OpenAI’s SaaS Era Begins🔥, State of AI Report🤖, The Vibe Coding Boom Hits a Reality Check📉

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

For fast-growing companies, trust is everything—and it starts with security:

Building and proving a strong security program takes time and expertise—but you don’t have to do it alone.

Download Vanta’s free guide to see how 10,000+ companies turned security into a growth engine, not a blocker.

In-Depth Insights 🔍

GTMfund on the State of the Market 📈

Early-stage investors are raising standards as capital rebounds. AI dominates early rounds, Series A pacing stays slow, and liquidity returns with renewed Big Tech acquisitions. [GTMnow]OpenAI’s SaaS Era Begins 🔥

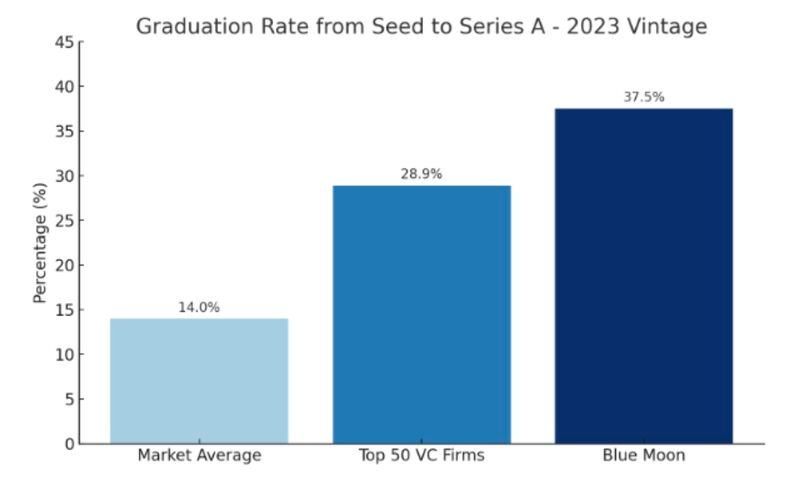

New internal sales and support systems move the company into direct enterprise competition. Its shift puts pressure on incumbents like Salesforce and HubSpot to adapt or integrate. [Business Insider]Blue Moon’s AI Bets on Billion-Dollar Founders 💡

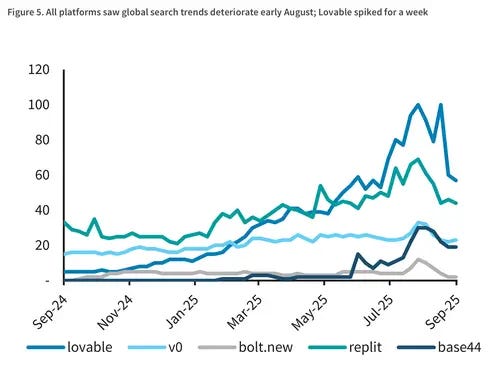

Proprietary models identify high-potential founders ahead of the market, driving a 44% Seed-to-A success rate. The firm combines algorithmic screening with partner judgment for sharper outcomes. [Benjamin Orthlieb]The Vibe Coding Boom Hits a Reality Check 📉

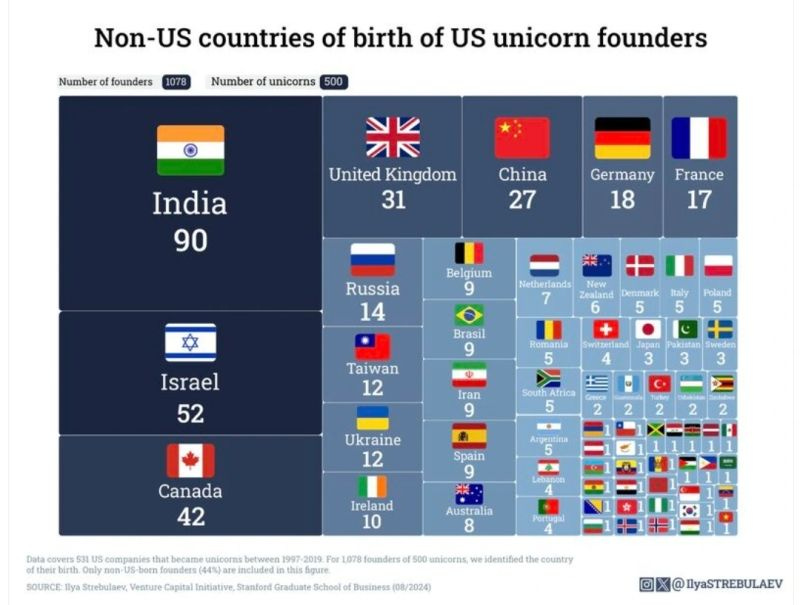

Recent traffic declines across top AI coding tools reveal slowing momentum. Startups are now reworking retention and monetization strategies after a year of rapid ARR growth. [Business Insider]Global Founders Power the US Unicorn Engine 🦄

Research shows immigrant entrepreneurs lead nearly half of billion-dollar startups. Founders from India, Israel, Canada, and the UK continue to shape the U.S. innovation economy.10 Proven Startup Resources That Shortcut Growth 🚀

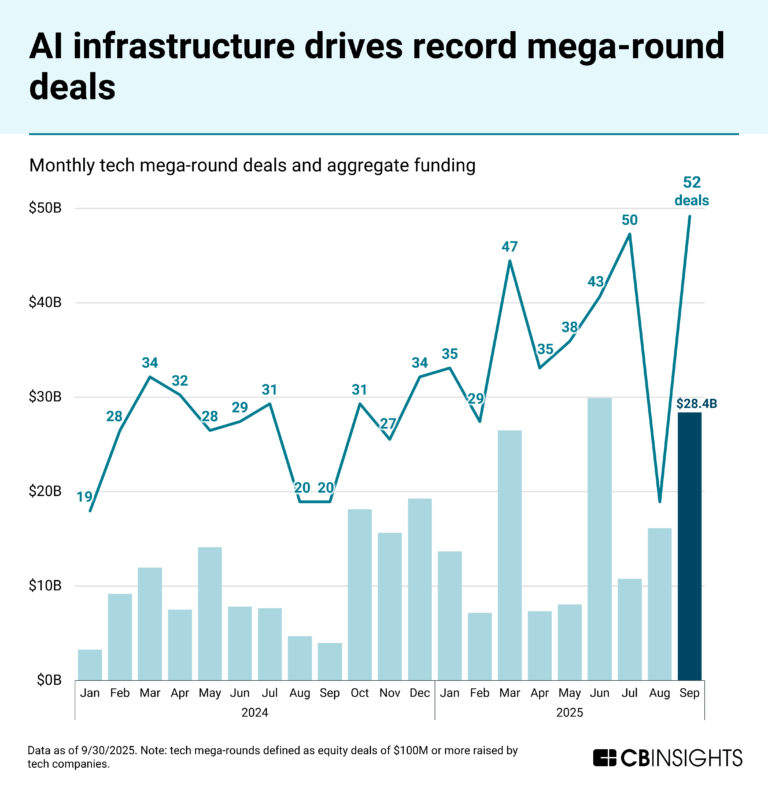

Rubén Domínguez curates pitch decks, investor lists, and product playbooks used by top founders. A streamlined toolkit for scaling faster and avoiding common early-stage mistakes.AI Mega-Rounds Signal Shift Toward Efficiency and Optimization 💰

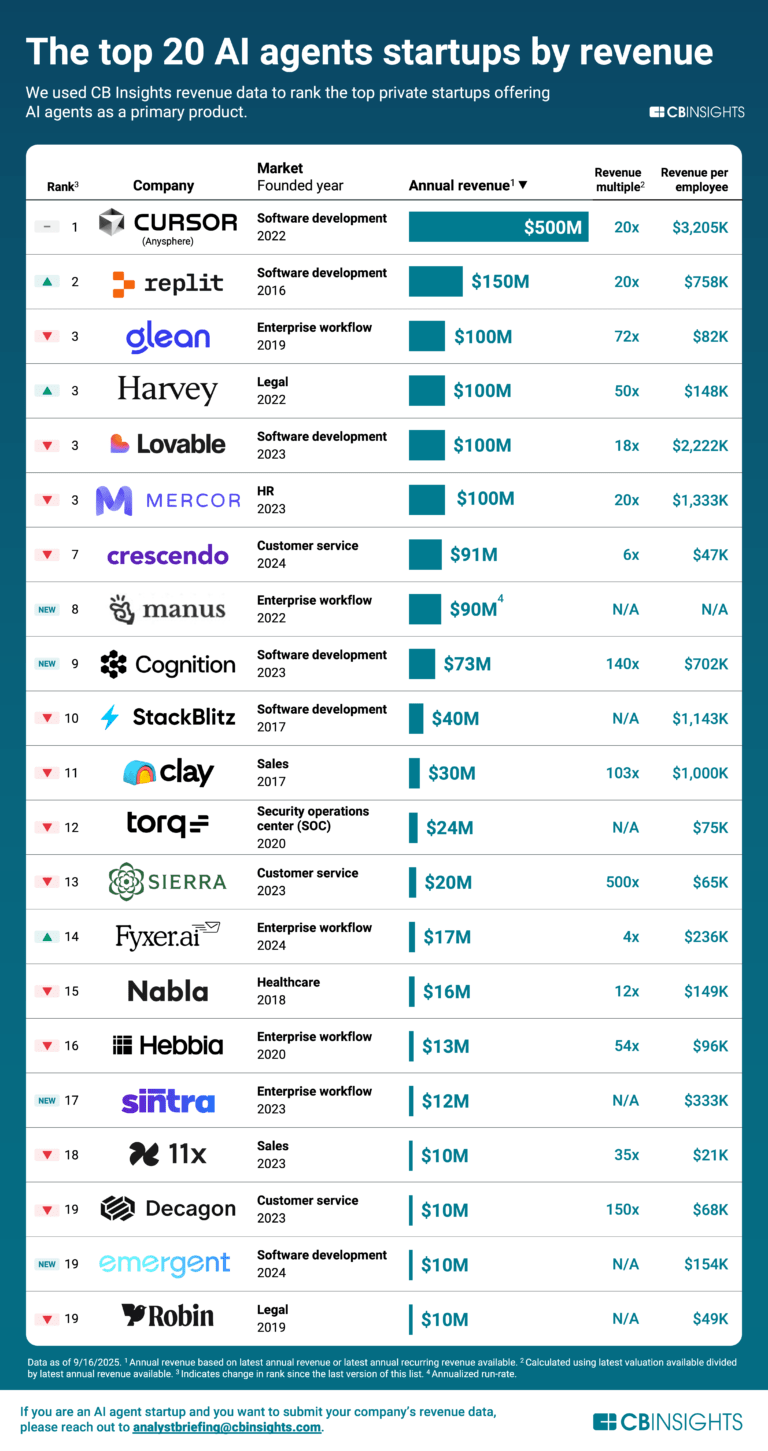

Recent $100M+ rounds center on infrastructure and inference startups. Investors are backing cost efficiency, performance gains, and vertical specialization over general-purpose models. [CB Insights]Coding AI Agents Lead the Revenue Race 💸

Leaders like Cursor and Replit now generate $500M+ ARR with unmatched productivity. Young teams under four years old are proving how fast agent-led software can commercialize. [CB Insights]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

From Agents to Automation: The Rise of Physical AI ⚡

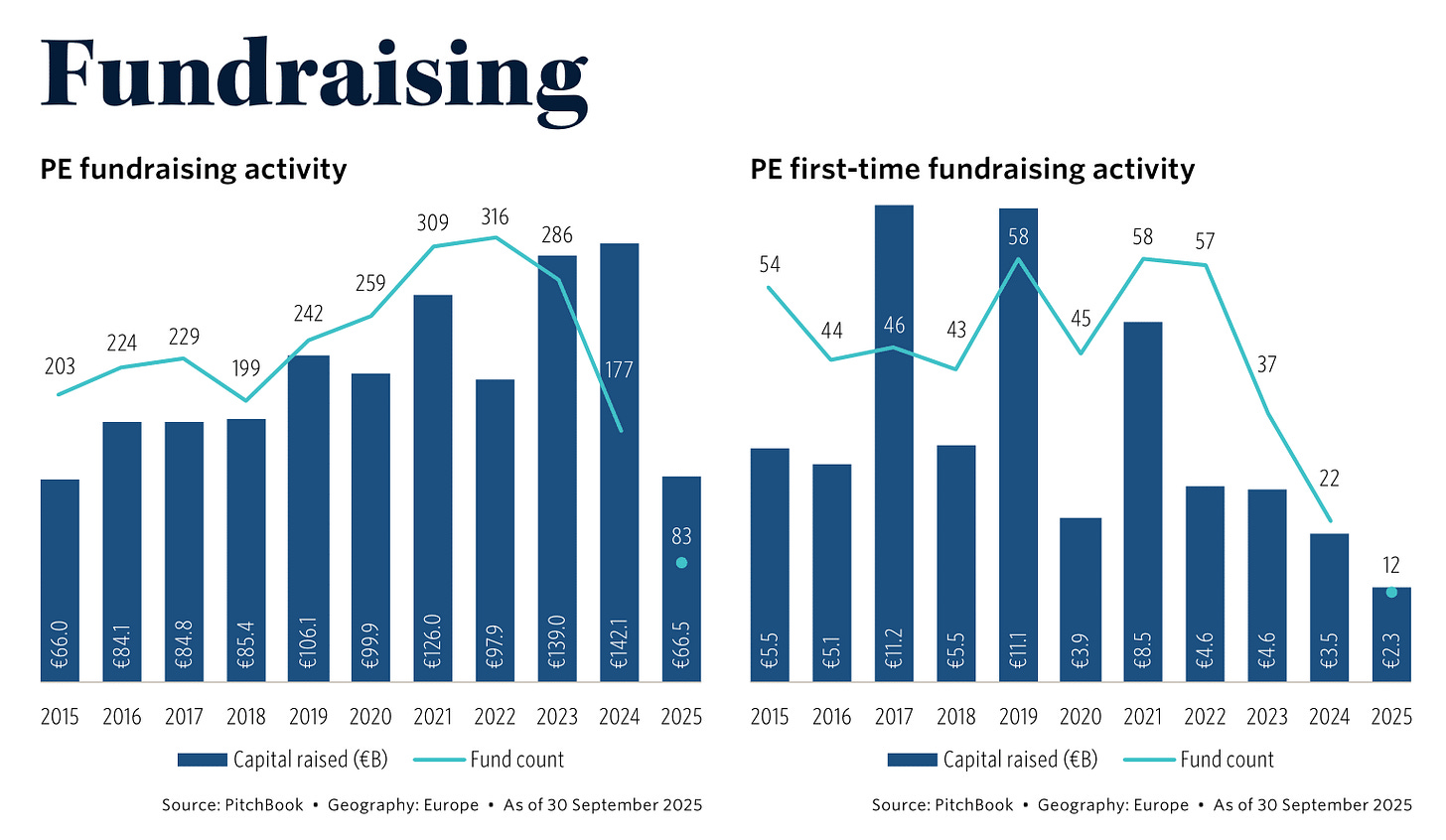

Insight Partners examines robotics moving from labs to real-world, revenue-generating deployments. The report highlights why vertical Robotics-as-a-Service models excel, how simulation and teleoperation close the prototype-to-production gap, and which use cases are transforming labor.European PE Breakdown – Q3 2025 💶

PitchBook shows private equity activity accelerating across Europe. Q3 saw dealmaking led by US sponsors and megadeals, a rebound in exits via continuation vehicles, and the UK maintaining its lead in capital raising.State of AI Report 2025 🤖

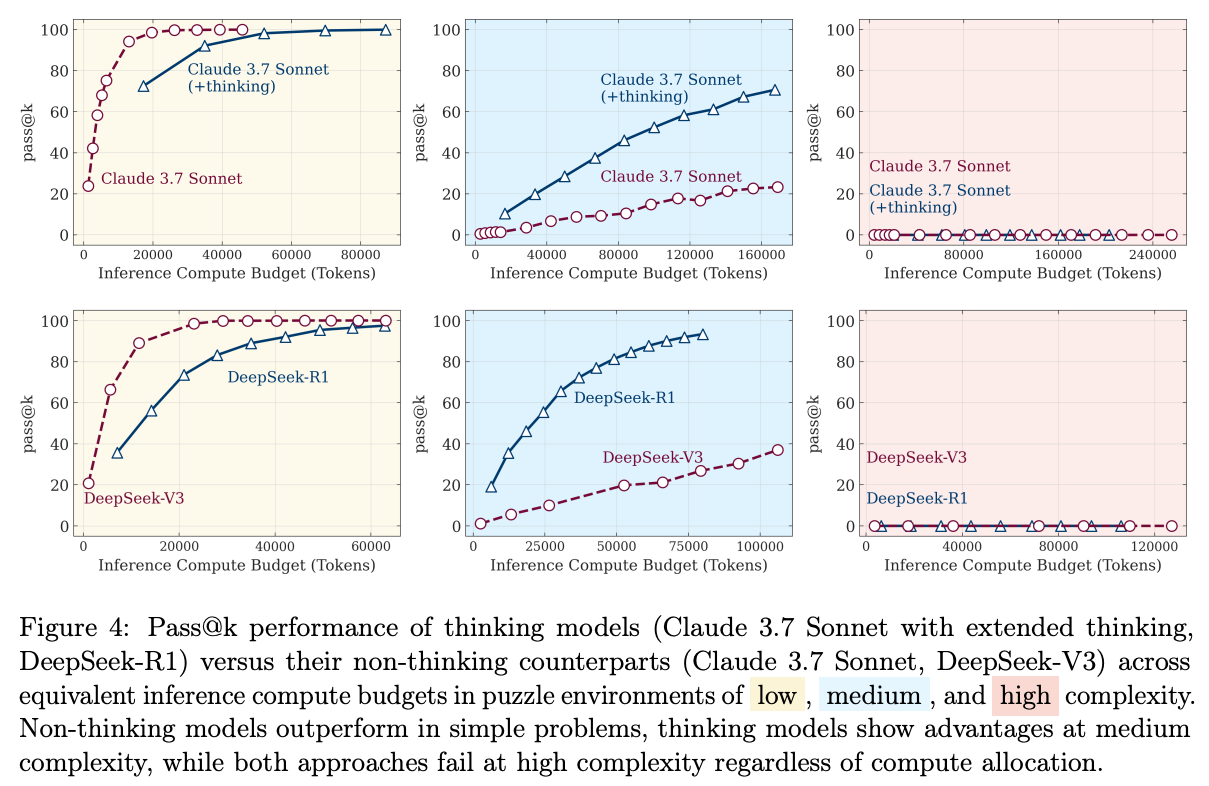

Nathan Benaich and Air Street Capital track major developments shaping model trends, funding flows, policy moves, and industrial adoption. The report offers a clear snapshot of where the field stands and what will define the next phase of technology deployment.

Recently Launched Funds 💸

Ascenta Capital closed its maiden $325M fund to back early-stage startups across technology and software sectors.

Origin Ventures announced the closing of its sixth fund at $140M, continuing its focus on seed and Series A investments.

May Ventures raised over €30M for its first fund, targeting early-stage European founders.

Xcellerant Ventures launched the Jetstream Venture Fund to invest in AI and frontier technology startups.

MARKD secured an additional $500M to expand its portfolio in the insurtech and fintech ecosystems.

Sugar Free Capital closed its first $32M fund, focusing on health, wellness, and consumer brands.

Crystal Venture Partners closed Fund I at $33M to support emerging founders in deeptech and SaaS.

TCG Crossover closed TCGX Fund III at a massive $1.3B, investing across public and private biotech companies.

Wave Function Ventures closed its $15M DeepTech Fund I to back scientific founders building advanced technologies.

Lisk launched a $15M venture capital fund to support blockchain-based startups in its ecosystem.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Investing?

THESE are the companies raising right now

VC Jobs 💼

Antler (San Francisco, CA): VC Associate (apply here)

Sunset Ventures (Los Angeles, CA): VC Fellowship (apply here)

Golden Falcon Capital (New York City, NY): Senior VC Associate (apply here)

Verdex Capital (Calgary, Canada): VC Manager (apply here)

Freight Ventures (Remote): VC Internship (apply here)

ECMC (Minnesota): VC Analyst (apply here)

Redalpine (London, England): VC Investor (apply here)

DTCP (Berlin, Germany): VC Internship (apply here)

ROI Ventures (Vienna, Austria): VC Analyst (apply here)

Picus Capital (Remote): VC Internship (apply here)

Hottest Deals 💥

n8n, raised $180M in Series C funding at a $2.5B post-money valuation. (read more)

Corvus Energy, raised $60M in Series E funding to expand its maritime energy storage systems. (read more)

Vulcan Technologies, raised $10.9M in seed funding to develop next-gen thermal management solutions. (read more)

Spellbook, raised $50M in Series B funding to scale its AI legal assistant platform. (read more)

Hoverfly Technologies, raised $20M in Series B funding to enhance its tethered drone systems. (read more)

Routefusion, raised $26.5M in Series A funding to accelerate cross-border payment solutions. (read more)

Veritas Prime, received a $31.5M investment to advance its HR technology and consulting services. (read more)

Nexl, raised $23M in Series B funding to expand its relationship intelligence platform for law firms. (read more)

Quilter, raised $25M in Series B funding to enhance its wealth management technology. (read more)

Yendo, raised $50M in Series B funding to expand its credit-building platform for car owners. (read more)

EvenUp, raised $150M in Series E funding to strengthen its AI-powered legal claim evaluation system. (read more)

eWake, raised €2M in pre-seed funding to develop electric hydrofoil watercraft. (read more)

Heidi, closed $65M in Series B funding to scale its AI-powered student housing platform. (read more)

Nanophoria Bioscience, raised €83.5M in Series A funding to advance nanoparticle-based drug delivery. (read more)

MediView, raised $24M in Series A funding to expand its augmented reality surgical visualization platform. (read more)

RESOURCES 🛠️

✅The Venture Capital Method: How Investors Really Value Startups

✅IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Great roundup as always! I was immediately drawn to the 'Vibe Coding Boom Hits a Reality Check.' It makes total sense that after the initial hype and massive ARR spikes, the focus is rapidly pivoting to retention and monetization strategies. It feels like the market is settling in for the long haul with AI coding tools, demanding real utility over just novel integration. Curious to see which startups successfully transition from 'cool demo' to indispensable workflow—the ones that master that transition will likely survive this recalibration. Thanks for surfacing that point! 💡