The Venture Arrogance Score🧮, The Bay is back🏙️, The $100B Empire You’ve Never Heard Of🏛️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the complete startup database

New: Search by deal data and track investor activity

Now investors can:

Automate weekly pipeline reviews – one saved search replaces your Monday spreadsheet ritual

Know what they missed – see every Series A your tracked investors led while you weren't looking

Follow the moves that matter – Identify the sectors attracting top-tier investors

In-Depth Insights 🔍

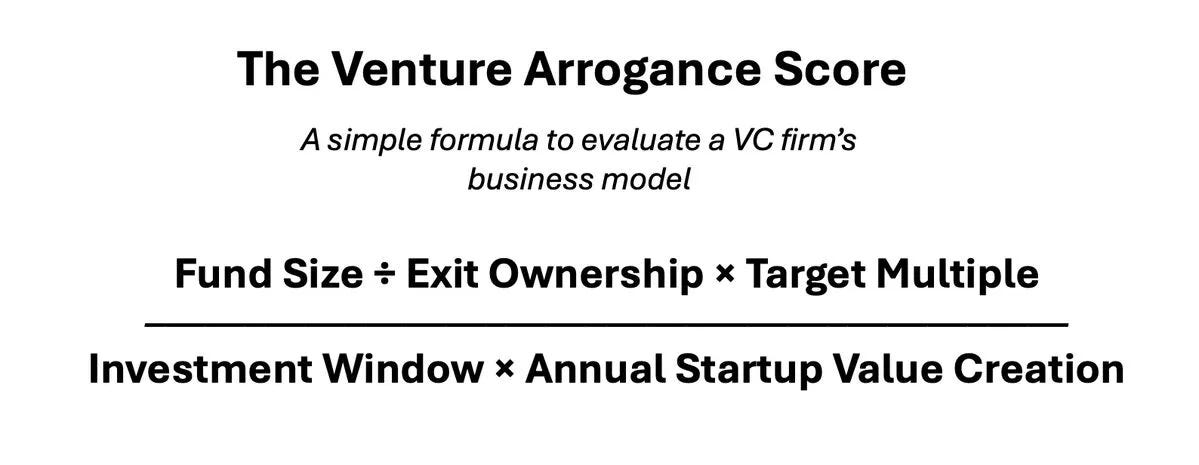

Most VC Funds Fail at Fifth-Grade Math 🧮

Big logos don’t matter if you miss the power law. It’s all about ownership and outliers. Small, sharp funds are quietly outrunning mega-funds still chasing scale. [Rex Woodbury]

AI boom revives San Francisco’s talent and investment scene 🏙️

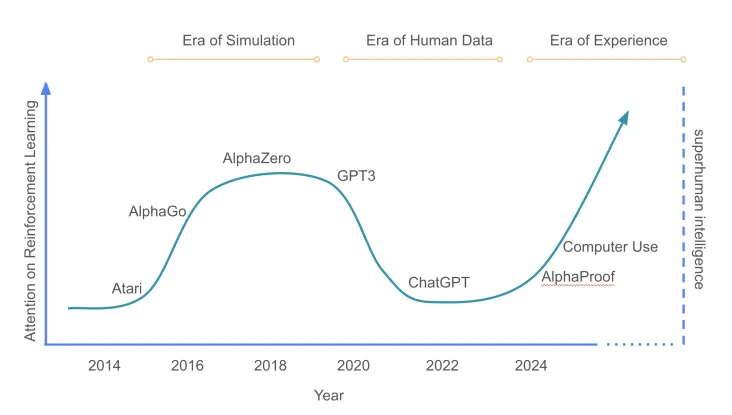

The Bay is back. Founders, engineers, and capital are flooding San Francisco again, and AI is the magnet. Office space is vanishing, optimism is rising, and the city’s second act might just outshine its first. [Washington Post]AI Infra Is Entering Its Reality Check Phase ⚙️

Building models used to be the flex. Now it’s about designing environments that actually solve problems. The edge belongs to infra teams who can ground evals in messy, real-world data. [Janelle Teng]VCs Who Think in Frameworks Win More Deals 📊

"Value-add" means nothing unless you can show it. The best investors sketch their edge using metaphors, mental models, and market maps that actually stick. [Refining VC]

The $100B Empire You’ve Never Heard Of 🏛️

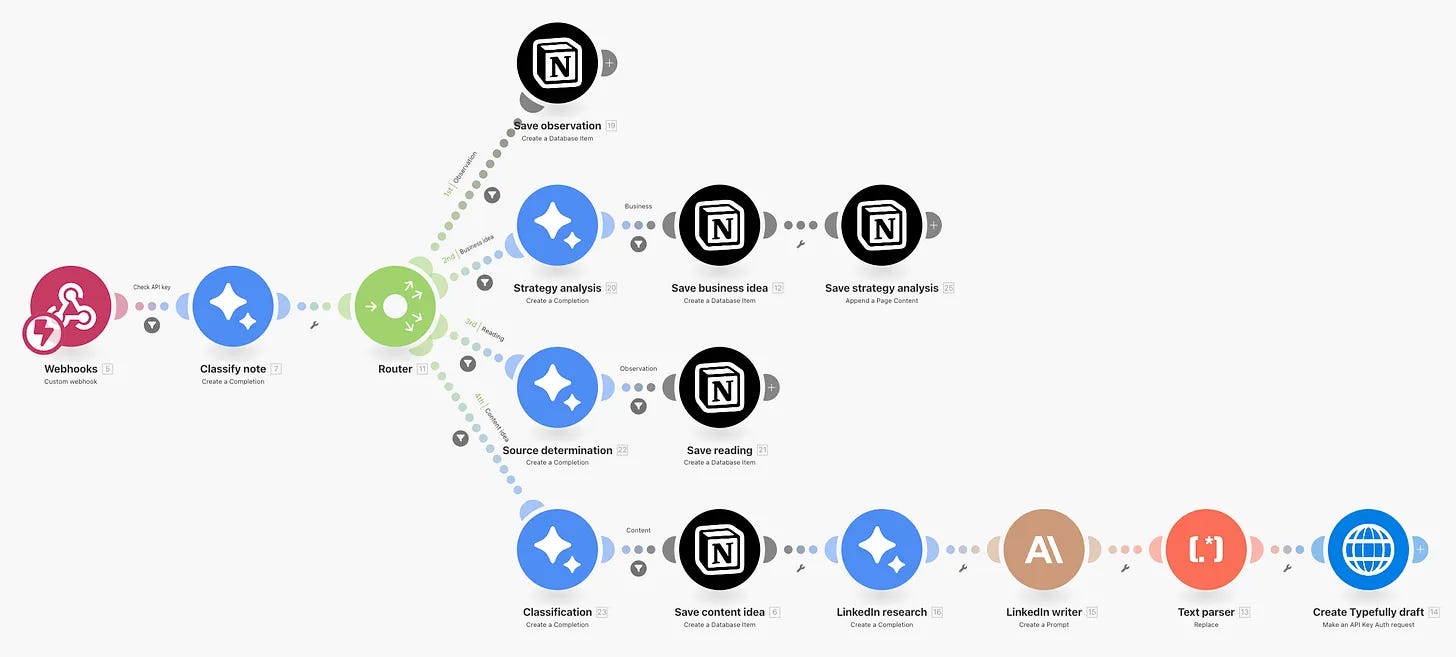

Mark Leonard skipped the hype, bought boring software, and never sold. No PR stunts. No founder theatrics. Just patient capital and relentless focus. And it worked. [Henry Shi]Built a Second Brain in 3 Hours 📲

Here’s the play: voice memos, Make.com, and Notion. Thoughts go in messy, come out structured. AI turned my daily chaos into execution-ready clarity. [Jonas Braadbaart]

Why Breakout Startups Now Hide in Plain Sight 🕵️♀️

Forget flashy growth curves. The next unicorns are lean, quiet, and buried deep in niches. Old-school signals like headcount, press, or noise have become investor blind spots. [Parul Singh]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

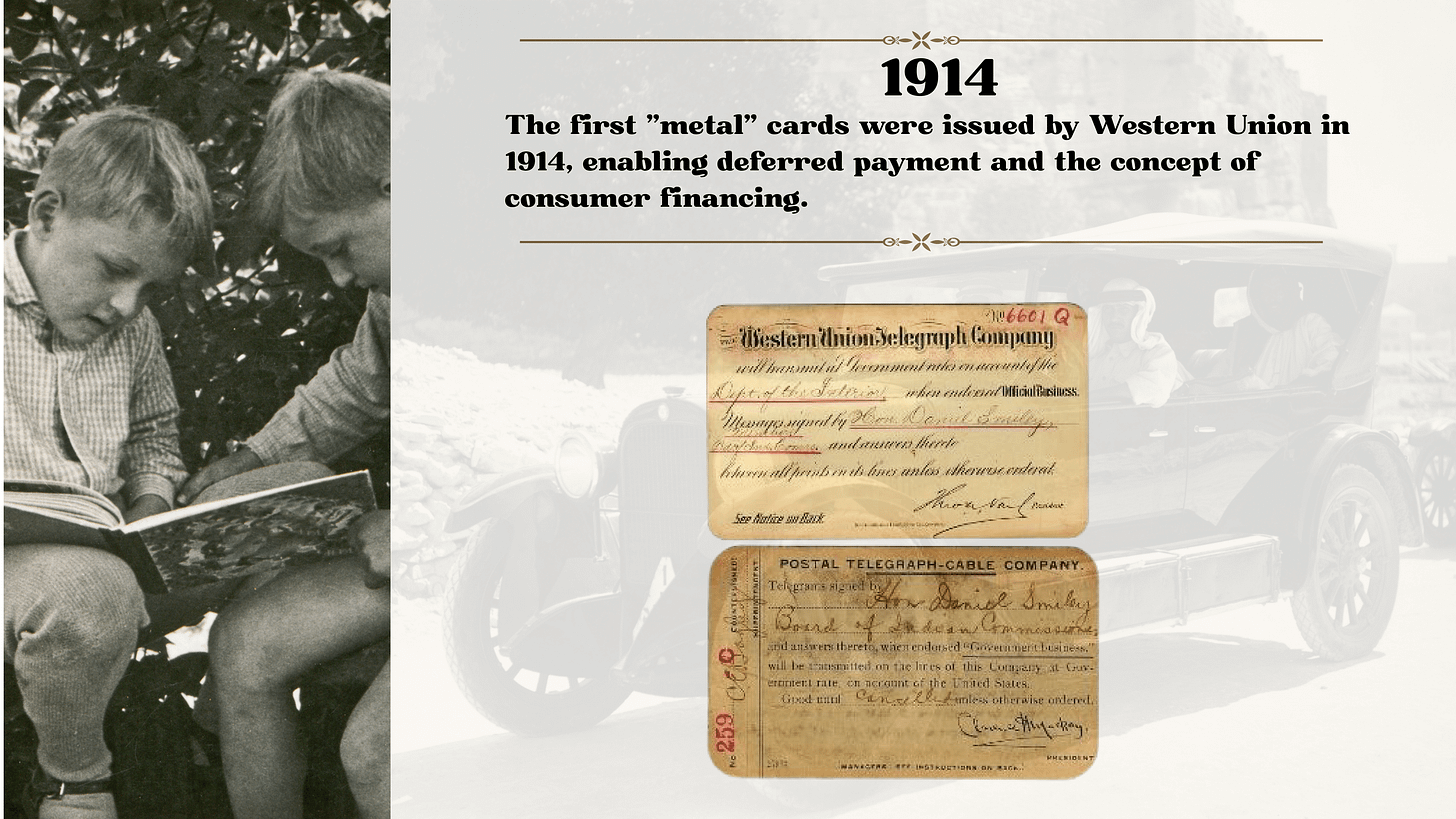

History of Payment Cards 💳

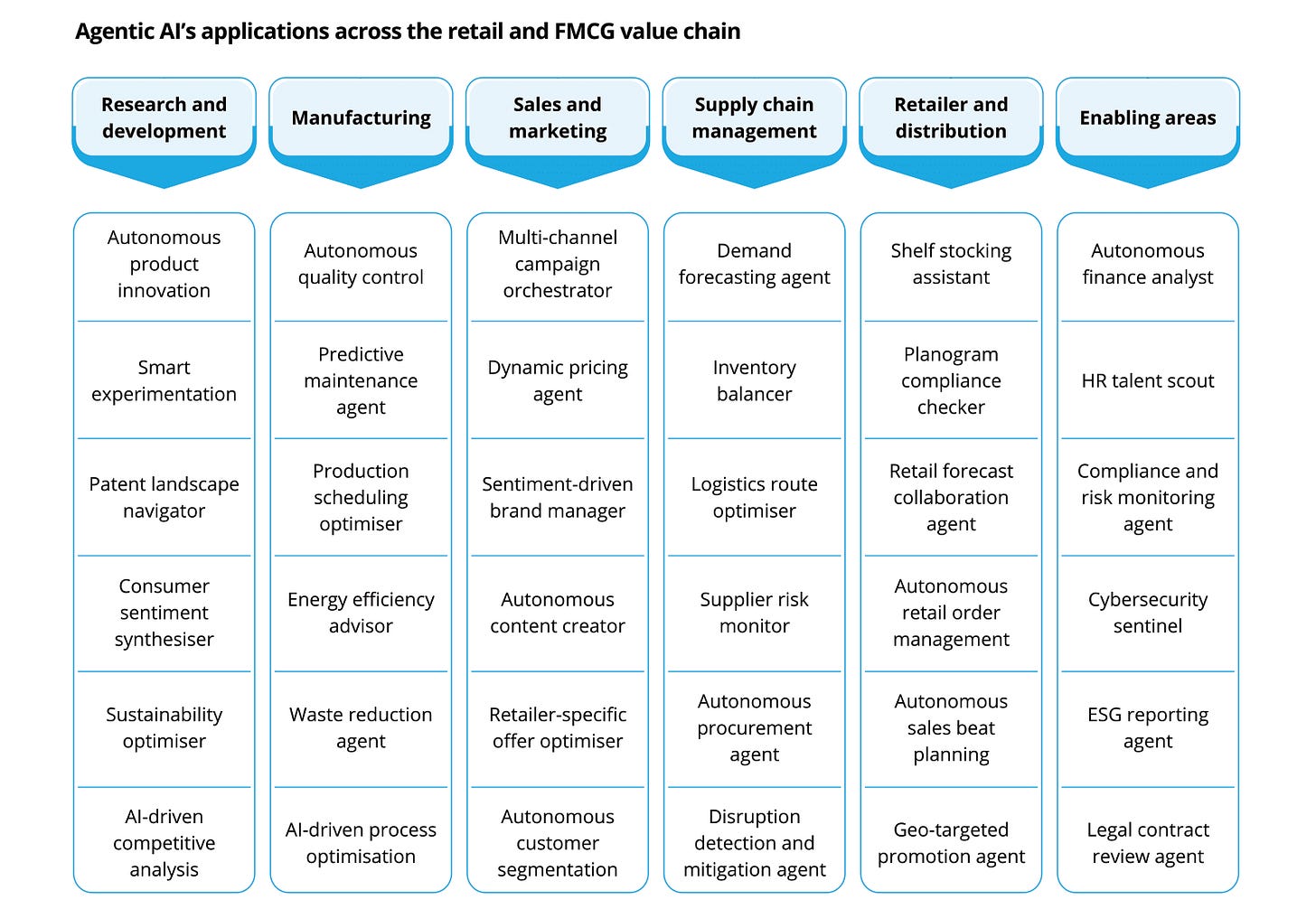

From embossed metal to Apple Pay, this report captures decades of payment innovation in a single glance. A slick timeline that shows just how far fintech has come and where it’s heading next.Deloitte’s Agentic AI Playbook Is a Must-Read 🤖

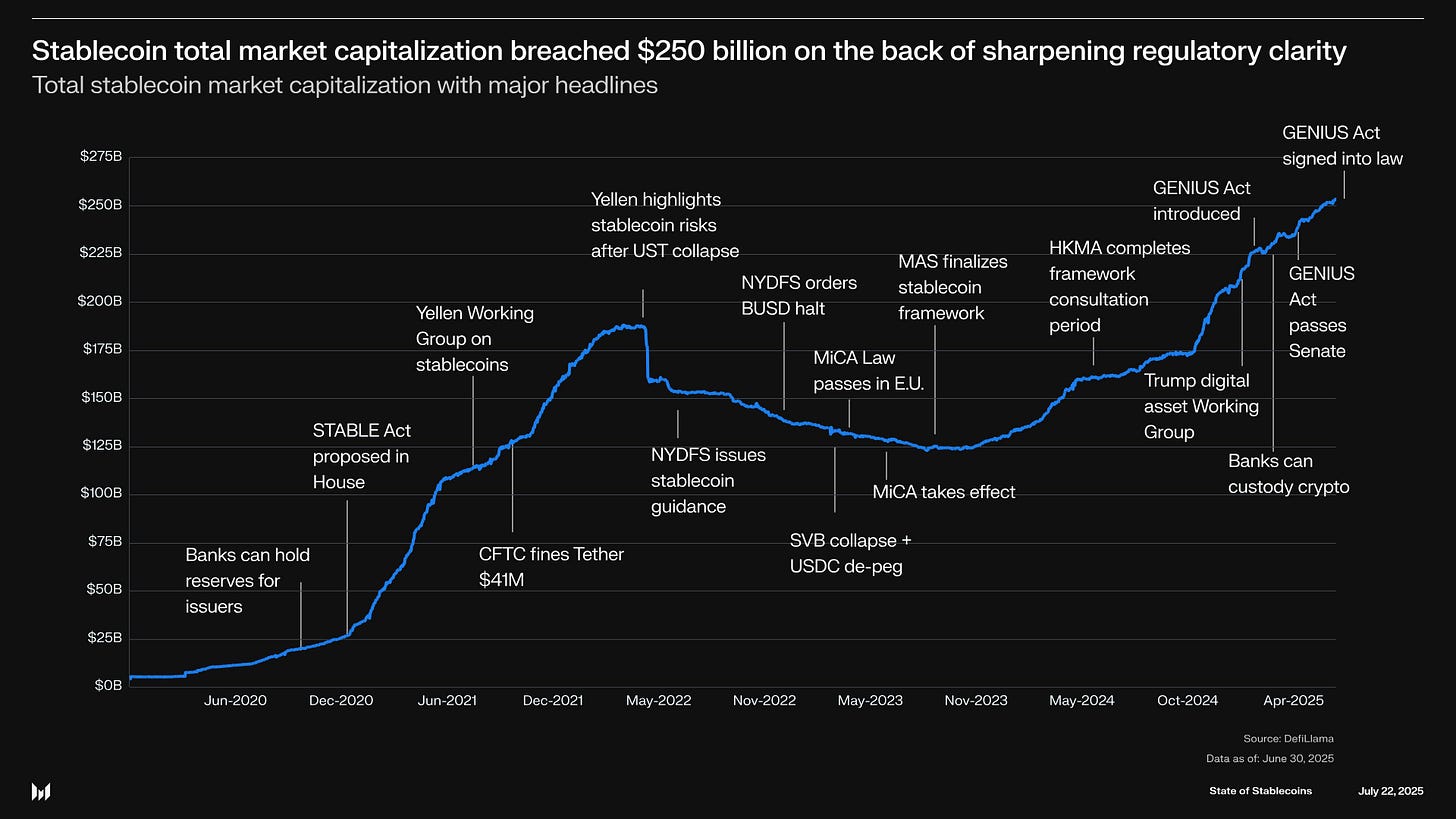

Packed with frameworks, checklists, and enterprise-ready metrics, this report is your field guide to deploying AI agents. Whether you're exploring LLMs, RPA, or orchestration layers, the clarity here is rare. [Jimmy]Stablecoins Are Now Core to Global Finance 💸

Over $250B in market cap. 400M+ USDT users. From P2P transfers to cross-border commerce, stablecoins are becoming critical rails for the global economy. Messari's latest report breaks it down.

Recently Launched Funds 💸

Foxmont Capital Partners closed the first tranche of its $20M Fund III to back early-stage startups in the Philippines.

China Galaxy & CICC eyeing over $1B in investment vehicles to expand into Southeast Asia, targeting innovation and tech.

NEO Group launched a new private equity fund with a focus on Southeast Asian tech and consumer sectors.

Vietnam’s National Innovation Centre VC fund backed by the government, aims to support 100 Vietnamese startups by 2030.

Inflection Point Ventures rolled out a ₹500 Cr ($60M) fund through GIFT City to target 100+ Indian startups.

Sameer Verma former Nexus Venture partner launches solo GP fund to back early-stage Indian tech.

UTEC & Emerging Asia Capital Partners teaming up for a new fund to target deep tech and emerging markets across Asia.

Skyline Investors closed a $125M fund to support overlooked “micro-market” companies in the U.S.

KKR raised $6.5B for its second Asset-Based Finance fund to tap into private credit markets.

Yaletown Partners secured a $100M first close for its $250M Innovation Growth Fund III targeting Canada’s tech ecosystem.

Verified Capital debut fund closed at $175M to invest in early-stage climate and infrastructure tech.

Blackwood Ventures closed its first fund with over $25M to back pre-seed and seed-stage startups.

Anansi Capital vinay Iyengar launches Anansi Capital to support overlooked and underrepresented founders.

Juchain launched a $100M initiative to support early-stage Web3 startups in Asia.

360 ONE Mutual Fund rolled out a new multi-asset allocation fund under its New Fund Offer (NFO) scheme.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Primary Venture Partners (New York City, NY): OIR (apply here)

Workday (Pleasanton, CA): Manager of Corporate Development (apply here)

Mass General (Somerville, MA): VC Director (apply here)

RA Capital (Boston, MA): Senior VC Associate (apply here)

Mairs & Power Venture Capital (Minneapolis, MN): VC Associate (apply here)

ERA (New York City, NY): VC Analyst (apply here)

Zacua Ventures (San Francisco, CA): VC Associate (apply here)

Smith Point Capital (San Francisco, CA): Senior VC Associate (apply here)

Cerity Partners (Los Angeles, CA): VC Associate (apply here)

Lichen Ventures (Remote): VC Internship (apply here)

Hottest Deals 💥

Good Job Games, raised $60M Series A to level up mobile gaming. Casual, addictive, and now VC-backed. (read more)

Anaconda, locked down $150M+ Series C to scale its open-source AI stack. Pythonistas, rejoice. (read more)

MyPrize, landed $21M to turn real-money gaming into a platform play. Twitch meets Vegas. (read more)

FuriosaAI, raised $125M bridge round to fuel its AI chip race. Korea’s answer to Nvidia? (read more)

Observe, nailed $156M Series C to give enterprises god-mode visibility into their data. (read more)

Magentiq Eye, secured Series A to AI-up your colonoscopy. Early detection just got real. (read more)

Motive, raised $150M to automate the boring stuff for truckers and beyond. From fleet to fintech. (read more)

Stargate Hydrogen, got a shot of capital from Repsol to make green hydrogen not just a buzzword. (read more)

Kuvi AI, raised $700K to make AI video for the rest of us. Seed money for seed-level virality. (read more)

Caspian, scored $5.4M seed to bring some UX to healthcare coordination. Doctor, meet dashboard. (read more)

Teramount, raised $50M to solve the very nerdy, very critical problem of AI chip connectivity. (read more)

Wingspan, grabbed $24M Series B to keep freelancers paid and platforms happy. Payroll, reimagined. (read more)

ArtBio, raised $132M Series B to build targeted radiation cancer therapies. Alpha waves, big alpha. (read more)

Fable Security, secured $31M to bring confidential computing to the masses. Privacy, but make it default. (read more)

BlinkOps, raised $50M Series B to automate SaaS workflows before your IT team loses it. (read more)

RESOURCES 🛠️

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

This is absolutely buzzing with insights, Ruben! I’ve got to say, the “outliers over optics” idea really hit home. I’ve seen too many people obsess over pitch decks and logos, while missing the real value in owning smart, scrappy plays that quietly deliver. What trend do you reckon will be the one we all kick ourselves for missing in 12 months?

(This is something I advise people to do in my training sessions:

— Use LinkedIn’s “custom button” on your profile to drive clicks to demos, reports or booking pages

— Tag niche thought leaders in your posts to start conversations in untapped corners of your market

— Use “Search Appearances” weekly to gauge if your content is attracting the right investor eyes)

Great curated list of resources! Ever considered offering more insight & data on employee or exec comp for startups?