2026 Tech Trends🔮, Startups That Win⚔️, Why Cambridge Associates Is Cautious⚠️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta:

How to automate Compliance ⚖️

As you scale, security and compliance don’t have to slow you down 🚀

Vanta automates evidence collection and centralizes 35+ frameworks—ISO 27001, SOC 2, GDPR & more—in one platform 🔐

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

In-Depth Insights 🔍

How Startups Can Win Against Big Profitable Companies ⚔️

Large companies protect their profitable lines, creating openings for startups with lower costs and new ideas. Focusing on these high-margin areas lets small players capture share without sparking a destructive price war. [Jason Cohen]Q3 2025 Fund Performance Highlights 📊

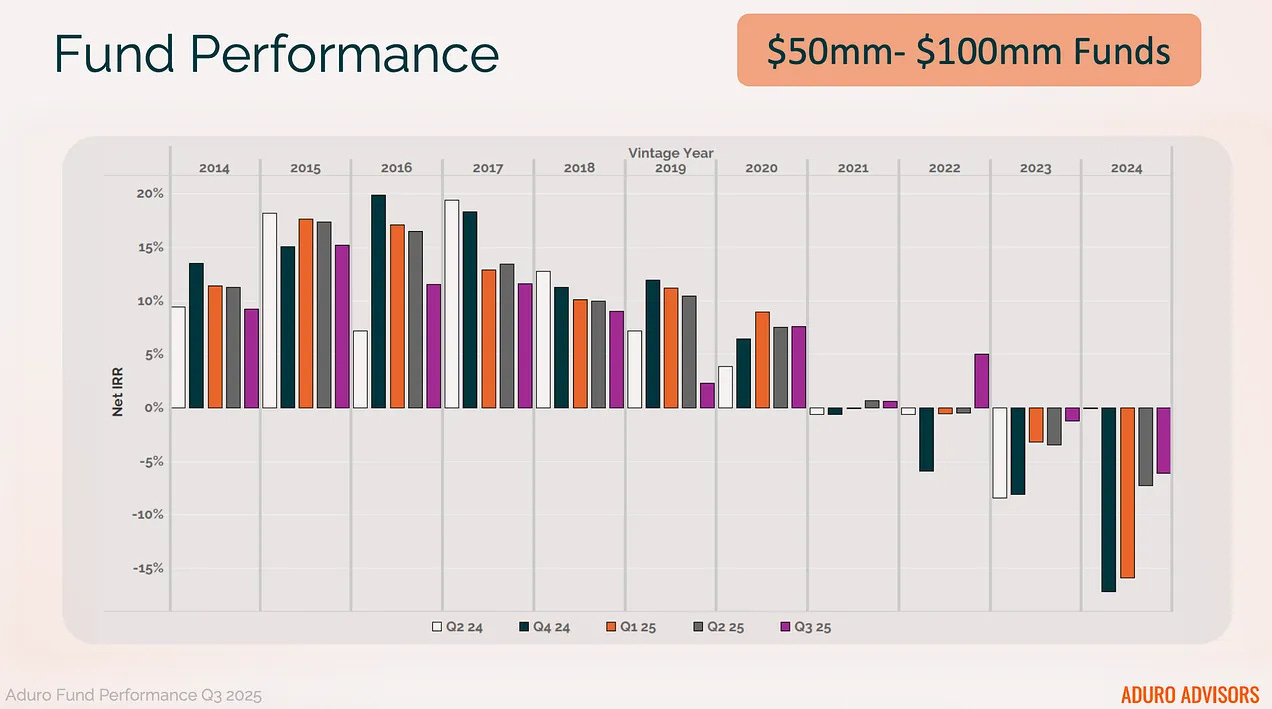

Aduro’s report shows how fund size and vintage impact returns, from early-stage volatility to long-term value in larger funds. Dispersion and J-curve effects shape outcomes across the private fund landscape. [Doug Dyer]

FREE Notion Templates Kit (+investor’s list) for AI-First Startups 🚀

Notion built a stage-based workspace with 58 templates to streamline operations, fundraising, launches, and scaling. The kit removes decision friction, organizes processes, and includes 10,000+ investor profiles plus 6 months of Notion Business with AI for early-stage teams.

The Fast-Moving AI Race 🏎️

Top AI leaders have shifted repeatedly in just 2.5 years, showing how quickly the baseline changes. Speed of execution and the right tools now matter more than ever for builders and investors.

Who’s Funding the AI Boom in 2025 💸

Startups have raised 5x more than VC fund commitments this year, driven by bigger checks from non-traditional investors and high-net-worth individuals. Fund formation is slow, but capital deployment is surging, especially into the hottest AI startups. [Jackie DiMonte]Cambridge Associates Urges Caution on Seed Funds in 2026 ⚠️

LPs are advised to moderate commitments to pre-seed and seed strategies due to crowded markets, high valuations, and longer paths to IPO. Seed funds can still deliver returns via secondary sales, especially in fast-moving sectors like AI, but careful allocation is key. [Yuliya Chernova, WSJ Pro]Google’s Quiet $14B Venture Powerplay 💰

Google’s portfolio includes stakes in SpaceX, Waymo, and Anthropic, totaling $14B invested for roughly $250B in potential equity value.

These bets show patient, long-term compounding with strategic leverage across Search, Cloud, and Ads.

ask me anything on a consulting call 🔥

Tools 🧰

FREE Startup in a Box with everything founders actually use (59 templates):

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

MongoDB for Startups gives you the tools and support to accelerate your growth

an AI co-worker who’s always on the clock :)

fre AI Native Stack (Gamma, Lovable, Clay, Notion…)

Hubspot’s FREE LinkedIn Growth Playbook for Startup Founders

Attio, the CRM used by both startups and VCs (including me). Try it for free here

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

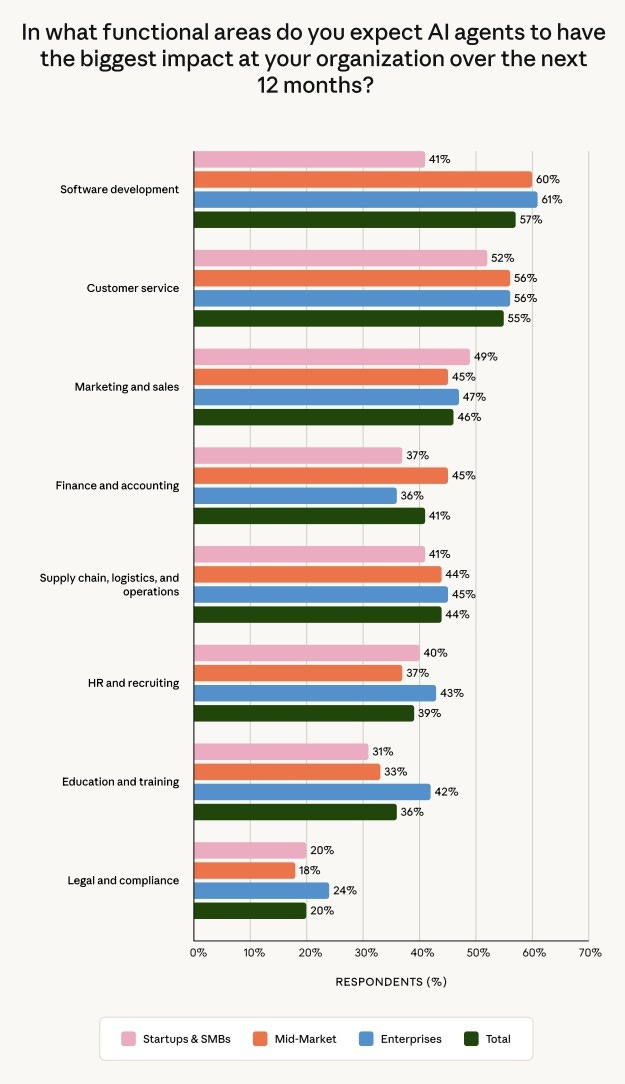

AI Agents Are Moving from Experiments to Core Infrastructure 🏗️

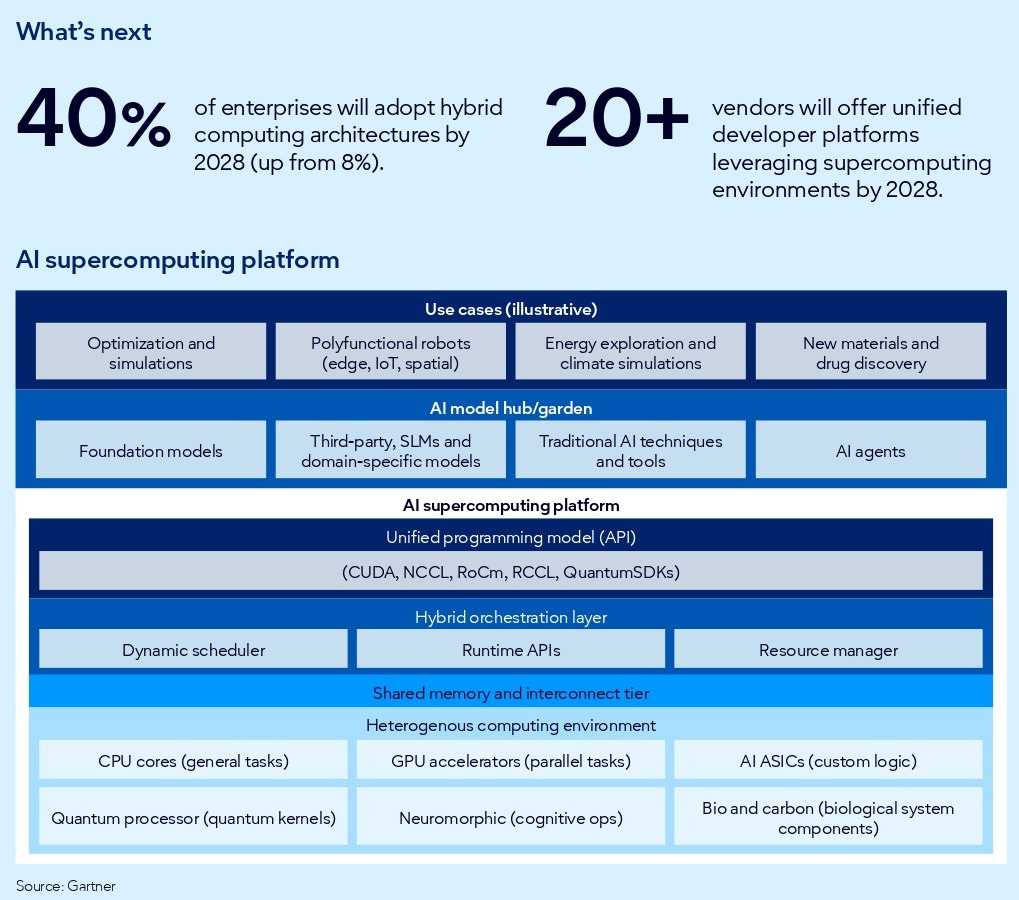

Anthropic’s 2026 report shows companies embedding agents into workflows, redesigning processes, and measuring real operational ROI. The biggest gains go to teams that rebuild work around agents, not those layering AI on top of old systems.Gartner’s Top 10 Tech Trends for 2026 🔮

AI is moving from add-on to core enterprise logic, shaping development, security, robotics, and decision-making at every level. From AI-native platforms to geopolitically aware architectures, these trends highlight where companies must focus to stay ahead. [Andreas Horn]a16z’s AI Playbook for 2026 💼

The focus has shifted from AI copilots to systems that act, coordinate, and replace workflows across industries. Founders building for 2026 are designing AI as the foundation, turning software into the execution layer of the economy.

Recently Launched Funds 💸

Lightspeed Venture Partners closed over $9B in new capital, doubling down on backing the next wave of category-defining companies.

S3 Ventures launched a $250M Fund VIII to keep backing early-stage companies across tech, healthcare, and consumer.

Viola Ventures raised $250M across two funds to support early-stage software and tech startups from Israel and beyond.

MBX Capital raised $100M to invest in biotech startups turning deep science into real products.

FemHealth Ventures closed Fund II at $65M to invest in women’s health startups fixing long-overlooked problems.

Cloudberry Capital first €30M close of its debut fund, backing European startups that start niche and scale globally.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

imec (Boston, MA): VC Manager (apply here)

Nemetschek Ventures (Berlin, Germany): VC Analyst (apply here)

Finch Capital (Amsterdam, Netherlands): Senior VC Manager (apply here)

Weyerhaeuser Ventures (Seattle, WA): VC Director (apply here)

lvlup Ventures (Remote): VC Internship (apply here)

First Round Capital (San Francisco, CA): Chief of Staff (apply here)

upHonest Capital (Palo Alto, CA): VC Associate (apply here)

Carlson Investments (Remote): VC Internship (apply here)

1752 (Remote): VC Fellowship (apply here)

Vituity (Remote): VC Associate (apply here)

Hottest Deals 💥

Databricks, raised $4B in a Series L round at a $134B valuation to accelerate AI and data infrastructure innovation. (read more)

Sobi, agreed to acquire Arthrosi Therapeutics for $950M to expand its rare disease and specialty care portfolio. (read more)

Radiant, raised over $300M in funding to advance next-generation clean energy and nuclear technology solutions. (read more)

Tebra, received $250M in funding to scale its healthcare practice management and patient engagement platform. (read more)

PremiaLab, secured a $220M growth investment from KKR to expand its specialty insurance and reinsurance capabilities. (read more)

MoEngage, raised an additional $180M in Series F funding to fuel global expansion of its customer engagement platform. (read more)

Syremis Therapeutics, raised $165M in Series A financing to advance novel therapies targeting immune-mediated diseases. (read more)

Imprint, closed a $150M Series D round to grow its co-branded credit card and embedded finance platform. (read more)

Highland Electric Fleets, received a $150M equity investment from AIGa Capital Partners to scale electric school bus and fleet electrification solutions. (read more)

Chai Discovery, raised $130M in Series B funding to accelerate AI-driven drug discovery and development. (read more)

Mythic, raised $125M in funding to advance edge AI computing and energy-efficient semiconductor technology. (read more)

Esusu, raised $50M in Series C funding at a $1.2B valuation to expand its rent reporting and financial inclusion platform. (read more)

RedotPay, raised $107M in Series B funding to drive global adoption of stablecoin-based payments. (read more)

Nirvana, raised $100M in Series D funding to expand its AI-powered insurance platform for trucking and logistics. (read more)

Neural Concept, raised $100M in Series C funding to scale its AI-driven engineering and simulation software. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox