Liquid and Illiquid Careers📈, 5 AI Distribution Plays That Build Moats🚀, Notes on China🏭

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta: ✅ SOC 2 without the chaos

SOC 2 is one of the first things customers ask for—but it doesn’t have to slow you down.

Vanta’s checklist gives you a clear, startup-friendly path so you can get compliant fast, even without a security team:

In-Depth Insights 🔍

15 AI Distribution Plays That Build Moats 🚀

Distribution is the deciding factor in survival, not features. Fifteen plays from workflow embedding to output-as-marketing show how compounding loops create defensible positions. [Miqdad Jaffer]

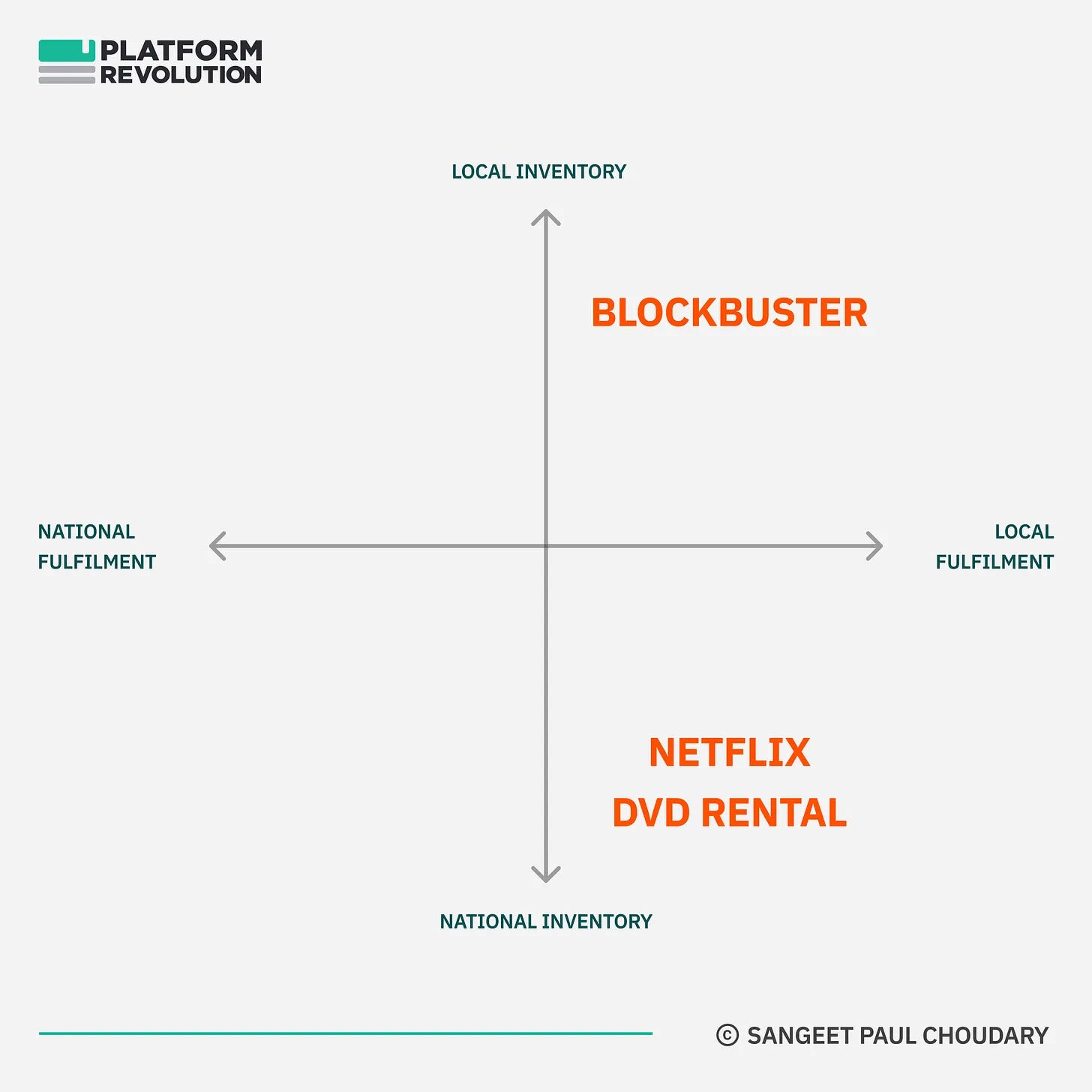

The Data Moat Fallacy: Architecture Wins 🔒

Owning data does not create defensibility because rivals can copy datasets and features. Real moats come from system design and feedback loops that are costly to replicate. [Sangeet Paul Choudary]Why Continuation Funds Matter 🔄

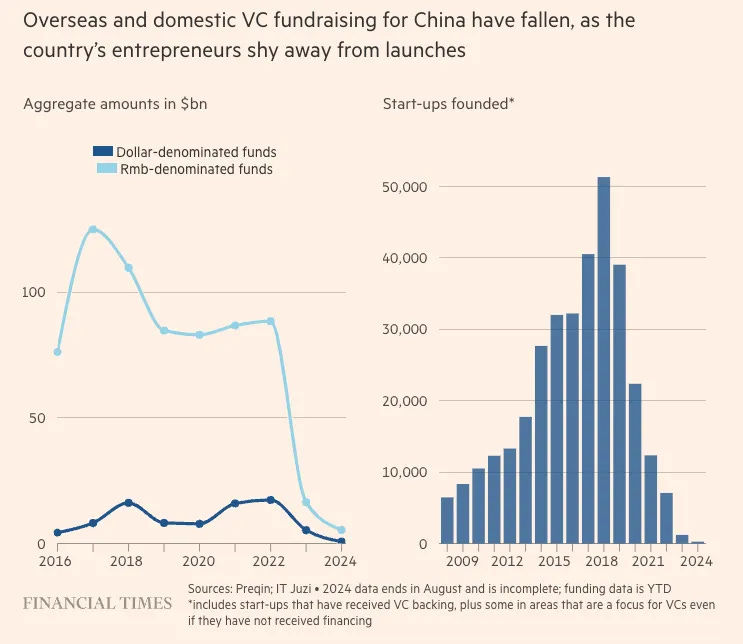

Early-stage VC faces long timelines to liquidity, especially in Europe. Continuation funds provide near-term returns to LPs while letting VCs and founders hold strong companies longer. [Speedinvest]Notes on China: State Engineering and AI Goals 🏭

China’s rise is fueled by state-led investment, intense competition, and long-term planning. From EVs and robotics to 90% AI penetration by 2030, the playbook mirrors past national mobilizations. [Akash Bajwa]Liquid and Illiquid Careers 📈

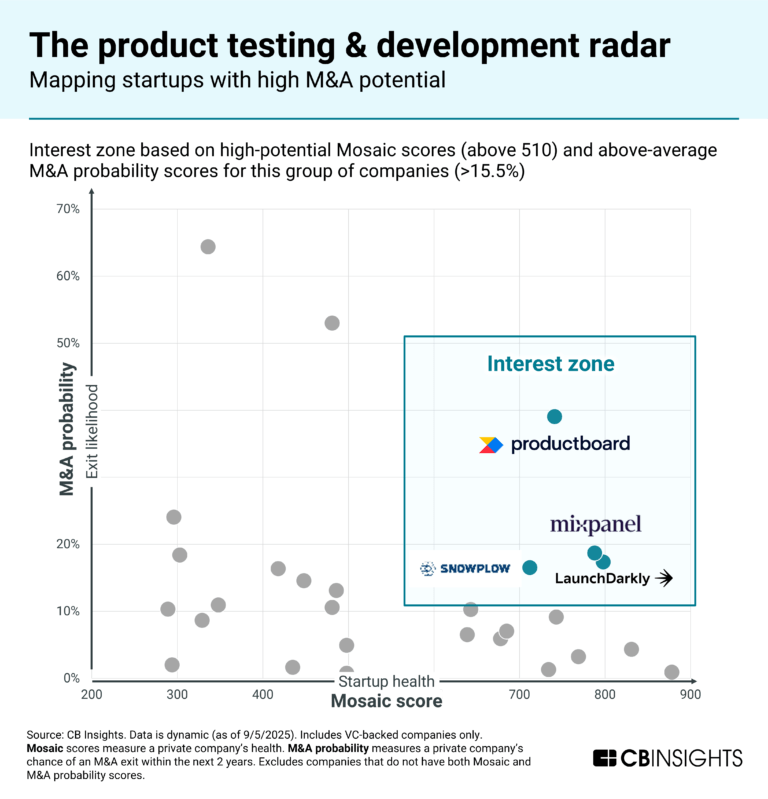

Careers differ in liquidity, shaping how skills are valued in the market. Linear paths provide security and options, while illiquid paths carry higher risk and higher potential reward. [Vaishnav Sunil]OpenAI’s $1.1B Statsig Deal 💰

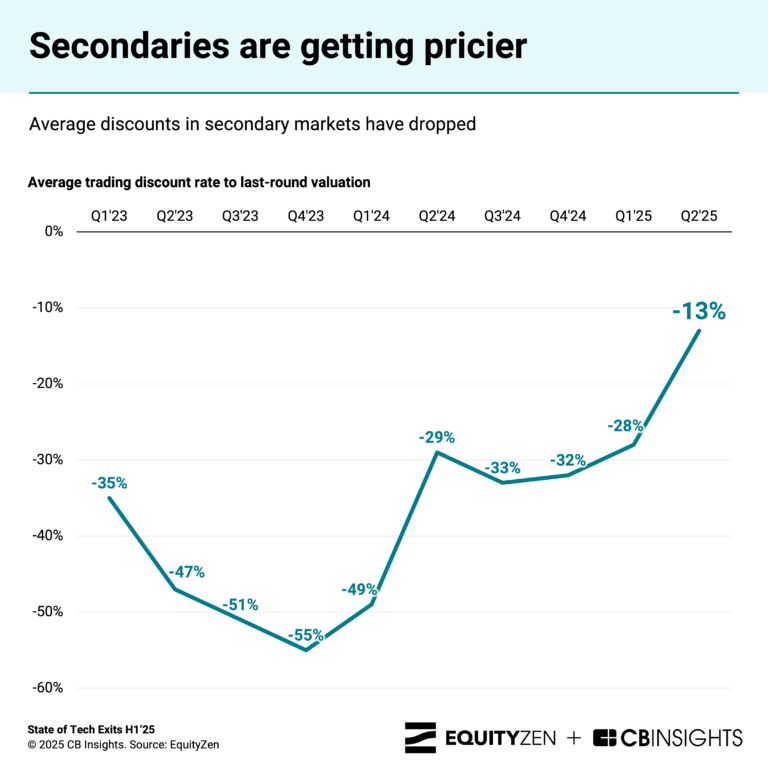

With model performance gains slowing, tech giants are buying platforms that speed product testing. Mixpanel, Snowplow, LaunchDarkly, and Productboard are likely next targets. [CNBC Insights]Tech Exits H1 2025: AI M&A Surges 💵

AI acquisitions above $100M hit record levels, IPOs remain tentative, and secondaries accelerate. Minority stakes and reverse acqui-hires show private markets driving most liquidity. [CNBC Insights]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

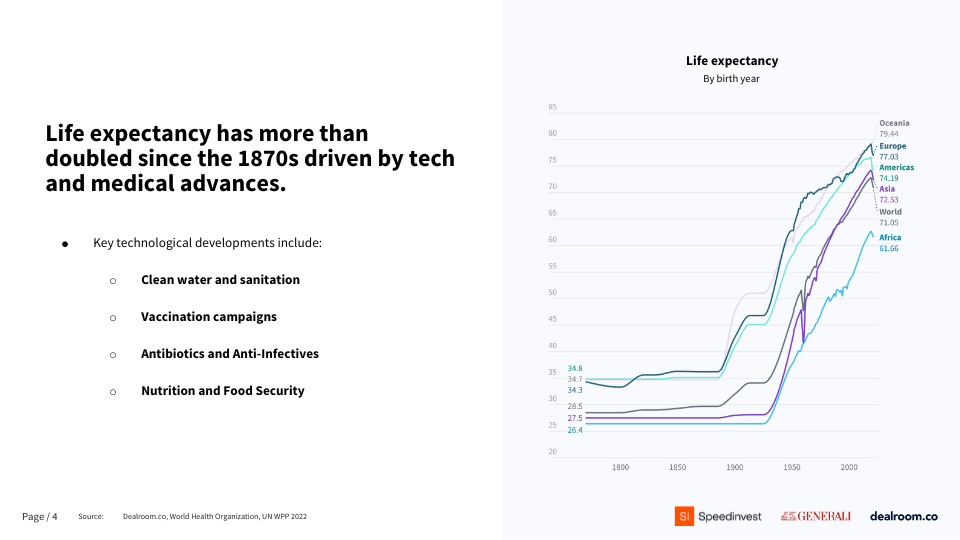

Longevity Tech Stack: The Race to Extend Life 👵

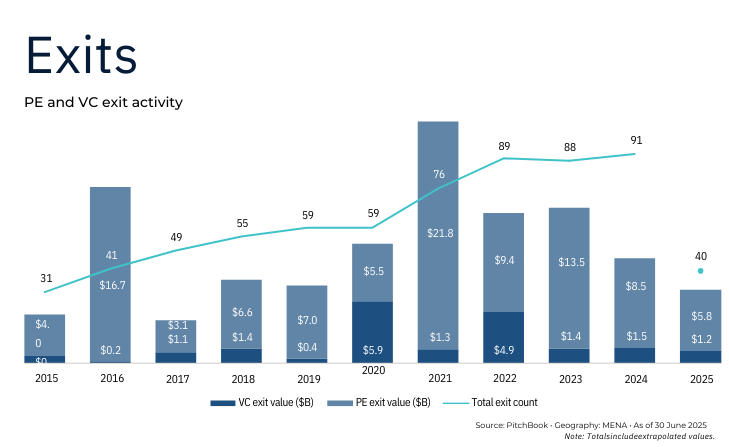

By 2050, people over 55 will represent 45% of the global population, driving demand for longevity solutions. Startups and billionaires are betting on genetic repair, preventive health, and elderly care in a trillion-dollar market.MENA Private Capital Hits New Highs in H1 2025 🤝

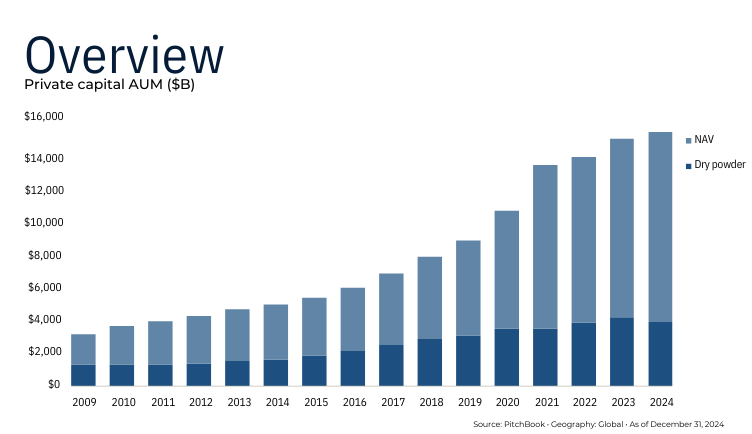

Private equity reached $13.8B across 100 deals while venture capital held steady at $1.5B over 362 deals. Saudi Arabia accounted for 43% of VC value, powered by AI megadeals and cross-border activity.Global Private Market Fundraising Report Sept 2025 💰

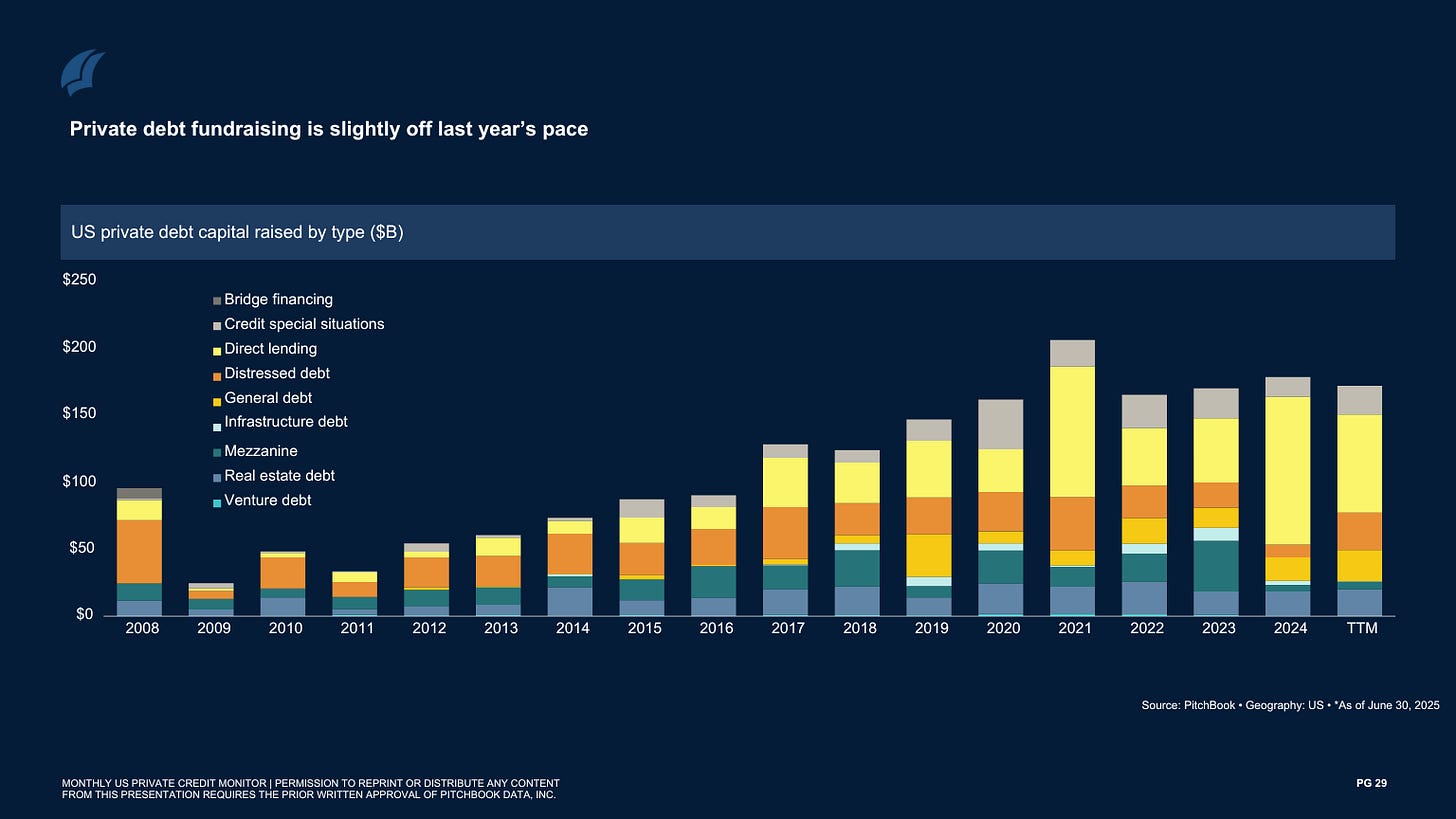

Private equity and venture fundraising slowed as LPs pulled back, but secondaries and real assets showed strength. Infrastructure funds and continuation vehicles emerged as rare bright spots.US Private Credit Monitor Sept 2025 📈

Volumes, spreads, and deal counts highlight a cautious but active private credit market. CLO issuance and direct lending activity signal how mid-market financing is shifting.

Recently Launched Funds 💸

Yachad Capital Partners held the initial close of its inaugural fund to back early-stage ventures.

CoreWeave Ventures launched a corporate venture capital arm to invest in cloud and AI-focused startups.

Vireo Ventures closed €50M Electrification Fund I to support energy transition and electrification solutions.

TVM Capital Healthcare reached first closing of its $150M Southeast Asia-focused healthcare fund.

Sora Ventures introduced a Bitcoin Treasury Fund to support blockchain projects and digital assets.

Legion VC launched to back breakout startups across multiple industries.

JVP closed a $290M continuation vehicle with TPG to support portfolio company Earnix.

Solaire Partners set to manage a $28M IPTV-focused investment fund.

Corenest Capital launched a global accelerator in El Salvador with a $25M tokenized VC fund.

VCUK rolled out a new private equity and VC initiative with a Europe-focused strategy.

Accion Venture Lab closed its $61.6M second fund to back inclusive fintech innovations.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Giant Ventures (London, UK / New York, NY / San Francisco, CA): Analyst Program (apply here)

Tower Research Ventures (New York City, NY): Analyst (apply here)

Bessemer Venture Partners (San Francisco, CA): AI Associate or Senior Associate (apply here)

2048 Ventures (Boston, MA): Associate (apply here)

Lightbank (Chicago, IL): Growth Equity Investor (apply here)

ElevenX Capital (Remote): COO (apply here)

Coinbase Ventures (Remote): Principal (apply here)

Speedinvest (London, UK / Berlin, Germany / Paris, France / Vienna, Austria / Munich, Germany): VC Associate (apply here)

DRW (Palo Alto, CA): Venture Capital Analyst Intern (apply here)

Clocktower Ventures (Santa Monica, CA): Investor Relations (apply here)

Hottest Deals 💥

Mazlo raised $4.5M in seed funding to scale its platform. (read more)

Brain scored $30M Series A to push deeper into AI innovation. (read more)

Diana Health locked $55M Series C to expand its women’s health clinics. (read more)

Unmind received $26M in growth capital to grow its mental health platform. (read more)

RushOwl raised $10M Series A to scale its urban mobility network. (read more)

Odyssey Therapeutics pulled in $213M Series D for next-gen medicines. (read more)

Pixverse landed $60M Series B to build its immersive media platform. (read more)

Optain Health secured $26M Series A to expand its health tech offering. (read more)

Pest Share raised $28M Series A to disrupt pest management. (read more)

Higgsfield closed $50M Series A for its AI video generation tech. (read more)

Oranai secured multi-million-dollar angel funding to kick off operations. (read more)

Torus raised $200M to scale its digital identity and security platform. (read more)

Motion bagged $60M across Series B, C, and C2 rounds at a $550M valuation. (read more)

DataCrunch raised €55M Series A to accelerate cloud infrastructure growth. (read more)

Proxima Fusion added €15M to its Series A, bringing total funding to €200M. (read more)

RESOURCES 🛠️

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox