Forbes’ 25 Next Unicorns🦄, Women Now Hold 20% of Top VC Roles👩💼, The Case for Optimism🌟

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic - the complete startup database

Prepare your deal review meetings in minutes.

With the new deal search, you can:

Automate weekly pipeline reviews – one saved search replaces your Monday spreadsheet ritual

Know what you missed – see every Series A your tracked investors led while you weren't looking

Follow the moves that matter – Identify the sectors attracting top-tier investors

In-Depth Insights 🔍

All Property Becomes Cryptography 🔐

Balaji predicts that almost every asset, from money to real estate, will be locked and transferred onchain. The idea is simple: ownership becomes software you can verify instantly anywhere in the world. [Balaji]Women Now Hold Nearly 20% of Top VC Roles 👩💼

Female leadership in U.S. venture capital has doubled since 2018, now at 18.6%. A meaningful shift in who makes the biggest investment calls. [WSJ]Cursor’s Surge Comes With a Price ⚠️

Cursor is riding GPT-5’s momentum, attracting more coders than ever. The growth is real, but so are the steep compute costs and razor-thin margins investors are eyeing. [Tom Dotan]Are Secondaries Coming to VC Fund Rules? 📜

Two proposed U.S. laws could expand what venture funds can invest in, adding secondaries and fund-of-funds to the mix. They would also raise investor caps for 3(c)(1) funds. [TheFundLawyer]Why Most VC Firms Hire Associates Wrong 🔍

Mike Dauber says firms treat associates as disposable leverage instead of future partners. Amplify’s approach invests in mentorship and long-term career growth from day one.Inside Dylan Field’s Figma IPO 🎨

Figma went public with a bang, jumping from $33 to $142 on day one. Dylan Field is already looking past the IPO to expand the company’s reach. [Wired]The Case for Optimism 🌟

Optimism doesn’t mean ignoring reality, it means believing in your ability to shape it. Leaders who embrace this mindset inspire their teams, attract opportunities, and build resilience! [Guy Kawasaki]

Forbes’ 25 Next Billion-Dollar Startups 2025 🦄

Forbes names the U.S. startups most likely to hit unicorn status this year, from defense to creative tools. Their past lists have been eerily accurate. [Forbes]

The 10 Paul Graham Essays Every Founder Should Read 📚

A curated shortcut to Paul Graham’s best startup essays, from building what users love to persuading investors. Essential reading for any founder with big ambitions.

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

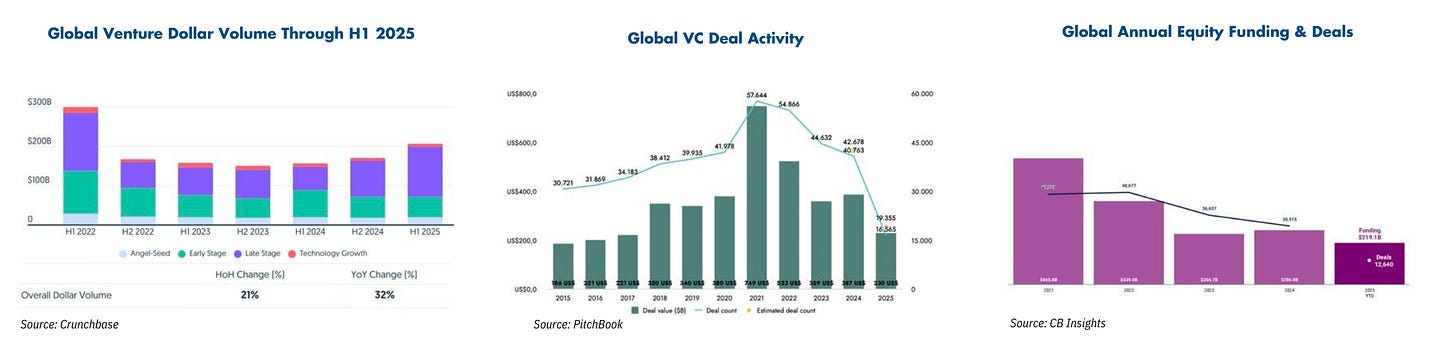

The Big Book of Venture Capital - Q2 2025 Edition 🚀

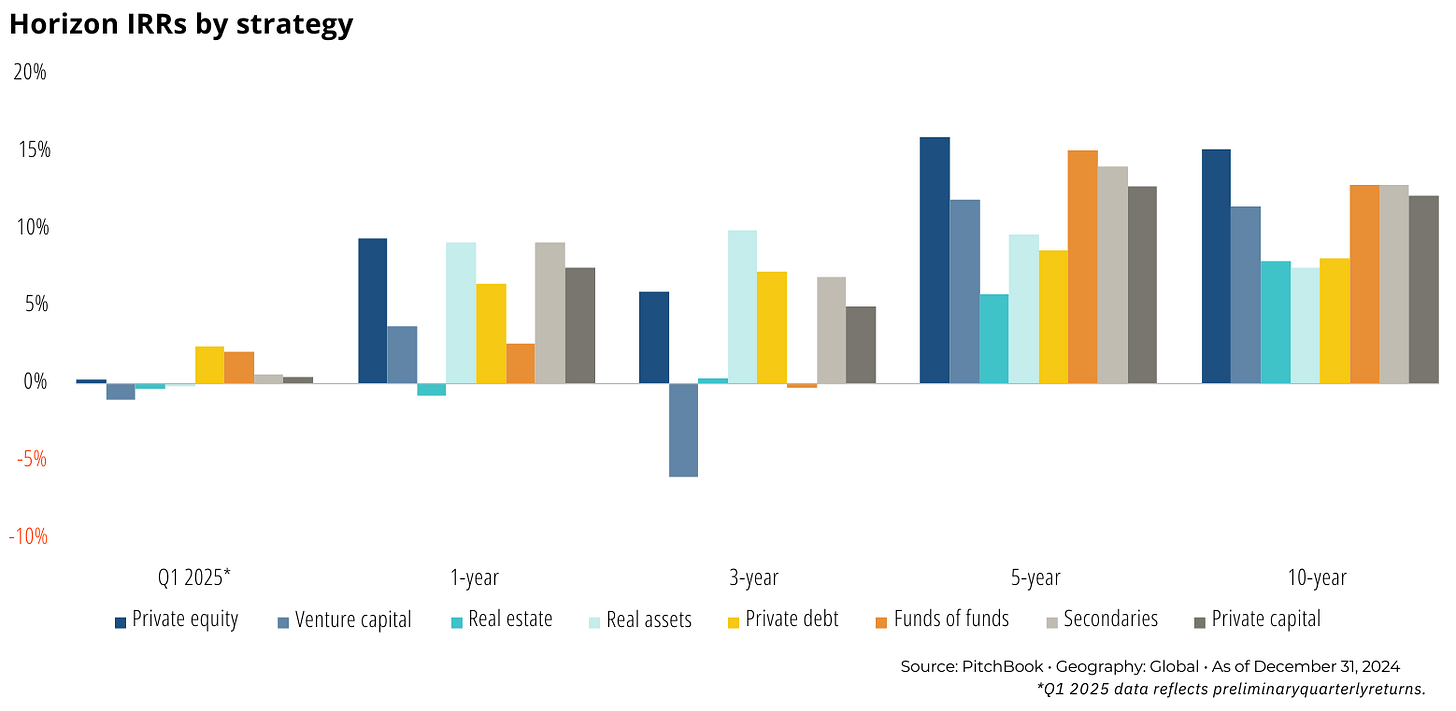

A 130+ page review of global venture trends shows $205B raised in H1, AI-led M&A growth, valuation recovery, and secondaries momentum. The data points to a market reshuffling rather than a full recovery.Global Fund Performance Report – Q4 2024 & Preliminary Q1 2025 Data 📊

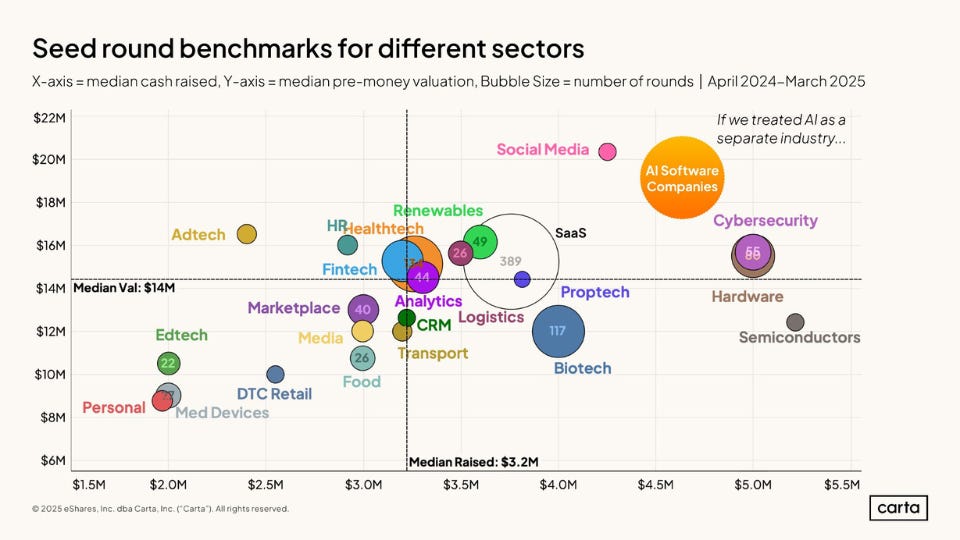

PitchBook’s latest report finds private capital’s tentative rebound slipping in early 2025. U.S. tariffs, inflation, and weaker exits are shaping global fund performance.State of VC 2025 - New Capital Dynamics 📊

Carta’s data shows longer gaps between rounds, record-high seed valuations, and smaller teams. Investors are pushing leaner cap tables and efficiency-focused growth.The Longevity Tech Stack - Startups, Funding & Trends 🧬

An overview of 400+ European longevity startups highlights biotech advances and preventative health platforms. VC funding is flowing to innovations that extend healthy lifespans.State of AI 2025 - Bessemer Venture Partners 🤖

Bessemer’s AI forecast spotlights “Supernovas” and “Shooting Stars” as key growth paths. The firm sees momentum in AI browsers, generative video, data traceability, and AI-native social platforms.

Recently Launched Funds 💸

GoalVest closed the first tranche of its Venture Growth Fund II, aiming for a $50M target.

Hatteras Venture Partners raised over $200M across two healthcare-focused venture funds to support innovation in biotech and life sciences.

Scenius Capital launched a $20M fund-of-funds to invest in emerging managers and early-stage funds.

LJMI Equity closed a $3.1B fund focused on software investments, marking one of its largest vehicles to date.

Immortal Dragons debuted a $40M fund targeting longevity and biotech startups pushing the boundaries of human healthspan.

Frachtis introduced its first-ever pre-seed crypto fund, supporting founders building foundational web3 infrastructure.

Acquisition.com rolled out ACQ Ventures to back scalable, high-margin service businesses under its media and investment umbrella.

500 Global launched a Sustainable Innovation Program, backed by Catalytic Partners, to support early-stage climate and impact startups.

Alumni Ventures unveiled an “AI First Fund” to invest in startups building and leveraging AI across industries.

1834 Ventures kicked off a $20M fund to invest in Tulane University-affiliated startups and broader entrepreneurial networks in Louisiana.

Portal Innovations raising a $100M venture fund to accelerate life sciences companies emerging from academic and incubator ecosystems.

Achmea launched a €250M private equity impact fund focused on ESG-aligned companies across Europe.

1435 Capital rolled out a $25M innovation fund targeting early-stage startups in New Jersey's tech and health sectors.

StartUpNV - Nevada Seed Fund announced a $10M pre-seed and seed-stage fund for Nevada-based startups building across key verticals.

Delphinus Venture Capital raised €80M as an evergreen fund for research-led startups across Europe.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Impact Capital Managers (New York City, NY): VC Manager (apply here)

Mouro Capital (San Francisco, CA): VC Associate (apply here)

Ajinomoto Group Ventures (Boston, MA): VC Associate (apply here)

Accion (Washington, DC): VC Associate (apply here)

Planet A Ventures (Remote): VC Internship (apply here)

Coinbase Ventures (Remote): VC Associate (apply here)

Kopa Ventures (London, England): VC Internship (apply here)

DZ Ventures (Heilbronn, Germany): VC Internship (apply here)

Smart Infrastructure Ventures (Leipzig, Germany): VC Internship (apply here)

Alstin Capital (Munich, Germany): VC Internship (apply here)

Hottest Deals 💥

PlanCraft, secured €38M Series B to digitize project workflows for the construction industry. (read more)

Transak, landed $16M to make crypto on-ramps frictionless for web3 users worldwide. (read more)

Uncle Arnie’s, secured $7.5M Series A to expand its cannabis beverage empire. (read more)

HolmesAI, closed an undisclosed seed round to bring GenAI to enterprise documentation. (read more)

Celestial AI, raised $255M in Series C1 to scale optical computing for AI workloads. (read more)

Jump, secured $23M Series A to reimagine how teams collaborate in digital workspaces. (read more)

Hyphen Technologies, raised $25M Series B to simplify connected device onboarding. (read more)

Appcharge, closed $58M Series B to boost in-app monetization for mobile game developers. (read more)

Jocasta Neuroscience, raised $35M Series A to commercialize brain stimulation tech for cognitive performance. (read more)

Gameto, raised $44M Series C to accelerate biotech for women’s reproductive longevity. (read more)

Aira, secured €150M to build out its European heat pump manufacturing and deployment network. (read more)

Novig, closed $18M Series A to bring AI-native infrastructure to sports betting. (read more)

BinSentry, raised $50M to scale its sensor-driven grain monitoring platform. (read more)

Certivity, secured €13.3M Series A to help product teams navigate regulatory complexity. (read more)

LIT, raised €570K to gamify learning through digital collectibles and quests. (read more)

RESOURCES 🛠️

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

August’s form - https://tally.so/r/3y5O4g