AI In a Bubble?🫧, Moats Revisited🛡️, AI makes the old VC playbook obsolete⚡

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Hubspot for Startups

Unwrap Your AI-Native Stack

AI-native founders don’t need more noise, they need clarity…

That’s why I’m bringing you exclusive startup offers and the AI Tech Stack Playbook, packed with real-world use cases to help you build smarter and scale faster.

From product to GTM, these tools give you everything you need to power your workflows, automate growth, and succeed with AI.

In-Depth Insights 🔍

Going to market when no market exists 🧭

When you’re creating a new category, pricing and sales model choices determine viability more than features do. Anchor high, learn pricing through real sales motions, and evolve from evangelical “hunters” to scaled execution as the market matures. [Martin Casado]

The 100 Most Important Pension Funds in the World 🏛️

Long-horizon allocators control multi-trillion-dollar pools that shape late-stage private markets and critical infrastructure. Understanding mandates, decision cycles, and relationship pathways is essential for founders targeting institutional capital.

ask me anything on a consulting call 🔥

Sequoia’s Brian Halligan: There’s More Sizzle Than Steak About Some Gen-AI Startups 🥩

Rapid top-line growth means little if pilots don’t turn into durable enterprise contracts. Teams that pair speed with disciplined hiring and customer conversion mechanics will outlast hype cycles. [WSJ]The AI Brief: Backing Enduring Companies in the Super-Cycle 🏗️

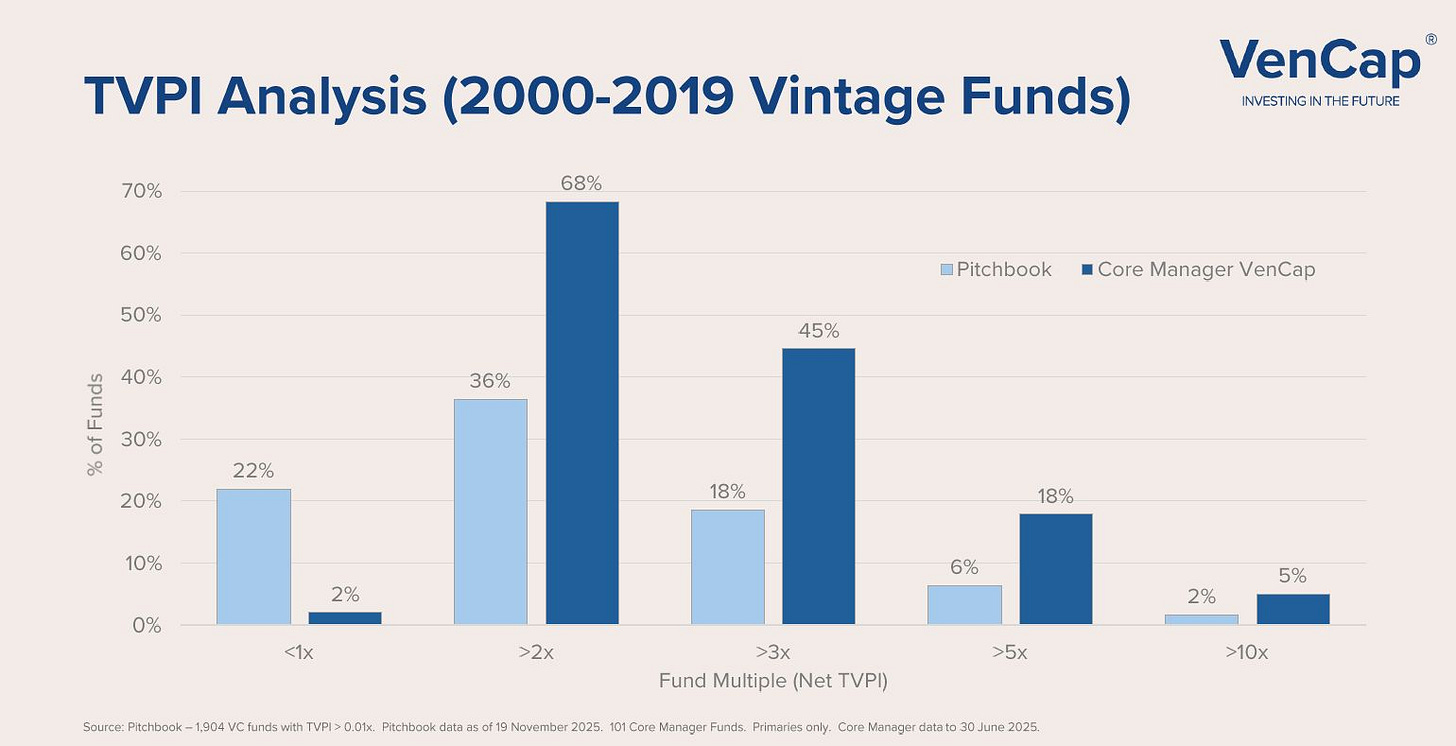

Value in the next wave accrues to application-layer products that embed into workflows, drive measurable ROI, and meet enterprise governance standards. Instead of model bets, investors should prioritize defensibility through data flywheels, domain focus, and strong NRR. [Notion VC, Chris Tottman]A 5x VC Fund Is Rare - But It’s Not a Myth 💰

Industry averages hide the performance delta: manager selection, ownership discipline, and concentration materially increase the odds of outlier multiples. LPs and GPs who optimize for access and structure can still achieve top-decile outcomes. [Doug Dyer]

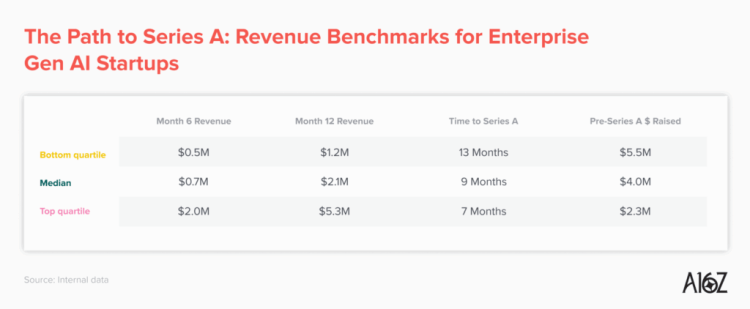

AI makes the old venture playbook obsolete ⚡

Hyper-growth benchmarks and fundraising thresholds have shifted upward as automation compresses time-to-scale. In this environment, conviction, speed, and concentrated follow-ons matter more than precision pricing or legacy heuristics. [VC Cafe, a16z]

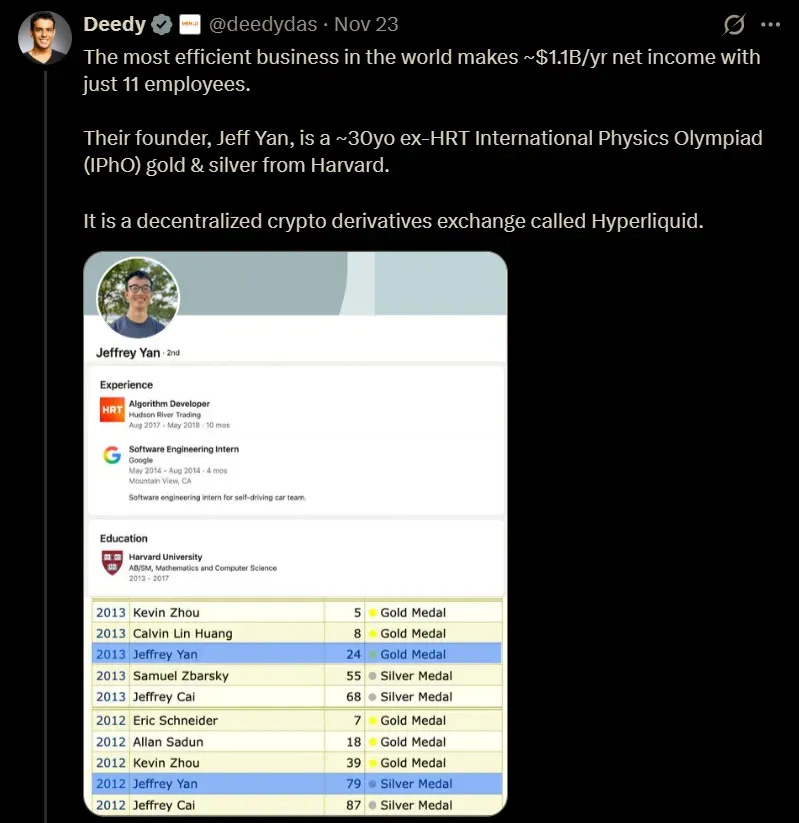

Hyperliquid: The 11-Person Exchange That Shows How Extreme AI-Era Efficiency Can Get 🧠

A lean team with a fully automated, on-chain CLOB can deliver CEX-grade performance and triple-digit millions in revenue per employee. Treating the platform like an autonomous agent turns code into the operating workforce and concentrates regulatory and operational risk.

Moats Before (Gross) Margins: Revisited 🛡️

Durable advantages still come from defensibility: network effects, scale, switching costs, brand, and unique data, while speed earns the right to build those walls. In the AI era, margin signals can mislead; focus on usage love and compounding moats. [Alex Immerman & David George]

Tools 🧰

MongoDB for Startups gives you the tools and support to accelerate your growth

an AI co-worker who’s always on the clock :)

fre AI Native Stack (Gamma, Lovable, Clay, Notion…)

Hubspot’s FREE LinkedIn Growth Playbook for Startup Founders

Attio, the CRM used by both startups and VCs (including me). Try it for free here

Webflow, where smarter sites start. Try their AI-native platform here

deel: The all-in-one HR tool. Bring the world to work starting with a Free Demo

Notion: work faster with your AI team, and get their FREE AI Kit:

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

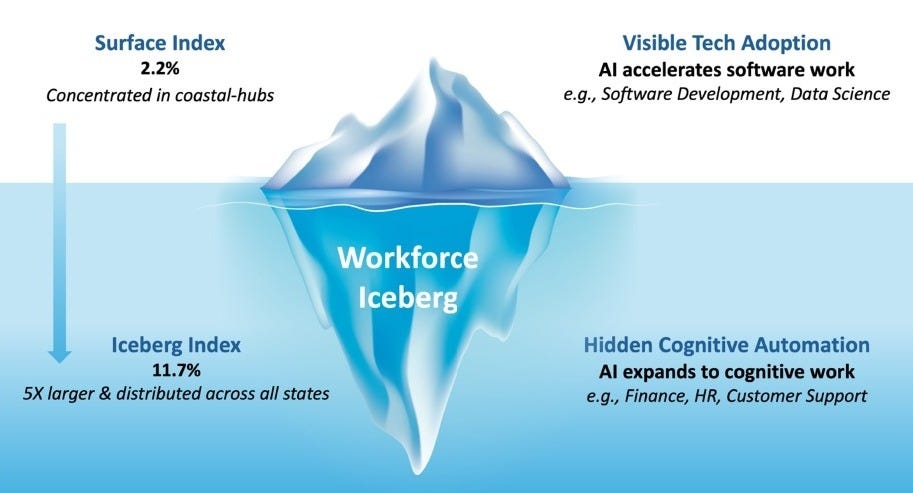

The Iceberg Index: Measuring Workforce Exposure in the AI Economy 🤖

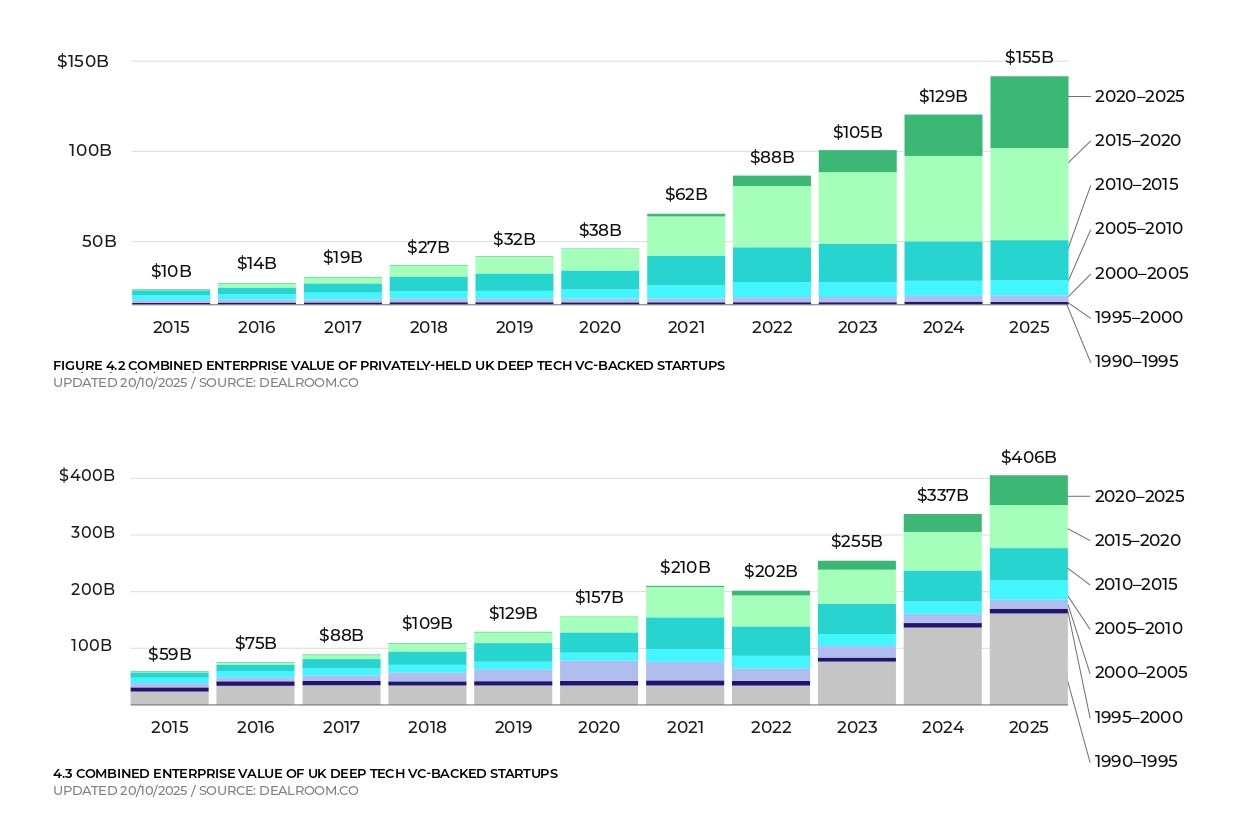

A research team introduces a skills-centered metric that quantifies how much of each occupation’s wage value could be performed by machine capabilities. Their analysis maps exposure across states and industries to help policymakers target training, infrastructure, and interventions ahead of adoption.State of UK Deep Tech 2025 report 🇬🇧🧬

This analysis provides a snapshot of emerging science-based startups, investment flows, and regional strengths across the country. It highlights momentum in areas like compute, biotech, and climate tech while outlining the funding landscape and ecosystem enablers.AI64: Redpoint’s Outlook on AI Applications 🔮

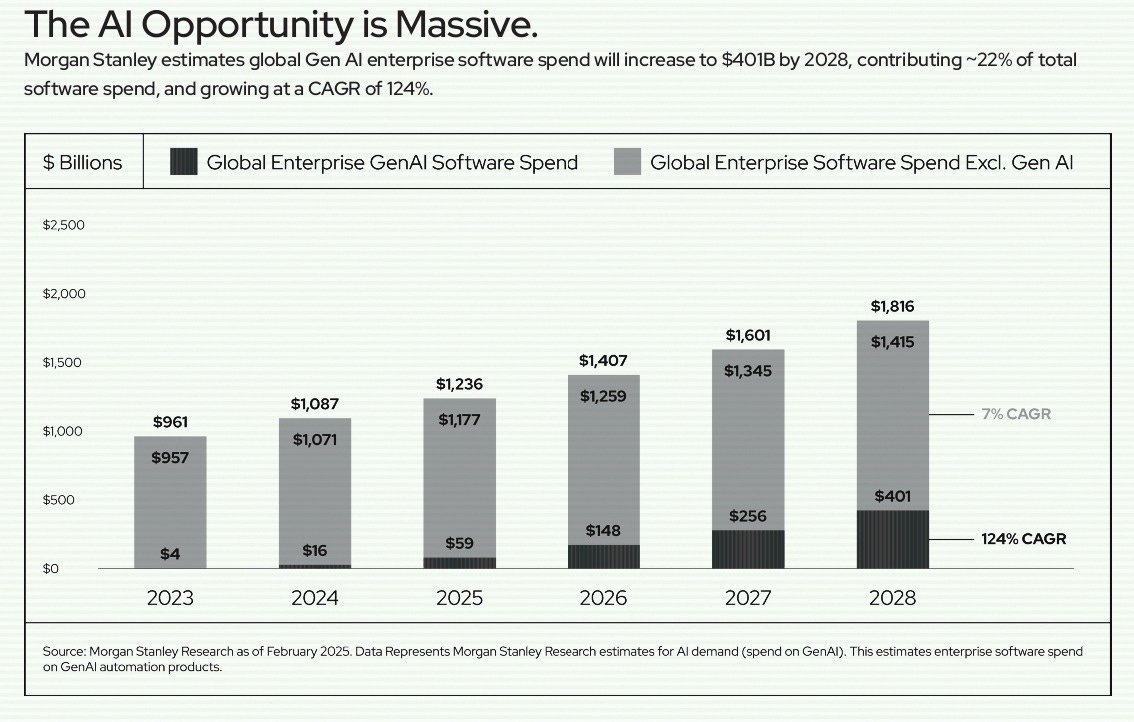

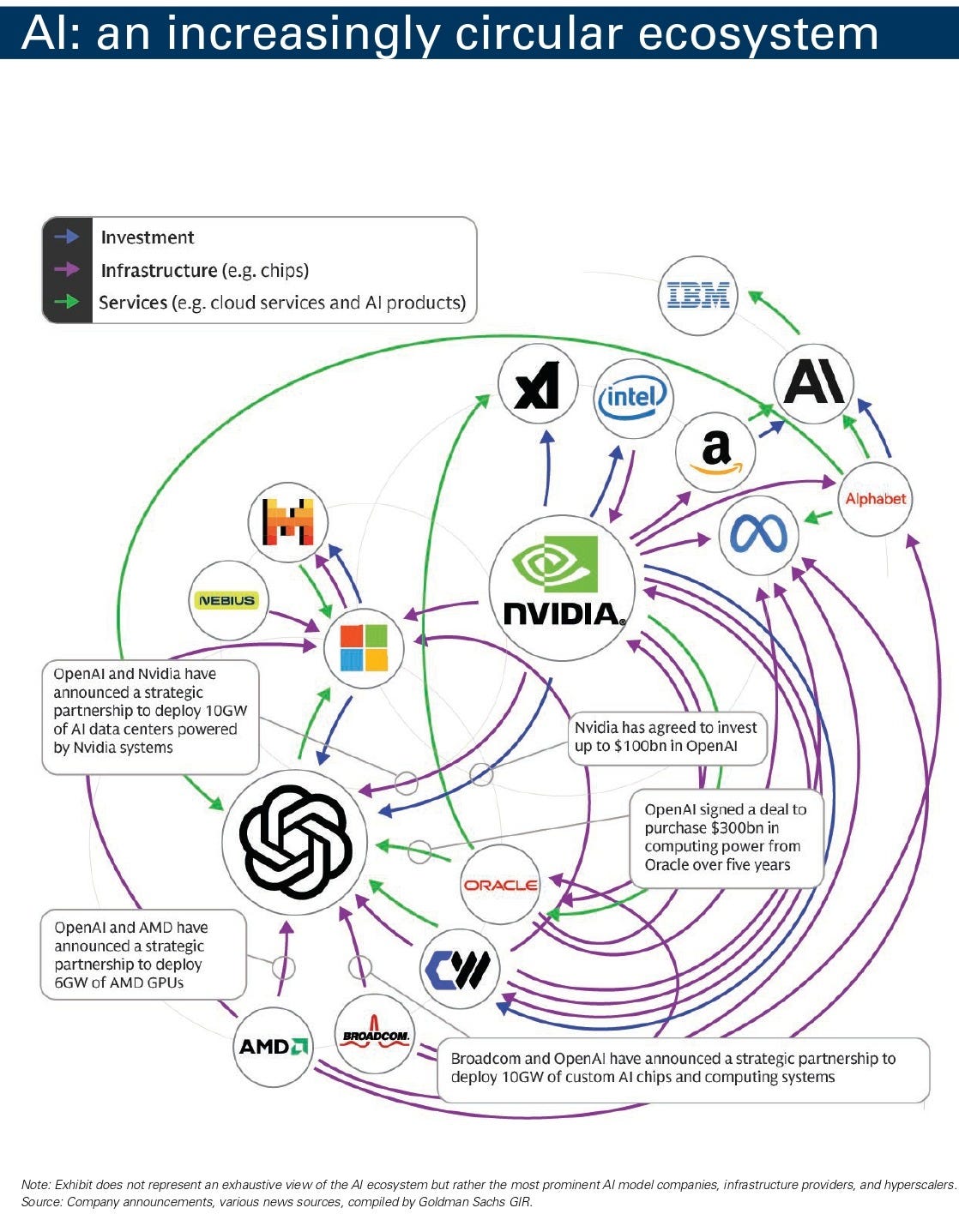

The report argues that generative systems are expanding software’s addressable market by performing work traditionally handled by people. It explores a shift from classic subscriptions to outcome-based models, alongside data on revenue trajectories, funding, and category leaders.Top of Mind: AI In a Bubble? 🫧

This briefing weighs exuberance against fundamentals across valuations, earnings power, and capital spending tied to the compute cycle. Contributors debate scenarios for sustainability, risks of overbuild, and signals that would indicate a healthier normalization.

Recently Launched Funds 💸

Firgun Ventures just dropped a $250M quantum tech fund to back the next wave of deeptech breakthroughs.

Future Energy Ventures locked in €205M for Fund II, doubling down on climate-forward energytech plays across Europe.

Flashpoint sealed a $67M close for its second growth debt fund, fueling scale-ups from Europe to Israel.

Propeller launched a $50M AI-focused fund connecting top-tier MENA talent with global markets.

Disruptive AI raised $40M for Fund II to back Israel’s sharpest minds building in AI and ML.

Chui Ventures debuted with a $17.3M fund led by powerhouse African women betting on local brilliance.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Altuva Group (San Francisco, CA): Partner (apply here)

DBL Partners (Palo Alto, CA): Analyst (apply here)

Newlab (Brooklyn, NY): Senior Analyst (apply here)

Powerhouse Ventures (Remote): Internship (apply here)

Arnold Ventures (New York City, NY): Director (apply here)

Vituity (Remote): Associate (apply here)

LVLUp Ventures (Remote): Manager (apply here)

Biogen (Cambridge, MA): Senior Director (apply here)

Possible Ventures (Munich, Germany): Associate (apply here)

IDC Ventures (Copenhagen, Denmark): Internship (apply here)

Hottest Deals 💥

Kalshi, raised $1B to challenge Polymarket in the prediction market race. (read more)

X-Energy, secured $700M Series D to fuel the next era of nuclear power. (read more)

CookUnity, got fresh capital to expand its private chef meal delivery service. (read more)

Harmonic, hit a $1.45B valuation with backing for its math-first AI platform. (read more)

Sapi, landed $80M to boost small business financing across the UK. (read more)

Guardio, raised $80M to protect consumers in an AI-powered cybersecurity future. (read more)

Model ML, secured $75M in one of fintech’s largest Series A rounds. (read more)

Tenzai, raised $75M to strengthen its cybersecurity tools from Israel. (read more)

Dayra Therapeutics, launched with $70M and Biogen to develop new peptide-based drugs. (read more)

Overstory, secured $43M for an unnamed SaaS company. (read more)

Sortera, brought in $45M to scale AI-powered aluminum recycling. (read more)

Sorcero, raised $42.5M Series B to expand its AI platform for life sciences. (read more)

Clover Security, quietly raised funds with backing from top-tier cyber investors. (read more)

Numerai, raised $30M Series C at a $500M valuation to scale its crypto hedge fund ecosystem. (read more)

DualBird, secured $25M to redefine surgical imaging with its dual-mode technology. (read more)

RESOURCES 🛠️

access all for the next year with a 50% limited discount (Black Friday)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox