AI is Polytheistic⚖️, Where's My Moat?🏰, Index is the New Sequoia🚀

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Attio, the AI-native CRM for the next generation of teams

Sync your email and calendar, and Attio instantly builds your CRM — enriching every company, contact, and interaction with actionable insights in seconds.

Join fast growing teams like Granola, Flatfile, Modal, and more.

In-Depth Insights 🔍

Should VCs Invest In ‘Jockeys’ Or ‘Horses’? 🧑💼

Founder-first investing is overrated. New data shows focusing too much on charisma and credentials often leads to poor investments. The best VCs evaluate founders through their business, not separately. [CrunchBase News]Dude, Where's My Moat? 🏰

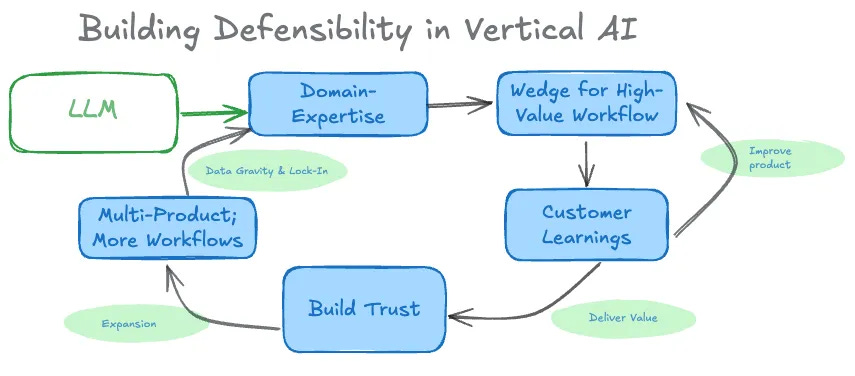

In Vertical AI, speed gets you started, but defensibility is what keeps you in the game. Euclid Ventures breaks down how data loops and long-term lock-in strategies should be built from day one. [Euclid Ventures]

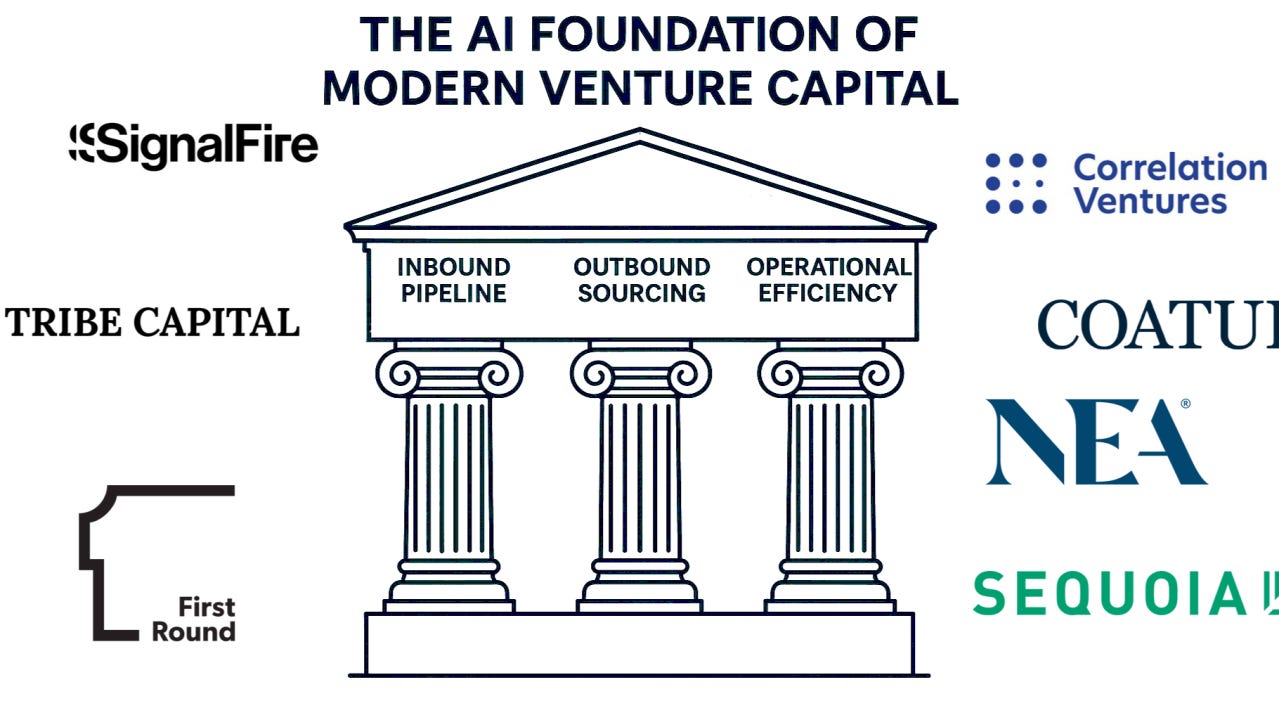

How the Best Venture Capitalists Are Using AI 🤖

AI isn’t replacing VCs, but it’s automating the grunt work. Top firms use AI for triaging inbound, generating reports, and streamlining workflows, freeing them to focus on what matters most.

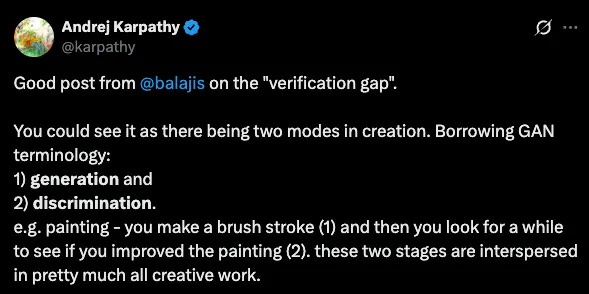

AI is Polytheistic, Not Monotheistic ⚖️

Balaji argues that AI isn’t a single all-powerful model. Instead, it’s a collection of competing systems. This sharp, multi-angle framework shows how AI will scale and shape various industries. [Balaji]

Index is the New Sequoia. And No, Bankers Didn’t Screw Figma 🚀

Figma’s IPO was a massive success, Index Ventures is rising fast, and Adobe’s struggling. This breakdown explains why Index is leading the way in VC, while others are stuck in the past.

Why Winners Win 🏆

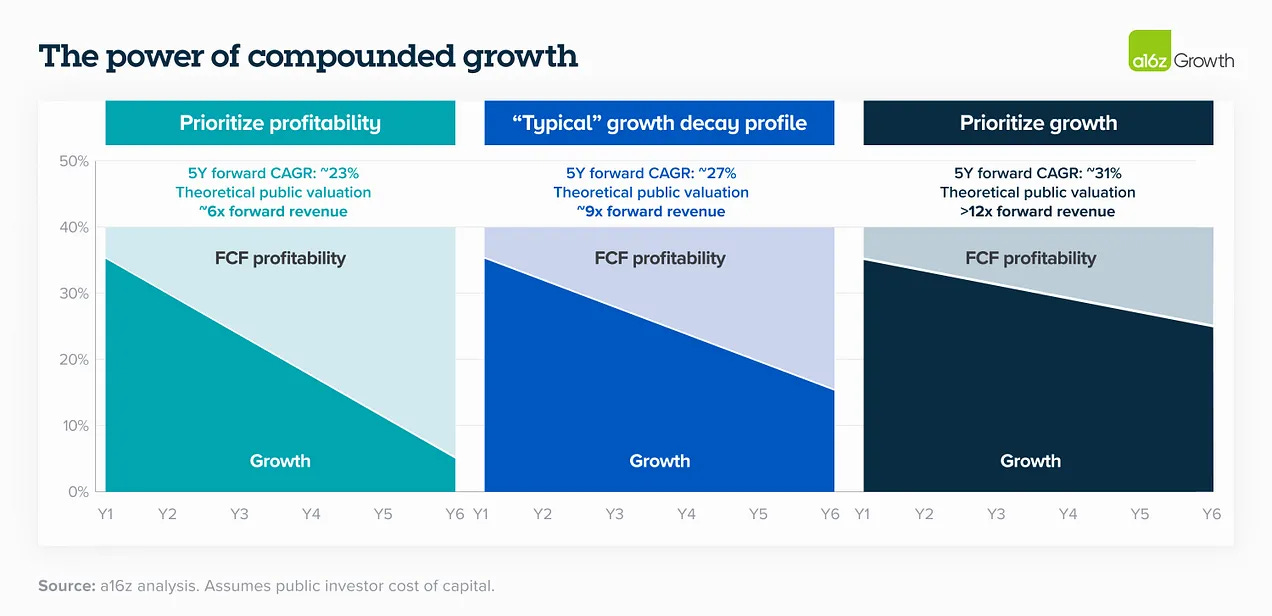

a16z reveals the traits of “modelbusters”, companies that redefine their markets and grow at extraordinary rates. Here’s how to build a business that blows past expectations and keeps compounding. [a16z Growth]

This VC Firm Is Striking Gold, Reaping $11 Billion From Figma, Other Startups 🏛

Index Ventures is already reaping $11 billion from Figma, Wiz, and Scale AI. While most firms wait for exits, Index is seeing huge returns now. [The Wall Street Journal]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

The Big Book of Venture Capital - Q2 2025 Edition 📘

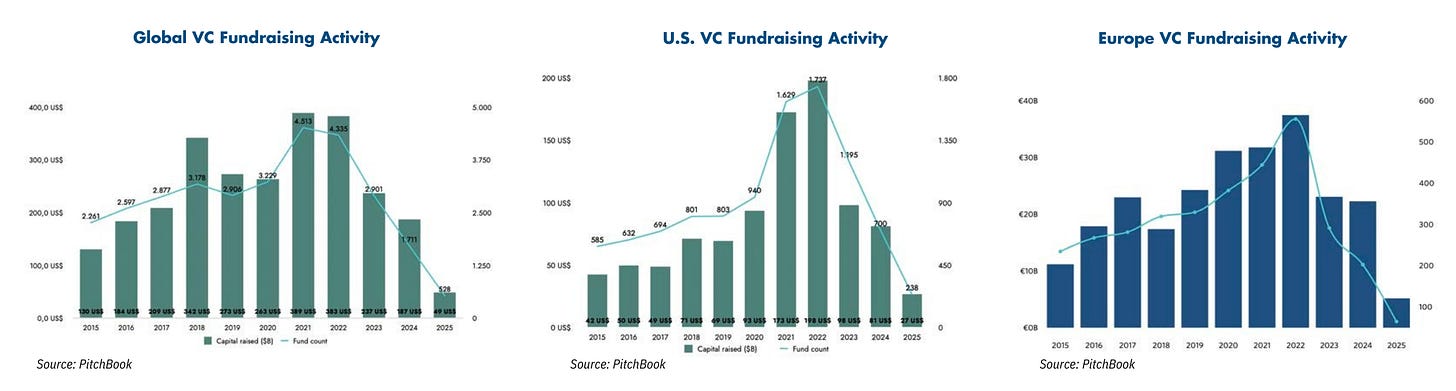

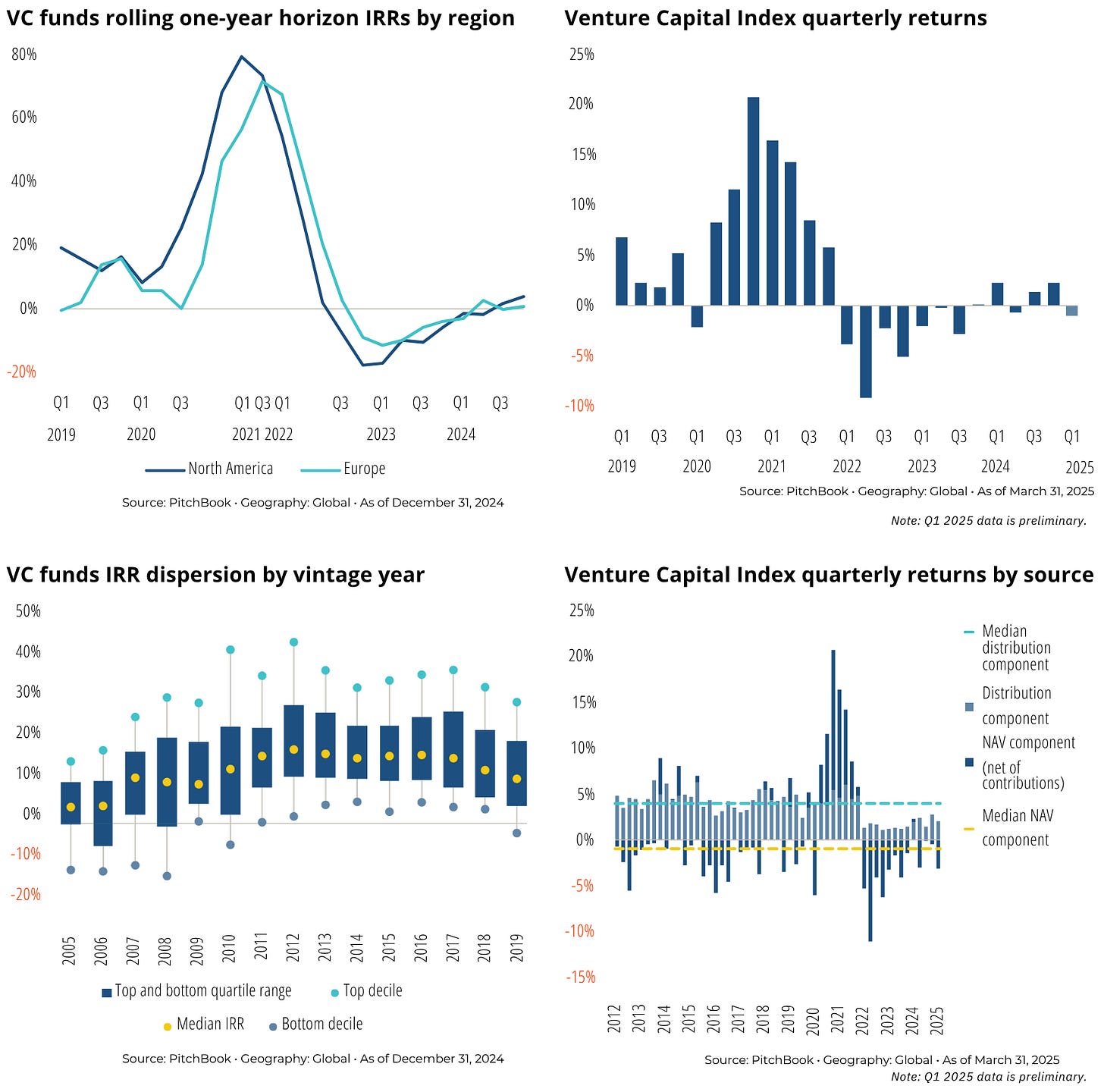

Rohit Yadav’s Q2 report dismantles the “venture winter” myth. With $205B raised globally and valuations bouncing back, the market reshuffling points to power consolidation, strategic capital, and AI-driven shifts.Global Fund Performance Report - Q1 2025 Preview 🌍

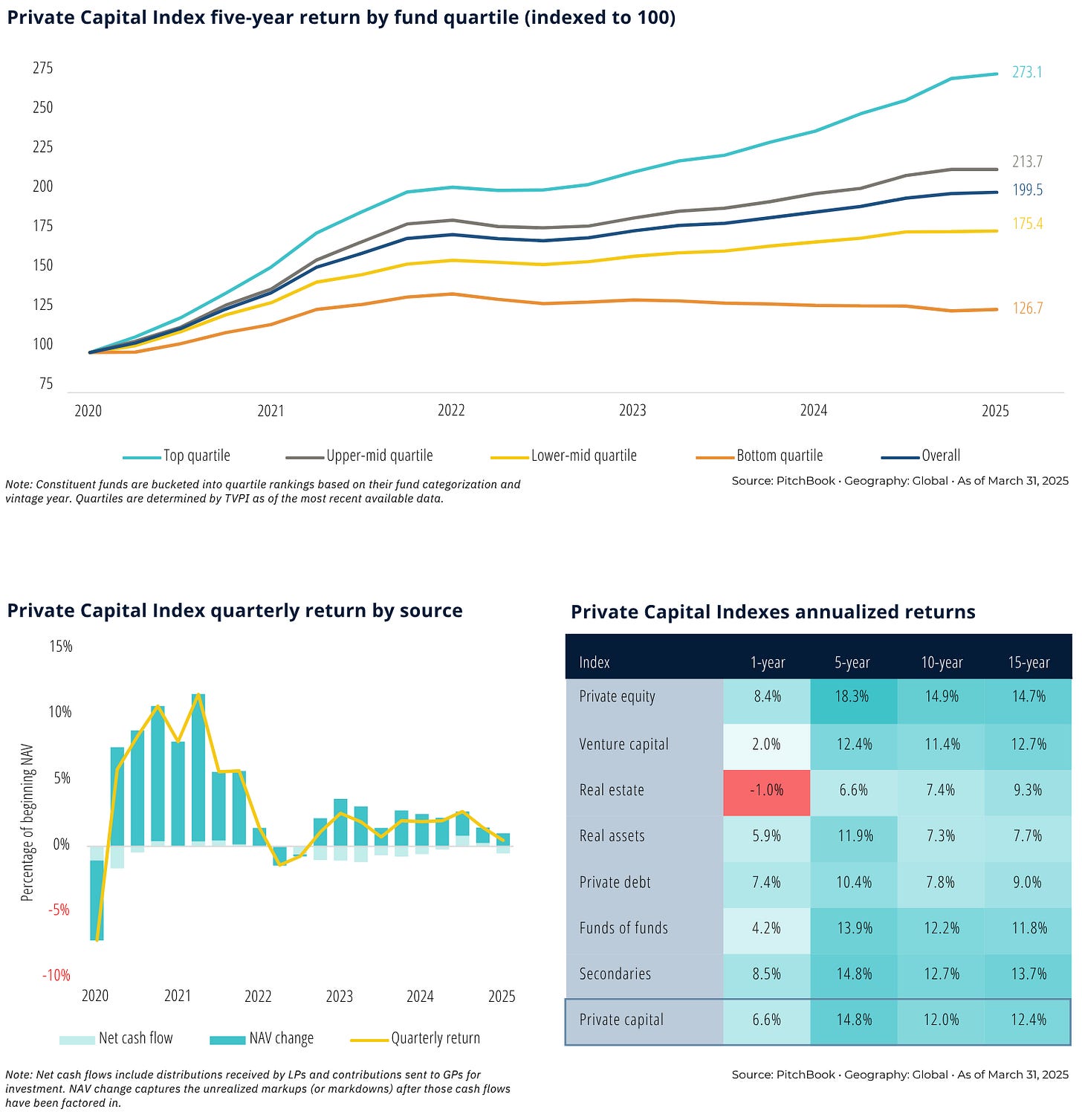

PitchBook’s Q1 preview paints a rocky picture. Tariffs and inflation are dragging on private markets, stalling exit activity just as recovery seemed within reach. Global uncertainty is putting the brakes on momentum.Secondaries Lead in Q1 2025 Private Capital Indexes 📈

PitchBook’s Q1 data shows secondaries leading the pack, with an 8.5% return. Real estate, on the other hand, is struggling at the bottom with a -1% return, highlighting the volatility of today’s markets.

Recently Launched Funds 💸

AirTree Ventures closed two new funds totaling A$650M to back ambitious founders across Australia and New Zealand.

Curql Collective closed Fund II at $360M to continue investing in fintech solutions for credit unions.

Italian Founders Fund raised €35M from Italy’s Digital Transition Fund, bringing the total to €90M.

OrbiMed raised $1.86B for its fifth Healthcare Royalty & Credit Fund, targeting biotech and life sciences.

Deciens Capital closed Fund III at $93.33M to invest in early-stage fintech and impact-driven startups.

Expanse launched an $18M inaugural fund to back frontier tech founders from day zero.

Northpoint Capital closed its first fund at $150M to invest in growth-stage companies across North America.

Victus Global launched a $10M fund to support early-stage ventures in food, health, and sustainability.

Yali Capital raised ~$104M for its debut deeptech-focused fund targeting transformative technologies.

Wyser launched a maiden fund focused on agentic AI and B2B enterprise startups.

MUSC established a new VC arm to invest in startups commercializing next-gen medicine and biotech.

GREE launched a $30M fund of funds to support emerging managers across Asia’s venture ecosystem.

Prelude Growth Partners closed Fund III at $600M to back high-growth consumer brands. Operators at heart, capital in hand.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

NFX (Remote): VC Fellowship (apply here)

Lionheart Ventures (Remote): VC Associate (apply here)

Decasonic (Chicago, IL): VC Investor (apply here)

Myriad Venture Partners (Boston, MA): IR Associate (apply here)

Mighty Capital (San Francisco, CA): VC Associate (apply here)

TCV (New York City, NY): IR Analyst (apply here)

In Pledge Ventures (London, England): Head of Platform (apply here)

Volta Circle (London, England): VC Analyst (apply here)

Match VC (Stuttgart, Germany): VC Analyst (apply here)

Capacura (Berlin, Germany): VC Manager (apply here)

Hottest Deals 💥

Clay, raised $100M in Series C to scale its relationship intelligence CRM. (read more)

Adanola, received investment from Story3 Capital Partners to accelerate brand growth. (read more)

Kustomer, raised $30M in Series B funding to scale its customer service CRM platform. (read more)

Orbital Operations, raised $8.8M in seed funding to develop its space logistics infrastructure. (read more)

Casap, secured $25M in Series A to expand its digital home services platform. (read more)

Capacity, received $92M in investments to enhance its AI-powered support automation platform. (read more)

Decart, raised $100M at a $3.1B valuation to fuel its AI commerce solutions. (read more)

Tracelight, raised $3.6M in seed funding to build its legal risk management software. (read more)

Pale Blue, received investment from Mitsubishi Electric’s ME Innovation Fund for space propulsion tech. (read more)

Elion, raised $9.3M in seed funding to grow its AI-powered design collaboration platform. (read more)

Snappt, acquired Trigo and secured $50M in growth financing to expand its fraud detection tools. (read more)

Prelude Growth Partners, closed its third fund at $600M to back consumer brands. (read more)

BeatBread, raised $124M in funding to expand its artist-focused music financing platform. (read more)

Employee Navigator, completed $100M in funding to enhance its HR and benefits software. (read more)

Metis Technologies, closed RMB 400M Series D to scale its intelligent manufacturing solutions. (read more)

RESOURCES 🛠️

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Just landed here. This was so insightful!