Logic isn’t traceable. You can’t tweak a single number live in a partner meeting without risking a #REF! implosion.

And worse, no one’s ever on the same page. One partner’s version differs from another. Founders don’t even recognize the assumptions baked in.

Why One Tab Works

A single-tab return analysis forces discipline. It aligns both sides on what matters: revenue, margins, raise sizes, valuation, ownership, and eventual outcomes.

You can model the impact of a different pre-money valuation, check dilution modelling across rounds, toggle pro rata assumptions, and see how the VC MOIC changes without flipping through ten tabs or waiting for someone to rework a broken formula.

This is instant clarity. You test live scenarios and audit fast. Most importantly, everyone speaks the same language, from founders to partners to the next investment committee memo.

Why It’s Non-Negotiable

This model is a survival tool. For founders, it prevents accidental overpricing and protects against surprise dilution.

For investors, it’s a checkpoint before every wire transfer. If your forecast doesn’t map cleanly to a believable fund-level impact, then you know a deal should be off.

2. What is the Return Analysis Model?

The Return Analysis Model is a single-tab worksheet that connects forecasted financials, funding rounds, and valuation assumptions to generate investor returns, multiples, and percent-of-fund impact, so you can price rounds, size checks, and judge outcomes in minutes.

And no, it’s not a five-tab circus. It’s one clean sheet. The blue cells are your inputs: projected revenue, cost structure, funding needs, pre-money valuation, and exit multiple.

The black cells are formulas. No editing required, no risk of breaking logic mid-pitch. It’s built for speed, clarity, and decision-making under time pressure.

What you get instantly is VC absolute return in dollars, cash-on-cash multiple (MOIC), return as a percentage of fund size, and cumulative investment as a percentage of fund.

The sheet also auto-rolls pro-rata ownership over multiple rounds and sanity-tests your price-to-sales multiple against an implied price-to-earnings check, so if your modeled exit starts to smell like fiction, you’ll know.

Alongside every input is a crucial comment column that will guide you. It flags common benchmarks (e.g., “SaaS gross margins typically 75–85%”), warns against red-flag assumptions (like mature enterprise exits at 20× revenue), and prompts you to keep it real.

What you don’t need to touch:

– Locked formula rows that ensure math integrity

– Grey output block for IC/pitch screenshots

– Ownership roll-forward section that auto-calculates based on inputs

It’s all in one place, without broken links, no tab roulette and no second-guessing what’s driving the number.

3. Why This Model Matters

What most people get wrong is that they use modelling after a decision is made, to either tackle an error or validate their assumptions.

But the right model should be used to shape decisions. Before the pitch, during IC, and when it's time to reprice or recalibrate. Here’s how it matters for every player at the table.

For Founders: Valuation Discipline and Raise Control

Every founder wants to raise at the highest possible valuation. But without knowing how that valuation plays out downstream, on ownership, dilution, and future funding risk, it’s just bravado.

A VC return model forces you to test your assumptions.

Does this pre-money valuation make sense given the margins? Does the size of this round push me into capital inefficiency?

With the model, you can pressure-test your raise before the term sheet. You’ll avoid inflated pricing that sets you up for a down round or leaves you sitting on unused capital you didn’t need. A clean model creates defensible valuations, the kind that hold up in partner meetings and boardrooms.

For VCs: Hurdle Visibility and Fund Allocation Sanity

Every check needs a reason to exist. This model gives you one fast. You see your cash-on-cash multiple, the MOIC, and what percent of your fund a deal returns if it hits the projected exit multiple. That’s your baseline.

It helps distinguish “nice to have” from “fund maker.” If the math doesn’t clear your internal bars - MOIC ≥ 3×, return ≥ 10% of fund - you're either negotiating, passing, or fixing the forecast.

For Both: Forecast Gaps and Exit Realism

The model forces one key question early. Are we lying to ourselves?

If your startup P&L projections are aggressive but your exit multiple is unreasonably high, the return falls apart.

This tool surfaces those tensions immediately, before capital goes in, before burn escalates, before market softness turns into markdowns.

It also gives a shared frame so you can course-correct. You know if you need to make changes in pricing, reduce spend, or adjust timing before it’s too late.

Let’s say your Series A model targets a $100M exit. But the M&A landscape softens, and the most likely outcome is $60M. Your MOIC drops from 5× to 3×.

Is it still a win? Depends on fund size. For a $150M fund, maybe. For a $400M fund, probably not. The math speaks for itself.

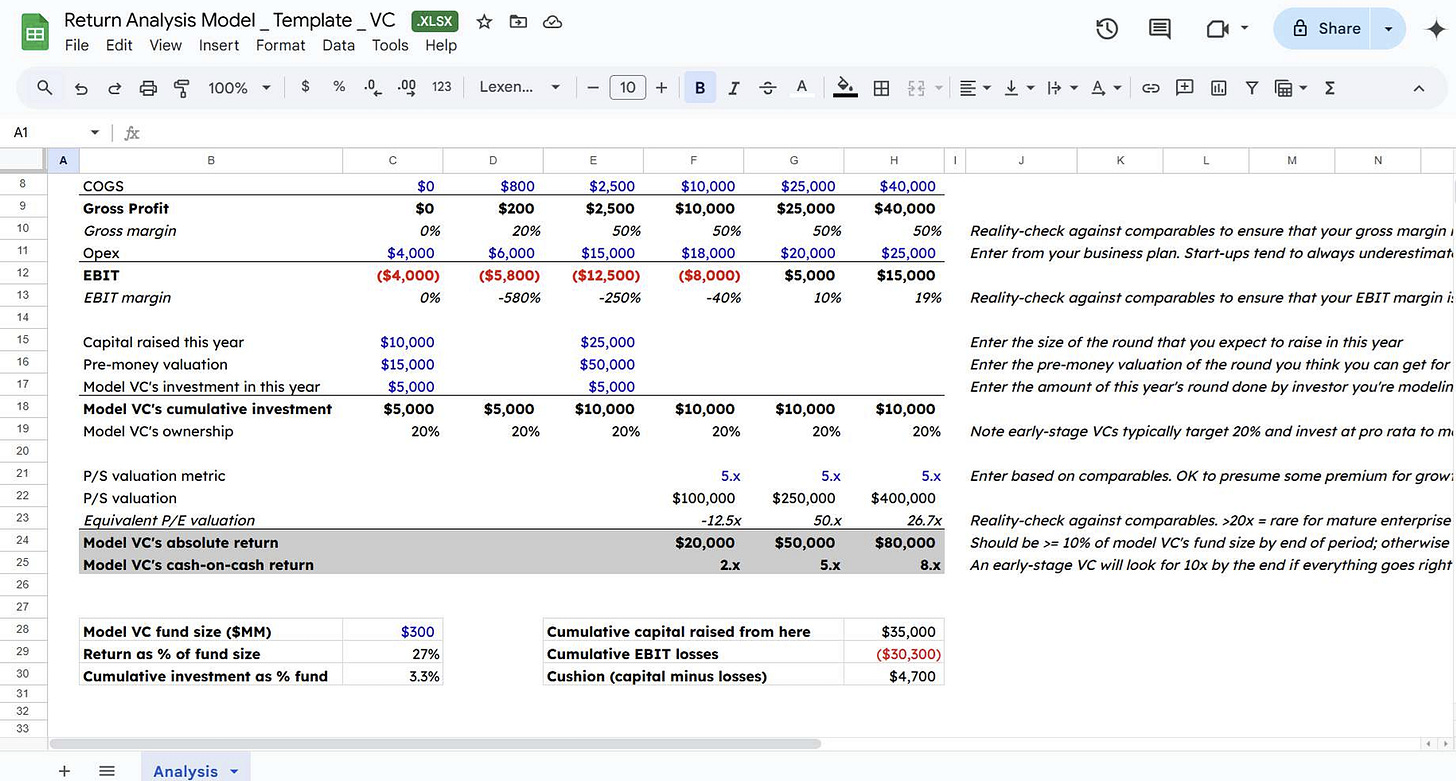

4. Inside the Sheet: The Single Tab & Its KPIs

One tab. Six core blocks. Everything you need to evaluate a deal from forecast to fund-level impact, without switching sheets, breaking formulas, or losing the plot.

Below is a breakdown of what each section in the single-tab return analysis does, what it tracks, and why it matters in real time.

Analysis (only tab)

Revenue, COGS, Gross Profit, Opex, EBIT

Enter topline and cost data by year. The model auto-calculates Gross Margin % and EBIT %, so you get immediate signals on operational leverage and scalability.

Capital raised by year, pre-money valuation, modeled VC’s annual and cumulative checks

You enter raise amounts and pre-money valuation per round. The model computes annual check size and cumulative investment from the VC’s perspective. No separate cap table tab needed.

VC ownership roll-forward (assumes pro-rata)

Ownership gets updated round by round, with a default assumption of pro rata participation. Toggle it off to simulate non-participation or partial follow-ons.

Valuation section

Adjust the price-to-sales multiple (P/S) to model exit valuation. A built-in cross-check displays the equivalent P/E multiple, a gut check against sector norms or public comparables.

Output block

That’s where you will find clean, export-ready metrics such as:

– VC absolute return ($)

– cash-on-cash multiple (MOIC)

– return as % of fund size

– cumulative investment as % of fund

Comment column

Every input is flanked by a built-in prompt or range check: “Is 82% gross margin realistic?” or “20× P/S? Rare even for top-tier SaaS.” Guardrails baked in.

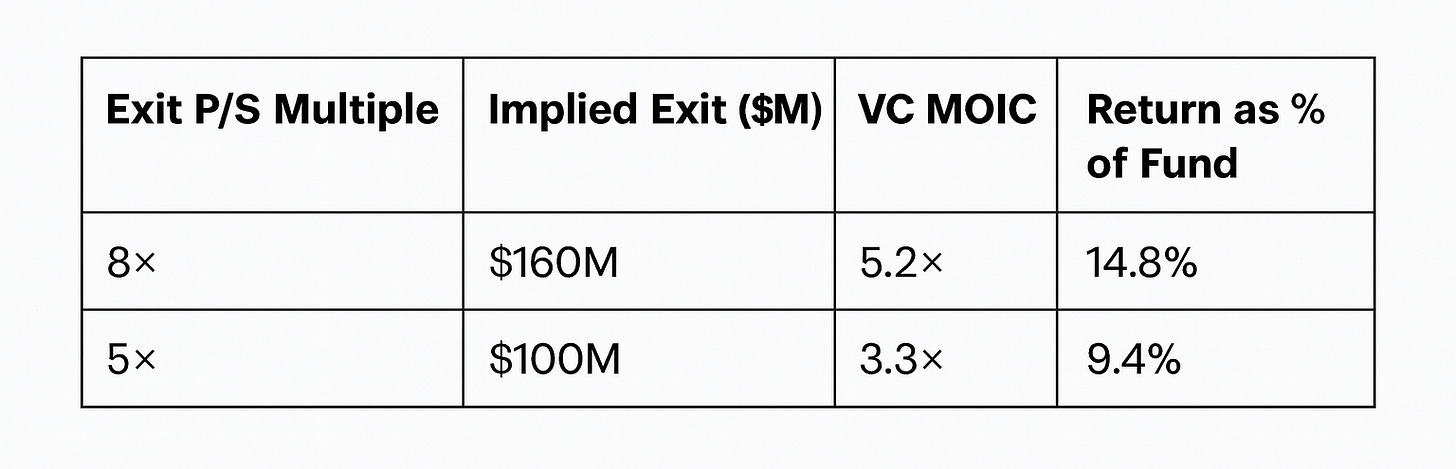

Example: How Exit Multiple Impacts Returns

The takeaway: a change in exit multiple can mean the difference between greenlight and pass.

5. How to Use It (3-Step Workflow)

Here’s how to go from raw numbers to a decision-ready output in under ten minutes.

1. Drop Your Data

Start by replacing the blue cells, and only the blue cells. Input projected revenue, COGS, and Operating Expenses across years. Plug in your raise amounts, set the pre-money valuation by round, pick an exit multiple, and enter your fund size.

Pro Tip: Use actual calendar years (e.g., 2025, 2026) instead of “Year ½.” It makes alignment easier when comparing board decks or downstream updates.

2. Review Auto-Metrics

Scroll through the formula-driven blocks and you’ll see your ownership roll-forward across rounds, implied exit value based on revenue and P/S, total VC dollar return, cash-on-cash multiple (MOIC), and return as % of fund. This is the pulse-check.

Pro Tip: Keep your firm’s internal hurdles in view; mark MOIC ≥ 3× and return ≥ 10% of fund size in green. If the deal doesn’t hit those, it’s either a tweak or a pass.

3. Decide & Share

Now you’re in decision territory. Adjust the raise size or pre-money valuation if needed. Once the numbers land, export the tab as a PDF or screenshot the grey output block. The output is perfect for pasting into pitch decks or investment committee memos.

Pro Tip: Always build two versions: a base case and one with the exit multiple cut by 30%. That second view forces discipline and saves you from optimism bias.

6. Who Should Use It and When

The single-tab return analysis model is not just for VCs. It’s designed for anyone trying to bridge forecasted performance with real-world returns. And to do it fast, clearly, and with no margin for confusion.

Founders and CFOs Pressure-Testing Series A/B

Before you step into a pricing conversation, you should know what your fundraising amount actually implies. This model helps founders and CFOs decide how much to raise, what kind of valuation makes sense, and how much dilution they’re taking for each incremental dollar.

You can also map losses against revenue to calculate your cushion, or how much room you have before EBIT falls off a cliff.

VC Associates Screening and Drafting

If you're sifting through decks, this becomes your compression tool. In five minutes, you can drop in P&L projections, apply standard comps, and check whether the deal clears internal bars.

When it’s time to write the investment committee memo, this model ensures consistent logic and avoids “model drift” across deals or partners.

Angels, Syndicates, and Family Offices

When you're writing smaller checks, secondaries, or evaluating a follow-on, this model helps ground the upside. Plug in your original entry point, estimate future rounds, and see whether your pro-rata rights still deliver meaningful return.

Ideal contexts: Fundraising prep, IC reviews, and board talks around exit timing, burn pace, and exit multiples.

7. Download the Excel Template That Turns Forecasts Into Fund-Makers

Most models tell you what might happen. This one tells you what you need to know.

The single-tab return analysis gives you speed, clarity, and a shared language for turning startup P&L projections into actual VC MOIC, fund-level impact, and investment conviction. It cuts through noise, exposes weak assumptions, and helps you make sharper decisions before you sign a term sheet or walk into IC.

Download the Return Analysis Excel template below.

Use it before the next round. Or risk modelling the wrong win 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.