Top Resources for Founders🚀, Do Top VCs Really Bet Contrarian?🤔, Reverse Imposter Syndrome🪞

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the complete startup database

8VC, Arctern, Bedrock, DST, Emergence, Fintech Collective, First Round, Greyhound, GV, Insight, IVP, Mosaic, NEA, NGP, Pear, Precursor, Redpoint, Scale, Spark, Zetta. And hundreds more we can’t name in ads.

The world’s best VCs use Harmonic to find their fund returners.

In-Depth Insights 🔍

10 Must-Have Startup Resources for Founders 🚀

From 100+ pitch decks and 10k+ investor lists to financial models and OpenAI’s strategy guide, this toolkit is a cheat code. It covers fundraising tactics, dilution math, cap tables, and cold outreach scripts.Do Top VCs Really Bet Contrarian? 🤔

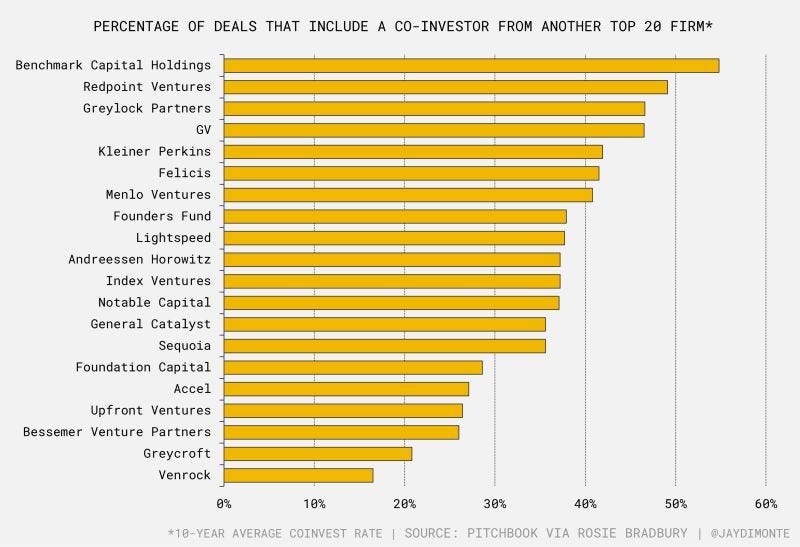

PitchBook shows nearly 40% of elite VC deals include another top firm, blurring the line between consensus and conviction. Syndication spreads risk but dilutes ownership and challenges the contrarian myth. [Rubén Domínguez Ibar]OpenAI: Most AI Startups Are Just Demos ⚠️

OpenAI’s Miqdad Jaffer argues AI features get copied fast while costs outrun revenue. Durable moats come from data, distribution, and trust, not hype, with pricing discipline as the survival filterReverse Imposter Syndrome: Seeing Your Own Strength 🪞

This flips the usual script: you know you’re good, but others undervalue your work. Wes Kao suggests making strategy visible and aligning perception with your actual ability. [Wes Kao]The AI Skills Divide Reshaping Tech Hiring ⚡

Even with record CS grads and layoffs, companies chase only rare AI prodigies with salaries hitting $500k. Mid-career and non-AI engineers get sidelined in a brutal winner-take-most market. [WSJ]Private Equity Benchmark Report 2025 📊

Data from 200+ firms reveals how dealmaking has shifted and which tactics separate winners. Origination, competition, and execution stand out as the levers for long-term PE success. [affinity]

Growth Hacking: The Discipline Behind Scale 🚀

Born in 2010, growth hacking is rapid, data-driven experimentation across the AARRR funnel. Airbnb, Dropbox, Slack, and TikTok show how scrappy tests compound into lasting scale. [First Round]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

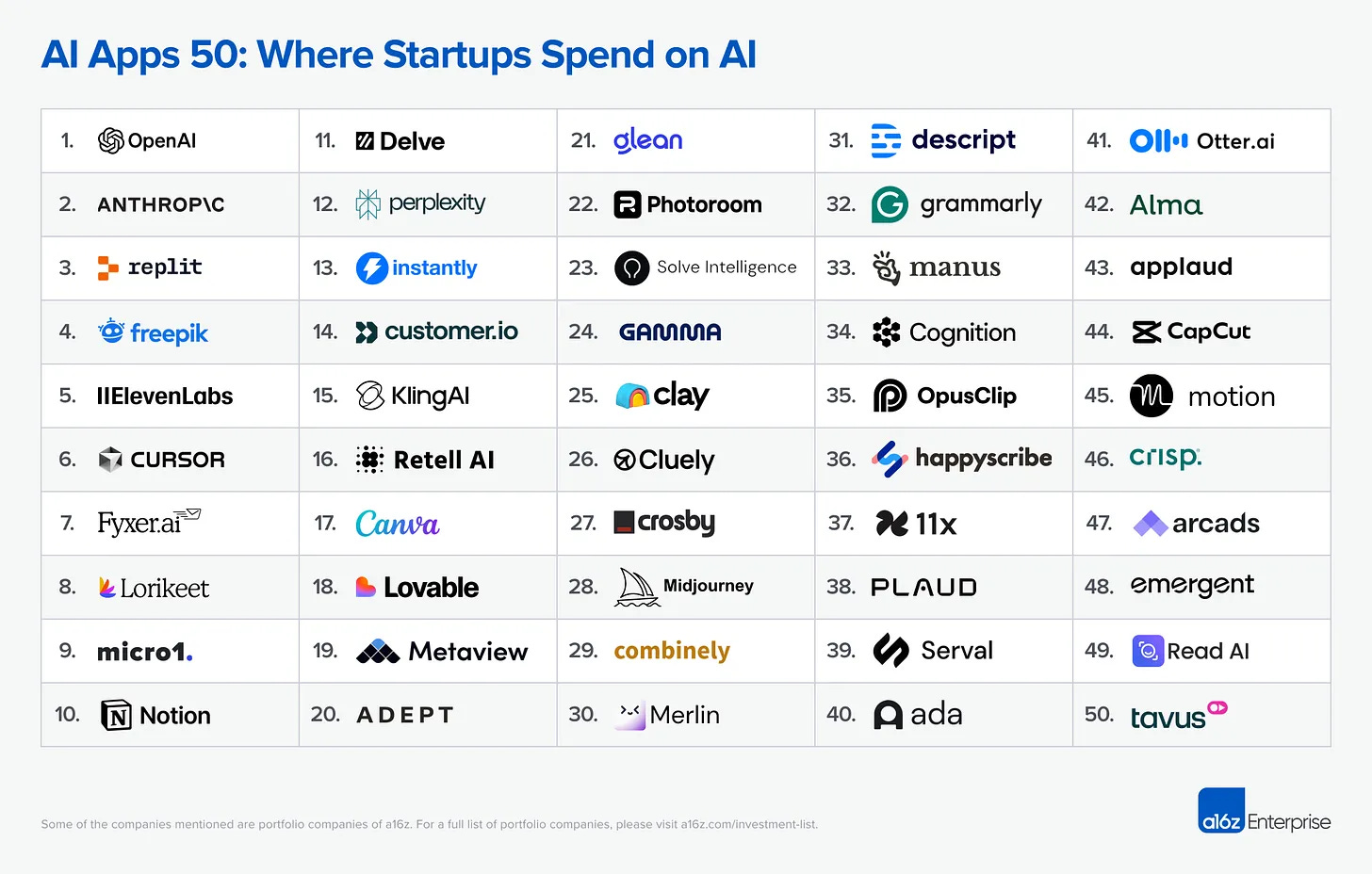

AI Application Spending Report 2025 💳

Drawing on $200B+ in startup transactions via Mercury, the report ranks the 50 AI-native apps driving spend. Horizontal tools dominate, vertical AI augments roles, and consumer-first players like Replit and Canva are scaling into enterprise [a16z]The State of Defence Tech 2025 🛡️

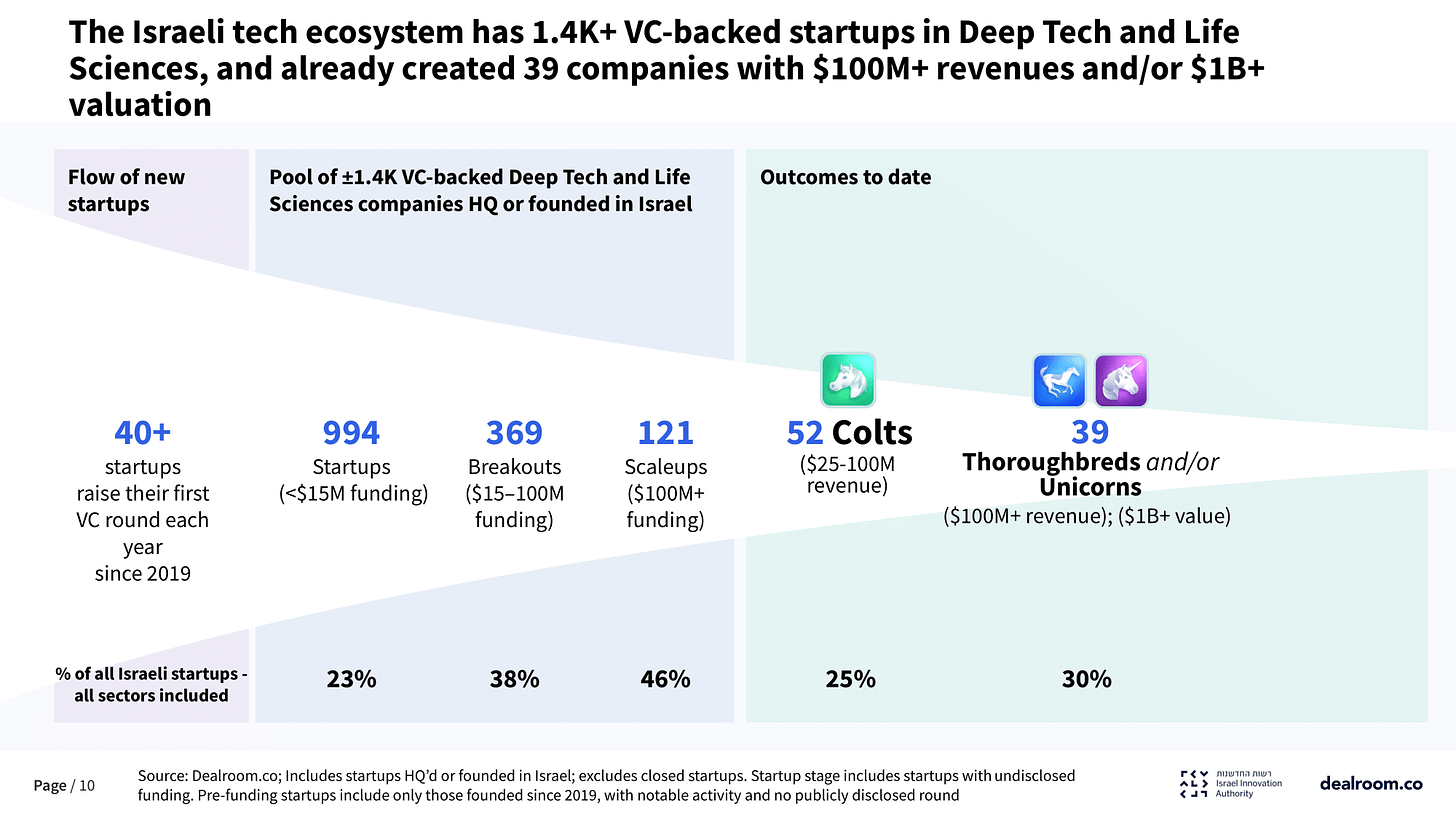

Created with Resilience Media, this report maps defence, security, and resilience technologies in 2025. It tracks key innovations, market shifts, and the hurdles nations and companies face against next-generation threats.Israel Deep Tech Report 2025 🔬

A deep dive into Israel’s innovation economy set against global and macroeconomic trends. The report outlines the ecosystem’s strengths, challenges, and future paths as one of tech’s most dynamic hubs.

Recently Launched Funds 💸

Touring Capital, closed $330M debut fund to back AI-driven SaaS at Series B and C.

Yu Galaxy, raised $90M to invest in startups tackling major global challenges.

55 North, held €134M first close of its inaugural quantum technology fund.

Creator Fund, raised $41M for its first European fund supporting scientific founders.

Hamilton Lane, launched a global venture capital and growth evergreen fund.

Cyberstarts, closed its second opportunity fund at $380M.

Boost VC, closed Fund 4 at $87M to back frontier tech startups.

Toyota / Woven Capital Fund II, toyota launched a strategic investment arm and unveiled Woven Capital Fund II.

European Investment Fund, invested €260M in Jolt Capital V.

Notion Capital, closed $130M growth fund to support scaling SaaS companies.

Breachway Capital, launched to back B2B software, AI, and data companies.

Presight & Shorooq, jointly launched a $100M global fund.

BECO Capital, raised $370M across two new funds.

Expeditions, raised over €100M for Fund II.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Investing?

THESE are the companies raising right now

VC Jobs 💼

PINC (Stockholm, Sweden): Senior VC Manager (apply here)

Lunicorn Ventures (London, England): VC Analyst (apply here)

DTCP (Berlin, Germany): VC Internship (apply here)

ROI Ventures (Vienna, Austria): VC Analyst (apply here)

LvlUp Ventures (Remote): VC Internship (apply here)

Picus Capital (Remote): VC Internship (apply here)

SGE (Bala Cynwyd, PA): VC Analyst (apply here)

Samsung Next (Mountain View, CA): VC Investor (apply here)

Pivotal Life Sciences (San Francisco, CA): Senior VC Associate (apply here)

Inspired Capital (New York City, NY): VC Analyst (apply here)

Hottest Deals 💥

OpenSolar, closed $20M in equity funding. (read more)

PeakaIO, raised $3.7M in funding. (read more)

Advisor.com, secured $9M in seed funding. (read more)

DualEntry, raised $90M in Series A funding. (read more)

Ualett, received $150M debt facility from Thiele Capital Management. (read more)

Pacaso, closed $72.5M raise. (read more)

Cartography, raised $67M in Series B funding. (read more)

Feedzai, raised $75M in funding. (read more)

OncoC4, raised nearly $50M in Series B funding. (read more)

Tihive, raised €8M in funding. (read more)

Empower Semiconductor, raised over $140M in Series D financing. (read more)

Dashmote, raised $6M in Series A1 funding. (read more)

AudioShake, raised $14M in funding. (read more)

Supernova, raised $9.2M in Series A funding. (read more)

Eve, raised $103M in Series B at $1B valuation. (read more)

RESOURCES 🛠️

✅The Venture Capital Method: How Investors Really Value Startups

✅IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox