Solo Founders Take the Lead🔥, Startup Market Report📊, Projected 2026 IPOs🚀

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

brought to you by Gamma

Fast, AI-powered content creation for freelancers and consultants

Gamma helps you turn ideas into beautiful proposals, presentations, documents, social posts, and even websites, without design skills. It’s built for speed, clarity, and client-ready results.

Over 250M+ presentations, documents, websites, and social posts already created.

If your expertise deserves better packaging, Gamma is the tool teams keep coming back to.

In-Depth Insights 🔍

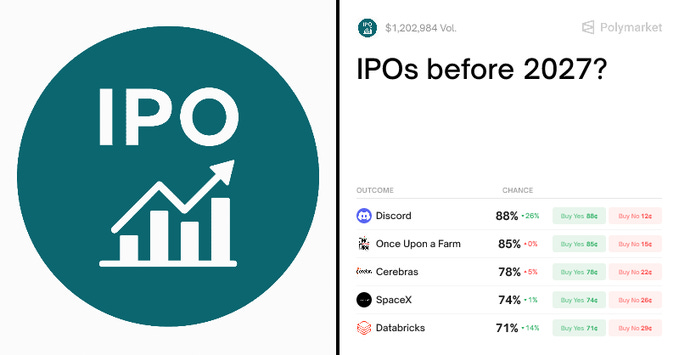

Discord, SpaceX, Deel, & Databricks Projected to IPO 🚀

Polymarket expects these four companies to go public in 2026. The wave could impact valuations and liquidity across the broader tech ecosystem

Series A Without the Circus 🤝

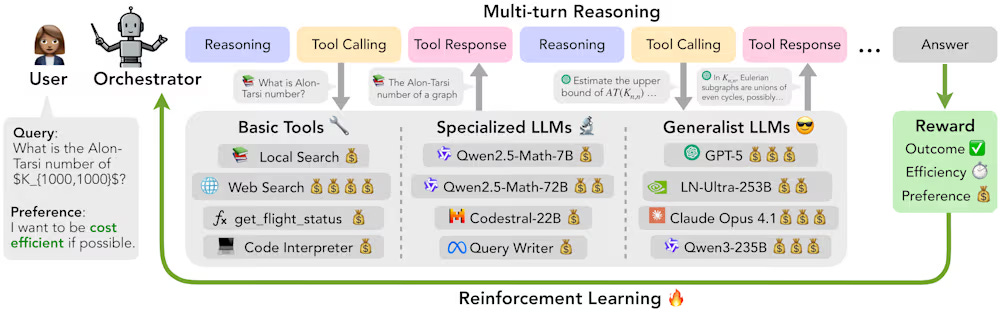

A new AI-native firm is opening Winter 2026 funding with a fast application process and no warm intros. Founders keep control, set their own valuation, and join curated peer cohorts. [Standard Capital]Four AI Research Trends Enterprise Teams Must Track 🔍

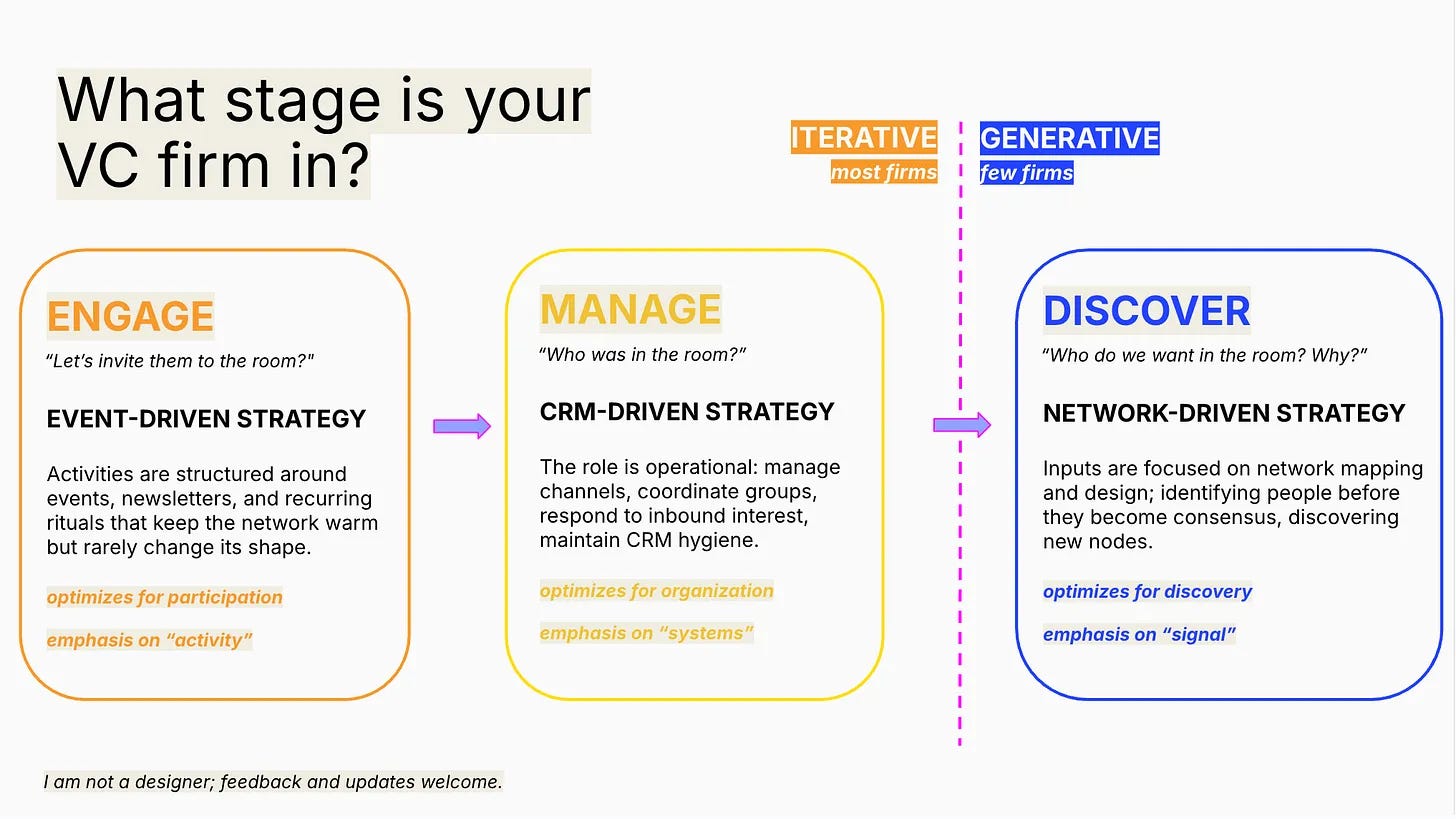

Continual learning, world models, orchestration, and refinement are turning demos into reliable production systems. These advances enable AI that remembers, simulates, coordinates tools, and improves answers over time. [Venture Beat]Community Is Venture Capital’s Hidden Moat 🌐

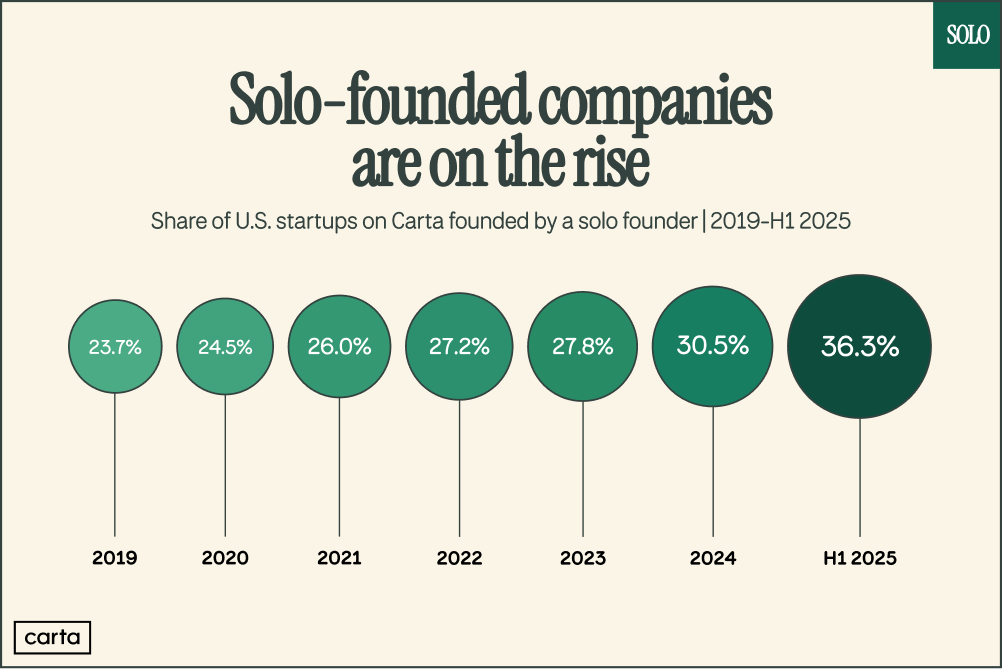

Event hosting is becoming a system for sourcing deals and shaping conviction before pitch decks exist. Firms that treat networks as living infrastructure gain a decade of proprietary access. [Hidden Networks]Solo Founders Take the Lead 🔥

Solo founders now launch over a third of all new companies, marking a structural shift in startup building. AI tools and strong communities make category-defining products possible without cofounders. [Solo]Finding a Technical Co-Founder That Actually Builds 🛠️

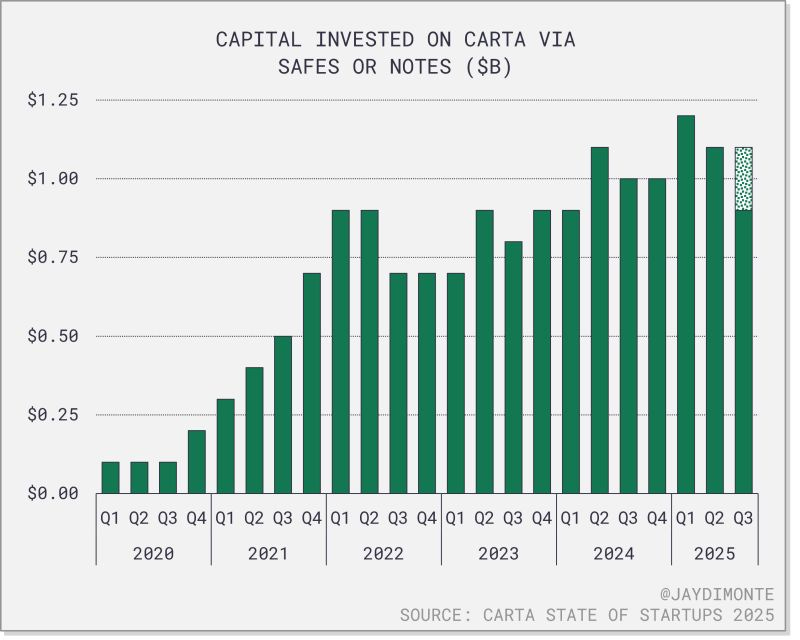

Productive non-technical founders attract great builders by shipping, writing publicly, and proving demand first. This playbook shows how to de-risk ideas and turn cold outreach into lasting partnerships. [next play]Early-Stage Legal Docs Lag Behind ⚖️

SAFEs and convertible notes still dominate $4–5M rounds as founders prioritize speed. AI tools can review closing documents efficiently, leaving room for priced rounds to return. [Jackie DiMonte]Relevance Decays in Venture ⏳

Early-stage investing depends on constant exposure to founders, ideas, and market shifts. AI-native startups accelerate this cycle, making ongoing engagement essential to stand out. [Sarah Guo]UK Tech Hits a Breakout Year ✨

In 2025, 15 new unicorns were created, surpassing the previous two years combined. $24B flowed into AI, fintech, hardware, and deep tech, with global founders reshaping Europe’s startup narrative.

Tools 🧰

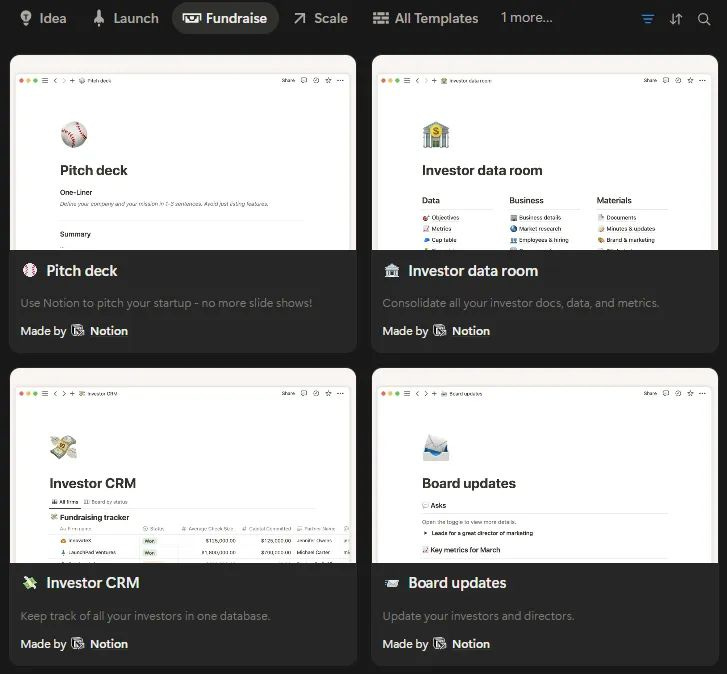

FREE Startup in a Box with everything founders actually use (59 templates + 10k investor list):

Attio, the CRM used by both startups and VCs (including me). Try it for free here

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

Fast, AI-powered content creation for freelancers and consultants. Try Gamma for free here.

free AI Native Stack (Gamma, Lovable, Clay, Notion…)

Hubspot’s FREE LinkedIn Growth Playbook for Startup Founders

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

Inside the 2025 Startup Market Report 📝

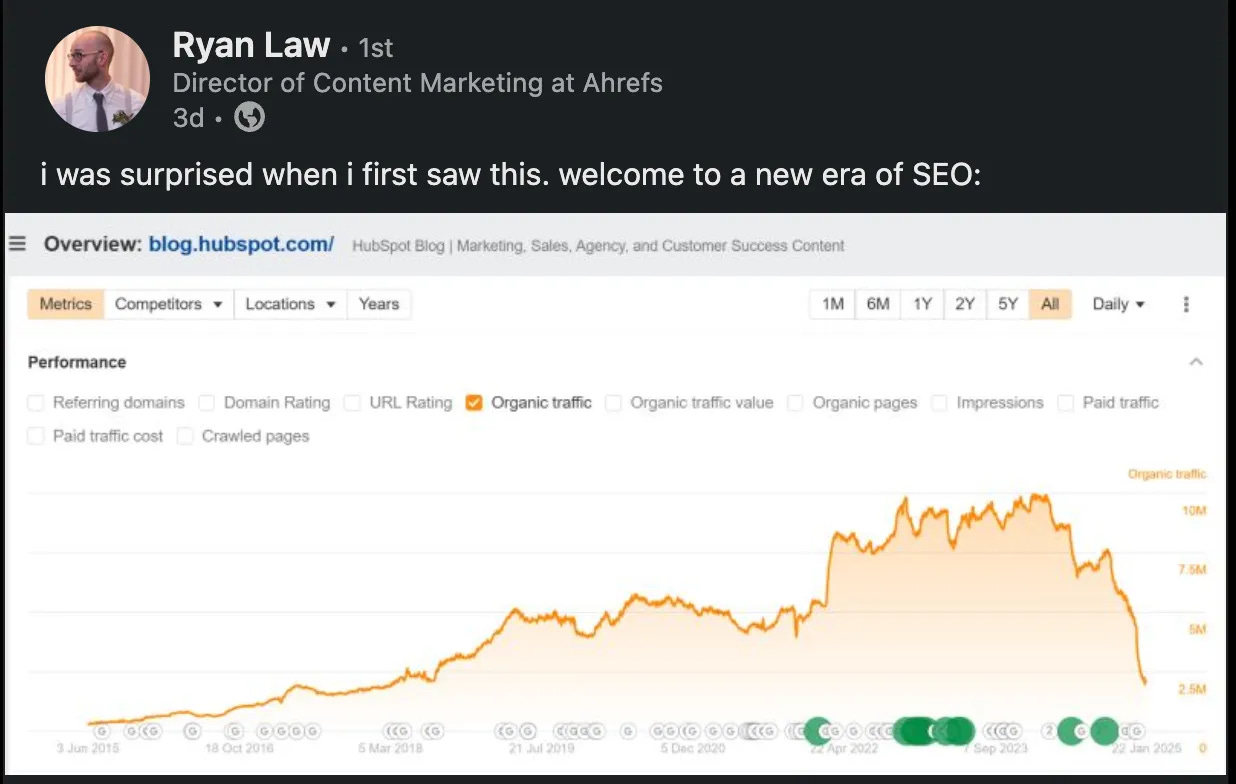

Carta analyzed over 60,000 startups and found a two-speed market. AI startups attract 44% of US capital at record valuations, while initial equity grants fell 50% since 2022 amid fewer IPOs. [carta]RIP SEO: The GEO Playbook for 2026 🔍

AI assistants like ChatGPT and Perplexity are replacing Google as the main discovery layer. Generative Engine Optimization is becoming essential as models now cite only 2 to 7 sources per query.

Recently Launched Funds 💸

BV Investment Partners closed Fund XII at $2.465B to continue investing in middle-market software and tech-enabled services companies.

Lux Capital closed its $1.5B ninth fund to double down on frontier science and deep tech.

AppWorks closed Fund IV at $386M to continue backing startups across Greater Southeast Asia.

Antler closed a $160M fund to back founders at day zero and scale early-stage investing at global volume.

January Capital raised a $130M Asia-Pacific fund focused on growth credit for scaling tech companies.

Xirius Ventures raising a $50M debut fund focused on early-stage venture bets.

Grit Road Partners announced its second fund to support Midwest agtech and food system innovation.

Striker Venture Partners launched a new U.S. fund committing millions to early-stage Israeli AI and cybersecurity startups.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

Hello World (Remote): VC Analyst (apply here)

MicroVentures (Austin, TX): IR Manager (apply here)

Delphi Ventures (San Francisco, CA): VC Associate (apply here)

Intuit Ventures (Mountain View, CA): Senior VC Principal (apply here)

Quanta Ventures Fund (San Francisco, CA): VC Partner (apply here)

MicroVentures (Austin, TX): VC Associate (apply here)

First Analysis (Chicago, IL): VC Internship (apply here)

Coparion (Köln, Germany): VC Internship (apply here)

Newlab (Brooklyn, NY): Managing VC Director (apply here)

Santander (Madrid, Spain): VC Associate (apply here)

Hottest Deals 💥

Cyera, raised $400M in Series F funding to accelerate growth of its cloud data security platform and expand global operations. (read more)

Parabilis Medicines, secured $305M in Series F funding to advance its precision oncology pipeline and support clinical development. (read more)

Rain, raised $250M in Series C funding to scale its financial wellness and earned wage access platform. (read more)

Soley Therapeutics, closed $200M in Series C financing to expand its metabolomics-driven drug discovery efforts. (read more)

Alveus Therapeutics, raised $160M in Series A financing to advance treatments for neurodegenerative diseases. (read more)

LMArena, secured $150M in Series A funding to grow its competitive AI benchmarking and evaluation platform. (read more)

Diagonal Therapeutics, raised $125M in Series B financing to progress its protein-misfolding therapeutic programs. (read more)

Corgi, secured $108M in funding to expand its technology platform and accelerate market adoption. (read more)

Swap, raised $100M in Series C funding to scale its cross-border payments and treasury management solutions. (read more)

Nocion Therapeutics, extended its Series B financing to $93M to advance non-opioid pain treatments into later-stage trials. (read more)

Pomelo Care, raised $92M in Series C funding, reaching a $1.7B valuation as it scales value-based maternity care. (read more)

Apella, secured $80M in Series B equity and venture debt to expand its healthcare technology offerings. (read more)

Corsera Health, raised $80M in Series A financing to grow its digital health platform and partnerships. (read more)

Mediar Therapeutics, secured $76M in Series B financing to advance therapies targeting fibrotic diseases. (read more)

Valinor Enterprises, raised $54M in Series A funding to support expansion of its next-generation technology solutions. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

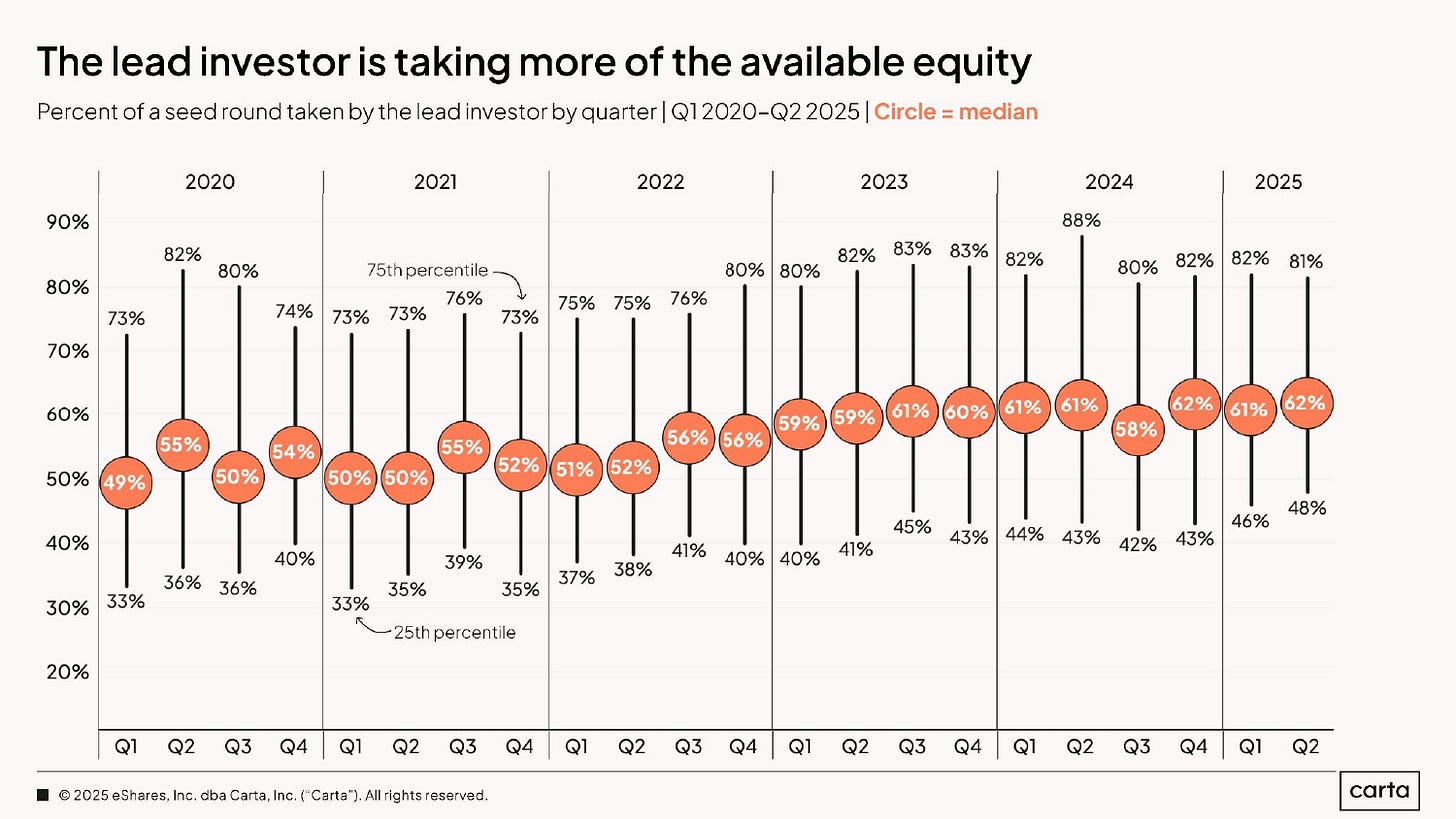

As long as they are adding more and more value, nothing wrong with it. If it’s more equity for the same or less value… then it’s broken

https://github.com/MichaelSimoneau/crypto-fabric/blob/main/BUSINESS_PLAN.md