Most Founders Miss Out on This $50K+ Funding Source (It's Right Under Your Nose)

The complete guide to raising your first startup capital from the people who know you best without breaking trust or your cap table.

Why Founders Start With Friends and Family

Every startup begins with a leap. Not one, but multiple leaps. The first is that of belief.

In those earliest days, when there’s no product, no revenue, and often no clear roadmap, what you’re really building on is trust. And for most first-time founders, that trust comes from the people who know them best.

That’s why so many founders raise their first round from friends and family. Not because it’s easy, but because it’s the only door that’s even open at that point…

sponsored by MongoDB for Startups

Building the next big thing?

MongoDB for Startups gives you the tools and support to accelerate your growth:

• Exclusive credits: Jumpstart your development with MongoDB Atlas credits

• Expert support: Access hands-on guidance from MongoDB’s startup team

• Built for scale: Whether you’re building AI applications or mobile apps, Atlas delivers the flexibility and performance you need.

👉 Join us at MongoDB.local San Francisco on Jan 15 to connect with founders and builders shaping the next wave of innovation.

Venture capitalists don’t fund rough sketches. Angel investors want warm intros and traction. But your college roommate, or your aunt who’s seen you grind since school? They are willing to take a bet on you and not your pitch deck.

Friends and family funding is often the first real lifeline. It’s accessible. It’s fast. It’s rooted in something deeper than metrics, and that is belief in the founder as a person. That’s why nearly a third of founders raise money this way. That makes it more common than bank loans, credit cards, or even angel capital.

But make no mistake, this isn’t casual capital. This is emotionally loaded, strategically risky money. If mishandled, it can wreck relationships, clutter your cap table, and sabotage future rounds before you even get to pitch a real investor.

So if you’re going to raise from the people who love you, do it with clarity, care, and structure. Let’s talk about timing first, because knowing when to raise from friends and family is just as important as how.

Table of Contents

1. When Is the Right Time to Raise a Friends and Family Round?

2. Debt or Equity? The First Decision That Shapes Everything

3. The Best Legal Structures (And Why Most Founders Get Them Wrong)

4. How Much Should You Raise and What Should You Give Away?

5. How to Pitch Friends and Family Like a Professional

6. Essential Legal Documents You Cannot Skip

7. Managing the Round After the Money Hits

8. Mistakes That Kill Friendships and Future Rounds

9. Final Takeaway: Raising Capital Without Regret

1. When Is the Right Time to Raise a Friends and Family Round?

Timing is everything. Raise too early, and you’re asking people to fund a fantasy. Raise too late, and you may have already missed your window, or worse, boxed yourself into a cap table that scares off real investors.

The best time to raise a friends-and-family round is after you've made a real commitment, but before you hit expensive roadblocks. That means putting in your own sweat, savings, and hours to validate the idea first.

Have you tested the assumptions? Built a scrappy prototype? Talked to real customers?

If the answer is no, you’re probably not ready to ask someone else to put in what you haven’t.

But if you have laid that groundwork, and you’re staring down the next leap, whether that’s a minimum viable product, a critical hire, or a pilot launch, then you’re in the zone. Friends and family capital is designed to get you to your next sharp milestone. It’s the bridge you urgently need.

Take Sara Blakely, who used early “trust money” from family not to create cushion, but to manufacture her first batch of Spanx prototypes.

Now think of a founder like yourself, who needs $40K to get a beta version live and gather data before a real pre-seed raise. That’s the point of this round: to unlock real progress.

What it’s not for: dragging your feet, delaying hard product decisions, or buying time while you “figure it out.” Founders who use F&F funds to stall often end up wasting both the capital and the goodwill behind it.

Use this round to hit specific, meaningful outcomes. Because once it’s gone, you can’t re-ask, and you’ll need to show results if you ever want to raise again.

2. Debt or Equity? The First Decision That Shapes Everything

Before you raise a single euro or dollar, you have to make one fundamental call: Is this a loan, or are they buying a piece of your company?

It’s not just a paperwork question. The structure you pick affects everything that comes after. That includes your taxes, your ownership, your cap table, and your relationships. Done right, it sets you up for clean growth. Done casually, it can turn into a mess no investor wants to touch.

Let’s walk through the two core options (and the one popular in-between).

Option 1: Debt - You Borrow It, You Owe It

This one’s simple. Someone lends you money. You agree to pay it back. Maybe with interest, maybe not. But it’s a loan, not a bet on your business.

Founders go this route when they:

Don’t want to give up equity

Know they’ll start generating revenue soon

Have friends/family who prefer predictability over upside

Say your cousin gives you $25K. You agree to pay it back over 3 years. No drama, no complicated terms, no dilution.

It’s clean, but risky. Because if the company fails, you’re still on the hook. And if the business needs every dollar to survive, repayment pressure can bite hard.

Option 2: Equity - You Sell a Piece of the Company

This one’s also clear. Friends & family give you money, and they become part owners. No repayment, no interest. If you succeed, they ride the upside. If you don’t, they lose their money.

For most friends and family rounds, this feels fair. But you need to know what you’re giving away.

Let’s say someone gives you $50K and you sell them 10% of your company. That locks in a $500K valuation. Totally fine. Unless two years later you’re trying to raise at $2M and VCs balk at how much your aunt owns.

And that’s just one piece of it. Once you start giving out equity, you also need to track it, explain it, and eventually dilute it.

That’s why more founders are using tools that push the valuation decision to later.

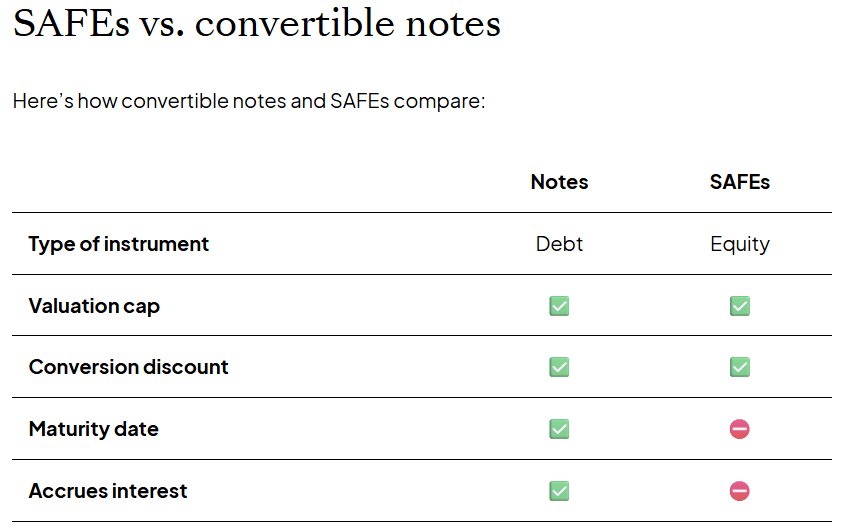

The Hybrid Route: SAFEs and Convertible Notes

Instead of deciding now what the company’s worth, you raise money through a SAFE (Simple Agreement for Future Equity) or a convertible note.

Here’s the idea: your friends give you money now, and it converts into equity later, usually during your next priced round, and usually at a discount.

No interest (in the case of a SAFE), no monthly repayments, no early valuation arguments. It’s fast and flexible. And in the U.S. and other startup ecosystems, it’s now standard.

But there’s a big catch founders often miss.

Only Some People Can Legally Invest in SAFEs or Notes

In the U.S., these are considered securities. Which means only accredited investors (people who earn $200K+ or have $1M+ in net worth (not counting their home) can safely hold them without extra legal disclosures.

If your best friend or your dad doesn’t qualify, and you still put them into a SAFE, you could:

Break securities laws

Complicate your future VC raise

Force yourself to unwind the deal later

In short: it’s best to not wing it here. If someone isn’t accredited, either give them a small equity slice under clear terms or structure it as a loan. Hybrid setups (like small equity + promissory note) exist, but they need careful handling.

The bottom line: Debt means you owe them. Equity means you own less. Convertibles mean “we’ll sort it out later” (with strings attached).

Pick the path that matches your business, your runway, and your relationships. And once you choose, write it down. Every clean round starts with clarity.

3. The Best Legal Structures (And Why Most Founders Get Them Wrong)

How you take money from your friends and family isn’t just a formality, but also a test. Of your conviction. Your discipline. And your future reputation as a founder.

Early investors may never look at your documents again. But future ones will. And if your first round is a legal mess of unstructured equity, no agreements, and jumbled promises… they’ll notice. Immediately.

Let’s break down the three most common legal structures founders use in a friends and family round, and where they often go wrong.

Common Stock for Cash: Simple, but Problematic

This is the instinctive route: “They give me money, I give them shares. What’s the big deal?”

Here’s the big deal:

To sell shares, you have to assign a valuation.

If you set that valuation too high, you’ll box yourself in later.

If you set it too low, you risk IRS scrutiny (in the U.S.), especially if you’re issuing yourself shares at a much lower price.

And worst of all, if you do this informally, with no paperwork, you’ve got cap table chaos in the making.

Founders who rush into this structure often:

Don’t document the share issuance properly

Skip a Shareholders’ Agreement

Create long-term dilution without realizing it

If you go this route, keep the round small, the valuation modest, and the paperwork tight. Also, make sure you are actually issuing shares, instead of just “promising” them.

SAFE or Convertible Note: Clean, But Only If Done Right

These are now the go-to tools for early-stage startup funding, and for good reason:

You don’t have to assign a valuation today

You do get money in quickly

The investor gets equity later, typically at a discount or with a valuation cap

Founders mess it up when they offer SAFEs or notes to non-accredited investors, like their parents, college friends, or younger siblings.

As we’ve mentioned, In the U.S., that’s a legal landmine. Because these instruments fall under securities law, if you raise improperly without disclosures or outside the right exemptions, you could lose your legal protections, scare off future institutional investors, and worst of all, be forced to unwind the round entirely.

So the rule of thumb is to use SAFEs or notes only with accredited investors. If you’re not sure someone qualifies, don’t wing it. Either ask your lawyer, or use a different structure.

Common Stock + Promissory Note: A Rare Hybrid That Works

This one’s less common, but when you’re dealing with non-accredited investors, it can be the cleanest compromise.

Here’s how it works:

You sell them a tiny number of common shares at a nominal price (e.g., same price founders paid)

The rest of their capital is treated as a loan, with clear terms and repayment flexibility

If things go well, you may repay or convert the note later in a structured round

Why it’s smart:

You avoid assigning a high valuation too early

You don’t expose non-accredited investors to securities issues tied to SAFEs

You still give them a small stake in the business, and skin in the game

Although it might not be the right tool for everyone, if your investor base is mostly non-accredited and you want to stay clean, this hybrid can be a lifesaver.

Your First Round Speaks Loud

Whichever path you choose, treat this like the beginning of your company’s public record. It’s a part of your story that will define you.

When VCs look at your startup, they look at your cap table. When lawyers review your docs, they look for sloppiness. When future investors ask, “How did you structure your early raise?” you need a clear, confident answer.

So take the extra time now to do it right. Not just for your investors. For your future.

4. How Much Should You Raise and What Should You Give Away?

One of the biggest mistakes founders make in a friends-and-family round is raising money without a vision or a plan.

This isn’t a “raise as much as you can” situation. It’s a “raise exactly what you need to hit real milestones” situation.

Find Your Number, Then Work Backward

Most friends and family rounds fall somewhere between $10,000 and $500,000. Now that’s a huge range, but your number should be a function of one thing: What do you need this capital to accomplish?

Not “How long can this keep me alive?”

But: “What real progress can I make with this money?”

Can you build a working MVP?

Can you get 100 pilot users?

Can you test pricing and unlock real feedback?

If $75K lets you ship a product and prove retention, then raise $75K. If $200K lets you go full-time and land your first enterprise contract, that’s your number.

But don’t raise just to stretch time or avoid hard decisions. That’s how founders end up with bloated cap tables and no traction.

Dilution Is Forever

As a rule of thumb, don’t give away more than 10-15% of your company in a friends and family round. That’s the cap. Any more, and you’re boxing yourself in for your next raise.

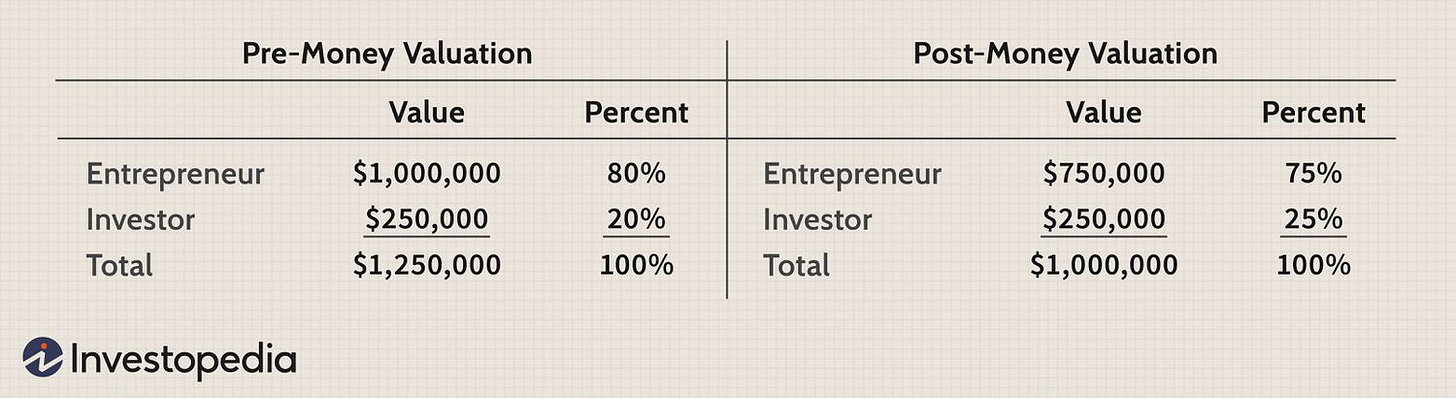

Let’s say you give away 20% for $100K today. That means your valuation is $500K, and that valuation becomes the anchor. If a seed investor comes in a year later and sees you haven’t made major progress, you’re stuck. Raise at $1M and they’ll balk at the minimal upside. Raise at $750K and it’s a down round. Neither looks great.

Explain Valuation in Plain Terms

Valuation is simple math: Funding amount ÷ equity given = implied valuation.

So $100K for 10% implies a $1M post-money valuation.

But that number carries baggage. If it’s too high, you risk overpromising. If it’s too low, you give away too much ownership early on.

That’s why many founders use convertibles or SAFEs at this stage to defer the valuation decision until there’s more traction.

If you are setting a price, keep it modest. You’re not selling what the company is worth in the future, you’re pricing it based on risk today.

Cash Isn’t the Only Thing That Matters

Not all investors bring equal value.

If your cousin is putting in $25K and happens to run a distribution company that could become your first major customer, that’s worth more than just cash. You might justify giving them a better deal, or a small advisory grant layered on top.

Founders often forget that money isn’t the only input. Strategic investors, especially in a round this personal, can move the needle in ways capital alone can’t.

3 rules to remember:

Set the amount based on outcomes, not runway.

Cap dilution now, or you’ll regret it later.

Treat equity like what it is, your most expensive currency.

5. How to Pitch Friends and Family Like a Professional

Just because you’re raising money from people who’ve seen you in pyjamas doesn’t mean this should be taken as a joke.

Indeed, you’re not pitching VCs, but you are asking for trust, money, and risk. That means you owe your friends and family a pitch that’s clear, honest, and well-prepared. No jargon. No fluff. No “trust me, it’s gonna be big.”

If you can’t explain what you’re building, why it matters, and what their money will actually do, you’re not ready to raise yet.

The Essentials of a Friends & Family Pitch

Here’s what you need, even if you’re pitching over a home-cooked meal:

A Clear, Jargon-Free Deck

This isn’t about animations or fundraising theater. Just cover the basics:

What problem are you solving?

What’s your solution?

Who is it for?

What’s your plan to bring it to life?

Use plain language. Relatable. If your investor doesn’t work in tech, skip the acronyms. You’re not trying to impress them, you’re helping them understand the bet they’re making.

Some Form of Validation

You don’t need revenue yet. But you do need evidence that the idea has legs:

Have you interviewed real users?

Do you have a waitlist?

Has someone used an early version and said, “This is what I need?”

Do you have soft commitments from real investors?

Have you done any other meetings with experts or gathered opinions?

Even if it’s rough, put together a short one-pager or slide with any proof that you're building for a real need. Show them you’re not guessing.

A Term Sheet, Not Just a Conversation

Yes, this is your uncle. Yes, he says he trusts you. But you still need to spell things out for him.

Create a basic term sheet that clearly shows:

How much you’re raising

What the money will be used for

What the investor gets in return (loan, equity, SAFE, etc.)

When and how you’ll update them

You don’t need to drown in legal language, just make it unambiguous.

Even if your pitch is happening at a kitchen table, it’s still a pitch. If you’re asking people you care about to risk their money, the least you can do is come prepared.

Because taking this round seriously isn’t just respectful. It’s the first signal that you’re capable of leading a real business.

6. Essential Legal Documents You Cannot Skip

Taking money from friends and family without paperwork is a bit like launching a rocket without fastening the bolts. It might work, until it really, really doesn’t.

Every founder raising a friends and family round, whether through debt or equity, needs to treat documentation as non-negotiable. It protects the people backing you, it protects your business, and it sets the tone for how seriously you run your company.

If You’re Raising Debt

When someone is lending you money, even informally, you need a Loan Agreement. This spells out how much is being loaned, whether there’s interest, when repayment begins, and what happens if you can’t pay it back.

Don’t assume a verbal understanding will hold up months, or years, later.

If the loan is secured by anything (like personal property, business assets, or future revenues), you’ll also need a Security Agreement. It documents exactly what’s at stake if repayment fails. Most friends and family loans are unsecured, but even then, having it in writing keeps everyone aligned.

If You’re Offering Equity

Equity comes with more moving parts. You’ll need two core documents.

First is a Share Subscription Agreement. This covers what the investor is buying, as in how many shares, at what price, and under what terms. It also records payment and helps formalize the transaction on your books.

Second is the Shareholders’ Agreement. This is where governance lives. It outlines how decisions are made, what happens if someone wants to sell their shares, how future funding rounds affect current investors, and what protections (if any) early shareholders have.

If you’re planning to raise more capital down the line, this document keeps your cap table and your control structure intact.

The IP Ownership Most Founders Forget

Let’s say your friend helped you code the prototype on weekends. Or you started designing an app long before you incorporated the company. Unless that work is explicitly assigned to the company, ownership could be disputed later.

That’s why you also need an IP Assignment Agreement. That is a simple document that transfers ownership of all intellectual property created before (or during) funding into the company. It’s a one-time step that prevents messy fights later, especially if someone decides to leave, or sue.

Digitize and Track Everything Properly

Once the paperwork is signed, don’t shove it in a drawer. Use tools like Carta, Pulley, or Vestd to track your share issuances, investor ownership, and cap table in one place. These platforms also help with investor updates and compliance, especially as your company grows.

If you’re in a regulated market like the U.S. or UK, remember that you may also need to file or register these equity events. In the U.K., that means logging changes with Companies House. In the U.S., depending on the raise size and structure, you may need to file a Form D with the SEC.

The moment you accept money, especially from people you care about, you’ve crossed into serious territory. Do them a favor. Do yourself a favor. Put it in writing, and do it right.

7. Managing the Round After the Money Hits

The money landed. You’re moving forward. But the job doesn’t end when the wire clears, it just changes.

And although a friends and family round doesn’t come with a board, formal governance, or pressure to hit monthly KPIs, it does come with something else: expectations. And how you handle that will say more about your leadership than anything you build next.

This Isn’t a Gift. It’s an Investment.

Founders often make the mistake of treating this capital casually, because it came from people who care. But your cousin didn’t write a check just to help you chase a dream. They believed you had a shot at building something real.

The moment someone puts money into your business, they become a stakeholder. That doesn’t mean they should have decision-making power, but it does mean they deserve visibility.

At a minimum, send updates. Monthly if you can, quarterly at the very least. Keep it short and honest. Highlight what’s going well, what you’re struggling with, and what’s coming next. You don’t need fancy metrics or polished decks. All you have to do is communicate.

Be the Kind of Founder People Trust Again

Respecting the capital means showing up, even when things aren’t working. Especially when they aren’t working.

Too many founders go quiet when they hit friction, hoping they’ll have better news next time. That’s the fastest way to break trust.

On the flip side, founders who are transparent, who say “we missed our goals this month, here’s why, and here’s what we’re doing about it”, these founders build credibility. And that credibility compounds. Investors who trust you are more likely to help, refer others, or back you again in a future round.

Don’t Let Your Cap Table Turn Into a Junk Drawer

One of the unexpected downfalls of early-stage startups is a messy cap table. Ten friends each writing small checks under slightly different terms may feel harmless now. But later, when you raise from VCs, it becomes a nightmare. Dozens of signatures needed, unclear ownership, conflicting rights.

Whenever possible, use pooled vehicles or standardized docs. Don’t accept checks under random terms just to “make it work.” You’ll regret it when your lead investor at Series A asks you to clean up a pile of inconsistencies just to close the deal.

Managing this round well isn’t just good etiquette. It tells everything about a founder's maturity. And investors, big or small, notice the difference between someone who’s winging it and someone who’s building with care.

8. Mistakes That Kill Friendships and Future Rounds

The friends and family round is where a lot of great startups may unknowingly poison their future.

Not because the idea was weak. Not because the product failed. But because the founder didn’t treat this raise with the structure and seriousness it demanded.

These are the mistakes that strain relationships, scare off future investors, and embed bad habits that are hard to unwind later.

Skipping the Paperwork

The number one mistake is taking money without documentation. It might feel awkward to put contracts in front of people you love, but it’s far more awkward when you both remember the deal differently six months later.

Without clear terms, every decision becomes a potential misunderstanding. Relationships suffer, and future investors won’t trust your cap table.

Giving Away Equity Too Liberally

Founders often feel grateful, but also guilty. A friend offers $5K, and you hand them equity without thinking twice. Multiply that by ten friends, and suddenly your cap table is packed with micro-owners holding mismatched terms. It creates long-term dilution and makes future fundraising harder than it needs to be.

Once again, keep equity tight. Say thank you. But remember that every percentage point given away early can cost millions later.

Allowing Non-Accredited Investors Into SAFEs or Notes

SAFEs and convertible notes sound founder-friendly, and they are, if used correctly. But in many jurisdictions, they’re designed for accredited investors. If you bring in someone who doesn’t meet that definition and something goes wrong, you could be exposed to serious legal risk.

If most of your circle isn’t accredited, stick to priced equity or hybrid structures that stay on the right side of the law.

Setting Valuations Too High, Too Soon

It feels good to say your startup is worth a million dollars. But if you can’t back that number up with traction, you’re just boxing yourself into a corner. A high early valuation can spook future investors, especially if you haven’t hit the milestones that justify it. It also sets unrealistic expectations among your early backers.

Better to raise modestly at a fair value than inflate the number and kill your flexibility.

Going Quiet When Things Get Hard

This one wrecks more relationships than failure itself. Founders who stop updating investors when things get tough usually aren’t being dishonest, they’re mostly avoiding discomfort. But silence feels like betrayal when someone has trusted you with their savings. It breaks more than trust. It breaks reputations.

Updates don’t need to be weekly. But they do need to be consistent, transparent, and real.

Messing Up the Cap Table

Founders often underestimate just how much cap table structure matters. If you’ve got ten different friends holding equity under different terms, future investors will either ask you to clean it up, or walk away entirely. No one wants to deal with messy ownership. It’s not just inefficient. It’s a red flag.

Keep it clean. Use standard terms. Don’t give away slices to anyone and everyone.

This round is about more than capital. It sets the tone for how you lead, how you communicate, and how you treat the people who believe in you first. Get it right, and you lay the foundation for real momentum. Get it wrong, and you might still build something, but it’ll cost you more than it should.

9. Final Takeaway: Raising Capital Without Regret

A friends-and-family round might seem informal. No term sheets from Sequoia. No tough questions from Sand Hill. But make no mistake. This is one of the highest-stakes rounds you’ll ever raise.

Why? Because the people backing you aren’t betting on a market or a model. They’re betting on you. And how you handle that trust will echo into every round that follows.

This isn’t casual capital. It’s the first test of your leadership, your judgment, and your ability to build something real.

So before you take that first check, get these five things right:

Pick the right structure. Debt, equity, or a SAFE, make sure it fits the investor and the business.

Pitch professionally. You owe it to your backers to come prepared, even at the dinner table.

Document everything. No handshakes. No assumptions. Put it all in writing.

Communicate like a CEO, not a cousin. Updates, clarity, and honesty go further than you think.

Respect the capital. Whether it’s $5K or $500K, treat it with care. Because someone believed in you when no one else did.

Get this round right, and you won’t just raise money, you’ll earn loyalty, credibility, and the confidence to raise again.