The VC Math Problem📊, Inside a16z’s Speedrun💸, The 5% Rule for AGI🧠

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic - the complete startup database

Market maps finally in venture software.

Scout — the AI agent made for VCs allows you to market map with ease. Simply describe what you’re looking for, or look up the competitive landscape for a particular company.

Scout handles the rest, scouring the internet as well as Harmonic’s private database trusted by thousands of investors from leading firms like GV and Insight.

In-Depth Insights 🔍

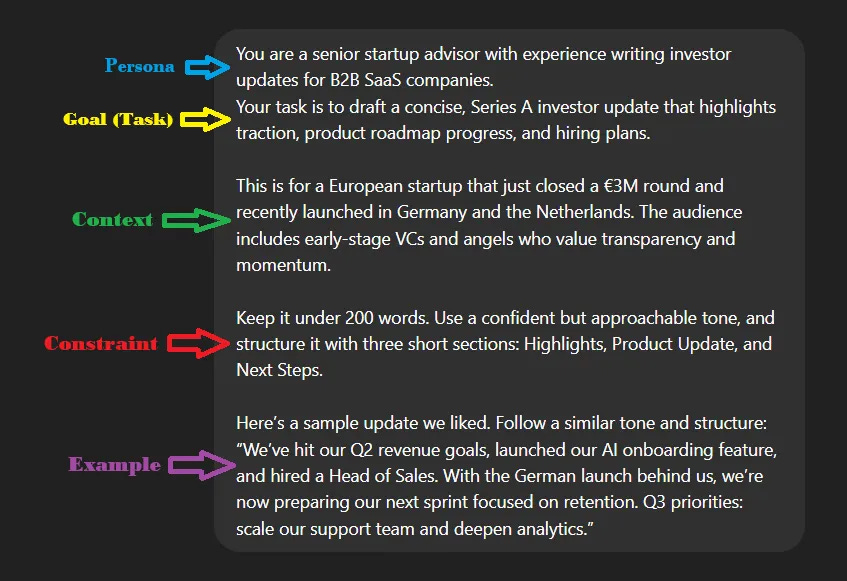

The Playbook for Writing Better Prompts 📚

Prompts work best when broken into role, goal, context, constraints, and examples. Frameworks like CLEAR and RGIO show why structure beats trial and error.The 5% Rule for AGI 🧠

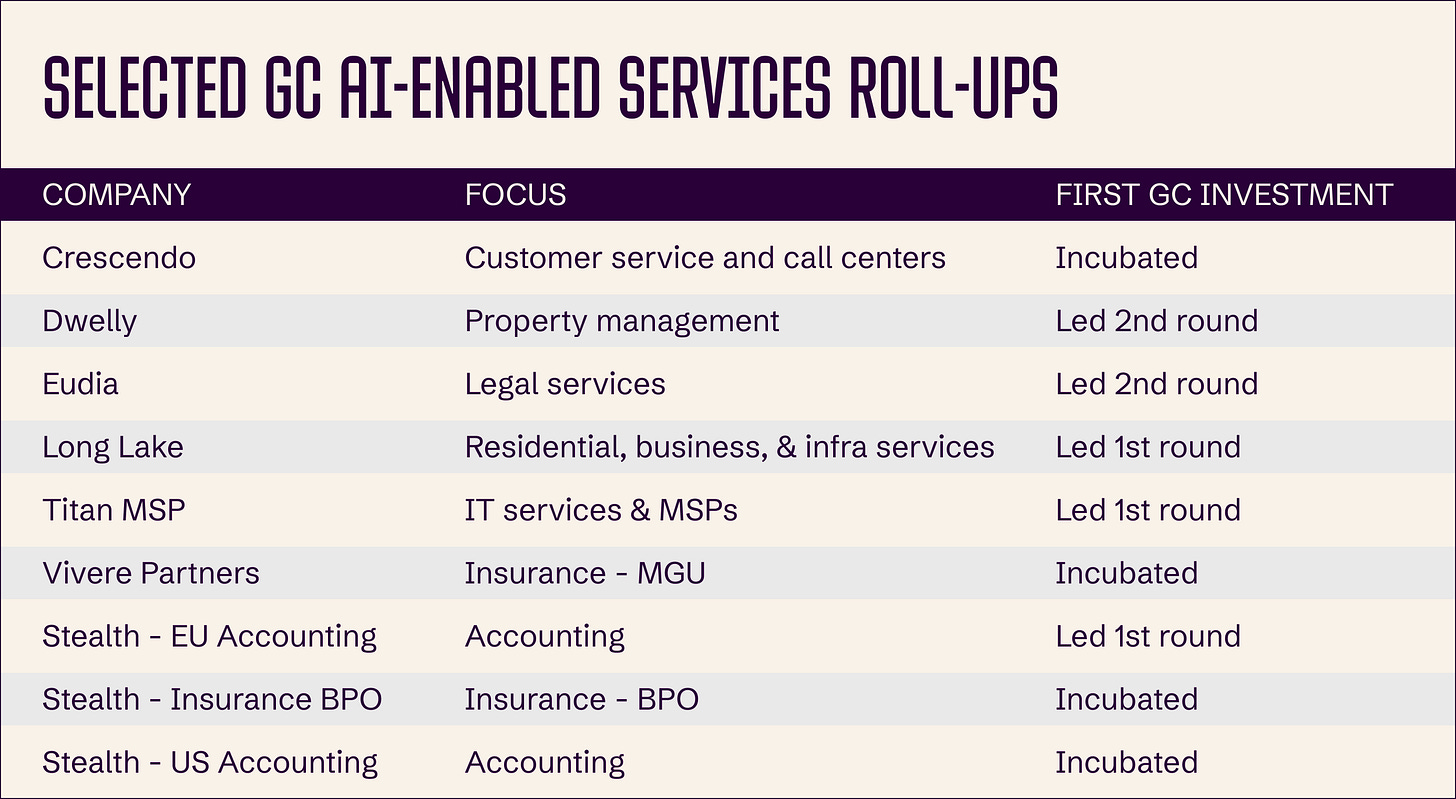

Progress isn’t about superintelligence but whether AI can handle the bottom 5% of tasks in any field. Raising the floor of competence could transform coding, writing, and customer service. [David Cahn]Roll-Ups Could Be Bigger Than SaaS 🛠️

A $6T+ services market is ripe for consolidation through acquisitions and applied AI. Legal, IT, customer service, and property are already proving the roll-up model works. [General Catalyst]Inside a16z’s Speedrun 💸

Founders get $1M checks, $5M in credits, visa support, and access to 500+ peers. Since 2023, Speedrun has funded 150+ startups with $180M deployed. [a16z speedrun]The First Real AI Business Model 💰

Investors are shifting focus from hype to coding assistants as the first big revenue stream. Billions in projected sales suggest software automation may be AI’s first true payoff. [NY Mag]The VC Math Problem 📊

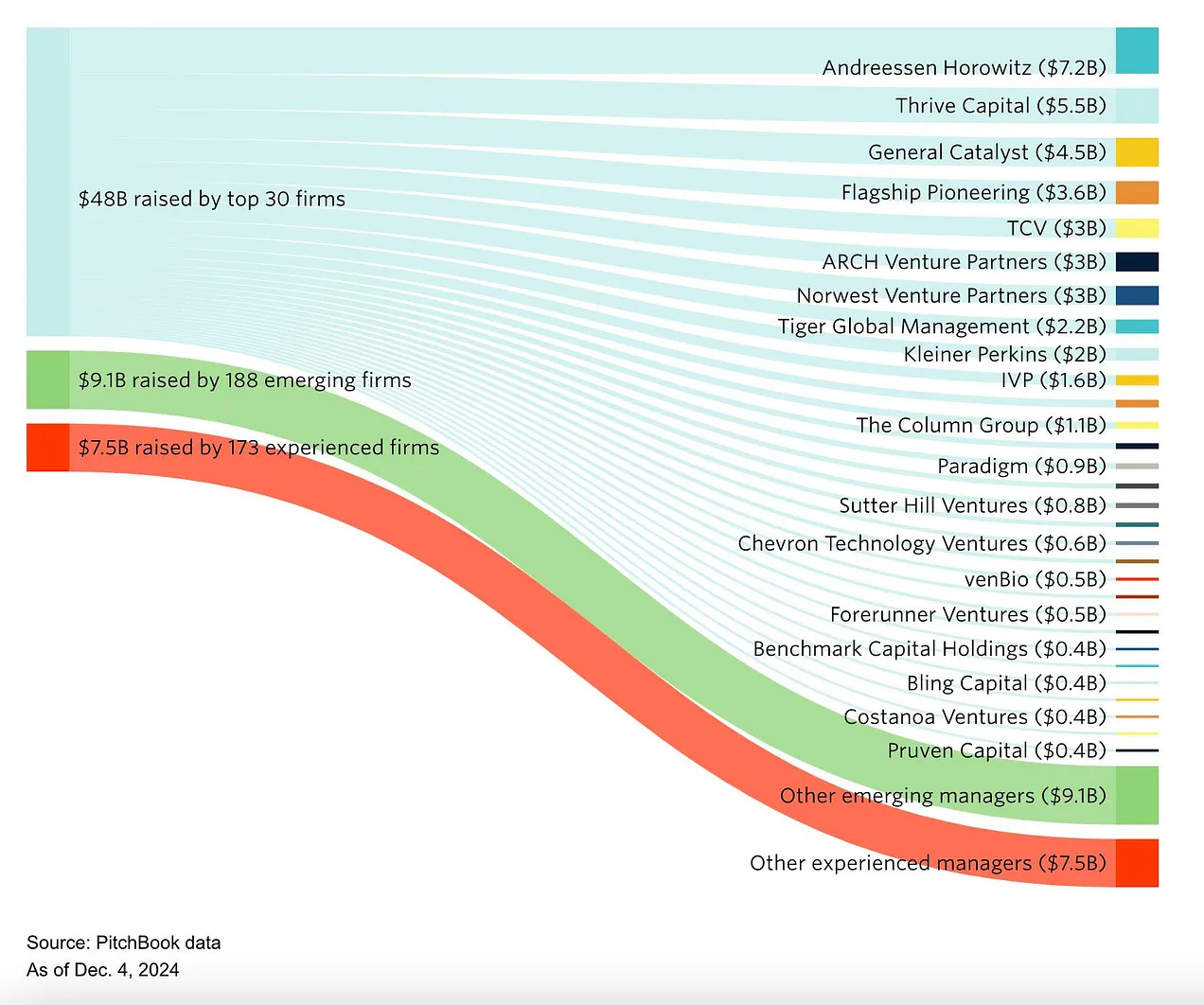

Mega-funds can’t make the numbers work without impossible ownership of winners. Smaller funds with disciplined reserves and recycling consistently post stronger multiples. [Rex Woodbury]

Why VCs Worked Through the Summer 💸

Competition for AI deals kept term sheets moving at weddings, parties, and weekends. In July, half of $100M+ private tech deals went to AI. [WSJ]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

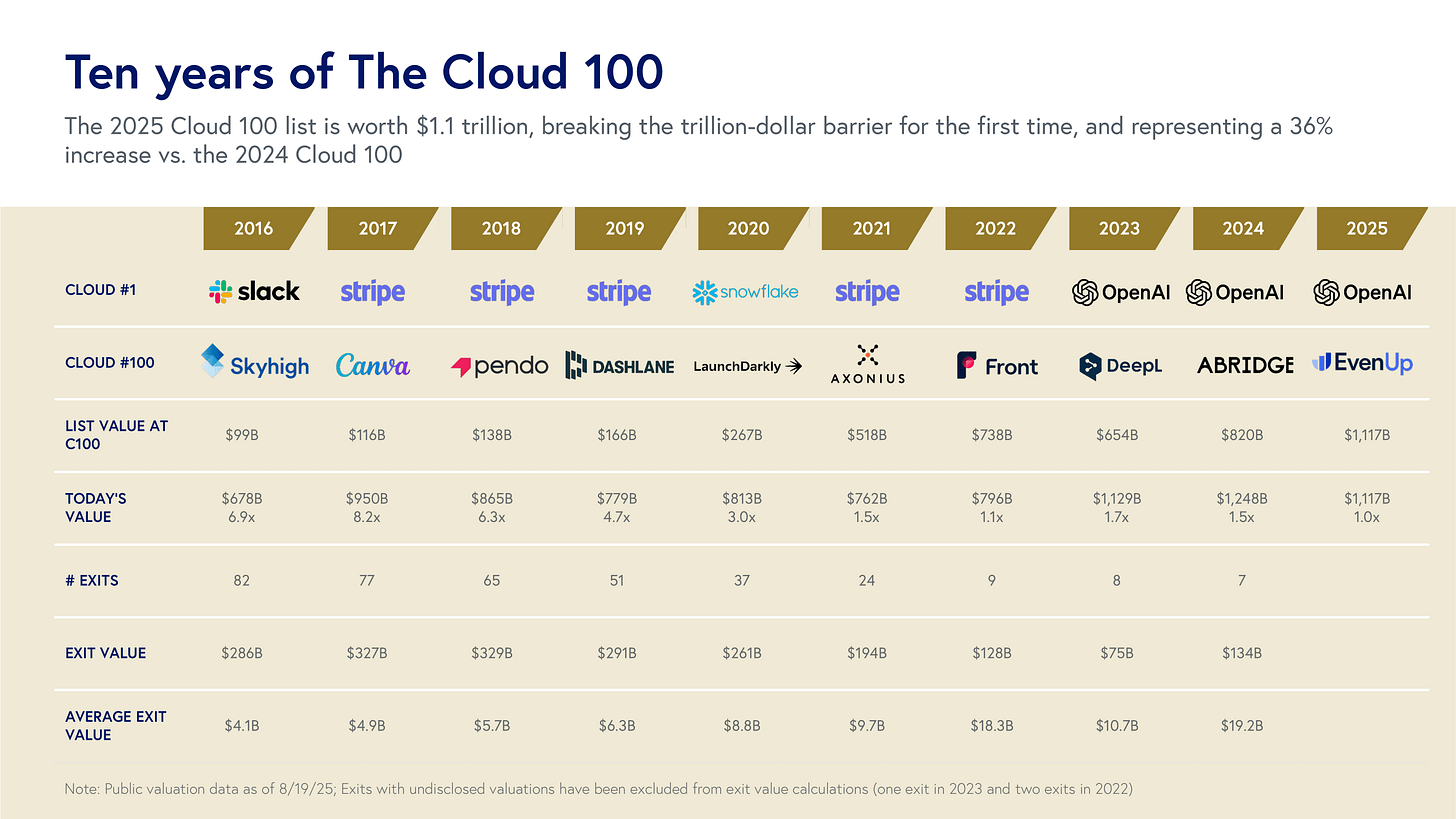

Cloud 100 Hits $1.1T on AI Surge ☁️

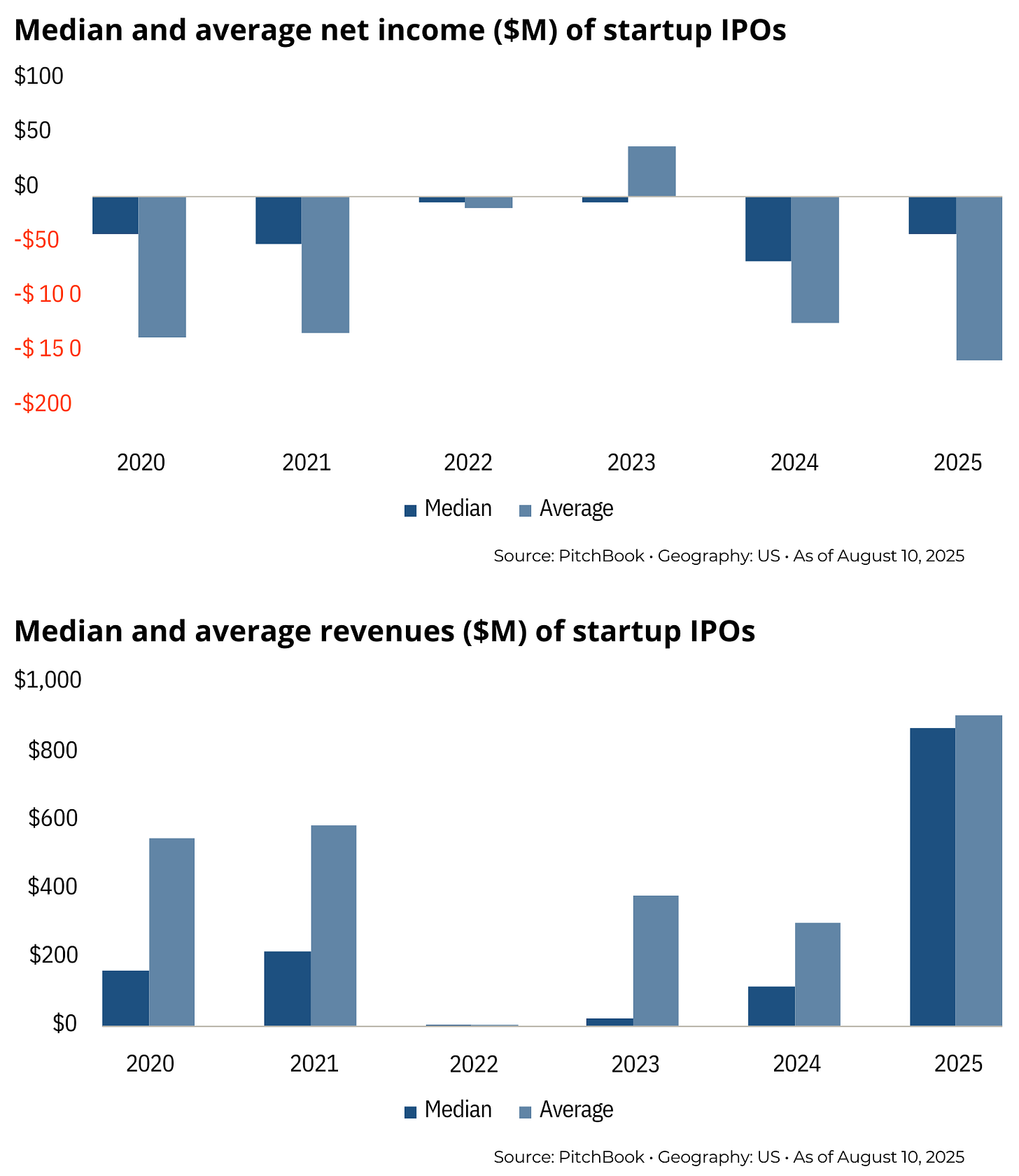

The 2025 ranking reached $1.117T, a 36% jump from last year. AI firms now represent $464B of the total, scaling revenue nearly 2 years faster than peers.IPO Standards Tighten in 2025 🚀

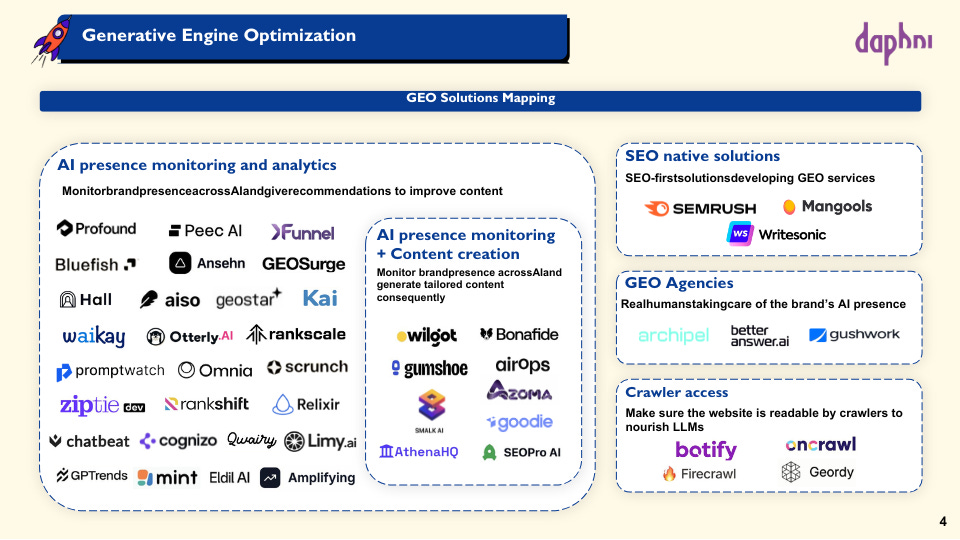

Figma’s debut reignited investor appetite but only strong companies are passing through. The pipeline is thin as markets shift away from 2021’s easy IPOs.Generative Engines Are the New SEO 🔍

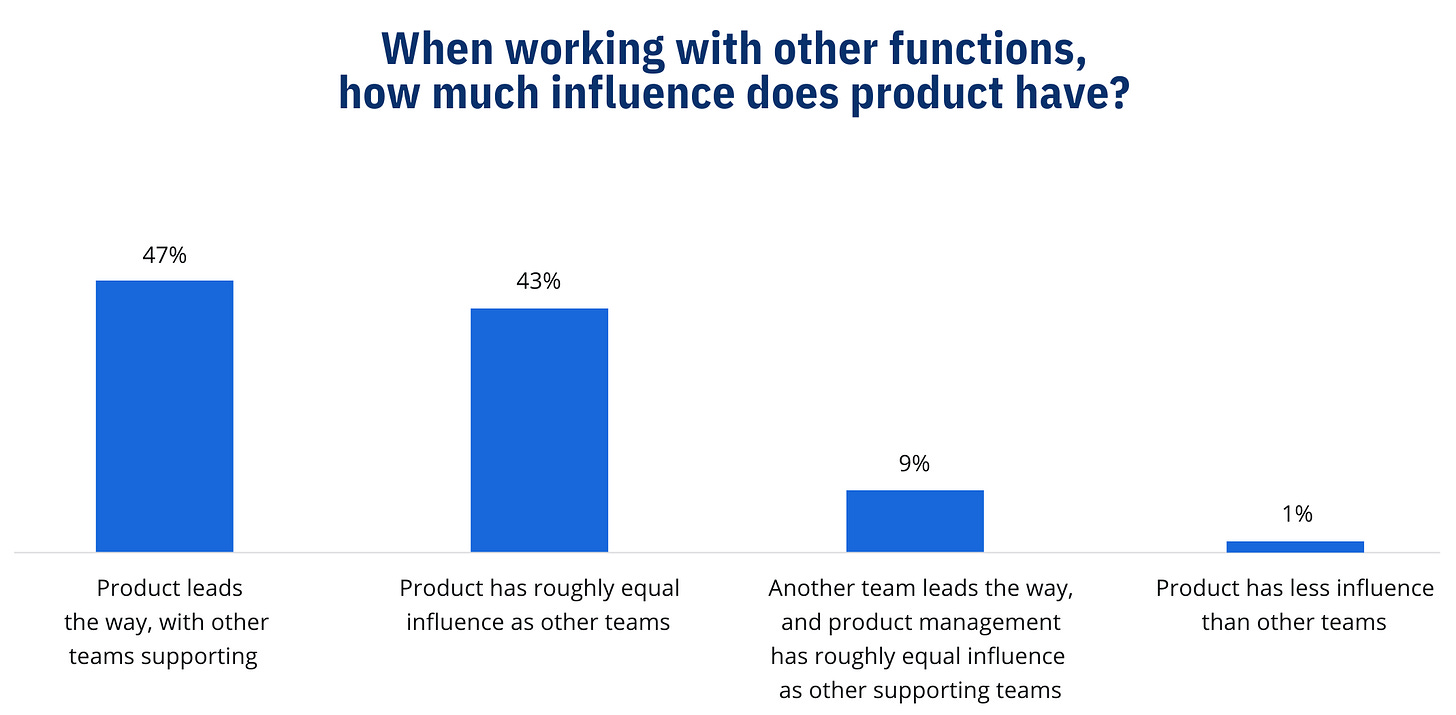

60% of Google searches now end with no click, shifting visibility away from search. GEO is emerging as the critical play for brands to stay discoverable.Atlassian’s 2026 Product Report 🤖

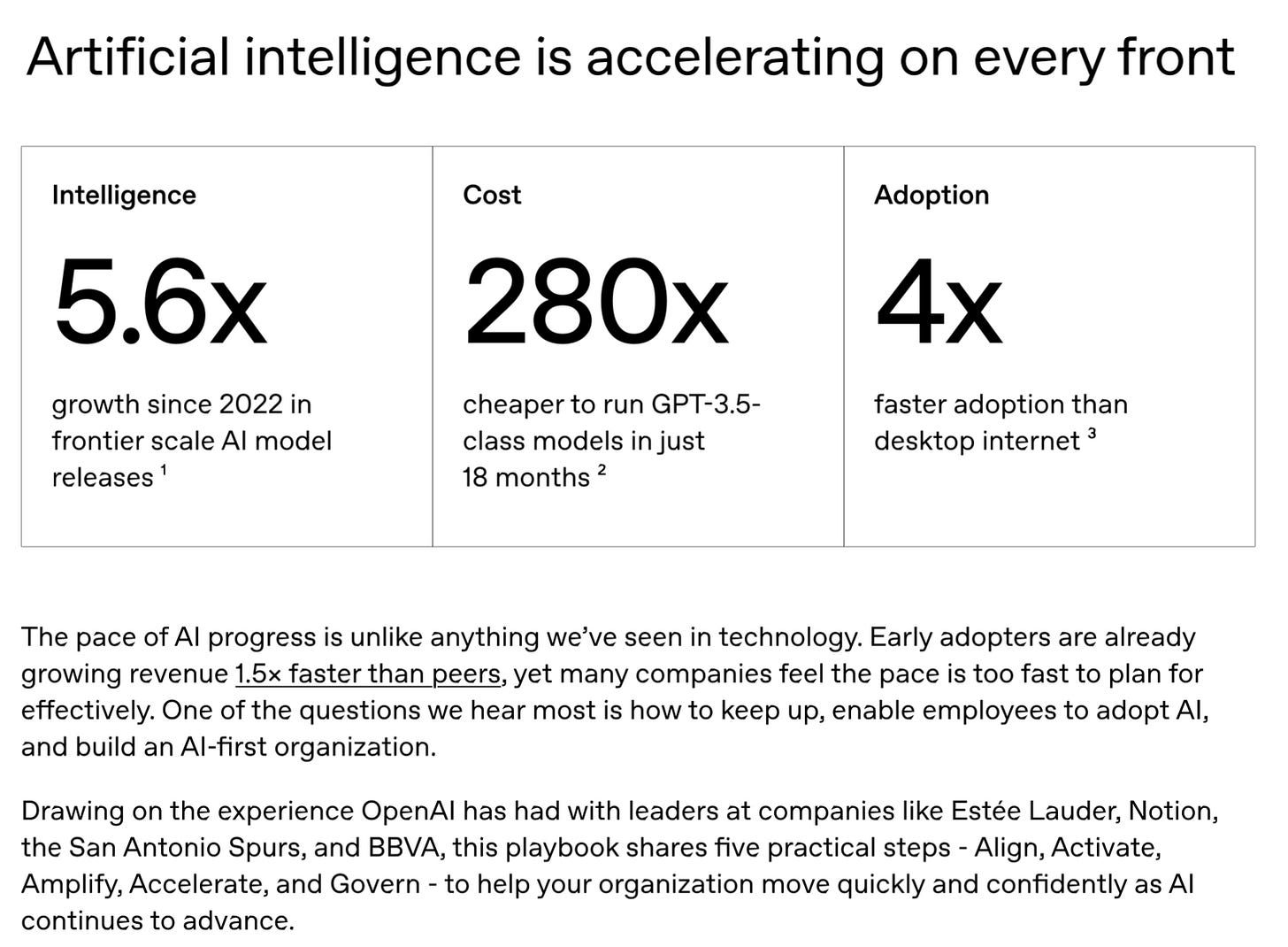

AI is improving efficiency but not solving gaps in strategy or collaboration. 84% of PMs doubt success as politics outweigh user needs inside companies.OpenAI’s Adoption Guide Exposes Tradeoffs ⚖️

The 5-step playbook shows the paradoxes of scaling new tech inside companies. Hype inflation and compliance theater dominate unless execution is measurable.Startup Pay in 2025 (Carta Data) 📊

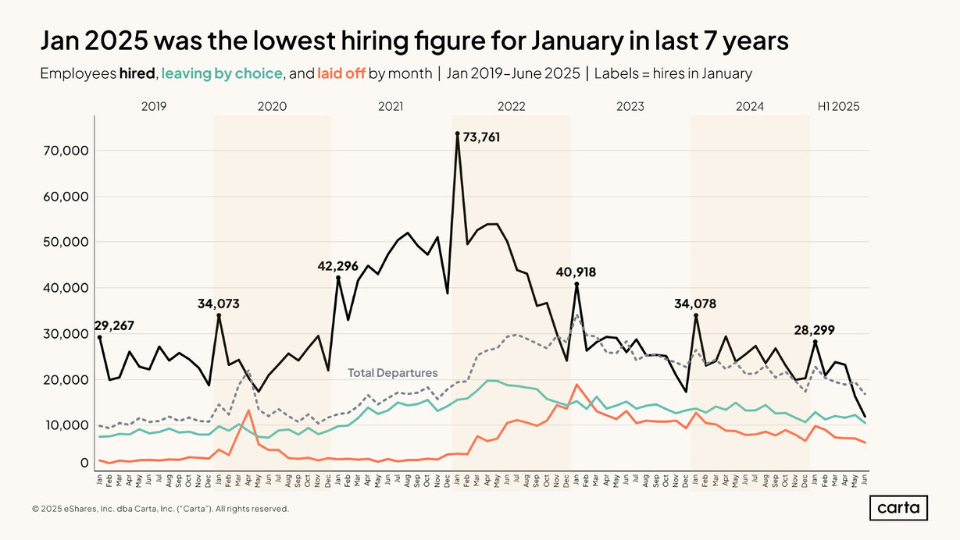

Series A companies are hiring smaller teams while equity grants shrink. AI engineers remain the outliers with comp rising 18% a year plus stronger equity.Revolut Tops Nubank at $75B 💳

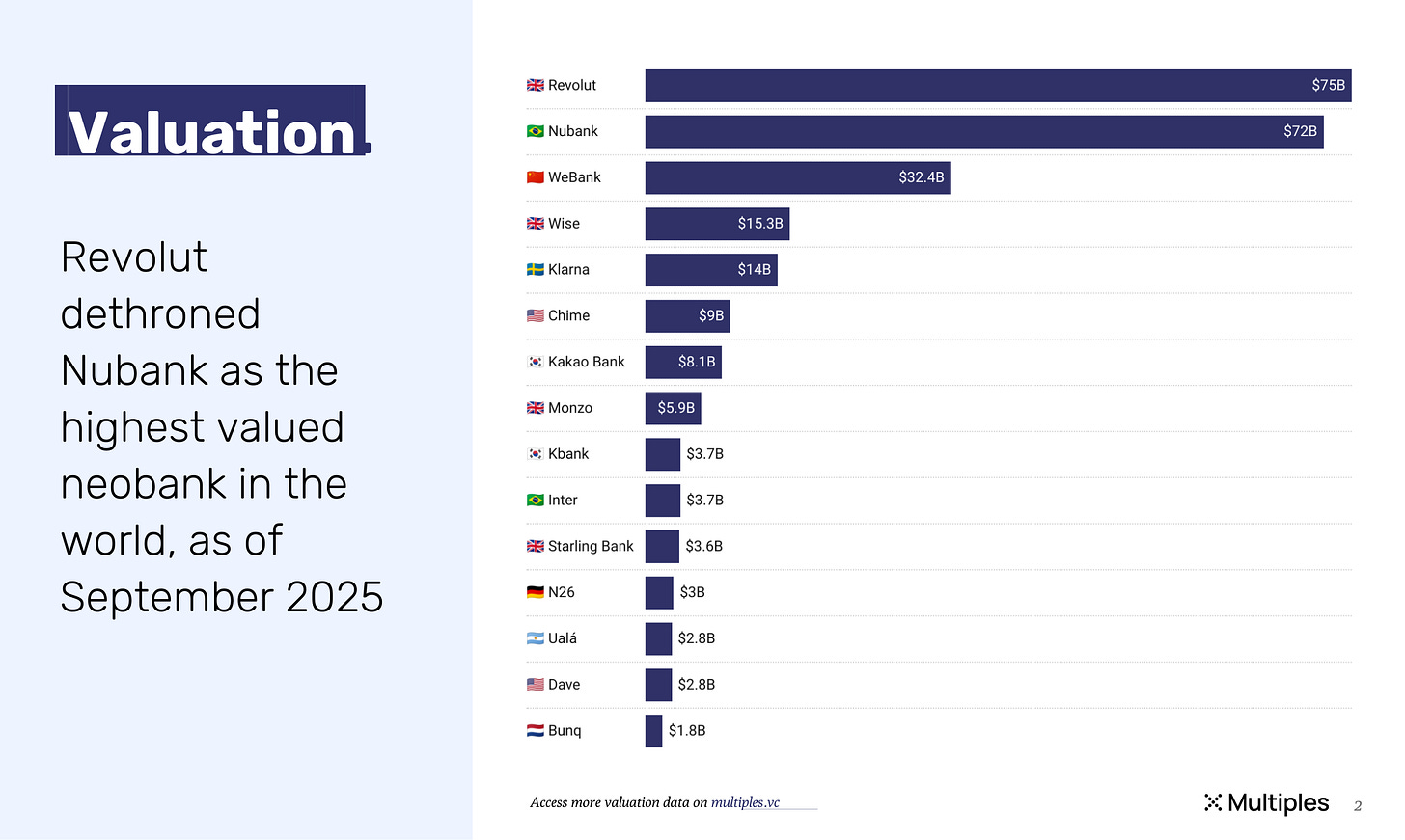

The UK neobank surpassed its Brazilian rival despite lower revenue and profit. London now counts 4 of the world’s 10 most valuable digital banks.

Recently Launched Funds 💸

Winter Street Ventures launched its inaugural fund to back innovative healthcare startups.

Atlas Venture closed its $400M third opportunity fund to continue investing in biotech breakthroughs.

White Star Capital completed the first close of its $50M North American seed fund targeting early-stage founders.

Eagle Venture Fund announced the launch of Freedom Fund II, a $50M vehicle backing mission-driven ventures.

Venturi Partners held the first close of Fund II at $150M, focused on scaling growth companies across Asia.

Sora Ventures launched a new $1B treasury fund dedicated to purchasing Bitcoin as a strategic reserve asset.

U.S. & Indian VC Alliance formed a $1B cross-border alliance to fund India’s emerging deep-tech startups.TED Leaders introduced a $300M “Valley of Death” fund aimed at helping later-stage climate tech companies scale.

Great Hill Partners closed its ninth growth buyout fund at $7B to invest in high-growth companies across tech and healthcare.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Anthos (Santa Monica, CA): Venture Capital Research Internship (apply here)

Apex Capital (Fort Worth, TX): New Ventures Manager (apply here)

Griffin Gaming Partners (Santa Monica, CA): Investor Relations Analyst (apply here)

Team8 (New York City, NY): Head of Investor Relations (apply here)

XDC Ventures (New York City, NY): Venture Partner (apply here)

Torch Capital (New York, NY): Pre-MBA Associate (apply here)

11 Tribes Ventures (Chicago, IL): Investment Sourcing Lead (apply here)

Bullpen Capital (San Francisco, CA): Analyst (apply here)

Montauk Climate (Remote): Head of IR (apply here)

DigitalDx Ventures (Remote): DigitalDx Fellowship 2025 (apply here)

Hottest Deals 💥

Geniez AI, raised $6M in seed funding to push forward its AI-driven platform. (read more)

Dispatch, secured $18M in Series A to scale its logistics and delivery solutions. (read more)

Octave Bioscience, pulled in $35M Series C to advance precision neurology care. (read more)

Euclid Power, raised $20M in Series A to optimize renewable energy project management. (read more)

Lead Bank, closed $70M Series B to scale its tech-first banking platform. (read more)

Sesh, raised $40M in total funding to expand its mental health support platform. (read more)

Enveda, landed $150M in Series D to unlock plant-based drug discovery. (read more)

Sola Security, raised $35M in Series A to build next-gen cybersecurity solutions. (read more)

Recall.ai, secured $38M in Series B to fuel growth in its AI meeting infrastructure. (read more)

Mega, grabbed $2M pre-seed to kickstart its product development. (read more)

You.com, raised $100M in Series C at a $1.5B valuation to scale its AI search engine. (read more)

Galvanize Therapeutics, closed $100M Series C to expand its bioelectric medicine platform. (read more)

ID.me, raised $340M in Series E to grow its digital identity verification network. (read more)

Treeline, locked in $200M in additional funding for its investment platform. (read more)

Microbiotix, raised KRW 20B (~$14.5M) in Series B to advance antimicrobial research. (read more)

RESOURCES 🛠️

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox