Sequoia Playbook

10 systems nobody else had the patience to build

Most venture advice sounds the same…

• Back great founders

• Find big markets

• Trust your gut

When Sequoia partners like Pat Grady and Alfred Lin talk about how they actually invest, the edge comes from something else.

Quiet systems.

Run for years.

Ignored by most firms because the payoff comes late.

Here are the ten that matter:

Brought to you by Attio

The CRM used by both startups and VCs (including me)

I use Attio to manage deal flow, track founder conversations, and sync everything across my team — no clunky setup required.

Startups use it as a sales CRM from day one

VCs use it for deal tracking, LPs, and intros

Fully customizable and updates automatically

It’s fast, flexible, and built for how we actually work.

1. The Talent Graph

Every time Sequoia helps hire a VP of Engineering, they ask one question:

Who are the five smartest peers you respect in this role?

Every answer goes into their CRM.

They’ve asked this question for more than ten years, across roles, stages, and geographies.

The result is a talent map that works like PageRank for people.

They can spot the next breakout operator years before the market notices. Not because that person is visible, but because the right people mentioned them early.

The delay is the feature. Most firms quit before the signal compounds.

Try this

Pick one role. Ask one question consistently. Track answers. Let time do the work.

2. Conviction beats consensus

Sequoia tracked partner votes for over a decade.

The pattern was clear.

Deals everyone mildly liked underperformed.

Deals that triggered strong conviction, even with disagreement, performed better.

To force clarity, they removed the middle option. No five out of ten votes allowed.

Great deals rarely feel safe.

Try this

Track conviction explicitly. Zero to ten only. Weak conviction everywhere means pass.

Quick aside before we continue 🎁

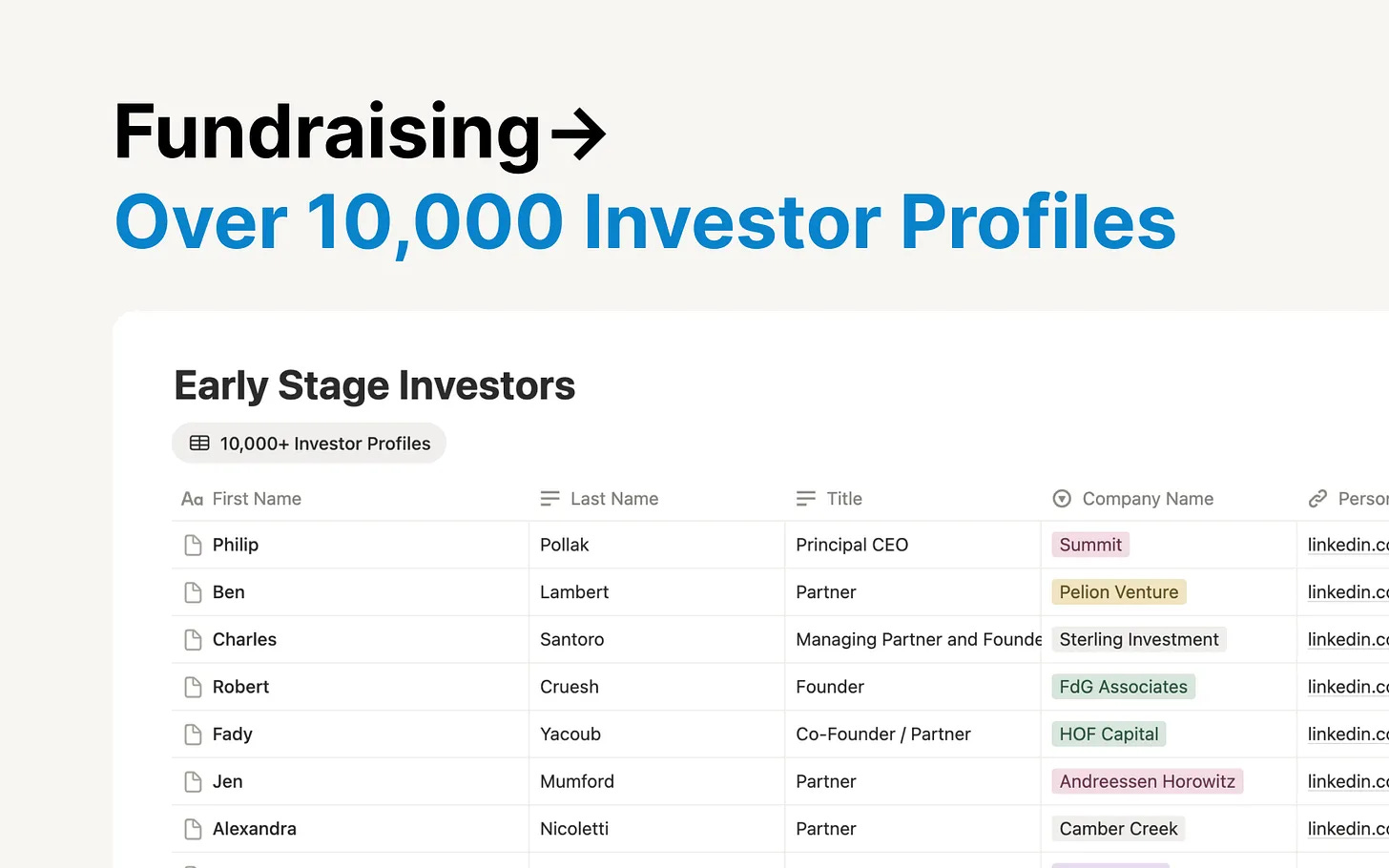

We partnered with Notion to build a free, full-stack set of founder templates.

Organized by stage from idea to scale, including pitch decks, data rooms, investor CRMs, and a 10,000+ investor database.

3. Freedom within frameworks

Sequoia defines values and standards clearly, then gives partners real autonomy.

Some think deeply with empty calendars.

Some run dense schedules.

Some focus on talent networks or regional ecosystems.

Different styles. Shared bar.

This works because expectations are clear and trust is real.

Try this

Define what must stay consistent. Let everything else vary.

4. The Curiosity Protocol

Most leaders ask questions that sound neutral but feel judgmental.

Why did you do that?

Sequoia uses a different phrase.

I’m curious why you chose that approach.

That small shift changes the conversation.

Mistakes become learning. Insight sticks because people arrive at it themselves.

Try this

Lead with curiosity. Learning accelerates immediately.

5. The mid-funnel problem

Sequoia noticed their biggest misses rarely came from final decisions.

They came from companies that received meetings but never got real attention.

Their fix was simple and strict.

No meeting without scheduled debrief time

Every meeting rated zero to ten, no middle score

It felt bureaucratic at first. The signal emerged over time.

Try this

Block fifteen minutes after important meetings. Rate them before distractions creep in.

6. The 40 biases

After every major miss, Sequoia ran post-mortems.

The same conclusion kept appearing.

The error came from psychology.

So they cataloged 40 cognitive biases and named them, creating shared language for catching mistakes early.

Examples everyone recognizes:

Competitive excitement influencing judgment

Similarity bias toward founders who feel familiar

Discomfort is part of the process.

Try this

Start naming your own traps. Language makes patterns visible.

7. The 50 percent write-off rate

One of Sequoia’s best funds included Airbnb, Dropbox, and Unity.

It also wrote off half the portfolio.

A small number of extreme outcomes drive returns. Failure comes with the territory.

Many investors understand this conceptually. Fewer tolerate it emotionally.

Try this

Track your write-off rate honestly. Low failure often means limited upside.

8. Founder-market Fit

Alfred Lin’s main filter:

Was this person made for this company?

Travis = Uber. Brian = Airbnb. Tony = DoorDash.

Can’t run someone else’s business. It’s a calling.

How he evaluates it:

What do you know about this industry others don’t?

Why is this problem interesting to you specifically?

What other problems here do you want to solve?

If they only want to solve one problem, limited runway. Need founders who see three moves ahead.

Try this

Spend less time judging decks. Spend more time understanding motivation.

9. How to pass well

Sequoia’s philosophy: “Maybe not now.”

When they pass, they invest real work in explaining why. Sometimes a detailed memo. Sometimes specific suggestions for what to focus on.

Alfred experienced this running Zappos. Sequoia passed 2-3 times with thoughtful feedback each time. When Zappos reached the right stage, they partnered.

Founders talk to each other. Graceful passes compound your reputation. Ghosting also compounds, just in the wrong direction.

Try this

Invest real time in your passes.

10. Authentic Love

Pat Grady started with no brand, no leverage, no track record.

His approach was simple. Show genuine interest.

Do the work. Understand the business. Explain why you want to partner.

Founders detect sincerity quickly. Performance disappears just as fast.

Your brand equals the sum of every interaction.

Try this

Stop selling your firm. Explain why you care about this company.

The real pattern

Sequoia’s edge comes from committing to a small set of systems and running them for years without interruption. Talent tracking, forced conviction, post-mortems, structured debriefs. Each one is simple on its own. Together, they create memory and judgment that compound over time.

Most firms start these processes and abandon them when results do not show up quickly. Sequoia keeps going. That patience is the advantage.

Up close, this kind of excellence looks unglamorous. Spreadsheets, slow feedback loops, thoughtful no’s that take time to write. None of it feels like insight in the moment.

Pick one system that improves your decisions. Start it now. Keep it running for a year. That is how durable advantage forms.

Full podcast on UNCAPPED:

RESOURCES 🛠️

access all for the next year with a 25% limited discount

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

The mid-funnel problem insight is underrated. Most deal flow analyses focus on top-of-funnel sourcing or final decision quality, but that middle zone where companies get stuck in 'meh' limbo is where real signal gets lost. The forced 0-10 rating with no middle ground seems painful at first but it eliminates the cognitive escape hatch of 'maybe later' which is usually code for 'probably never'. The talent graph approach working like PageRank is clever - you're basically running a reputation algorithm across hiring networks rather than trying to evaluate people in isolation. What I wonder about is whether the 40 documented biases become their own trap once everyone knows the list. Doesthe awareness of competitive excitement bias make you overcompensate and pass on legitimately hot deals? Systems are great until they calcify into dogma.