Why Retention is the Hardest Metric for Startups and 6 Ways to Master It

A founder and investor playbook on why retention matters, what great retention looks like by category, and how to build products that keep users coming back.

Why Retention Is the Hardest Metric for Startups and How to Master It

It doesn’t take long to realize that user growth is easy to fake.

Retention isn’t.

Anyone can spike signups with paid campaigns or get a short-lived boost from Product Hunt. But if users don’t come back, if they don’t stay long enough to form a habit or pay you, none of it matters.

Retention is where product meets reality. No matter how polished your pitch deck or onboarding flow looks, the data always answers the same question: did you build something people actually want to use again?

brought to you by MongoDB:

Bring your AI idea to a global stage

MongoDB, in partnership with Cerebral Valley, and top AI startups like Voyage AI, Fireworks, and Vercel, is hosting an Agentic Orchestration and Collaboration Hackathon in San Francisco on January 10th. They’re gathering the best AI hackers to build the future of agentic collaboration:

The top teams will earn an exclusive invitation to MongoDB.local SF (Use “MDBBuilder” 50% off tickets) to demo their innovative creation live in front of a panel of top industry judges. Don’t miss this chance to win $30,000 in prizes.

That’s why investors ask about retention before almost anything else. And it’s why founders who’ve been through the grind obsess over it. Behind every great product is a team that figured out how to keep users coming back.

But retention looks very different depending on the business. A 30-day retention of 8 percent might be strong for a mobile game and alarming for a fintech app. SaaS adds another layer with gross versus net revenue retention, expansion, and cohort behavior.

There is no single benchmark that works everywhere.

This guide breaks retention down by category. We’ll look at what healthy curves actually look like, how to measure retention properly, and which strategies reliably move the needle.

Table of Contents

1. What Retention Really Means for Startups

2. Why Retention Curves Always Go Down

3. Benchmarks for Retention by Category

4. The Golden Cohort and Why Scale Hurts Retention

5. Why Churn Is Asymmetric

6. How to Measure Retention the Right Way

7. What Drives Great Retention

8. Retention Playbook for Founders - 6 Ways to Master It

9. When to Pivot Instead of Optimizing

10. The Retention Mandate

1. What Retention Really Means for Startups

Founders usually love to talk about growth. But smart founders know that real growth doesn’t start with acquisition, but with retention. If users don’t stick, nothing compounds. And if investors sense churn hiding behind your pointless metrics, you are not getting a second meeting.

Let’s get crisp on what we’re actually talking about.

User Retention: Do They Come Back?

User retention measures how many users return to your product after their first interaction. It answers the most basic survival question: do people want to keep using this?

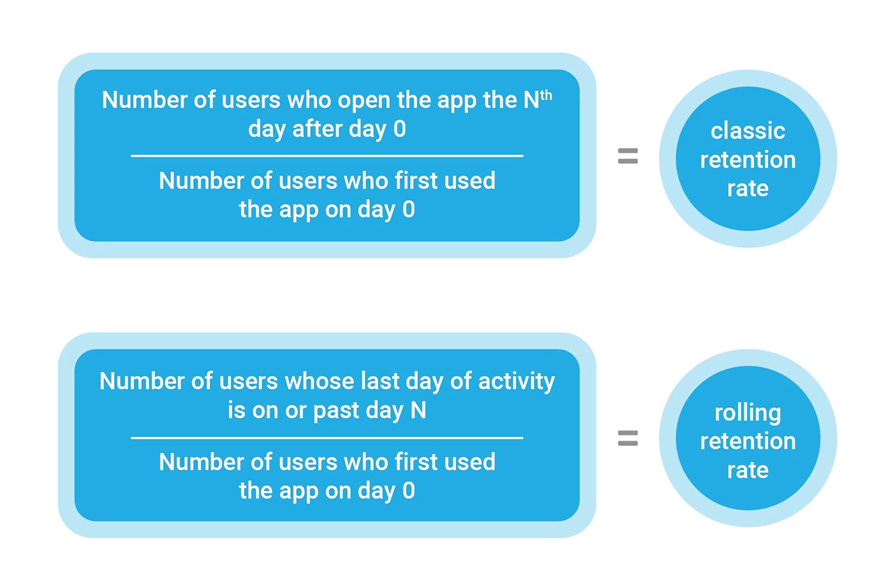

The most common method is N-day retention; how many users return on Day 1, Day 7, Day 30, etc.

For example, if 1,000 people sign up and 120 come back on Day 7, you’ve got 12% Day-7 retention. That’s useful, but limited.

Many teams now use rolling or unbounded retention: how many users return on or after a given day. It gives a more forgiving and realistic picture, especially for products that aren’t built for daily use. Think travel apps or budgeting tools where usage is periodic, not daily.

Both models are useful. But the key is consistency. Founders should pick a definition that matches their product’s rhythm and stick with it.

Revenue Retention: Do They Spend More?

In SaaS and enterprise, retention goes beyond logins and becomes all about revenue. That’s where these two key metrics come in:

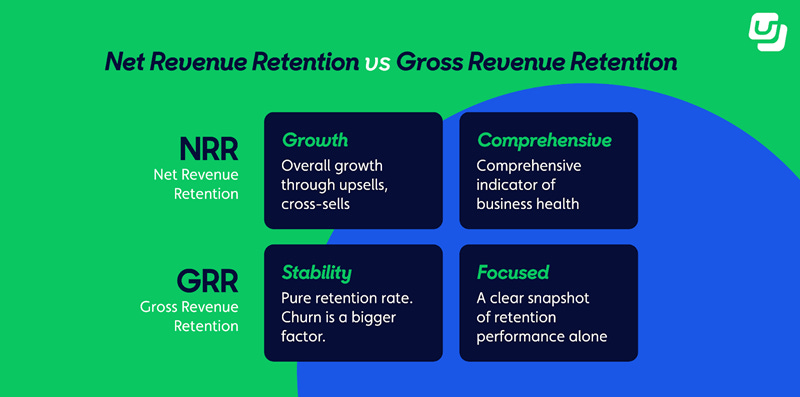

Gross Revenue Retention (GRR): How much existing revenue you retain before expansion or upsell.

Net Revenue Retention (NRR): How much you retain after expansion.

If you start a quarter with $1M in ARR and end with $950K (no upsell), your GRR is 95%. But if you expand some customers and end with $1.1M, your NRR is 110%.

NRR > 100% means your existing base is growing, even if you add zero new logos. That’s magic. Investors love it because it proves you’ve found high-value customers who grow with you. Slack famously reported 132% NRR in its S-1. Zoom did 140%+. These are the perfect examples of land-and-expand in action.

Retention = Product-Market Fit in Numbers

The reason retention gets so much weight is because it’s the cleanest proxy for product-market fit. It reflects actual user behavior and not just sentiment. It doesn’t care about your brand, your funnel, or your press hits. It’s used to answer one very important question:

Do users come back, and do they pay you more?

Consumer startups are especially anchored on user retention curves. B2B SaaS companies live and die by revenue retention. In both cases, bad retention means you’re not solving a problem users care about, or at least not solving it well enough.

2. Why Retention Curves Always Go Down

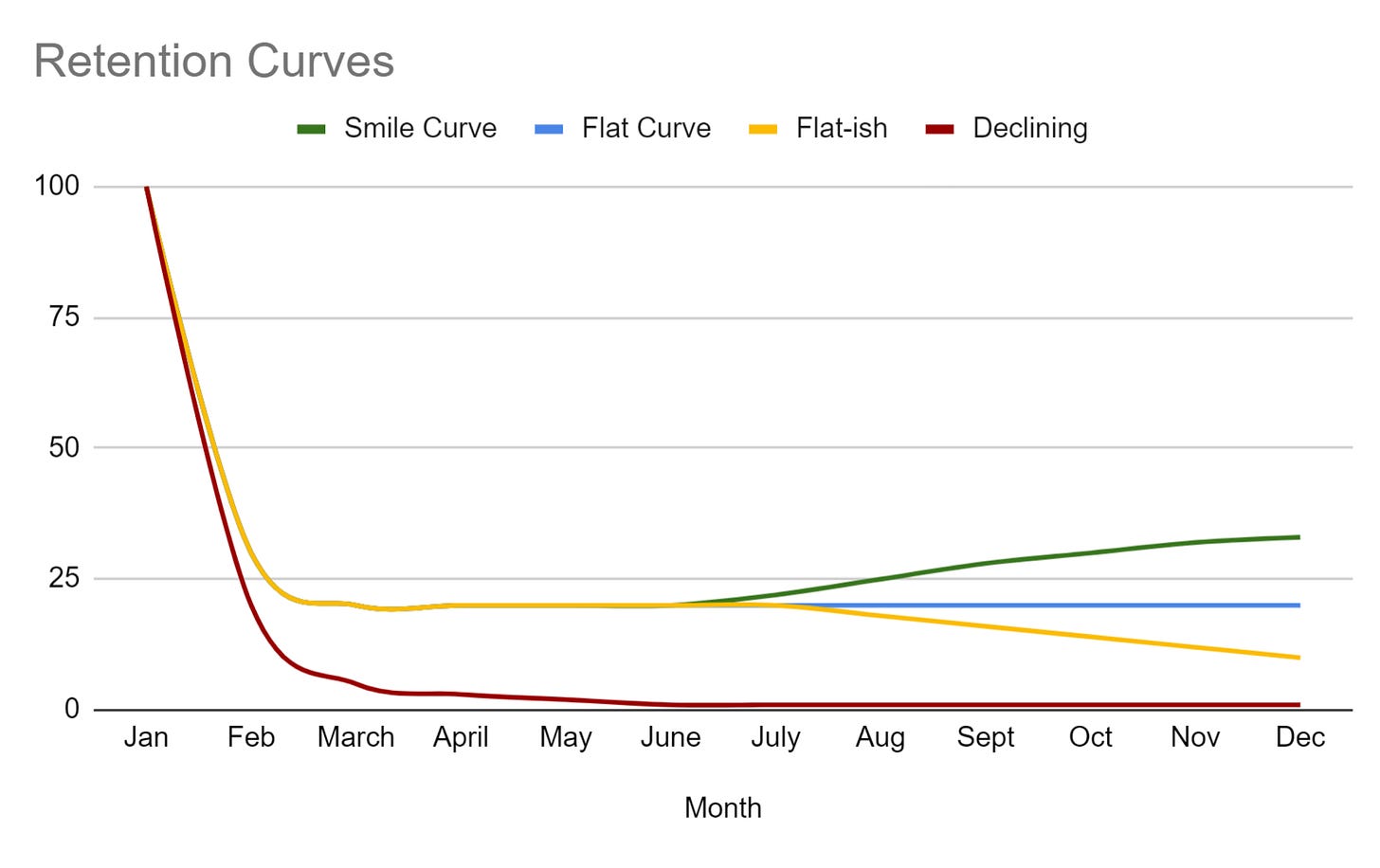

Every founder is eventually faced with the same graph. A beautiful spike on Day 0 - signups, installs, traffic. And then… the slow slide. Day 1, Day 7, Day 30. Each point is lower than the last. The classic retention decay curve.

The Half-Life of a New User

Retention curves almost always follow a half-life pattern. That means you lose half your users after the first day, half of what’s left after a week, then another half by Day 30.

Let’s say 1,000 users install your app:

Day 1: 500 return

Day 7: 250 return

Day 30: 125 return

Don’t panic already. That curve is normal. Although harsh, it’s normal. Even top-performing consumer apps lose 70–80% of new users by Day 7. Most SaaS tools don’t fare much better unless they're tied to a critical workflow.

And the reality is that retention curves rarely “bounce back.” If a user doesn’t come back within a few days, consider them gone. Win-back emails don’t save them, push notifications don’t save them; you only get one shot to prove value.

When Curves Flatten, And Why That Matters

The one thing you do want to see in a retention curve is a flattening tail. A steady base of users who stick. They log in, complete a task, consume content, transact, or whatever “active” means for your product.

That flat part of the curve is your core audience. The earlier it flattens and the higher it flattens, the better. It means you’ve found your people, and they’re not leaving.

The Exceptions to the Rule

Yes, there are rare cases where retention curves bend upward. But they’re outliers, not norms.

Hardcore products: Think professional tools, high-friction platforms, or games with steep learning curves. Users may churn early but come back once they “get it.” Poker apps, crypto dashboards, CRM systems.

Network effect loops: Products like Slack or Notion sometimes reactivate dormant users when teammates pull them back in. These can cause secondary bumps in retention, but they require very specific conditions.

If you’re counting on this kind of comeback, be honest: is it a network effect, or just wishful thinking?

Retention curves go down because most people try something once and never return. Your job as a founder is to slow the slide, raise the tail, and find out, fast, whether your product is sticky for anyone. If the curve flatlines near zero, you’re no longer looking at a retention problem, you’re most likely staring at a product problem.

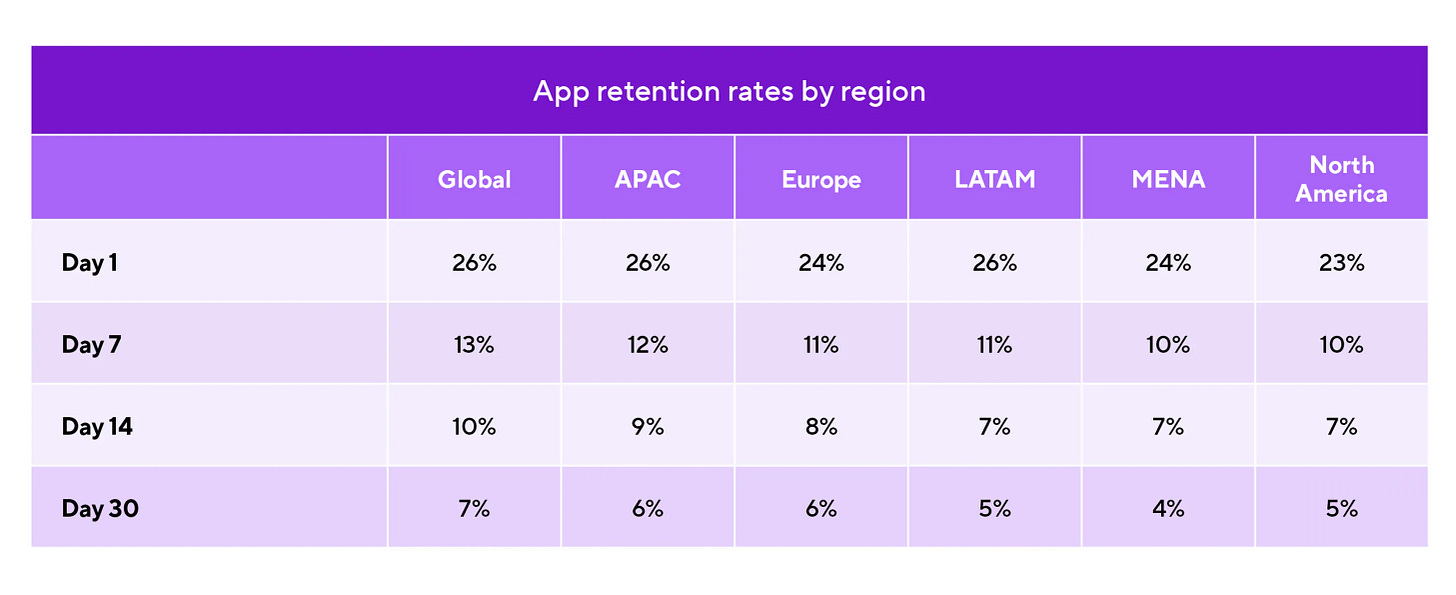

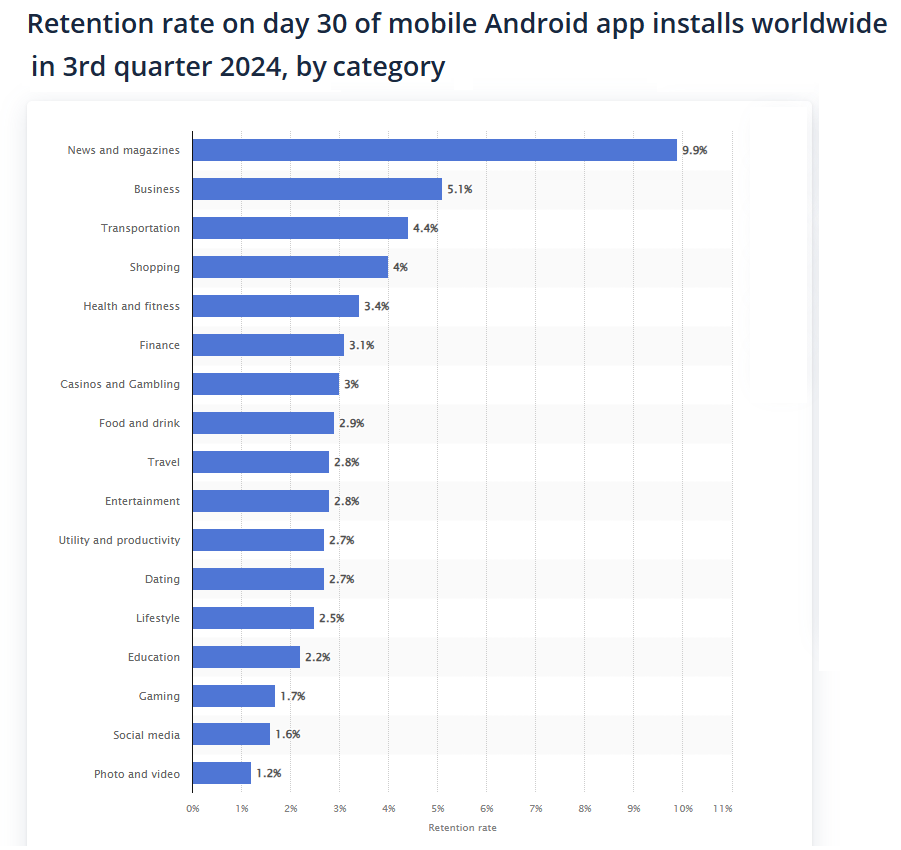

3. Benchmarks for Retention by Category

Not all retention is created equal. A 6% day-30 retention might be a red flag in fintech, but a runaway hit in mobile gaming. The right way to read your numbers is within context. And your product category is what defines the baseline.

Let’s break it down.

Consumer Apps: The First Week Is Make or Break

For most consumer apps, the drop-off is brutal. The industry median looks like this:

As you may notice, the numbers flatten fast. If you’re holding more than 5% by Day 30, you’re already top quartile in most consumer verticals. But outcomes swing dramatically depending on what kind of app you're building.

Shopping and E-Commerce

This category is impulse-heavy and seasonal.

Day 30 retention: ~5–6%

Stronger for marketplaces (e.g. Etsy, Amazon-style) than for single-brand stores.

Re-engagement is usually driven by sales, notifications, or replenishment reminders.

Fintech and Banking

This is an industry that requires high-friction to start, but high utility once set up.

Day 30 retention: ~10–12%

Apps like neobanks, credit monitors, or investment trackers show some of the highest retention across mobile.

Setup complexity filters low-intent users early, what’s left tends to stick.

Gaming

Churn is expected for this category. And it happens fast.

Median Day 30 retention: <1%

Top 1% of games can hit 5–8%, but that’s outlier status.

Even hits often see 90% churn by Day 30. Virality, ad monetization, and whales keep the business alive.

News and Social

Power users dominate this sector.

DAU/MAU ratios are the metric to watch, above 50% is elite.

News apps often hit ~10% day-30 retention; social networks can do much better if network effects kick in early.

Retention becomes a game of habit loops and peer pull.

SaaS: The Land-and-Expand Retention Game

For SaaS, especially B2B, the stakes are different because retention is measured by revenue and not logins. Here’s what the benchmarks look like:

Gross Revenue Retention: ~90%

Net Revenue Retention: 101–110% (median)

Top Quartile NRR: 120–140%

GRR tells you how well you hold onto existing revenue without expansion.

NRR tells the full story by measuring account growth, seat upgrades, and upsells.

Investors love an NRR > 100%. It means your product not only retains but grows inside your customer base.

Why These Benchmarks Matter

Don’t compare your gaming app to a fintech one. Don’t panic because your shopping app can’t hold 12% by Day 30. Retention lives inside the realities of usage frequency, user motivation, and habit depth.

Great retention feels like magic, but it’s mostly mechanics, matched to the nature of your product.

4. The Golden Cohort and Why Scale Hurts Retention

Every product has a honeymoon phase. You launch, and the first wave of users rolls in. They are all excited, curious, and ready to explore. And if you’re lucky, some of them will stick. They engage, they pay, they tell their friends.

That group is your Golden Cohort.

Who Is the Golden Cohort?

They’re the earliest adopters who got it instantly. Users who came in with high intent, used the product the right way, and weren’t distracted by price, polish, or FOMO. They showed up because they had the problem your product solved, not because of an ad or a discount.

Their retention curve is usually your best ever. It flattens high and early. And for a while, it feels like you’ve cracked it.

But that’s until you start scaling.

Why Later Cohorts Retain Worse

As you expand, your acquisition channels will change. You move from early X threads and word-of-mouth to paid ads, giveaways, SEO, PR campaigns. Your messaging broadens, your targeting loosens. And suddenly, you’re attracting users who might be a fit, but probably aren’t.

Here’s what happens:

In study after study, organic users retain 20–30% better than paid ones. And the reason is that these people were looking for you. Paid users, by contrast, clicked an ad. It’s often curiosity, instead of commitment.

Scaling brings volume, but it also brings noise alongside it. Your user mix gets messier and intent gets softer. Your retention curve goes down, not because your product got worse, but because your audience has changed.

This Isn’t Failure. It’s Physics.

Declining retention over time is normal. It doesn’t mean you’ve lost product-market fit. It means you’ve moved beyond your bullseye segment and now need to work harder to surface value early. What was once self-evident now needs onboarding. What used to be intuitive now needs friction removed.

The goal isn’t to maintain your Golden Cohort curve forever. That’s impossible. The goal is to understand the curve drop, and build systems to close the gap.

So treat your Golden Cohort as a benchmark instead of a baseline. Use their behavior to improve onboarding, refine messaging, and target the next best-fit users, not just the next warm bodies.

5. Why Churn Is Asymmetric

One of the hardest truths about retention is that once a user leaves, they’re probably gone for good.

You might get one email opened. Maybe a click. But actual reactivation, which means real usage, is rare. Most founders underestimate how cold a cold user really is.

The Physics of Lost Attention

It’s incredibly easy to lose a user. One bad onboarding experience, a confusing moment, a slow-loading screen, that’s all it takes. And once they’re out, they’ve most probably moved on mentally. They’re looking elsewhere.

Reactivation campaigns try to pull them back, but the numbers are brutal:

Email win-backs often get <5% click-through.

Reactivation discounts or promos get maybe 10–20% redemption rates.

Usage reactivation is usually <10%. And even then, few stick.

Even if you do bring someone back, the retention curve resets, and it’s usually worse than the first time.

Prevention > Resurrection

This is why great teams focus on preventing churn, not undoing it.

Here’s where you need to do a complete 180 in your mindset.

Stop asking: “How do we get them back?”

Ask: “Why did they leave in the first place, and how do we stop the next one from doing the same?”

That might mean shortening time-to-value, smoothing out the second-session experience, catching friction with heatmaps or NPS drop-offs, and segmenting by churn trigger (e.g. “users who didn’t complete onboarding step 3”).

Because reactivation is a gamble. But prevention is a system.

The Only Exception: Network Effects

There is one loophole in this whole situation, and that’s strong network products.

If your product’s value grows with each user (think Slack, Notion, Figma, multiplayer games) then you get second chances. A teammate invites them back, a file needs review, a shared doc shows up in their inbox.

There is no marketing involved here; it’s plain product-driven reactivation. And it works but only if you’ve truly built a network product. If not, don’t rely on this.

Churn is asymmetrical. It's more like a cliff instead of a revolving door. Once users fall off, the best you can do is learn from it, and build a product sticky enough that the next cohort never makes that jump in the first place.

6. How to Measure Retention the Right Way

Retention only means something if you're measuring it right. And most teams get tripped up; not by the math, but by choosing the wrong lens.

True measurement isn’t just about dashboards but about understanding how your users behave, where they're dropping off, and which signals actually predict stickiness.

Let’s break down the measurement stack that matters.

N-Day Retention: The Classic Snapshot

This is the default for most teams:

Day 1 Retention = % of users who return the next day after signup

Day 7 = % who return on the 7th day

Day 30 = % who return on the 30th day

If 1,000 users sign up on Monday and 120 come back the following Monday, that’s 12% D7 retention.

Use this if your product is meant to be used frequently, such as daily, weekly, or in a regular cadence.

Don’t use this blindly if your product isn’t built for daily use (e.g. travel, tax, or workflow-specific SaaS). N-day retention can drastically underreport true engagement in those cases.

Rolling (Unbounded) Retention: The Reality Check

This measures whether users return on or after a certain day, rather than on that day exactly.

So instead of “did they come back on Day 7,” you’re asking “did they come back any time after Day 7?”

It gives you a wider view of long-term re-engagement and is especially useful for products that are episodic or seasonal.

Use it when your product has flexible usage patterns.

Don’t use it as your only metric; it hides frequency and short-term drop-offs. Rolling retention should complement, not replace, N-day views.

DAU/MAU Ratio: Stickiness in a Sentence

This one tells you how frequently users return within a month.

A DAU/MAU of 10% = your average user shows up 3 days a month

A DAU/MAU of 50%+ = you’re in elite territory (think: messaging, games, productivity)

Use it to track changes in user habit depth over time.

Don’t compare it across categories. A 20% DAU/MAU in fintech might be great; in social media, it’s weak.

Cohort Analysis: Your Retention Microscope

This is where the real insight lives. Track users by signup week or month, and see how their behavior evolves.

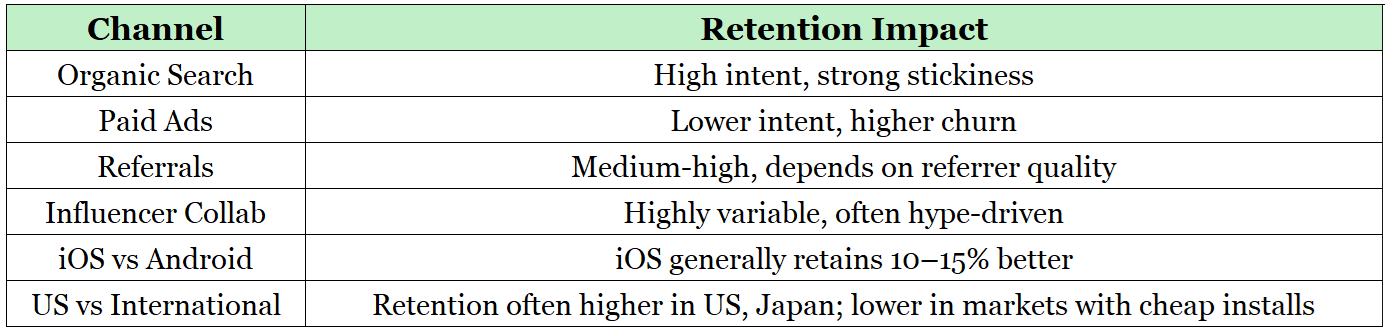

Better yet, segment by:

Acquisition source (paid vs. organic)

Device (iOS vs. Android)

Geo (US vs. India vs. Brazil)

Platform (web vs. mobile)

You’ll quickly spot retention cliffs, sticky segments, and promising curves to double down on.

Use cohorts to guide product decisions, especially onboarding changes and feature launches.

Don’t average everything into one retention curve. That’s how you miss hidden churn.

Avoiding the Measurement Traps

Even good retention setups can go sideways if you're not careful. Common pitfalls include:

Seasonality: If you’re launching during holidays, expect a drop after. Adjust for timing.

Bugs or downtime: A missed login window can flatten your curve artificially.

Feature launches: Big changes mid-cohort = inconsistent metrics. Always annotate.

The goal is consistency. Whatever method you choose, use it uniformly across cohorts so you can compare apples to apples, and not get tricked by noisy data.

Retention is your feedback loop. But only if you’re measuring it with clarity, consistency, and context. Otherwise, you’re flying blind, with a really nice dashboard.

7. What Drives Great Retention

Great retention doesn’t happen because your product is beautiful. It happens because your product gives users a reason to come back, again and again, without being asked.

Let’s break down the mechanics that actually move retention curves.

1. Activation and Time-to-Value: Win Early or Lose Fast

Retention starts in the first session. If users don’t see value quickly, they churn, and they don’t come back.

Time-to-value (TTV) is the clock ticking from signup to “aha.” Every extra step, delay, or distraction increases the chance they’ll walk away.

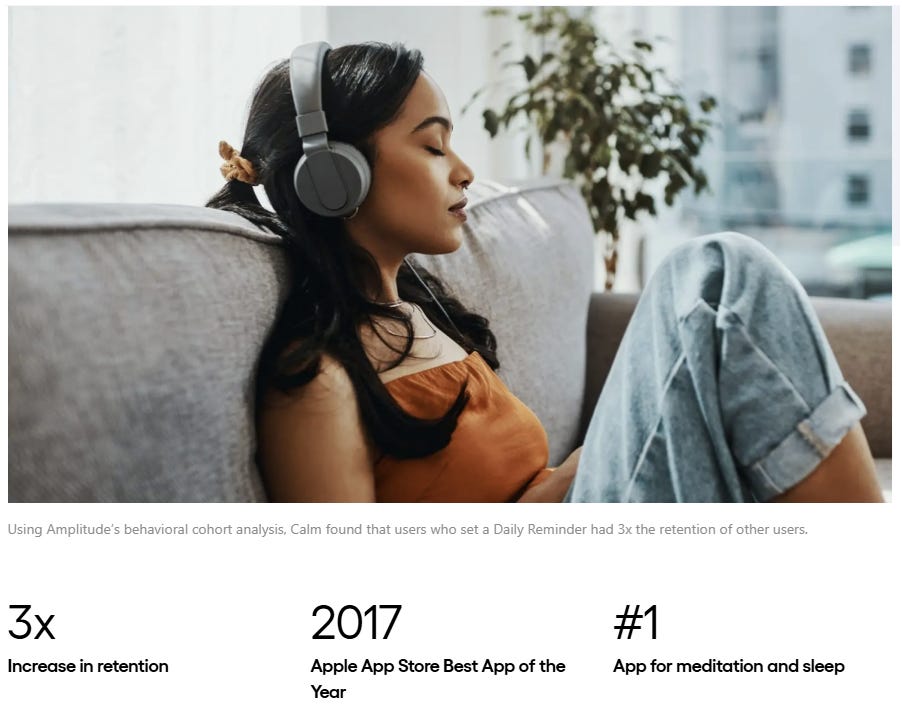

Calm found that users who set a reminder on Day 1 retained 3× better than those who didn’t. That small action connected them to a future habit. Facebook discovered that users who added 7 friends in 10 days had far better long-term retention, and rebuilt onboarding to drive toward that behavior.

Your job is to surface the core value ASAP. Don’t teach the whole product, just get them to the moment it clicks.

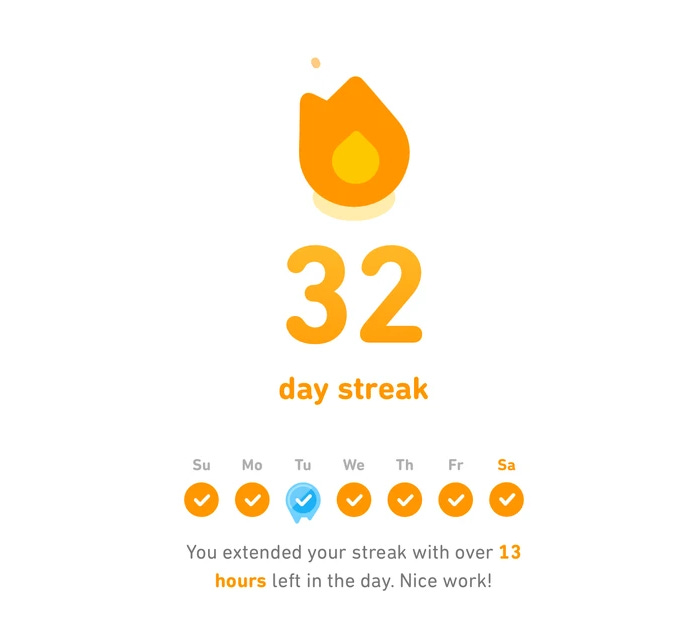

2. Habit Loops: Design for Return Behavior

Retained products have built-in triggers. They train users to come back.

The loop looks like this:

Trigger → Action → Reward → Stored Value

Duolingo nails this with daily streaks and light gamification. Open the app, do a quick lesson, get your streak badge, unlock more content.

Headspace and Notion send smart nudges based on past usage; not spam, but relevant friction reducers.

Build real rewards into recurring actions. Not just “yay, you did it,” but value that builds over time.

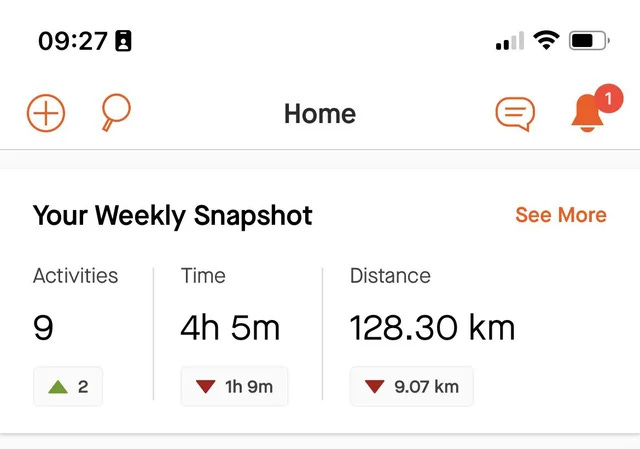

3. Progression Systems: Let Users See Growth

Users stick when they feel progress. It’s a basic psychological loop; small wins build momentum.

Strava shows weekly summaries. MyFitnessPal saves meal logs and goal streaks. Even SaaS companies like HubSpot show you how close you are to hitting your next campaign milestone.

Think about how you could let users “save” effort or “level up” over time. This increases stored value, and stickiness.

4. Network Effects: Bring Them Back Through Others

Some products pull you back in because someone else needs you there.

For example, Slack will ping your teammate, your project is in Notion and the whole team has access to it. Figma works the same way by tagging other people in the comments. Google Docs, Calendly, Loom, they all thrive on passive reactivation via collaboration.

If your product can build real-time or asynchronous collaboration into the core flow, you win multiple chances to reactivate users organically.

5. Revenue Expansion: Turn Retention Into Growth

In SaaS, some of the strongest retention loops are tied directly to expansion.

Slack’s NRR was 132% because teams kept adding seats as usage spread. Notion upsells when teams hit workspace limits. Uber for Business expands when companies invite more employees.

If retained users are growing their spend over time, then you’ve built a healthy, compounding business.

8. Retention Playbook for Founders - 6 Ways to Master It

Every startup says they care about retention, but few actually build for it.

This playbook is for those who want to move from talking about retention to actually improving it; step by step, with no fluff and no jargon.

1. Instrument Retention Properly

You can’t fix what you can’t see.

Set up N-day and rolling retention.

Break it down by cohort: signup source, geo, device, platform.

Layer in DAU/MAU, churn reasons, and usage drop-off points.

If your dashboards can’t tell you which users leave, when, and why, you’re guessing.

2. Identify Your Activation Milestone

This is the behavior that predicts retention. But it’s not always obvious.

For Duolingo, it’s finishing the first lesson.

For Notion, it might be creating a second doc or sharing one.

For your product? Dig into your retained users and find what they all did early.

Once you know the milestone, rebuild onboarding to drive toward it.

3. Improve Onboarding and Second-Session Value

First impressions matter. But second sessions decide everything.

Remove friction from onboarding (form fields, bad defaults, decision fatigue). Surface value fast, don’t bury key features behind tabs or tutorials. Give users a reason to come back on Day 2 that’s tied to their goal.

4. Use Contextual Messaging, Not Spam

Don’t beg users to return. Give them a reason.

Trigger emails or push based on behavior: what they started but didn’t finish, what they viewed, what others in their team did. Personalize nudges around user goals, not generic FOMO.

“Here’s your draft” beats “Come back!” every time.

5. Scale What Already Works

Look at your best cohorts, your organic users, referral traffic, specific geos. Where does retention already hum?

Double down on investing more in those acquisition channels, uUse their language in your messaging, and build features around their core needs. Don’t treat every user like they arrived the same way. They didn’t.

6. Monitor DAU/MAU and NRR Relentlessly

DAU/MAU shows habit strength. NRR shows dollar durability.

Track both. And do it weekly. If DAU/MAU dips, revisit your habit loops. If NRR drops below 100%, you’ve got a hole in your revenue bucket. If both are strong, you’re compounding.

This playbook is what the best teams use when they stop chasing top-of-funnel sugar highs and start building a product that lasts.

9. When to Pivot Instead of Optimizing

Not every retention problem has a fix. Sometimes the curve doesn’t need tweaking, it needs replacing.

Here’s how to know when it’s time to stop optimizing and start rethinking what you're building.

The Red Flags You Can’t Ignore

Some metrics speak louder than others:

Day 1 retention <10% in a daily-use category (e.g., social, productivity, messaging)

Day 7 retention <5% even after multiple onboarding, copy, or UX experiments

No cohort flattens, they all decay to zero

If these patterns persist across segments, devices, and geographies, the message is clear: the core value isn’t landing.

Small Tweaks Won’t Save a Broken Curve

Too many teams get stuck in what some refer to as the “the A/B test death spiral”. They spend their time tweaking buttons, headlines, email timings while ignoring the fact that users simply don’t want what’s being offered.

Notifications won’t fix it. Discounts won’t fix it. Neither will a prettier UI. If users don’t stick around, it’s not because they forgot, but because they didn’t care enough to return.

What Real Pivots Look Like

Pivots that improve retention usually share one trait: they redefine the core product value.

Not “change the landing page”

Not “rebrand and relaunch”

But: change the problem you're solving or the user you’re solving it for

Sometimes the insight comes from your best 1% of users. Sometimes from an entirely different use case you weren’t even targeting. But either way, the fix isn’t at the edges. It’s in the center.

Don't Burn Years Chasing a Dead Curve

The hardest part is letting go, especially after you’ve invested months into a roadmap, team, and story you believed in. But pouring time into a product with zero long-term retention is the slowest way to fail.

If you're stuck, be honest. Zoom out. Start again, not from scratch, but from truth. Some curves don’t bend, and that’s your cue to build something that does.

10. The Retention Mandate

Retention is where growth gets real.

It’s not the metric investors ask about first because it’s trendy, it’s because everything else flows from it. Activation, monetization, expansion, virality, even fundraising. None of it sticks if your users don’t.

Here’s what to walk away with:

Retention is the single most important growth metric. Without it, you’re just repurchasing the same users.

You can’t out-market a leaky product. Acquisition fuels the top of the funnel, retention decides what compounds.

Benchmarks matter, but only in context. Don’t measure your fintech app against a game. Use the right standard for your space.

Great retention isn’t magic. It’s the product of fast time-to-value, engineered habit loops, meaningful progression, and, above all, knowing your user.

Curves don’t lie. If your retention isn’t working, it will show early and clearly. Don’t ignore it.

In the end, retention is the clearest expression of product-market fit. It’s users voting with their time. And the only thing more powerful than getting them in the doo is giving them a reason to stay.

Really comprehensive breakdown of retention mechanics. The point about golden cohorts degrading as you scale resonates because we've seen similar patterns with paid acquisition diluting intent signals. What's underappreciated is how activation milestones shift across customer segments, meaning one-size-fits-all onboarding often underoptimizes for your best users while still failing to convert marginal ones.

Retention is the industry’s favorite lagging indicator.

It tells you who already failed, just with nicer charts.

We built Axiom Cortex because measuring retention after the fact is treating the symptom, not the system. Most vendors optimize hiring for surface signals resumes, years, frameworks and then act surprised when teams churn.

Our premise was simple: if you can model cognitive alignment upfront how engineers reason, make tradeoffs, handle ambiguity, collaborate under constraint then retention becomes an outcome, not a KPI you chase.

We don’t “improve retention” downstream.

We remove the mismatch upstream.

Neuro-psychometric composition and predictive performance modeling let us answer the real question before hiring starts: will this engineer actually thrive inside this team, this architecture, this operating cadence.

When alignment is right, retention takes care of itself.