YC's Handshake Deal Protocol🤝, The Generative AI Winners of 2025 🤖, Redefining Independent Media📰

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the complete startup database

New: Search by deal data and drack investor activity

Now investors can:

Automate weekly pipeline reviews – one saved search replaces your Monday spreadsheet ritual

Know what they missed – see every Series A your tracked investors led while you weren't looking

Follow the moves that matter – Identify the sectors attracting top-tier investors

In-Depth Insights 🔍

The Taxi Cab Theory of Venture Capital: Timing > Conviction ⏰

VCs are moving away from contrarian investing and leaning into timing. Like cabbies picking up passengers when the light’s on, they’re making deals based on market trends and FOMO rather than strong conviction. [Rex Woodbury]

Startups Raising Capital Right Now: 61 Opportunities You Shouldn’t Miss 🚀

61 startups are actively fundraising, spanning stealth to Series A/B. [Luis Llorens]

How Substack Went from Zero to $1B: Redefining Independent Media📰

Substack’s meteoric rise to a $1B valuation is a case study in empowering writers to monetize newsletters. CEO Chris Best discusses with Guillermo Flor and Ruben Dominguez Ibar their pivot to integrate social media, offering a blueprint for the future of independent mediaMiddle Market PE Deal Slump: Tariffs Hit the Heartland Hard 💥

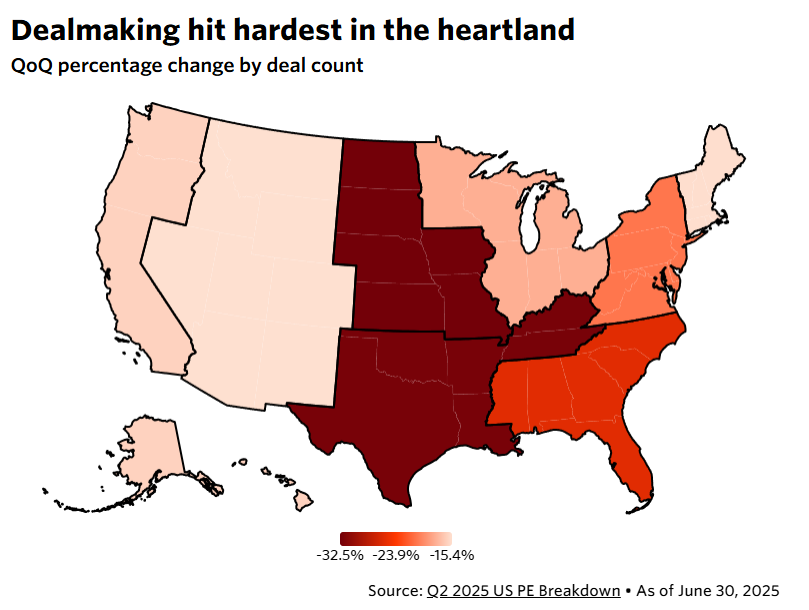

Tariffs from Trump’s “Liberation Day” hit the Midwest and South hardest, leading to a 32% drop in PE deal activity in the Midwest and a 26% drop in the Southeast. These regions, highly sensitive to trade policies, are seeing their deal pipelines shrink.

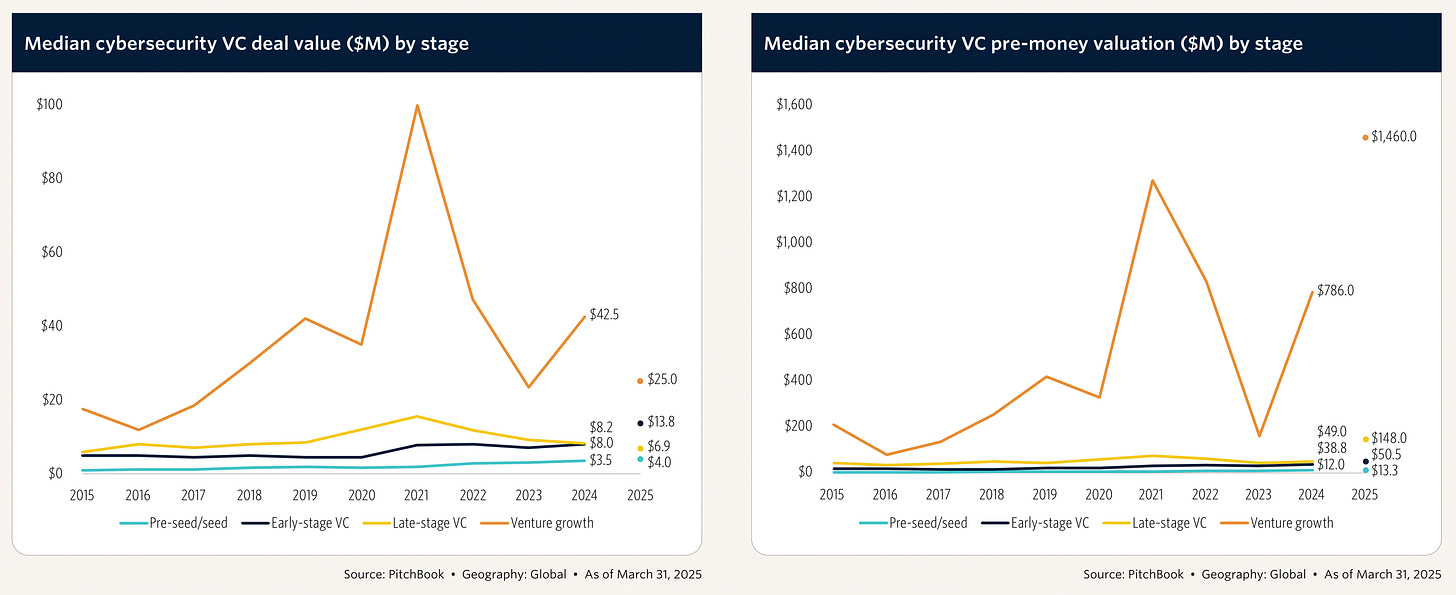

Cybersecurity VC Trends: Platform Consolidation Dominates Q1 2025 🛡️

Cybersecurity funding remained strong in Q1 2025 with $3.3B raised, but the real trend is consolidation. Larger firms are swallowing up smaller players to bolster their platforms, including major acquisitions by CyberArk and NVIDIA.

The YC Handshake Deal Protocol: Making Startup Transactions Crystal Clear 🤝

Handshake deals in Silicon Valley are often vague and prone to failure. The Handshake Deal Protocol aims to formalize these informal agreements, ensuring that verbal commitments lead to clear, actionable steps that everyone can trust. [Y Combinator]

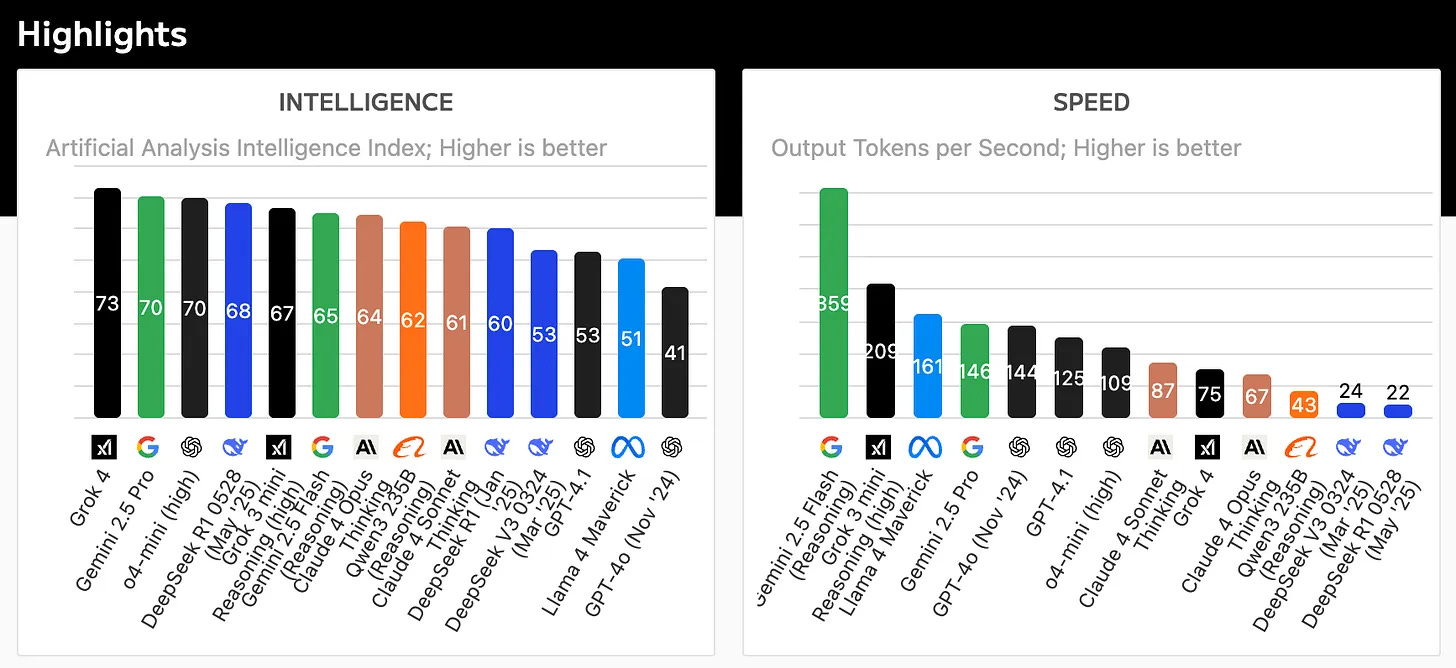

AI Market Clarity: The Generative AI Winners of 2025 🤖

The generative AI space is getting more competitive by the day. Companies like OpenAI and Anthropic are setting the stage for industry dominance, while specialized startups are taking over niches like legal and medical AI, shaping the future of the sector. [Elad Gil]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: rdominguezibar@gmail.com

Interesting Reports 📊

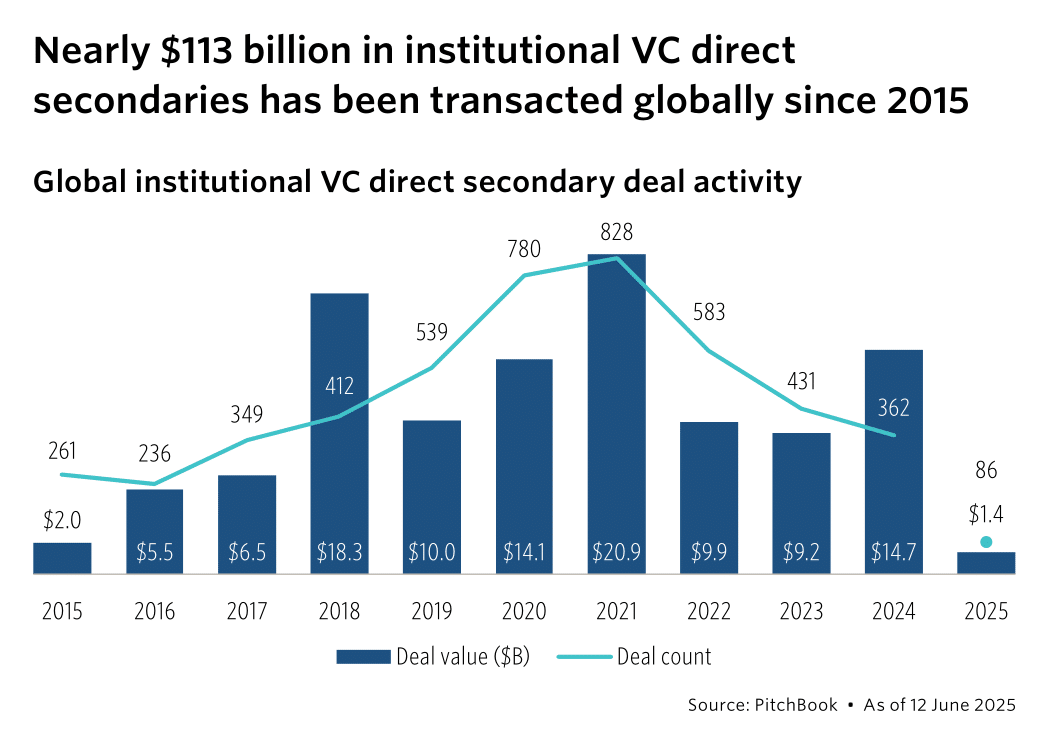

Sizing the European VC Direct Secondaries Market: A $77.2B Opportunity 💰

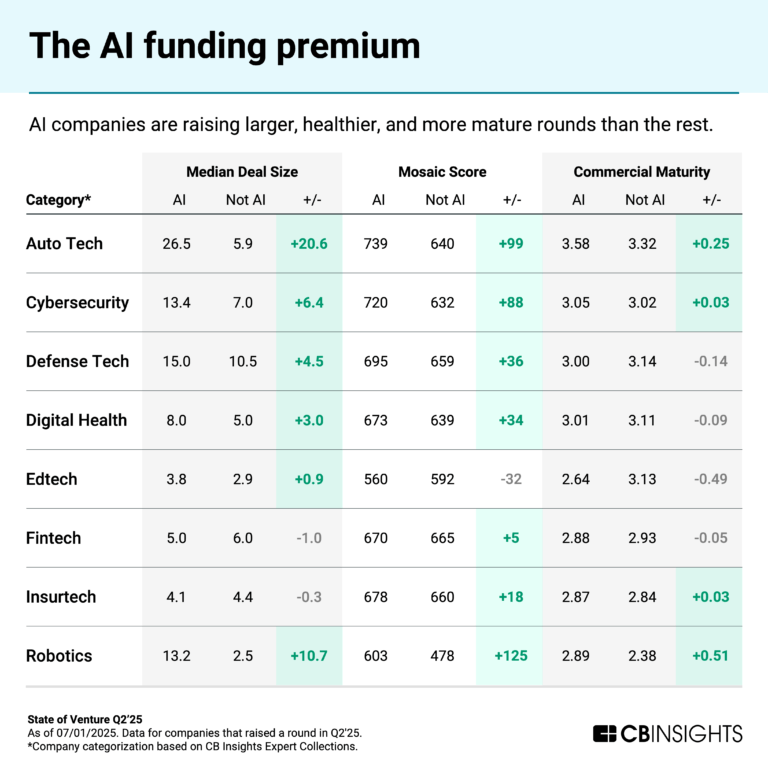

Europe’s VC direct secondaries market is on track to reach $77.2 billion, according to PitchBook. This surge, driven by liquidity constraints, is reshaping exit strategies and creating a new frontier for investors looking for smarter exits.Venture Funding Hits $90B for the 3rd Consecutive Quarter in Q2’25 📈

Venture funding reached a staggering $94.6 billion in Q2’25, a 53% increase from 2024. With AI, hard tech, and defense leading the charge, investors are pouring into fewer, larger deals as the market continues to shift towards high-impact sectors.

Recently Launched Funds 💸

Veralto committed €20M to a new fund focusing on innovative technologies in Emerald Technology Ventures.

RA Capital Management launched $120M for planetary health, supporting solutions to environmental challenges.

Yaday raised €100M to fund innovative technology solutions in various industries.

Brandon Capital closed $439M+ for Fund VI to focus on life sciences investments.

NUS Enterprise committed $150M to launch NUS VC program to support innovation and entrepreneurship.

Booz Allen venture capital $300M commitment to accelerate tech-driven innovation.

Auxxo raised €26M for the Female Catalyst Fund II, focused on investing in women-led startups.

Omega Funds closed $647M for Fund VIII, focusing on global health and biotech innovation.

Avalanche and Team1 launched $100K Fund to boost the Web3 ecosystem in India.

TechVision Fund raised €50M+ for TechVision Fund II to invest in cutting-edge technology companies.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

TCV (New York City, NY): VC Associate (apply here)

Audacious Ventures (San Francisco, CA): VC Investor (apply here)

Foreground Capital (Boston, MA): VC Associate (apply here)

Baird Capital (Chicago, IL): VC Associate (apply here)

Quona (Washington, DC): VC Manager (apply here)

Techstars (Los Angeles, CA): VC Associate (apply here)

Zoom (Remote): Corporate Development Manager (apply here)

Bouken Capital (Remote): VC Partner (apply here)

Planet A Ventures (Remote): VC Internship (apply here)

Kopa Ventures (London, England): VC Internship (apply here)

Hottest Deals 💥

Armada, raised $131M to expand its innovative platform. (read more)

Legalon, secured $50M in Series E funding to scale its legal tech solutions. (read more)

Agora, raised $50M in Series A funding to enhance its real-time communication platform. (read more)

Rune Technologies, raised $24M in Series A funding to advance its cybersecurity solutions. (read more)

Delve, raised $32M in Series A funding to accelerate its AI-driven analytics platform. (read more)

BetterComp, raised $33M in Series A funding to grow its compensation management software. (read more)

Spacely AI, secured $1M in seed funding to revolutionize its AI-driven space technology. (read more)

Scrunch AI, raised $15M in Series A funding to expand its influencer marketing platform. (read more)

Buena, raised $58M in Series A funding to scale its employee benefits platform. (read more)

Gupshup, raised over $60M to enhance its messaging platform. (read more)

Volca, raised $5.5M in seed funding to enhance its platform for next-gen communication. (read more)

Modern Baker, raised $2.5M in Series A funding to scale its health-focused bakery. (read more)

5C Group, raised $835M in funding to expand its global financial services. (read more)

April, raised $38M in Series B funding to grow its global insurtech platform. (read more)

Unlock, received a $250M capital commitment from D2 Asset Management. (read more)

RESOURCES 🛠️

✅ SaaS Financial Model

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth? Startups

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox