SaaS vs AI Economics💡, The Big Book of VC 2025, IPOs Struggle Despite Tech Rally 📉

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta:

How to automate Compliance ⚖️

As you scale, security and compliance don’t have to slow you down 🚀

Vanta automates evidence collection and centralizes 35+ frameworks—ISO 27001, SOC 2, GDPR & more—in one platform 🔐

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

In-Depth Insights 🔍

AI companies can tap bigger markets but operate at lower margins than SaaS. To match SaaS profits, AI needs higher revenue per customer, larger TAM, or scale, making the levers of growth and profitability different but not broken. [The SaaS CFO]

Waymo is in talks to raise over $15 billion in a funding round, led by Alphabet, aiming for a valuation near $100 billion. The company is positioning itself as a leader in autonomous taxis with both internal and external investors. [Bloomberg]

OpenAI Could Hit $830B Valuation 💸

OpenAI is aiming to raise up to $100 billion in a new funding round, potentially valuing the company at $830 billion. The startup is targeting the first quarter to close the round as it pushes ambitious growth plans in a cooling AI market. [WSJ]

Top 10 VC Investors in AI Agents 📊

2025 has been the year AI agents moved from chatbots to action heroes. Firms like Index and a16z are leading the charge, funding startups across coding, healthcare, and beyond as the category draws billions in venture capital. [PtchBook]

2025 IPOs Struggle Despite Tech Rally 📉

Many high-profile VC-backed companies that went public in 2025, including Figma, Chime, and Navan, are trading below their debut prices even as Nasdaq and S&P 500 rise. Market excitement fades quickly and macro uncertainty keeps IPO outcomes unpredictable. [PitchBook]

AI Is Already Outperforming Humans 🤖

Sam Altman shared that GPT-5.2 now matches or beats human experts on 74% of business tasks, but the real edge isn’t intelligence. Memory, workflow integration, and enterprise deployment are where AI creates lasting value and transforms how companies operate.

Creandum’s Early Bets Built a $2B VC Legacy 💡

Creandum backed Spotify, Klarna, and Lovable before they were obvious, proving conviction and timing beat comfort. Their founder-first, hands-on approach turns risky startups into category-defining wins across decades. [Guillermo Flor & Ruben Dominguez]

Google turned small bets into massive wins: Android ~$50M → $200B+, YouTube ~$1.65B → $300B+, DeepMind ~$500M → $100B+. Their playbook shows disciplined, high-conviction investing beats luck every time.

Jake Paul has quietly become one of the best-performing venture investors of the last decade, backing hits like Ramp, Chronosphere, Anduril, Ollipop, and Cognition. His success shows that timing, access, and distribution often outweigh pedigree in power-law markets.

ask me anything on a consulting call 🔥

Tools 🧰

FREE Startup in a Box with everything founders actually use (59 templates):

Attio, the CRM used by both startups and VCs (including me). Try it for free here

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

MongoDB for Startups gives you the tools and support to accelerate your growth

an AI co-worker who’s always on the clock :)

fre AI Native Stack (Gamma, Lovable, Clay, Notion…)

Hubspot’s FREE LinkedIn Growth Playbook for Startup Founders

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

The Big Book of Venture Capital 2025 💡

A 272-page deep dive into global venture trends, fundraises, and startup dynamics. Packed with data, charts, and forward-looking insights, it helps founders, investors, and ecosystem builders see where venture has been and where it’s heading. [Rohit Yadav, CAIA]

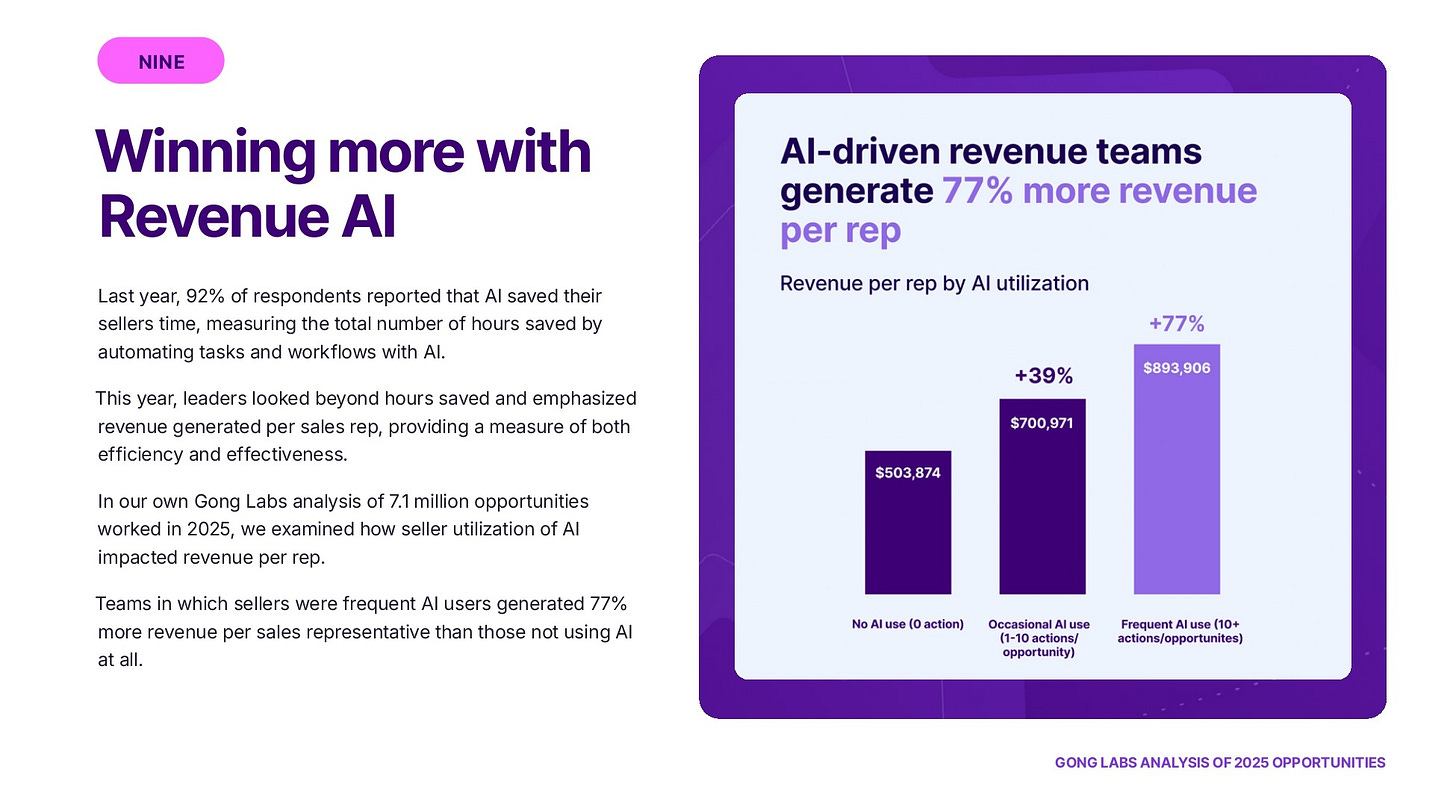

Revenue Teams That Outperformed in 2025 🚀

Top revenue teams focused on output per rep, deep AI adoption, and system-wide productivity instead of chasing growth through expansion. Frequent AI use and redesigned workflows drove ~77% higher revenue per rep than average teams. [Ivan Landabaso, Gong]

Dutch Competitiveness Gets a Blueprint 💶

The “Dutch Draghi” report lays out €175 billion in investments through 2035 but warns capital won’t grow without fixing systemic bottlenecks. Electricity delays, rigid labor rules, and protected cores block productivity, while 51 ready-to-launch projects show the upside if rules and execution catch up. [Yoram Wijngaarde]

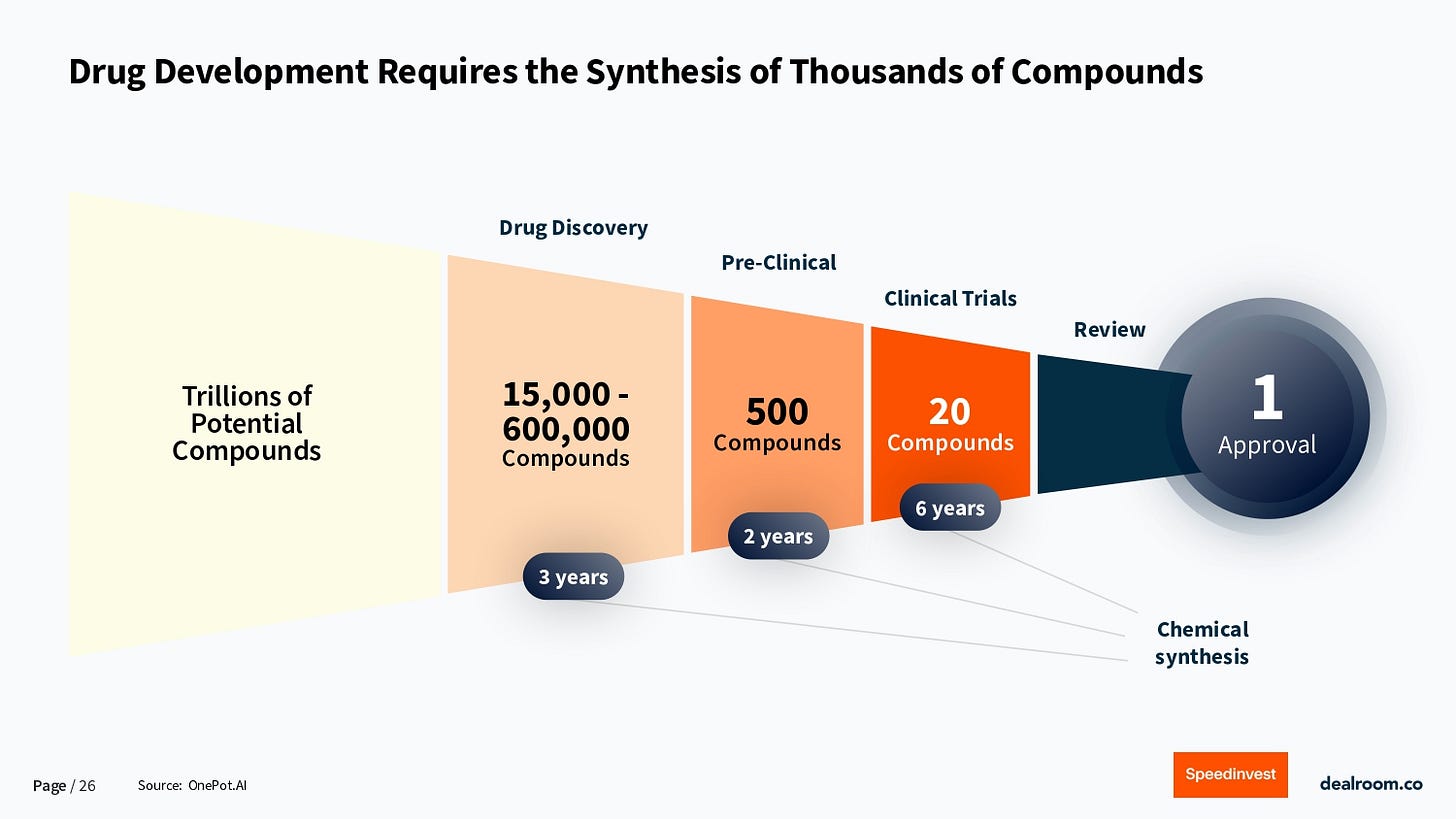

TechBio Meets AI in Drug Discovery 🧬

In 2025, TechBio is shifting from promise to production as AI driven platforms turn research into repeatable pipelines. Automation and deeper partnerships are pushing drug discovery from pilots into real multi step execution at scale. [DealRoom]

Recently Launched Funds 💸

Picus Capital Raised €150M from Carlyle AlpInvest to scale global investments across fintech, SaaS, and digital consumer platforms.

Hanoi Venture Capital Fund Hanoi is launching a government-backed VC fund to support technology startups and strengthen Vietnam’s innovation ecosystem.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

Seedcamp (London, England): VC Analyst (apply here)

HPI Ventures (Berlin, Germany): VC Analyst (apply here)

Entrepreneur First (London, England): VC Fellowship (apply here)

Verdex Capital (Calgary, Canada): VC Manager (apply here)

Innovaciones Alumbra (Remote): Senior VC Associate (apply here)

RBC (Newport Beach, CA): VC Associate (apply here)

Schreiber Foods (San Francisco, CA): VC Associate (apply here)

McKesson Ventures (San Francisco, CA): VC Associate (apply here)

Access Ventures (Remote): VC Lead (apply here)

SVG Ventures (Los Gatos, CA): VC Manager (apply here)

Hottest Deals 💥

Lovable, raised $330M in Series B funding at a $6.6B valuation to prove that breakout growth stories still exist at massive scale. (read more)

Galbot, raised over $300M in funding as capital keeps flowing into AI-native robotics with real-world use cases. (read more)

Syremis Therapeutics, raised $165M in Series A financing, signaling continued investor conviction in next-generation biotech platforms. (read more)

Mythic, raised $125M in funding to double down on compute-in-memory AI hardware as efficiency becomes the new arms race. (read more)

Atavistik Bio, raised $120M in Series B financing to push RNA therapeutics from promising science to scalable medicine. (read more)

Neural Concept, raised $100M in Series C funding as AI-driven engineering design moves from nice-to-have to mission critical. (read more)

Nirvana, raised $100M in Series D funding to modernize insurance for fleets, an unsexy market with very real dollars. (read more)

Edison Scientific, raised $70M in seed funding because deep tech with long timelines is officially back in favor. (read more)

SkillCorner, raised $60M in growth funding as sports analytics continues its quiet takeover of elite performance. (read more)

Fixated, received a $50M investment from Eldridge Industries to support its next phase of strategic expansion. (read more)

Kargo, raised $42M in Series B funding to scale contextual advertising while the industry debates cookies. (read more)

Architect Financial Technologies, raised $35M in Series A funding to rebuild financial infrastructure that still looks stuck in 2009. (read more)

Neurable, raised $35M in Series A funding as brain-computer interfaces move closer to everyday use. (read more)

TrueMed, raised $34M in Series A funding to make healthcare payments slightly less painful for once. (read more)

EtherealX, raised $21M in Series A funding to build reusable space transportation as the space economy keeps compounding. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

✅ FREE AI Fundraising Kit for founders

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox