VC Fund Performance Report📊, Is AI Really a Bubble🫧, Benchmarking Startup Success🎓

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta: ✅ SOC 2 without the chaos

SOC 2 is one of the first things customers ask for—but it doesn’t have to slow you down.

Vanta’s checklist gives you a clear, startup-friendly path so you can get compliant fast, even without a security team:

In-Depth Insights 🔍

Full Stack VC Marketing 📢

Venture firms are unifying brand, content, media, and PR into one system. Those that align all four pillars gain visibility, founder trust, and long-term advantage. [Refining VC]Benchmarking Startup Success 📊

VCBench standardizes how to predict founder outcomes using 9,000 anonymized profiles. It evaluates machine learning models against human judgment to improve venture decisionsIs the MBA Still a VC Ticket 🎓

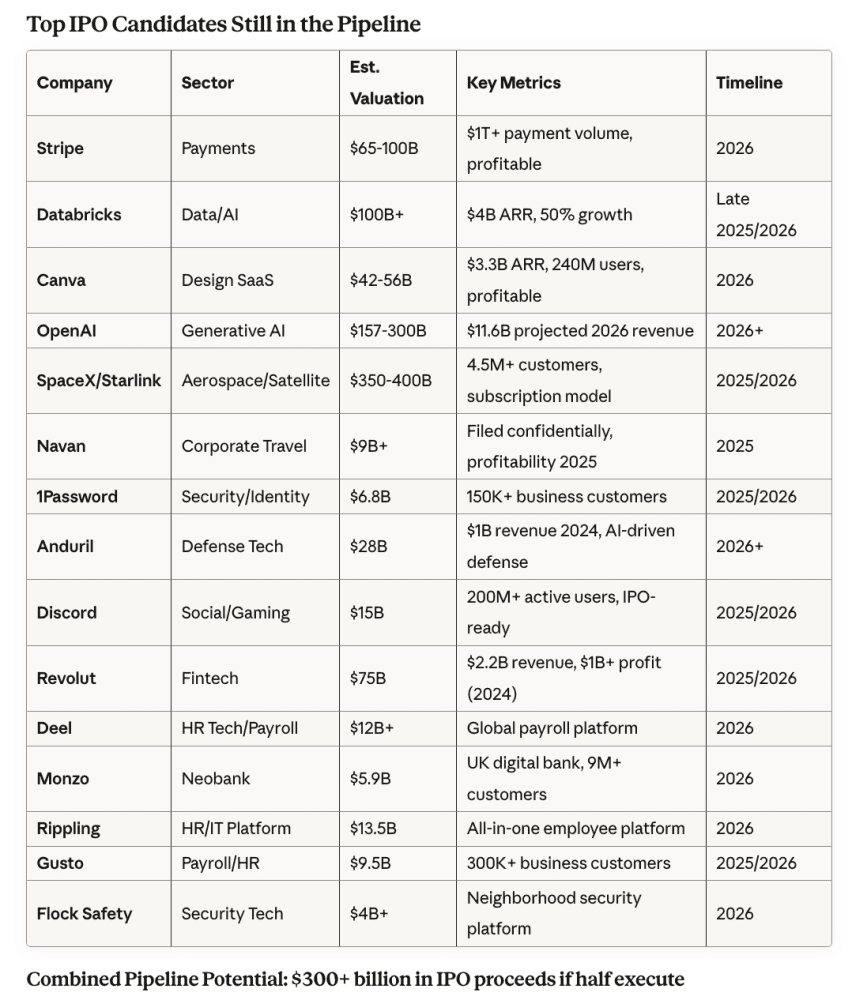

Stanford and Harvard still send grads into venture but operator backgrounds are rising in demand. With debt burdens growing, the MBA value for investors is less certain. [PitchBook]The Great IPO Reawakening 💰

September 2025 saw the busiest IPO wave since 2021, led by Klarna, StubHub, and Netskope. The market is rewarding scale, profitability, and disciplined valuations. [SaaStr]Is AI Really a Bubble 🫧

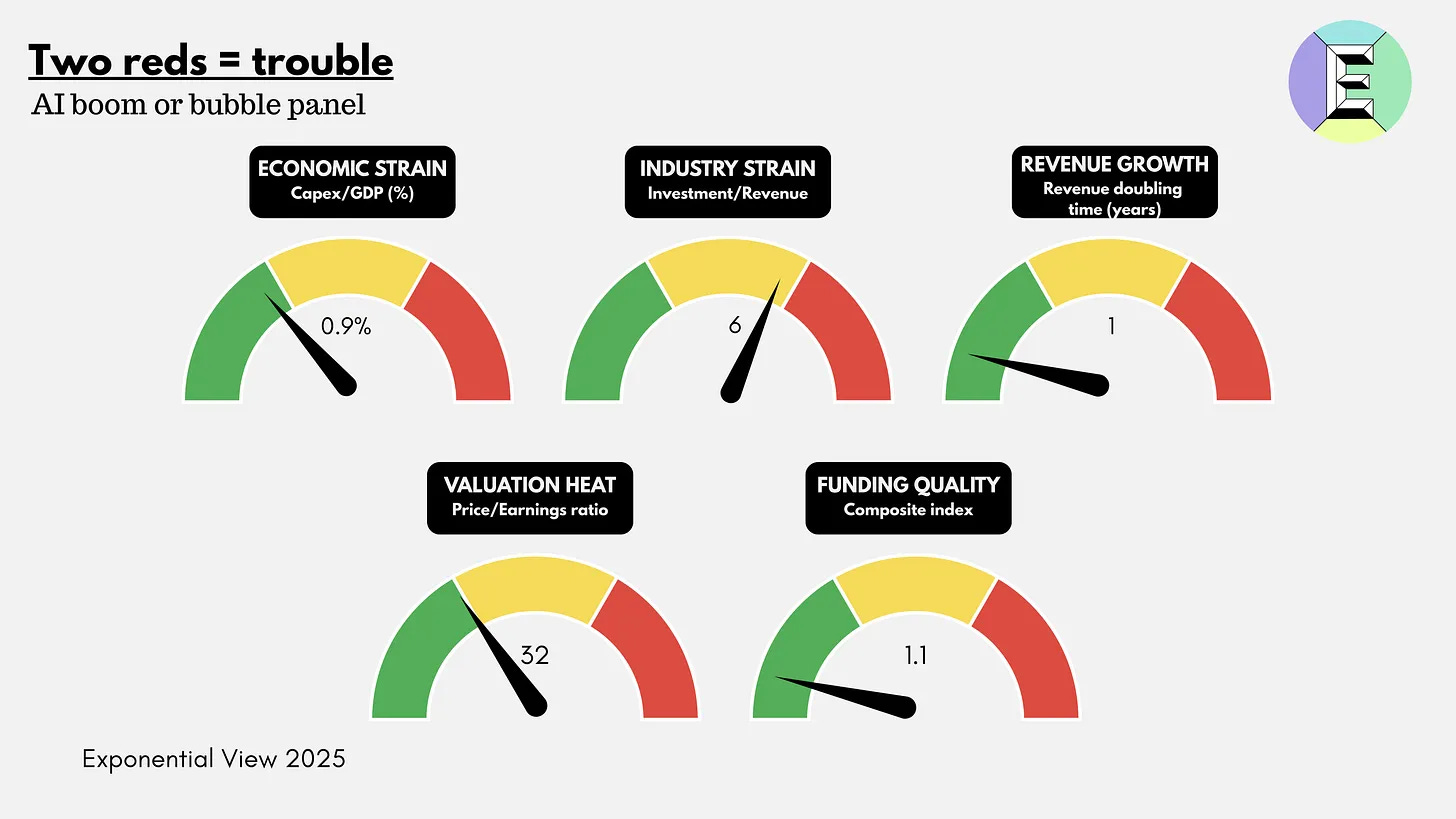

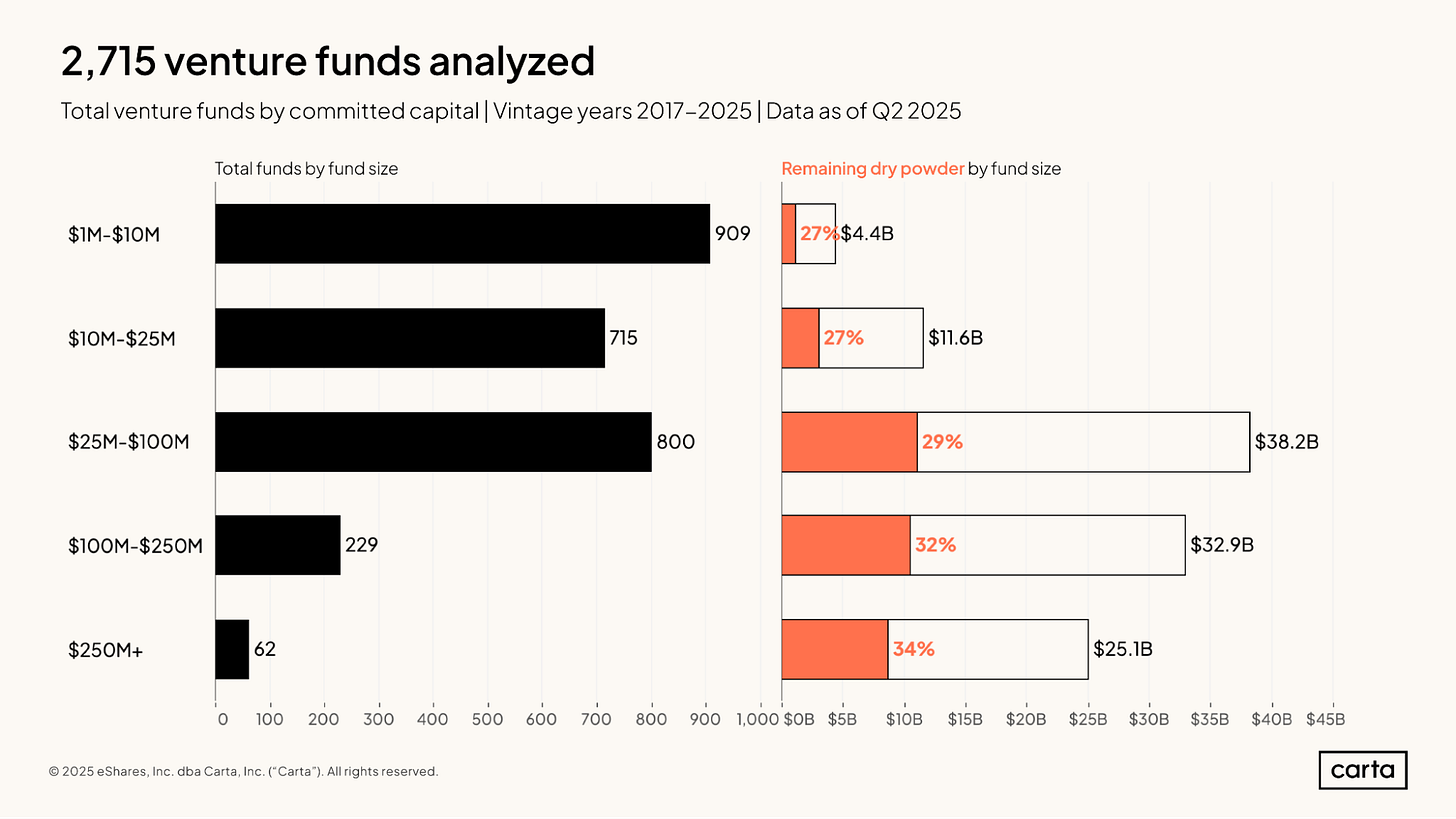

A new framework compares today’s boom with past bubbles across five measures of risk. Economic strain, returns, valuations, and funding quality reveal where AI stands. [Azeem Azhar and Nathan Warren]Optimism Creeps Back Into Emerging VC Funds 🌱

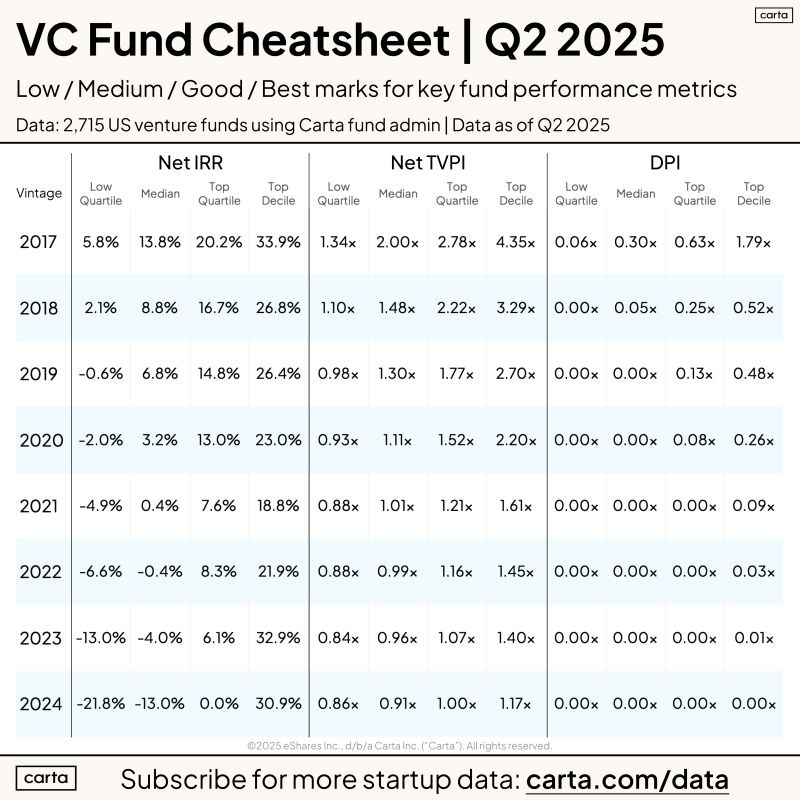

Carta data shows higher TVPI and IRR alongside bigger LP checks across tiers. Managers must balance early momentum with the reality of fast-depleting dry powder. [Peter Walker]Master Subscription Growth With Proven Forecasting 🧮

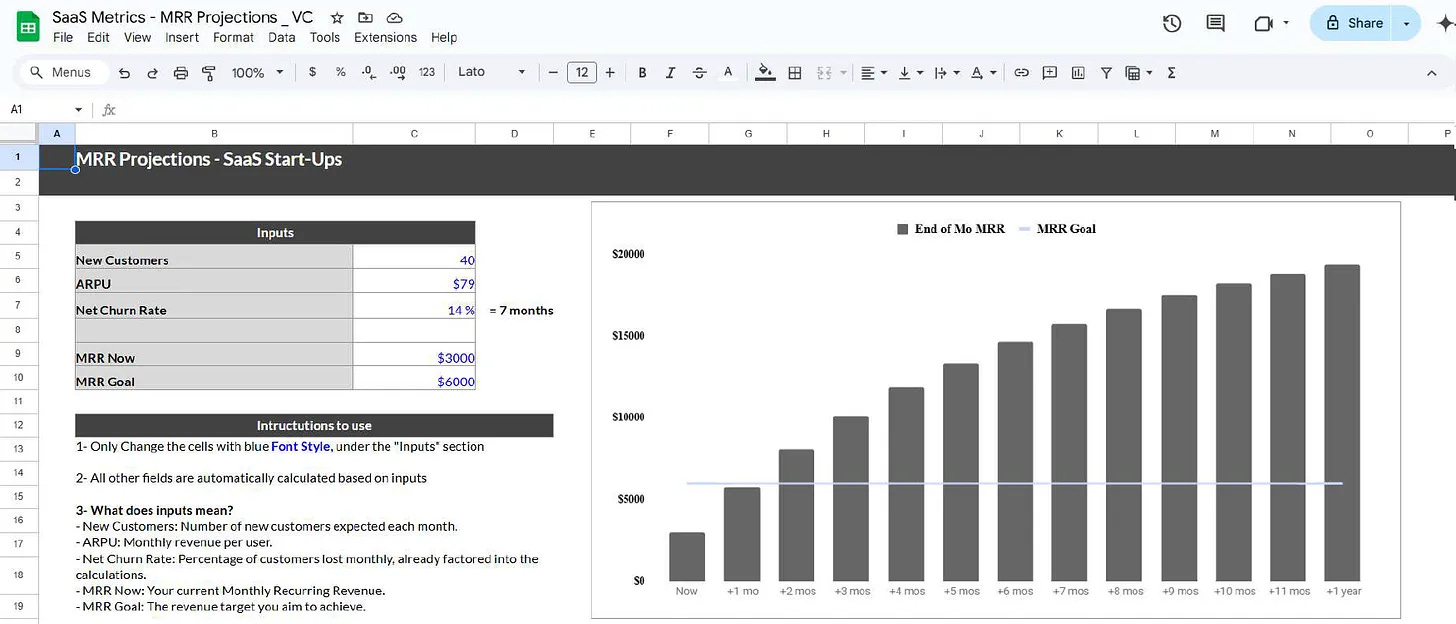

A founder-ready Excel model converts churn, ARPU, and new users into month-by-month revenue. Teams can pressure test hiring, pricing, and fundraising with clear numbers.

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

VC Fund Performance Report Q2 2025

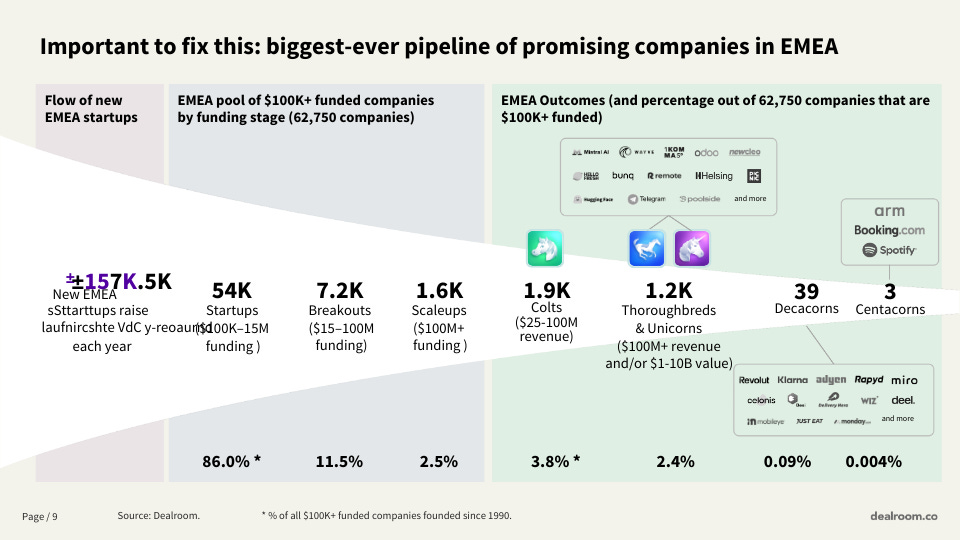

More funds are delivering capital back to LPs as DPI rises across 2017–2023 vintages. TVPI and IRRs climbed, LP check sizes grew, and dry powder fell with faster deployment.From Savings to Sovereignty: Europe’s Growth Challenge 🌍

European tech still leans on foreign investors while local pension funds avoid venture. Unlocking even part of that capital could drive innovation and secure long-term economic sovereignty.The Private Equity Benchmark Report 2025 📊

Data from 200+ firms shows how deal flow, origination, and engagement are shifting. Top-performing buyout funds stand out through sharper sourcing strategies and smarter capital deployment.

Recently Launched Funds 💸

Leonis Capital closed Fund II at $25M, continuing its focus on early-stage startups.

Touring Capital announced the close of Fund I at $330M, targeting global technology investments.

Simple Ventures raised $15M in funding, supporting its Toronto-based venture building model.

Archetype closed its third crypto fund at over $100M, doubling down on blockchain and Web3.

AZ-VC launched its second fund, aiming to back Arizona’s fast-growing startup ecosystem.

First Round Capital launching Fund X with a $500M target to keep backing the earliest-stage founders

Tribe Capital hit the $150M mark for its fourth AI-focused fund riding the wave of machine learning startups

Archetype closed Fund III at $100M doubling down on crypto and Web3 bets

Simple Ventures closed a $15M debut fund to fuel Canadian startups through its venture builder model

VastPoint Ventures debuted with a $22M fund to back startups coming out of Poland’s growing ecosystem

BNVT Capital launched a $150M debut fund focused on startups solving large-scale societal challenges

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Alumni Ventures (Menlo Park, USA): Principal (apply here)

Speedinvest (Berlin, Germany): Senior Associate (apply here)

Connecticut Innovations (Stamford, USA): Director (apply here)

Owl Ventures (San Francisco, USA & Europe): Associate (apply here)

Tech Square Ventures (Atlanta, USA): Associate (apply here)

First Round Capital (San Francisco, USA): Investor (apply here)

Chapter One Ventures (San Francisco, USA): Investor (apply here)

SET Ventures (Amsterdam, Netherlands): Internship (apply here)

Alumni Ventures (New York, USA): Investor Services & Operations Associate (apply here)

First Momentum Ventures (Munich, Germany): Manager (apply here)

Hottest Deals 💥

Lifeguard, secured $1.3M in seed funding. (read more)

AusperBio, raised $63M in Series B2 funding. (read more)

Brineworks, raised €6.8M in funding. (read more)

Cardless, raised $60M in Series C funding. (read more)

Salt AI, secured $10M in funding. (read more)

Curated For You, raised $8.3M in seed funding. (read more)

FREDsense, secured $7M in Series A funding. (read more)

BotCity, raised $12M in Series A funding. (read more)

Factory, secured $50M in Series B funding. (read more)

Yasp, raised $5M in seed funding. (read more)

Nscale, raised $1.1B in Series B funding. (read more)

Fetcherr, secured $42M in Series C funding. (read more)

Distyl AI, raised $175M at a $1.8B valuation. (read more)

Synthesized, secured $20M in Series A funding. (read more)

Ensoma, raised $53M in funding. (read more)

RESOURCES 🛠️

✅The Venture Capital Method: How Investors Really Value Startups

✅IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Looking for some a sales process? Try this framework instead of the traditional funnel:

https://open.substack.com/pub/engsales/p/from-funnels-to-flywheels?r=jhbvp&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Also, make sure you are focused on outcomes and not your features.

https://open.substack.com/pub/engsales/p/tft-stop-selling-featuresprescribe?r=jhbvp&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false