LLMs Will Never Be Intelligent🧠, Anthropic CEO on AI bubble⚠️, 2025 Fund Economics Report 📊

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta:

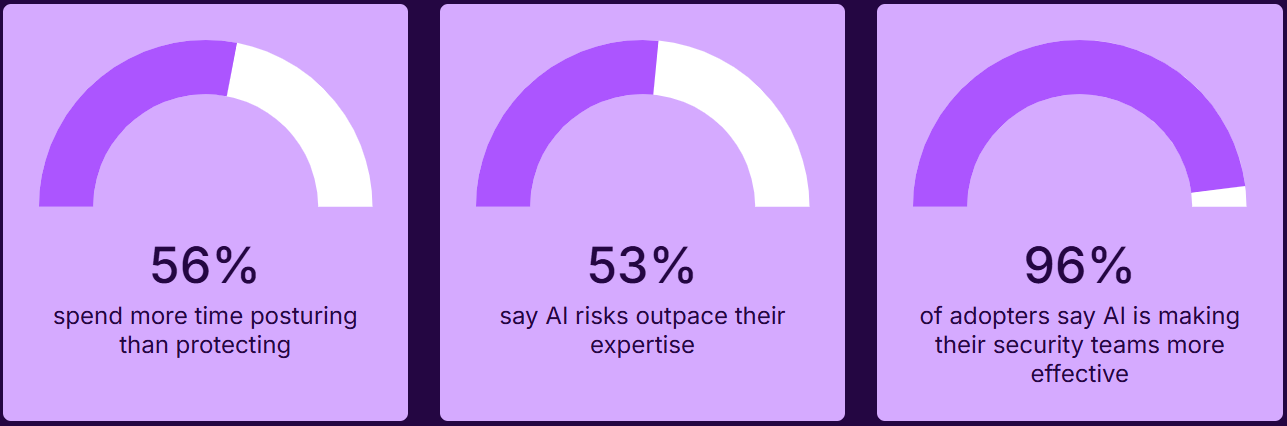

The State of Trust: UK

AI is moving faster than security teams can keep up—more than half say AI risks outpace their expertise.

See how organisations are navigating this gap, and what early adopters are doing to stay ahead. Get the full report 👇

In-Depth Insights 🔍

Large Language Models Will Never Be Intelligent, Expert Says 🧠

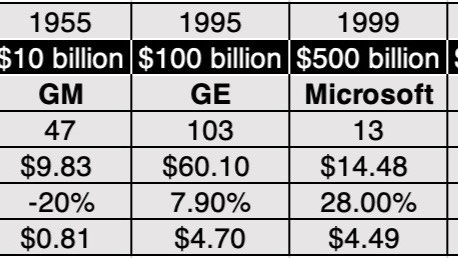

The article argues that language modeling emulates communication rather than the underlying processes of general reasoning, drawing on neuroscience that dissociates cognition from language. It warns that scaling data and compute may hit a creativity ceiling and conflate hype with scientific limits. [Futurism]Trillion Dollar Market Caps: Fairy Tale Pricing or Business Marvels? 🧮

Damodaran proposes a breakeven-revenue lens to judge sky-high valuations based on margins, growth, and reinvestment rather than multiples alone. He adds a “3P” test and flags big‑market delusions when individual narratives, aggregated, exceed plausible total demand. [Aswath Damodaran]

Win the First 5 Seconds: The YC Landing Page Formula for Early-Stage Startups 💻

This guide distills a conversion playbook: outcome‑first hero, one primary CTA, social proof near the fold, transparent pricing, and a mini‑FAQ that removes friction. It includes a blueprint and a 10‑step checklist to lift conversion with simple language, micro‑demos, and faster load times.

Elon Musk’s Most Important Interview in Years 🤖

The piece extracts 10 takeaways for builders: an abundance economy, convergence across AI, robotics, energy and space, global talent as a growth engine, and risk discipline. It frames where to build and invest across intersections that will define the coming decade.Micro1, a Scale AI competitor, touts crossing $100M ARR 📈

Micro1 says it leapt from single‑digit ARR to nine figures by supplying expert human data for evaluations, reinforcement learning, and emerging robotics pre‑training. The founder sees enterprise agents and real‑world demonstrations as new demand drivers as “data wars” escalate. [TechCrunch]

Anthropic CEO weighs in on AI bubble talk and risk-taking among competitors ⚠️

Dario Amodei highlights uncertainty in aligning revenue timing with massive infrastructure cycles and chip depreciation while cautioning against “YOLO” strategies. He contrasts conservative planning with rivals’ aggressive bets that could leave firms overextended if economics shift. [TechCrunch]Sam Altman Has Explored Deal to Build Competitor to Elon Musk’s SpaceX 🚀

The report says Altman explored multi‑billion investments to gain control in a rocket maker, positioning against SpaceX as part of a broader infrastructure push. It connects to ambitions like in‑space data centers to secure future compute for AI. [WSJ]

ask me anything on a consulting call 🔥

Tools 🧰

MongoDB for Startups gives you the tools and support to accelerate your growth

an AI co-worker who’s always on the clock :)

fre AI Native Stack (Gamma, Lovable, Clay, Notion…)

Hubspot’s FREE LinkedIn Growth Playbook for Startup Founders

Attio, the CRM used by both startups and VCs (including me). Try it for free here

Webflow, where smarter sites start. Try their AI-native platform here

deel: The all-in-one HR tool. Bring the world to work starting with a Free Demo

Notion: work faster with your AI team, and get their FREE AI Kit:

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

The State of Trust in the UK 🏦

AI is moving faster than security teams can keep up—more than half say AI risks outpace their expertise. See how organisations are navigating this gap, and what early adopters are doing to stay ahead:

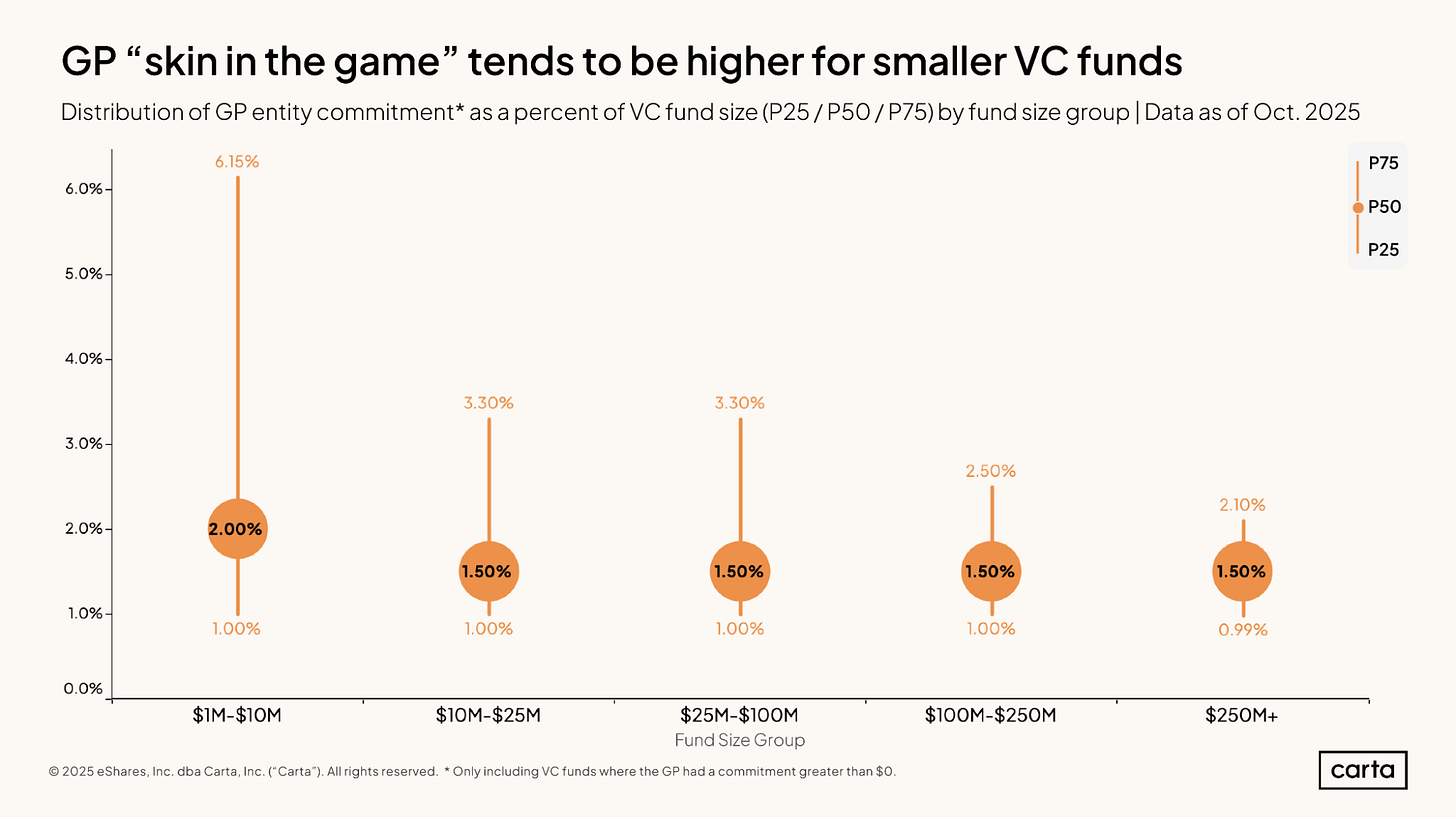

2025 Fund Economics Report 📊

New analysis reveals how private vehicles call capital, deploy cash, and structure fees across vintages and sizes. Chart-driven insights cover GP commitments, management charges, carry norms, and the pace of investment. [Carta]

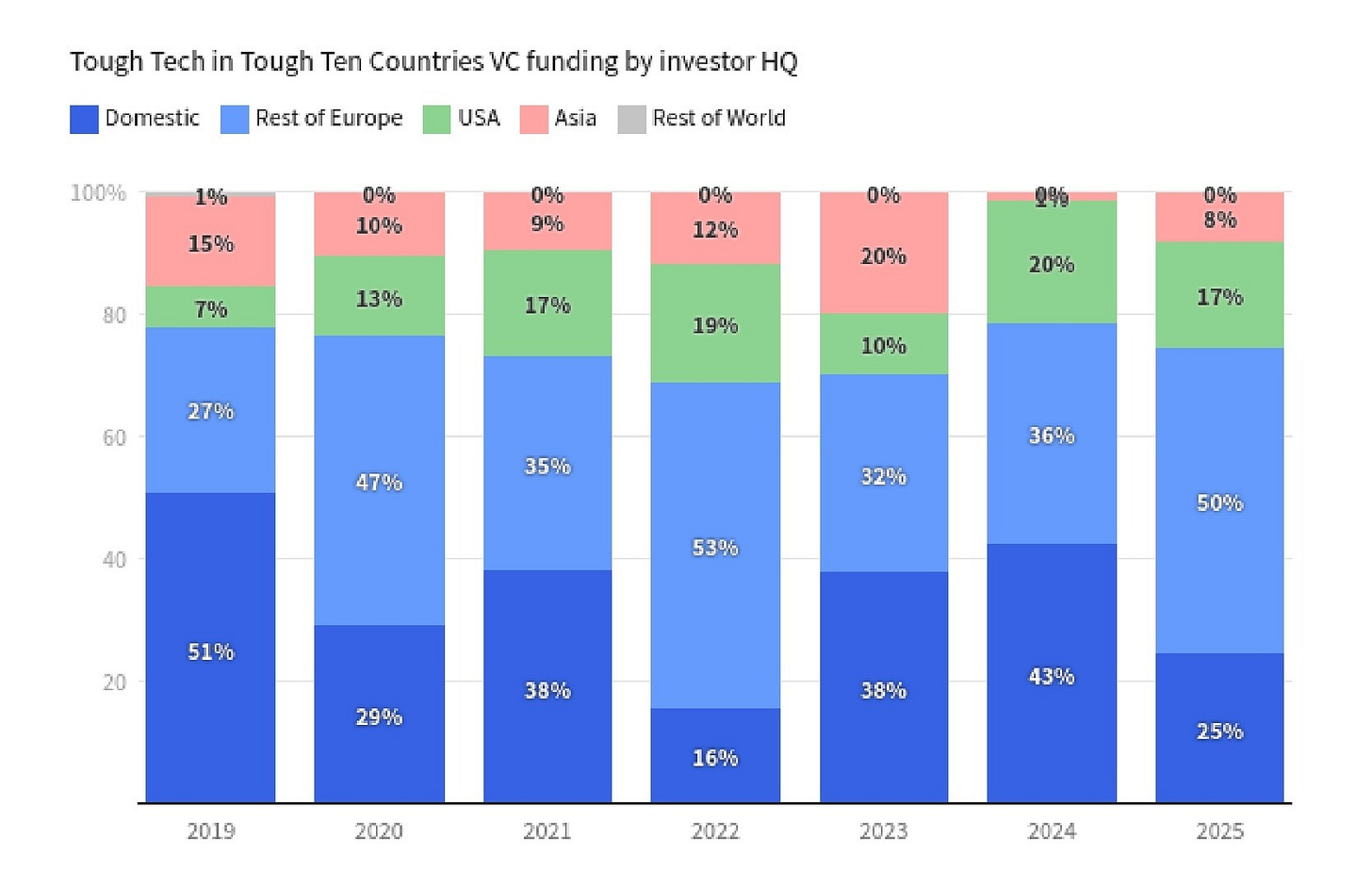

Tough Tech by the Tough Ten 2025 🛰️

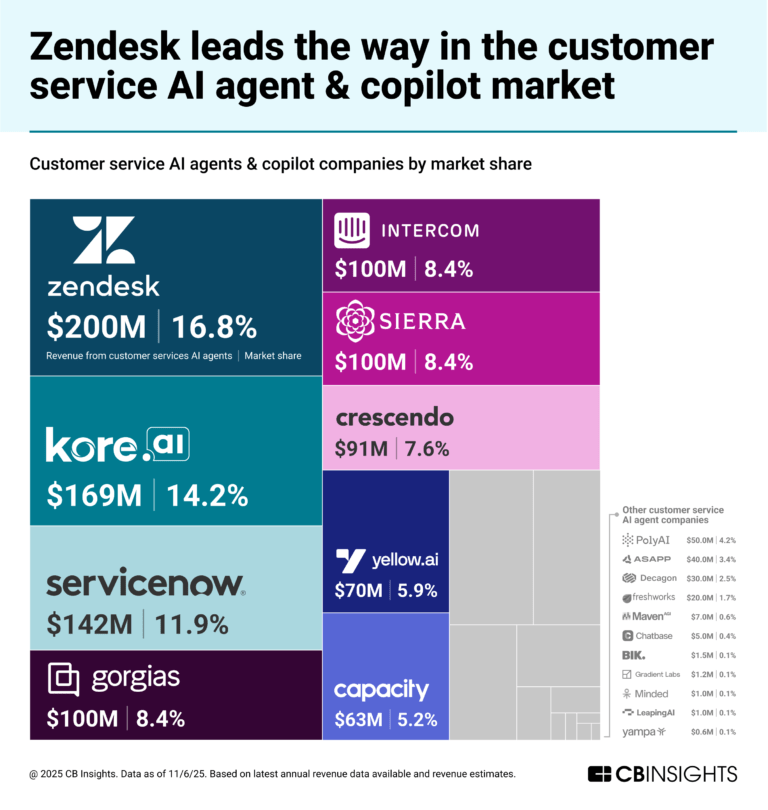

A new map highlights defense, dual-use, cyber, and space innovation hotspots across EU border nations. Backed by groups including the NATO Innovation Fund and regional investors, it spotlights founders, capital flows, and strategic corridors shaping security technology. [Dealroom]The customer service AI agents leading the market in 2025 💬

Revenue analysis shows a surge of newcomers hitting $100M+ ARR and challenging incumbents in support automation. Adoption is shifting toward autonomous resolution, outcome-based pricing, deeper integrations, and voice interfaces that expand measurable business impact. [CB Insights]

Recently Launched Funds 💸

Alantra raised €70M from EIF to fuel its energy transition growth strategy.

Unlimited launched a new fund bridging public markets with private VC-backed startups.

Conexus Venture Capital closed Fund II at $30M to back early-stage startups across Canada.

Nexus Venture Partners locked in $700M for Fund VIII to back breakout startups in India and the U.S.

Nazca Capital received €40M from EIF for its aerospace and defense-focused vehicle.

Indico Capital Partners secured €30M from EIF for its €125M Iberian VC fund.

SecondQuarter Ventures is raising a $2.6B fund to scale its secondaries strategy.

Anti Fund closed a $30M debut fund to invest in consumer brands and creators.

Propeller launched a $50M Fund III focused on ocean and climate tech.

Incore Invest hit €40M on its second close for Fund II, targeting European tech.

Expedition Growth Capital raised $375M for Fund III to scale growth-stage software in Europe.

Future Energy Ventures closed a €235M fund to back the next wave of energy tech.

India Global Forum launched a $250M fund to back high-growth Indian consumer brands.

CerraCap + Impact VC teamed up to launch a joint fund focused on tech-for-good startups.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

KSTC (Remote): VC Analyst (apply here)

Lightbank (Chicago, IL): VC Investor (apply here)

HSBC (San Francisco, CA): VC Director (apply here)

Forum Ventures (Remote): Managing VC Director (apply here)

Yahoo (Remote): Senior Corporate Development Analyst (apply here)

Realyze Ventures (Cologne, Germany): VC Internship (apply here)

Marktlink (Amsterdam, Netherlands): VC Internship (apply here)

Plug and Play (Sunnyvale, CA): VC Associate (apply here)

Arnold Ventures (New York City, NY): VC Director (apply here)

Newlab (Brooklyn, NY): Senior VC Analyst (apply here)

Hottest Deals 💥

Kalshi, raised $1B Series E at an $11B valuation to redefine event-based trading as a mainstream asset class. (read more)

Brevo, secured €500M to supercharge its global push in SaaS marketing automation. (read more)

Black Forest Labs, raised $300M Series B to build core crypto infrastructure at scale. (read more)

Mujin, pulled in $233M to bring robotics automation to warehouses and factories globally. (read more)

Omni Fiber, raised $200M (debt + equity) to lay fiber where Big Telco won’t. (read more)

Curative, locked in $150M Series B to scale its zero-deductible employer health plan. (read more)

PayJoy, landed a $140M debt facility to keep financing smartphones in emerging markets. (read more)

Angle Health, raised $134M Series B to push its AI-driven health insurance play. (read more)

7.ai, scored $130M Series A to replace customer service with generative AI at scale. (read more)

Protego Biopharma, raised $130M to tackle diseases caused by protein misfolding. (read more)

Triana Biomedicines, pulled $120M Series B to accelerate its protein degradation therapies. (read more)

Antithesis, raised $105M Series A to build AI infrastructure for deep scientific discovery. (read more)

Heven Aerotech, locked in $100M at a $1B valuation to scale autonomous aerial logistics. (read more)

Axiado Corporation, raised $100M Series C to embed cybersecurity directly into chips. (read more)

Antares, landed $96M Series B to go full-stack on AI-native drug discovery. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox