Can Sam Altman end up in jail?😮, “40% of startups die after a seed… 0.5-1% go IPO” 🏁

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Webflow, where Smarter sites start:

With Webflow’s AI-native platform, you can create, manage, and optimize stunning, personalized web experiences that drive real results — faster than ever.

Describe your idea, let AI generate tailored designs, and customize every detail visually. No code, no limits.

👉 Book a free 30-minute demo and see how Webflow + AI can bring your site to life.

In-Depth Insights 🔍

VC who bet on billion-dollar AI firm shares two red flags that stop him investing in a founder ⚠️

An early backer of ElevenLabs explains he walks away when teams lack deep technical capability or chase crowded, hype-driven markets. He argues these patterns slow product velocity and inflate pricing, creating pressure that harms long-term execution. [CNBC]

There is 9% chance that Sam Altman ends up in jail before July 2026 😮

Posts on X and recent news highlight ongoing scrutiny and speculation about his leadership and associated projects, such as Worldcoin, which faces regulatory challenges in multiple countries.

Volatility is All You Need 🌪️

The piece argues fatter market tails and rising “vol-of-vol” amplify outlier outcomes, making option-like exposure in startups especially attractive. It frames venture as right-tail access within a broader barbell, while cautioning that indexing won’t capture the extreme winners. [Jordan’s Writings]

153 Startups Fundraising Right Now (and Their Decks) 🚀

October’s roundup catalogs active raises with stage, region, and direct founder access, offering a curated pipeline for outreach. The breakdown skews to pre-seed and seed across global geographies.

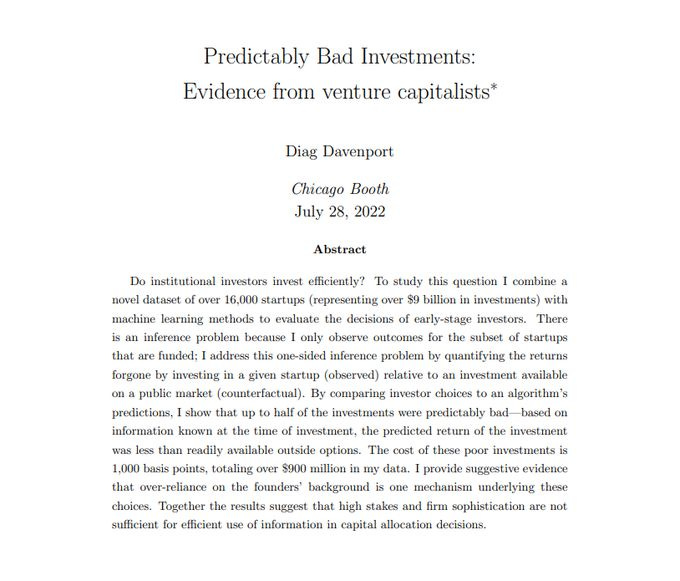

Repeated studies have shown that VCs overindex on shallow founder attributes, leading to predictably bad investments - and missed good investments. 🧠

The post critiques a fundraising-first bias that privileges performative traits over operating substance, distorting selection and outcomes. It calls for diligence that weighs problem-solving, execution, and context over pitch theatrics. [Dan G.]

An M.I.T. study found that 95% of companies that had invested in A.I. tools were seeing zero return. 📉

A reported survey suggests most adopters aren’t realizing measurable gains from current-generation tooling, raising questions about deployment maturity and fit. The commentary urges separating short-term hype from operational value while capabilities and workflows evolve. [The New Yorker]VCs: Four Steps To Find Billion-Dollar Talent 🧭

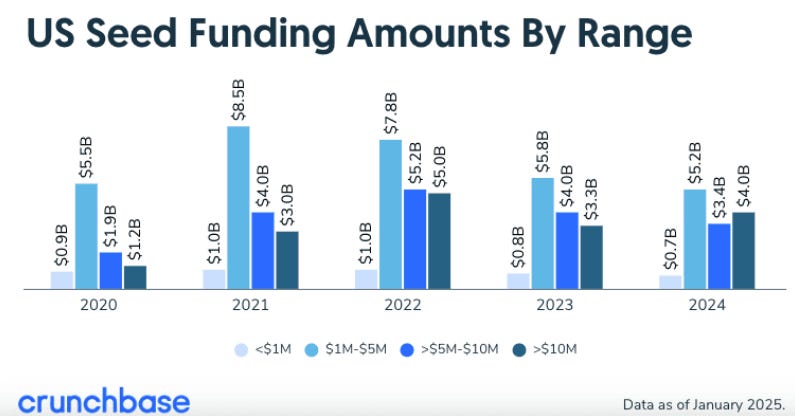

Research-backed behavioral markers like composure, analytical thinking, positive tone, and inclusive language correlate with exceptional founder performance. The piece offers a playbook to counter pattern-matching by instrumenting assessments and tailoring post-investment support. [Forbes]A Crisis Moment for Seed VC 🌱

Seed managers face structural headwinds from YC-scale funnels, mega-fund encroachment, power-law concentration, and an AI wave that rewards capital intensity. The result is tighter ownership, higher entry prices, and tougher differentiation, pressuring traditional seed models. [NextView]

“40% of startups die after a seed… 0.5-1% go IPO” 🏁

A survival funnel highlights steep attrition across stages, underscoring why portfolio construction and pacing matter more than point estimates. The figures imply concentration on asymmetric upside and disciplined reserves policy to capture scarce breakouts. [Deedy]Andreessen and Sacks on EU tech policy and AI “leadership” 🏛️

The discussion frames Europe’s stance as regulation-led “leadership,” contrasting it with a deregulatory approach aimed at faster innovation cycles. It suggests policy orientation meaningfully shapes competitiveness in AI, crypto, and national tech strategy. [a16z]

Tools 🧰

Attio: the CRM built for startups and VCs (like me). Try it for FREE here

live demo to learn how startups use Vanta’s Vendor Risk Management

Looking for an All-in-one HR tool? Deel can help you and is letting you take a Free Demo

Notion: work faster with your AI team, and get their FREE AI Kit:

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

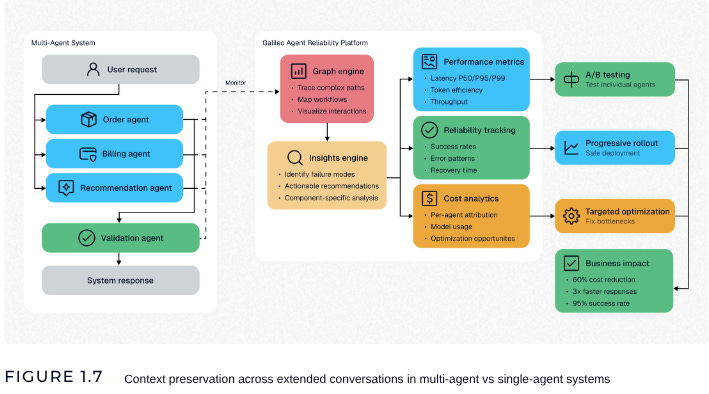

Galileo: Practical Playbook for Multi‑Agent Architectures 🛠️

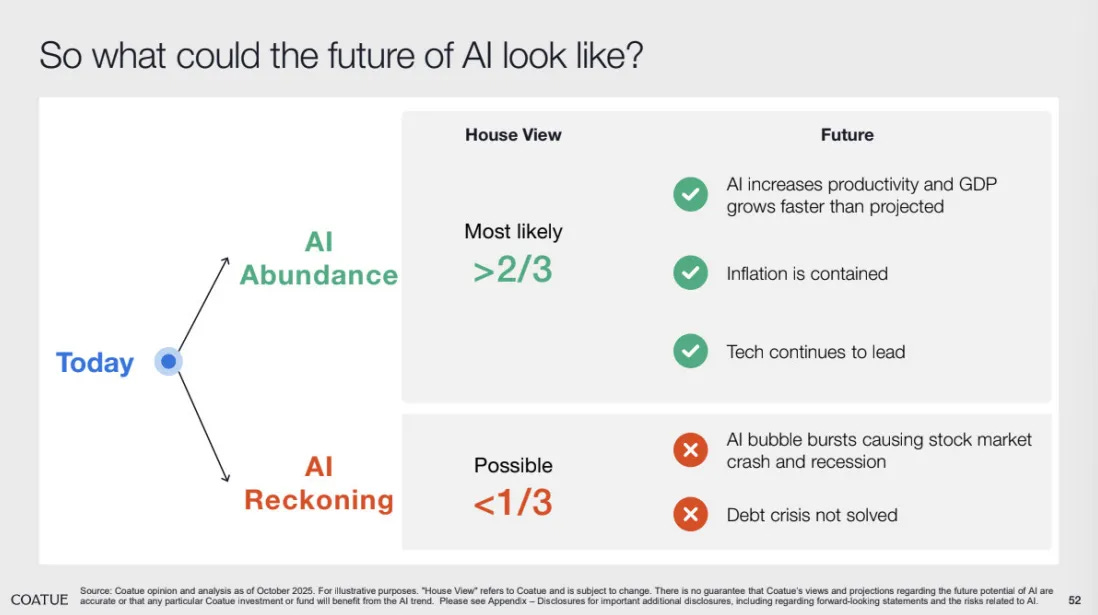

A new 165‑page guide distills how to design agent teams that coordinate reliably, evaluate performance with the right metrics, and manage context to avoid failure modes. It contrasts centralized, decentralized, hierarchical, and hybrid patterns while outlining trade‑offs such as coordination overhead, fragmented memory, and observability needs.Coatue’s 18‑Chart AI Report: Early, Not a Bubble 💹🤖

The hedge fund synthesizes centuries of market cycles to argue current valuations are grounded in earnings, productivity gains, and real enterprise adoption. The charts show leadership shifting to compute and energy, a measured IPO pipeline, and scenario paths that favor sustained growth if returns on investment continue to compound.

Recently Launched Funds 💸

Section Partners closed two new funds totaling $189M, doubling down on growth-stage tech with a sharp operator-first focus.

United Founders launched a pre-seed and seed fund to back emerging European founders before the crowd catches on.

Rubio Impact Ventures raised €70M for its third fund to scale purpose-driven startups tackling climate and social challenges.

Forbion closed the €200M BioEconomy Fund I, targeting biotech and sustainability plays that merge science with market potential.

MVP Ventures reported top 5% TVPI for its $125M Fund II, a strong signal that steady capital and deep diligence still win.

CMT Digital closed $136M Fund IV to invest in crypto infrastructure and digital asset innovation.

UKG Ventures launched UKG Ventures, the new corporate venture arm from HR leader UKG focused on early-stage worktech startups.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

World Fund (Amsterdam, Netherlands): VC Analyst (apply here)

World Fund (Munich, Germany): VC Internship (apply here)

DCG (Stamford, CT): VC Analyst (apply here)

Wisconsin Foundation (Madison, WI): VC Director (apply here)

Camino Partners (New York City, NY): Senior VC Associate (apply here)

Liberty Ventures (New York City, NY): VC Vice President (apply here)

Unity Growth (Washington, DC): VC Partner (apply here)

Coinbase (Remote): VC Associate (apply here)

VC Lab (San Francisco, CA): VC Associate (apply here)

Samsara (Remote): VC Director (apply here)

Hottest Deals 💥

Upward raised $8M in seed funding to build AI tools that optimize workplace collaboration. (read more)

Reflex Aerospace raised €50M in Series A funding to scale its satellite manufacturing operations. (read more)

GrayMatter Labs secured $1.3M in seed funding to advance neuromorphic computing research. (read more)

Accipiter Biosciences raised $12.7M in seed financing to accelerate its RNA-based therapeutics platform. (read more)

DealMaker secured $20M in equity and debt funding to expand its capital-raising software platform. (read more)

Metropolis Technologies received $1.6B in financing to scale its AI-powered parking and mobility infrastructure. (read more)

Upway raised $60M in Series C funding to grow its e-bike marketplace across new European markets. (read more)

Ripple received a $500M strategic investment at a $40B valuation, signaling renewed crypto investor confidence. (read more)

Rilevera raised $3M in seed funding to develop health data tools that enhance patient outcomes. (read more)

CommanderAI raised $5M in seed funding to build intelligent automation systems for logistics operations. (read more)

Armis closed a $435M pre-IPO round at a $6.1B valuation, strengthening its cybersecurity leadership. (read more)

Tala Health raised $100M to expand access to digital healthcare solutions. (read more)

Adaptronics closed €3.15M in funding to push advancements in adaptive material systems. (read more)

LambdaVision raised $7M in seed funding to develop its protein-based artificial retina. (read more)

Daylight raised $33M in Series F funding to expand its solar energy financing platform. (read more)

RESOURCES 🛠️

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

How do we responsibly separate real regulatory risk from headline speculation in an AI-fuelled startup world?