‘AI eats the world’🧠, Unicorn Production Hits a 3‑Year High🦄, 10 Startup Resources You Can’t Afford to Skip📚

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Attio

The CRM used by both startups and VCs (including me)

I use Attio to manage deal flow, track founder conversations, and sync everything across my team — no clunky setup required.

Startups use it as a sales CRM from day one

VCs use it for deal tracking, LPs, and intros

Fully customizable and updates automatically

It’s fast, flexible, and built for how we actually work.

In-Depth Insights 🔍

Build What’s Fundable 🤖

A veteran investor dissects how YC’s shift from problem-first quests to consensus-friendly prompts reflects a broader “Consensus Capital Machine.” The piece argues founders should pursue belief-driven missions over trend-chasing to –escape hyperlegible sameness. [Kyle Harrison]

18 Lessons from Harry Stebbings on Building and Investing 🎙️🔥

A distilled playbook from a decade of candid conversations covers intensity, relationship systems, and micro-ambition as compounding advantages. The thread emphasizes discipline over theatrics and treating relationships as an engineered pipeline.

Consolidated Market Outlook for 2026 🌍

A curated index of global macro outlooks brings major houses’ theses into a single reference to compare assumptions and risk narratives. Readers are reminded to use these documents as inputs, not forecasts, and to interrogate where they diverge. [Audrey Wang, CFA]10 Startup Resources You Can’t Afford to Skip 📚

A practical toolkit roundup spans investor databases, pitch deck libraries, valuation primers, and cap table templates to accelerate execution. The theme is simple: leverage proven artifacts instead of reinventing common motions.The Struggle That Sparked 20VC’s Fund 💥

A personal low created the space to launch a media platform that snowballed into a capital engine. The broader lesson: constraints can catalyze non-obvious breakthroughs that compound over years. [20VC]Kalshi’s Valuation Jumps to $11B After a $1B Round 📈

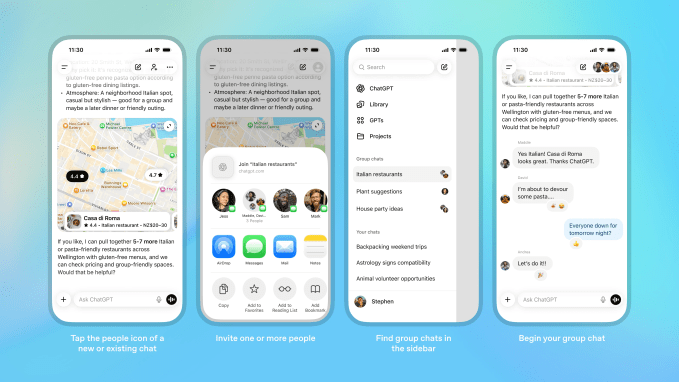

The prediction market’s step-up financing underscores surging volumes, competitive dynamics with Polymarket, and a complex regulatory backdrop. Massive growth coincides with legal friction, highlighting the category’s blurred line between finance and wagering. [TechCrunch]ChatGPT Launches Group Chats Globally 💬

Collaborative threads transform the assistant from a single-user tool into a shared workspace for planning, creation, and debate. Privacy-scoped profiles and tagging aim to balance autonomy with assisted coordination for up to 20 participants. [TechCrunch]

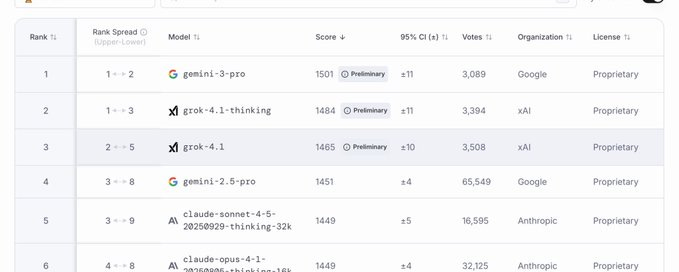

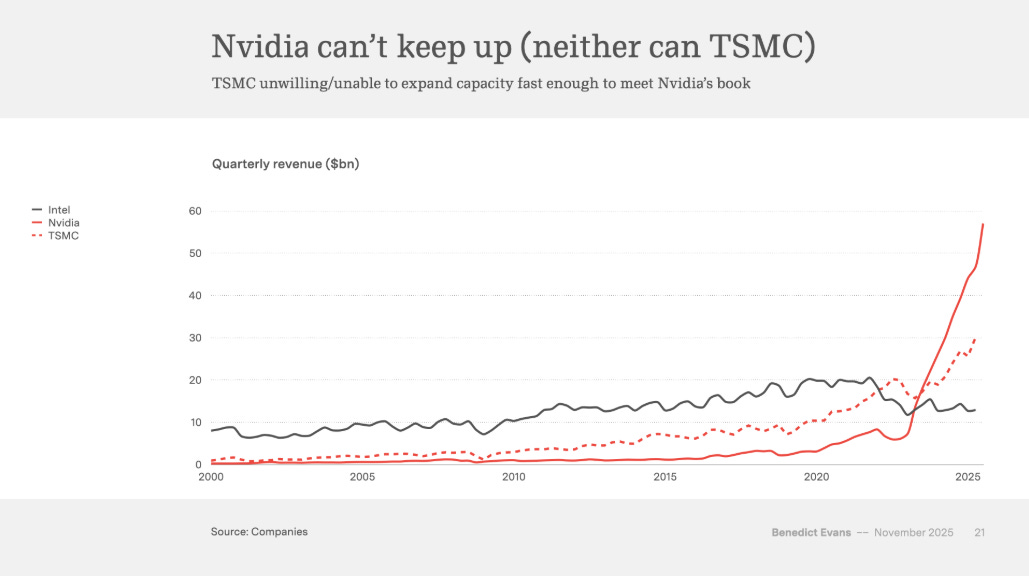

Gavin Baker: Scaling Laws, Blackwell, and AI Economics 🧠

A deep macro-thread argues pretraining scaling remains intact, token cost efficiency is the real moat, and power constraints will elongate the cycle. He sees Google and xAI flexing coherent compute advantages while Blackwell shifts the global competitive balance. [Gavin Baker]

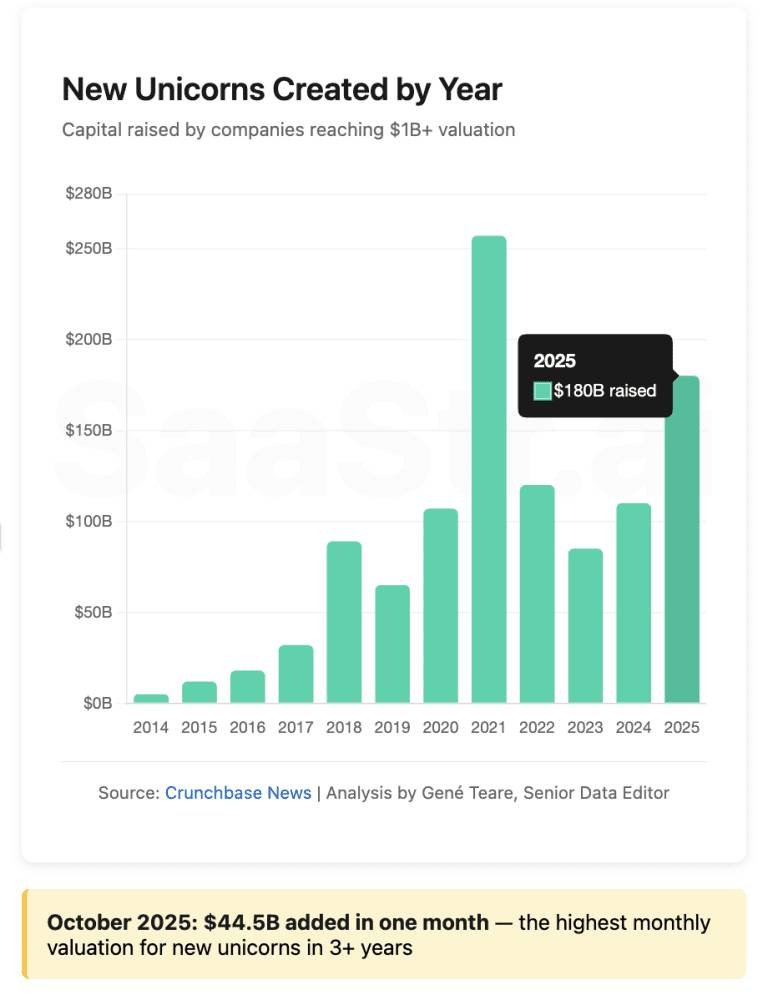

Unicorn Production Hits a 3‑Year High 🦄

October’s cohort added $44.5B in value, signaling a healing but selective market that rewards AI-native traction and disciplined metrics. The bar is higher than the boom years, yet rational growth stories are finding capital again. [Crunchbase]

The Simple Secret to Influence 🗣️

True influence isn’t about showcasing brilliance but helping others feel capable and understood through curiosity, clarity, and generosity. Leaders who build psychological safety unlock better ideas, stronger trust, and durable followership. [Deb Liu]

Tools 🧰

Attio, The CRM used by both startups and VCs (including me). Try it for free here

Webflow, where smarter sites start. Try their AI-native platform here

deel: The all-in-one HR tool. Bring the world to work starting with a Free Demo

Notion: work faster with your AI team, and get their FREE AI Kit:

FREE LinkedIn Growth Playbook for Startup Founders

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

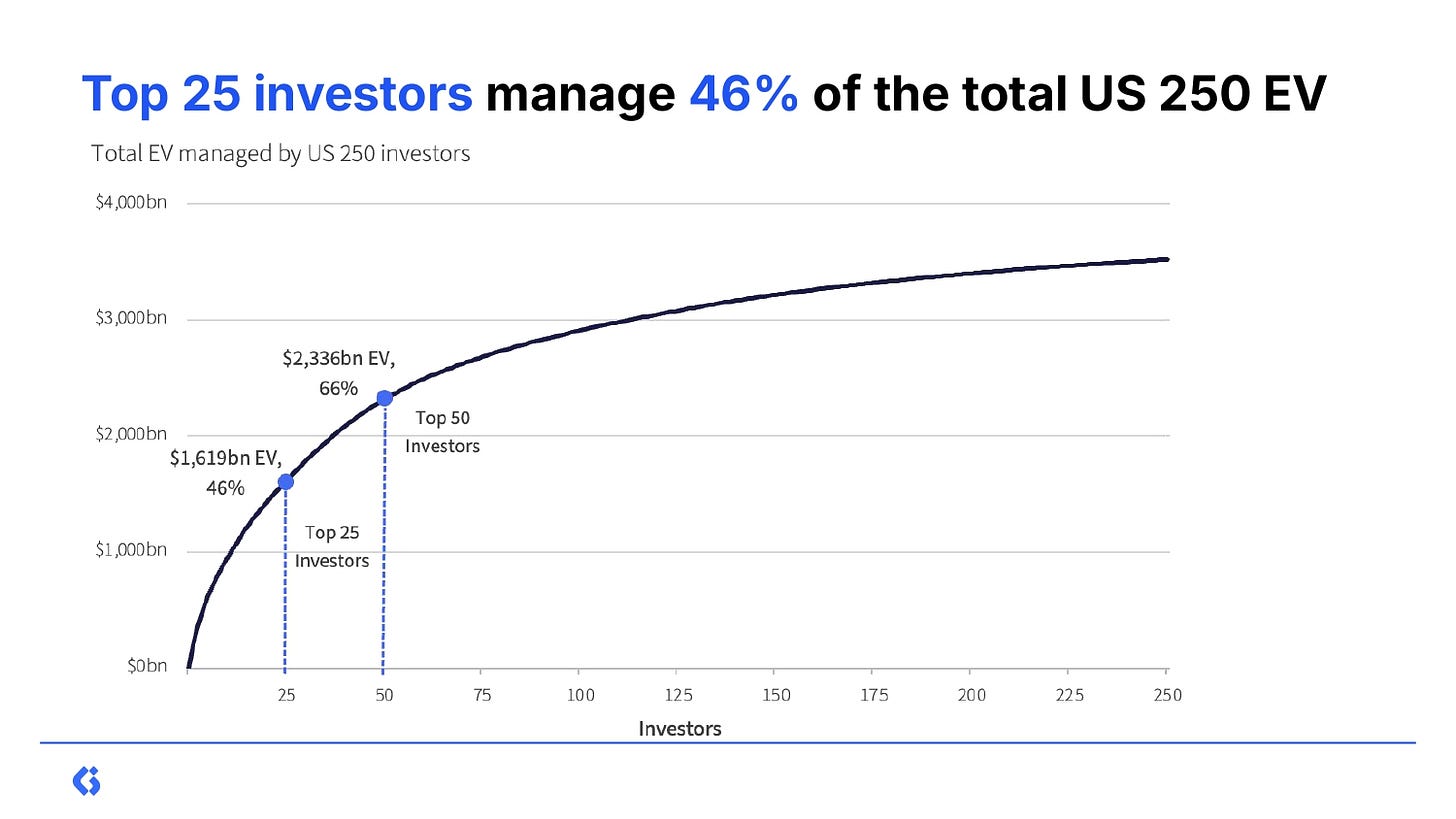

US250 Private Equity Presentation 📈

Expect takeaways on buyer behavior, sector dynamics, and activity across major sponsors.

Benedict Evans: Presentations and 2025 ‘AI eats the world’ 🧠

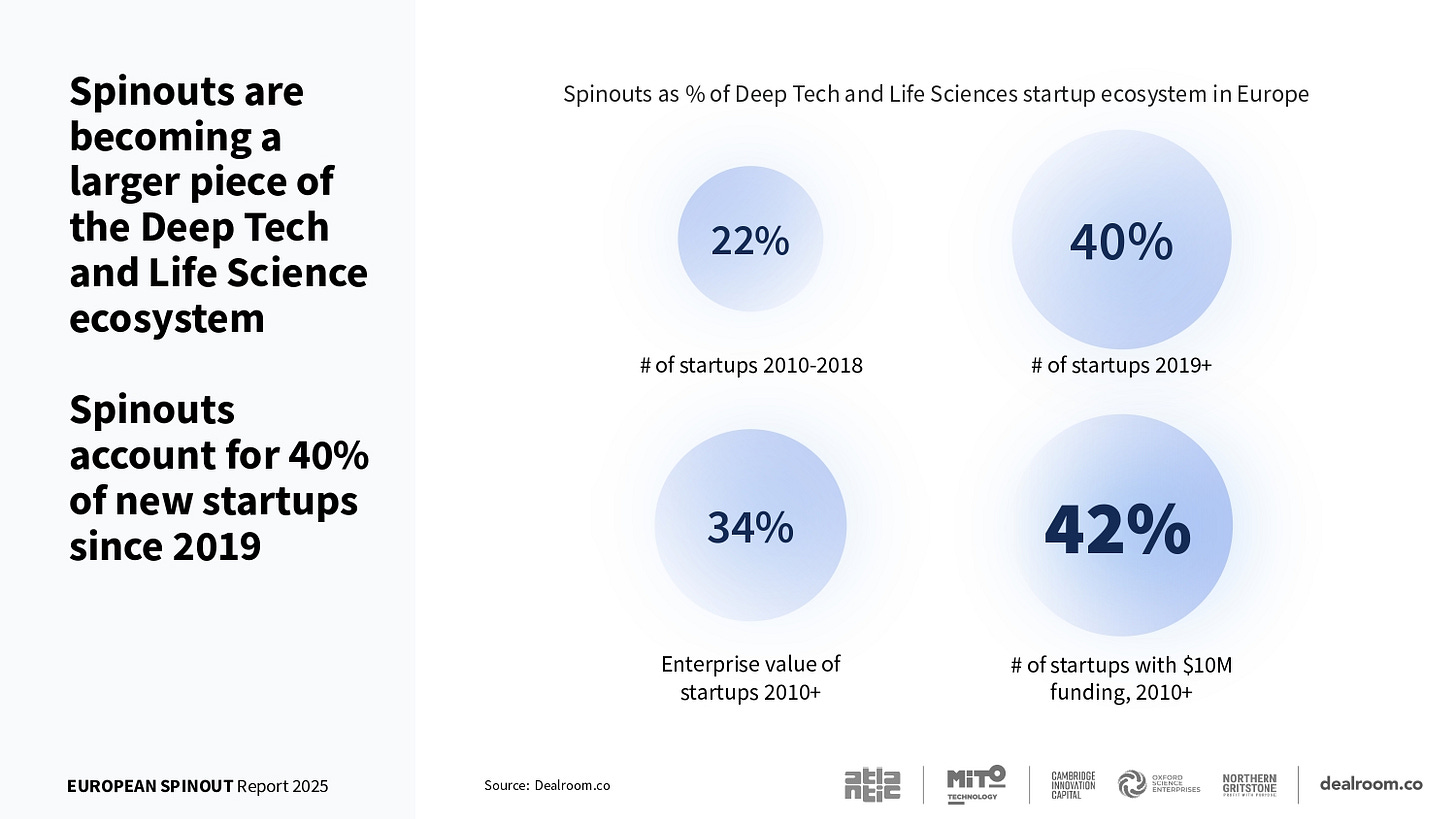

A yearly slide series distills macro shifts across tech platforms, distribution, competition, and regulation. Watch recent talks from Singapore and Helsinki and access prior decks going back to 2013.European Spinouts Report: Preview 🧪

Dealroom previews a first-of-its-kind ranking of university spinoffs across the region, covering value creation, jobs, and funding momentum. Findings highlight strength in deep tech and life sciences, with later-stage capital often sourced from abroad.Q3 2025 Healthtech VC Trends 🩺

Investors poured $3.9B into digital care startups as AI-enabled platforms lifted valuations and deal flow after a prolonged reset. Exit activity accelerated for smaller companies and several mature names are lining up potential listings in 2026 despite activity remaining below the 2021 peak.

Recently Launched Funds 💸

Lifeline Ventures selected Fundcraft as administrator for its €400M fund, ensuring smooth operations and compliance at scale.

Bitfury rolled out a $1B program focused on accelerating ethical adoption of frontier and emerging technologies.

BVP Forge closed its second fund at $1B, continuing its mission of long-term support for durable growth businesses.

R136 Ventures wrapped up its third fundraise (amount not disclosed) to back global founders building generational companies.

Remagine Ventures raised $25M for its second fund, focused on early-stage investments across media, entertainment, and gaming.

Keen Venture Partners held a first close of over €150M for its European Defence and Security fund, targeting frontier-tech opportunities.

The Legaltech Fund closed its second fund at $110M to continue backing innovation across legal, regulatory, and compliance tech.

Vistara Growth raised $321M for its fifth fund, fueling growth-stage investments across software, tech, and services.

NVP Capital closed its second fund at $80M, doubling down on its focus across fintech and future of commerce.

Sofinnova Partners closed Sofinnova Capital XI at €650M, continuing its leadership in life sciences venture capital.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Frontier Capital Partners (San Francisco, CA): VC Scout (apply here)

Empyrean Venture Partners (New York City, NY): IR Manager (apply here)

SoftBank (Menlo Park, CA): VC Associate (apply here)

Sands Capital (Arlington, VA): VC Internship (apply here)

Pegasus Angel Accelerator (Remote): VC Fellowship (apply here)

Atlassian Ventures (San Francisco, CA): Head Of (apply here)

CPG (New York City, NY): VC Director (apply here)

D11Z Ventures (Munich, Germany): VC Internship (apply here)

Allocator One (Vienna, Austria): VC Associate (apply here)

VC Lab (Remote): VC Associate (apply here)

Hottest Deals 💥

Ratex, raised $10.4M to expand its AI-powered dynamic pricing and revenue optimization platform. (read more)

Pibit AI, secured $7M in Series A to enhance its AI-native developer platform. (read more)

Cassidy Bio, closed $8M in seed funding to develop cell therapies for autoimmune diseases. (read more)

Point One Navigation, raised $35M in Series C to fuel growth of its precision location platform. (read more)

GenSpark, raised $275M in Series B at a $1.25B valuation to scale its AI cloud infrastructure. (read more)

Ncodin, raised €16M in seed funding to build out its generative code intelligence platform. (read more)

Coverbase, secured $20M in total funding to streamline embedded insurance APIs. (read more)

Arbiter, raised $52M to expand its supply chain risk and compliance intelligence platform. (read more)

TULU, raised an additional $17M in Series A to grow its smart rental hubs across urban buildings. (read more)

Bedrock Data, raised $25M in Series A to help companies sync customer data across platforms. (read more)

Profluent, secured $106M to accelerate generative AI for protein design and synthetic biology. (read more)

Luma AI, raised $900M in Series C to build the future of photorealistic 3D generation. (read more)

Asseta AI, raised $4.2M in seed to enhance asset intelligence for industrial operations. (read more)

Venn, raised $52M in Series B to advance its community operating system for residential spaces. (read more)

Agentio, raised $40M in Series B to streamline revenue operations for modern B2B sales teams. (read more)

RESOURCES 🛠️

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Excellent analysis! The 'AI eats the world' idea is so poweful. Makes you wonder.