YC’s Fall 2025 RFS🤖, 2500 AI Angel Investors⚡, How VCs Decide to Take a 1st Meeting💼

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

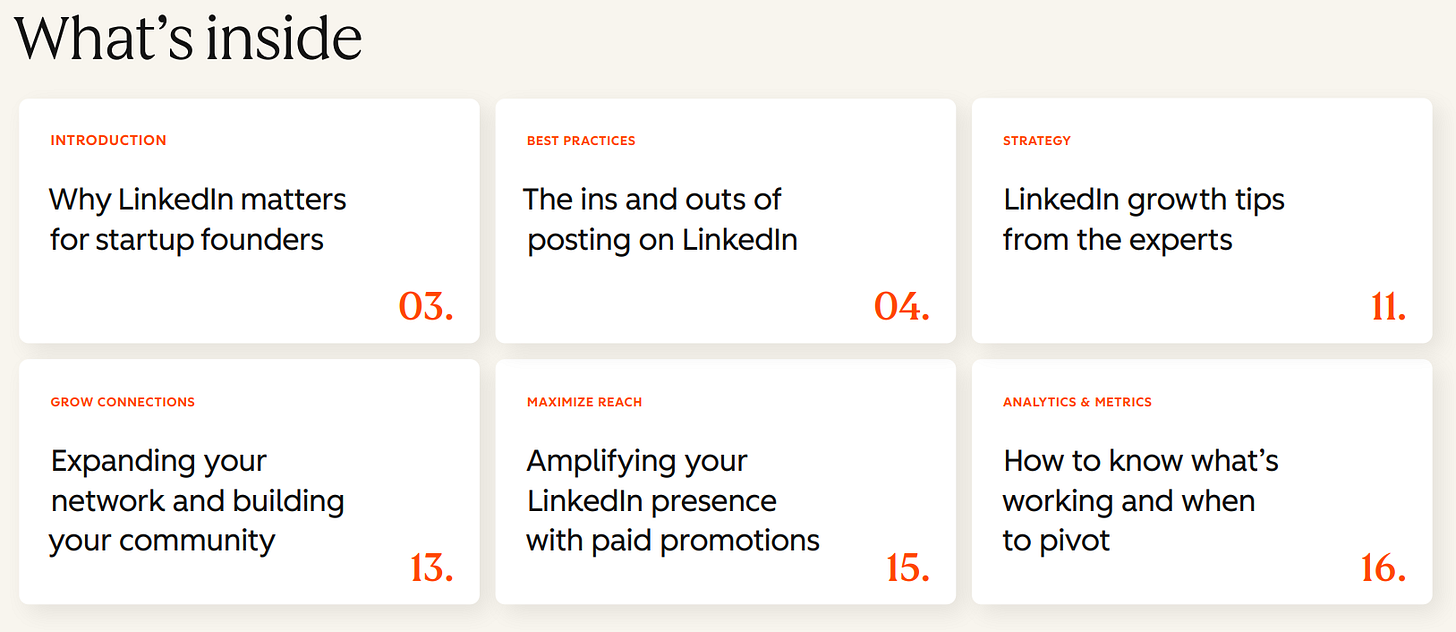

HubSpot for Startups just launched a LinkedIn Growth Playbook

It shows founders how to post with clarity, grow their network, learn from top creators, and understand what is actually working so you can adjust fast.

You also get 2 bonus tools:

▫️ A LinkedIn Analyzer that scans your last 100 posts and highlights your best hooks, themes, formats, and timing

▫️ A simple content checklist to plan consistently

If LinkedIn is part of your 2025 plan, this is worth downloading 👇

In-Depth Insights 🔍

YC’s Fall 2025 RFS: Where AI Is Ripe to Build 🤖

YC spotlights six build-now arenas, from agent infrastructure and AI-native enterprise workflows to workforce retraining, video generation, lean mega-companies, and automating public-sector consulting. The signal is that the experimental phase is over, and the edge goes to teams operationalizing AI into durable products and revenue. [The AI Corner]

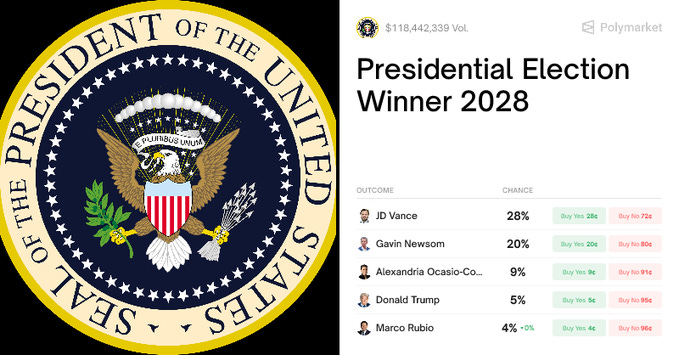

Trump Rises to 4th for 2028 Odds 📈

Prediction market pricing moved the former president into the fourth slot for winning the 2028 contest, reflecting a shift in participant expectations. Traders are weighing eligibility questions, party dynamics, and potential rule interpretations as the contract evolves.

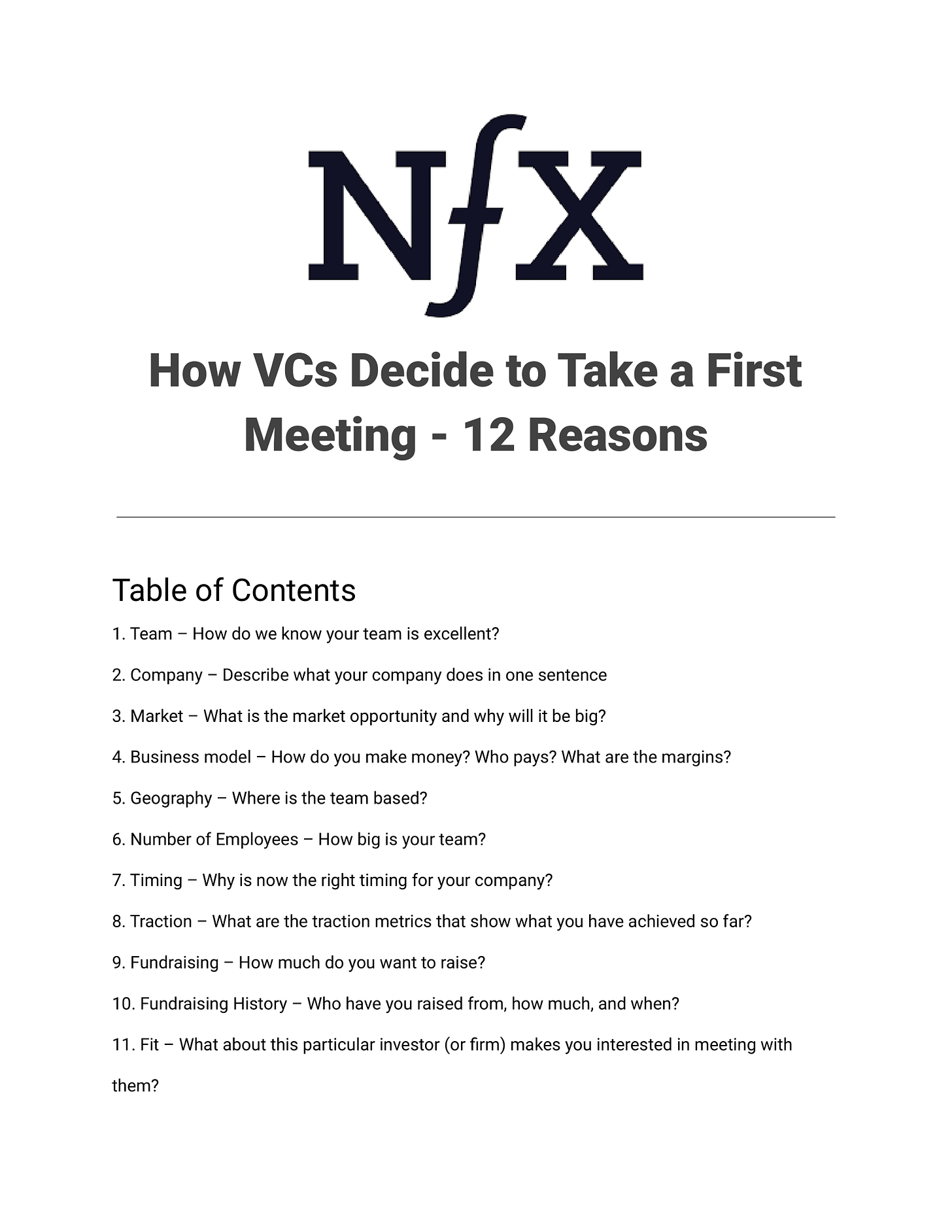

How VCs Decide to Take a First Meeting 💼

Investors triage intros by clarity, momentum, and fit, so use a crisp one-liner, tangible traction, and timing that maps to their thesis. Make the decision easy with specifics on market size, business model, team makeup, location, target raise, and a credible referral source. [Sahil S]

How to Be Creative (Without Taking Drugs) 🎨

George Mack shares 12 input switches, translate ideas across mediums, seek weird pre-2016 sources, isolate periodically, and lower pressure with “worst idea” sprints to spark original outputs. Tactics like “evil twin” thinking, timed question wheels, and off-hours focus help bypass mimicry and surface novel paths. [George Mack]

Founders and Investors Slam UK ‘Exit Tax’ Plans 💸

A rumored 20% levy on assets for wealthy founders relocating abroad has triggered pushback from operators and funds, citing competitiveness risks. Critics say the proposal could accelerate capital and talent flight just as the ecosystem seeks renewed growth. [tech.eu]

Tools 🧰

deel: The all-in-one HR tool. Bring the world to work starting with a Free Demo

Notion: work faster with your AI team, and get their FREE AI Kit:

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

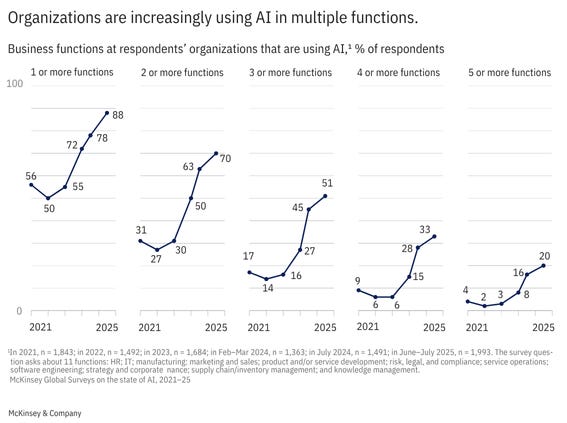

McKinsey’s State of AI 2025: Execution Over Hype 🤖

Most organizations remain in pilots while only a minority see enterprise-level impact, with leaders differentiating by redesigning workflows for measurable outcomes. Interest in agents is high and use-case benefits are real, but converting experiments into growth and EBIT still demands operational discipline and change management.Japan–Europe Tech Alliance Surges to €33B Since 2019 🌏

Cross-border capital is increasingly backing deep tech and applied intelligence, with the UK leading intake and a broad shift toward earlier-stage participation. Beyond big headline rounds, industrial partnerships across sectors are accelerating commercialization and ecosystem depth.

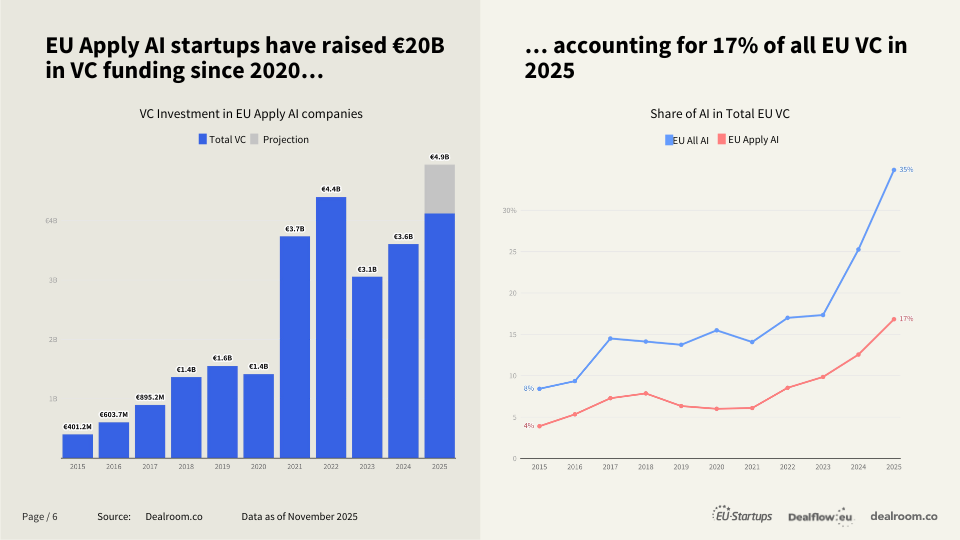

Startups Power Europe’s Applied AI Push 🚀

Thousands of young companies across strategic verticals are scaling solutions as public and private investment builds momentum in applications and open models. Capacity and sovereignty moves, such as investments in compute, aim to close gaps while nurturing industry-specific champions.

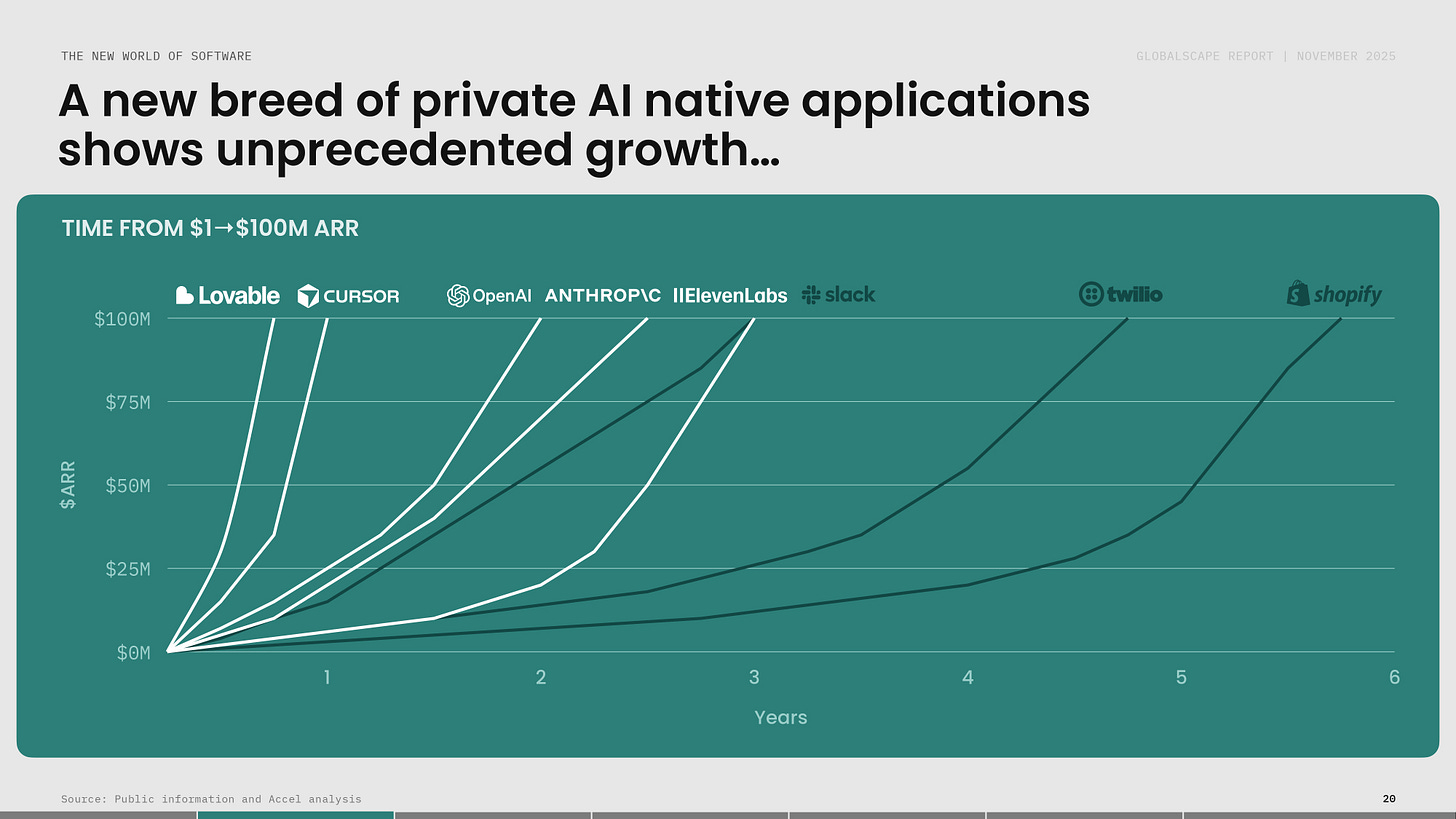

Accel Globalscape: AI Apps Fuel Record Funding⚡

Global capital is pouring into model builders and new software categories, with non-U.S. ecosystems closing the gap at the application layer. As agents and orchestration mature, the next wave of winners will be defined by speed to value, distribution advantage, and compute strategy.

Recently Launched Funds 💸

Glasswing Ventures just closed Fund III at $200M, doubling down on AI-first enterprise and cybersecurity startups across North America.

Step Fund kicked off with a $30M first close, eyeing early-stage tech ventures in emerging markets ready to scale.

Vendep Capital raised €80M for its fourth fund, to back the next wave of AI-era SaaS founders across Europe.

Backed VC locked in a $100M seed fund, reaffirming its mission to fuel bold early-stage founders in tech and science.

Quantum Exponential Group PLC launched a £100M fundraise, all-in on advancing the UK’s quantum tech ecosystem.

Activate Capital rolled out a AUD 50M fund, aiming to supercharge Canberra’s startup scene with innovation-driven bets.

Vendep Capital confirmed another €80M close, laser-focused on next-gen European SaaS founders building in the AI era.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Precursor Ventures (Remote): VC Internship (apply here)

Savano Capital Partners (Washington, DC): VC Associate (apply here)

Plug and Play (Sunnyvale, CA): VC Analyst (apply here)

Propel Venture Partners (San Francisco, CA): VC Associate (apply here)

YMCA (New York City, NY): Senior VC Associate (apply here)

Initio Capital (San Francisco, CA): VC Partner (apply here)

Cedars-Sinai (Los Angeles, CA): VC Analyst (apply here)

Working Capital Fund (San Francisco, CA): Senior VC Analyst (apply here)

Connecticut Innovations (New Haven, CT): VC Internship (apply here)

Signature Ventures (Aying, Germany): VC Internship (apply here)

Hottest Deals 💥

D-Matrix just landed a massive $275 M Series C, redefining AI chip architecture for a post-GPU era. (read more)

Majestic Labs raised $100 M to build the AI infrastructure every next-gen startup will want under the hood. (read more)

Sweet Security secured $75 M Series B to keep cloud stacks safe, fast, and yes, sweet. (read more)

Neros brought in $75 M Series B to supercharge enterprise data intelligence with serious AI horsepower. (read more)

Gamma raised $68 M Series B at a $2.1 B valuation, proving that storytelling still sells when powered by design. (read more)

House Rx filled a $55 M Series B to make specialty pharmacy operations less messy and more modern. (read more)

Attentive AI scored $30.5 M Series B to scale its AI-powered property intelligence engine. (read more)

Foxglove raised $40 M Series B to accelerate open-source robotics dev tools that keep engineers in the loop. (read more)

Fastbreak AI dropped $40 M Series A to level up sports analytics with machine learning precision. (read more)

1Mind secured $40 M to blend neuroscience and AI for cognitive tech that actually thinks. (read more)

Onramp fueled up with $15 M to smooth out fintech onboarding and compliance headaches. (read more)

Theo AI raised $10 M+ to build AI copilots that make context feel intuitive, not impossible. (read more)

Ladder Bio climbed with $5.5 M Series Seed to reimagine RNA therapy development. (read more)

Skycore Semiconductors raised €5 M Seed to build smarter, smaller, and faster chips for tomorrow’s devices. (read more)

Corun AI brought in $3.5 M Seed to turn data pipelines into decision-making machines. (read more)

RESOURCES 🛠️

✅ 350+ verified platforms where you can post your startup

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Hey Ruben! Thought you might find my latest piece interesting since you write about investing in companies building our future. A new Princeton study says enhanced geothermal could supply up to 20% of U.S. electricity by 2050, which could be huge for AI’s energy needs.

I profiled Tim Latimer, the founder making that a reality.

https://impactbuilders.substack.com/p/the-most-overlooked-solution-to-ais