12 Financial Models📊, Claude Opus 4.6🤖, AI Dominates🔥

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

PS. Massive win for this community.

I managed to secure something genuinely useful for founders reading this.

If you’re pre-seed or seed, Framer is giving one full year of Framer Pro free (worth $360)!

It’s the same tool many YC-backed teams use to ship a production-ready site in hours, without a dev team, and keep as they scale with CMS, analytics, and AI localization.

If you’ve been postponing your site or living on a half-baked landing page, this is a very good moment to fix it:

In-Depth Insights 🔍

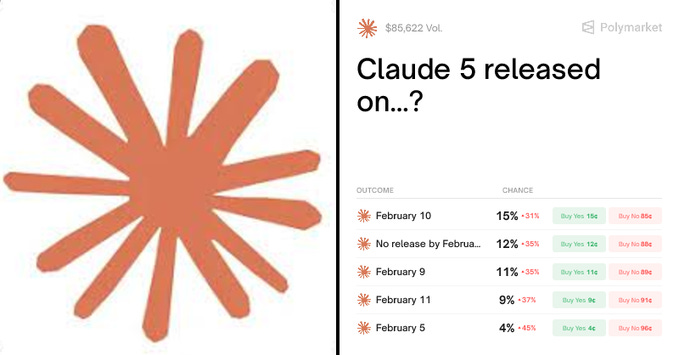

Claude 5 released on…?🎯

Prediction markets are assigning probabilities to release windows amid limited signals. The market predicts the new Claude model to be released on February 10th. [Polymarket]

12 Financial Models Founders Should Know Cold 📊

The collection covers valuation, dilution, cash flow, and unit economics in practical formats. These tools force numerical clarity before investors ever enter the room.

Claude Opus 4.6 Brings Adaptive Effort to Knowledge Work 🤖

The model dynamically adjusts reasoning depth based on task difficulty instead of treating all prompts equally. It sustains long research, coding, and analysis workflows without losing coherence across massive contexts.Free AI Hiring Kit for Founders. 🎁 get it here 🎁

A complete recruiting system trained on frameworks from a16z, Sequoia, and YC. It helps you hire your first engineers, operators, or GTM roles without having to invent a recruiting process from scratch.

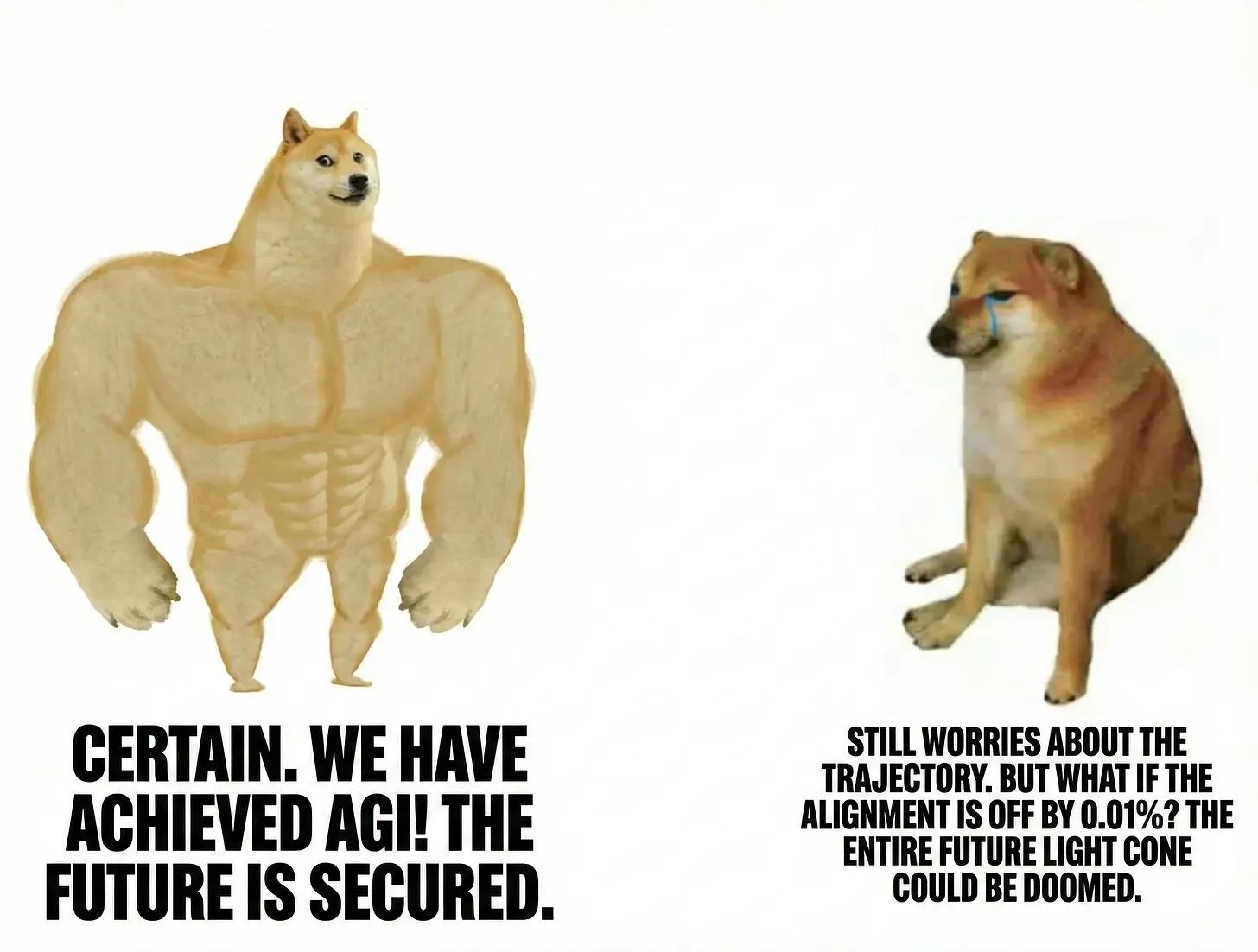

AI’s Biggest Risk Is Certainty Racing Ahead of Reality ⚠️

Confidence is solidifying faster than evidence while real capabilities advance unevenly. Capital and decisions are locking in around belief systems rather than demonstrated performance.YC Spring 2026 Reveals 70 AI-First Startup Directions 💡

Most priorities focus on replacing coordination-heavy human work with autonomous systems. The breakdown offers concrete angles across finance, government, industry, and AI-native services.The AI Adoption Gap Keeps Stretching ⚡

Top builders are quietly embedding AI into daily workflows while others wait for clarity. Execution compounds through small systems, not by consuming endless commentary.Patient Capital Is Reshaping the Future of Venture ⏳

Traditional fund timelines no longer match the reality of delayed liquidity.

Long-duration capital structures are emerging as exits become optional rather than required. [Will Manidis]

Tools 🧰

Free year (save $360) on Framer so you can launch a production-ready site

ISO 27001 Free compliance checklist by Vanta

20% Lovable discount for my audience

Attio, the CRM used by both startups and VCs (including me). Try it for free here

$1,000 off on your compliance, use it for ISO 27001 and SOC 2

📢 Want to get in front of +500k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn (290k followers), email: sponsorsthecorners@gmail.com

Interesting Reports 📊

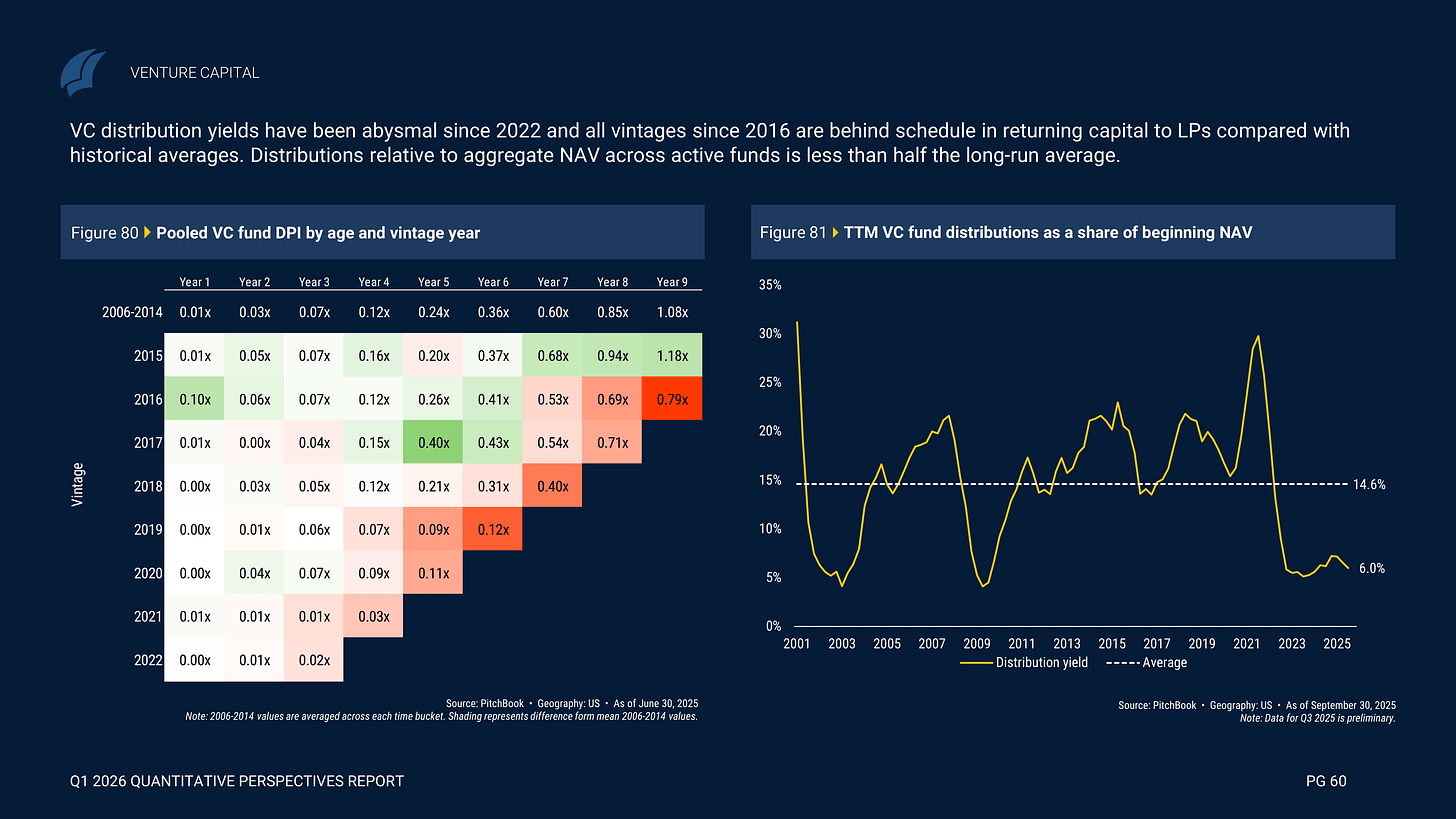

Private Markets Push Forward While Liquidity Stays Tight ⚠️

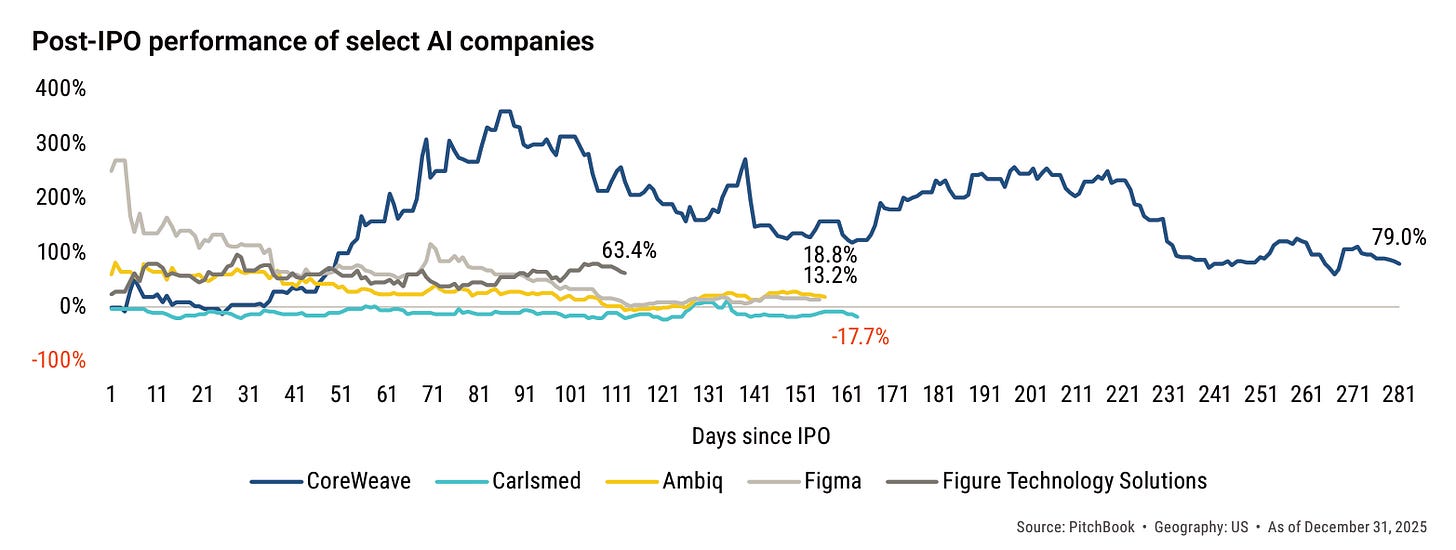

Deal activity and exits picked up in 2025 despite tariff shocks and shifting macro signals. LP cash returns lag badly, forcing heavier reliance on secondaries to free trapped capital. [PitchBook]2026 Sets the Test for Venture’s Locked Trillions 🦄

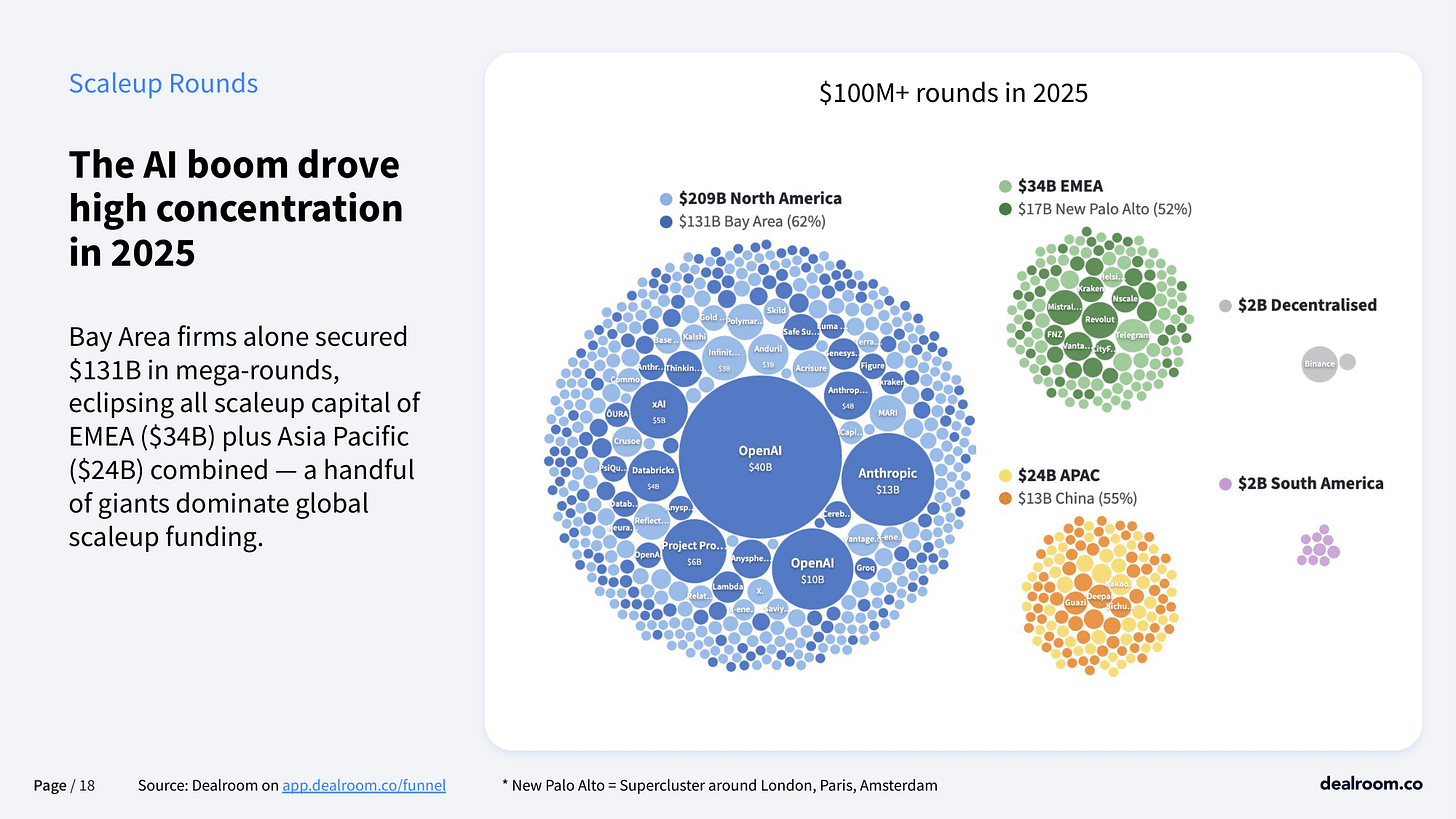

IPO momentum improved but remains far too small to unwind years of accumulated value. A handful of blockbuster listings could reset fundraising or deepen LP pullback. [PitchBook]AI Dominates as Global Venture Capital Concentrates 🤖

Investment rebounded sharply but flowed to fewer winners and larger rounds.

Liquidity improved through M&A, yet the exit backlog still dwarfs public market capacity. [PitchBook]

Recently Launched Funds 💸

2048 Ventures closed its third fund at $82M to double down on early-stage investments across emerging tech sectors.

Metavallon VC launched a €5M “Brain Gain” fund aimed at backing founders and talent returning to build in the region.

Zoho VC secured a €7M first close for its inaugural fund, focused on supporting early-stage technology startups.

Seedspeed Ventures closed its third fund at €90M to scale investments in high-growth startups across Europe.

Snak Venture Partners raised $50M for its inaugural fund, targeting early-stage opportunities in consumer and technology sectors.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

Chingona Ventures (Chicago, IL): Associate / Senior Associate (apply here)

Amex Ventures (New York or San Francisco): Enterprise Software Investment Manager (apply here)

Leonis Capital (San Francisco, CA): Full-Time VC Associate (Hire Partner Track) (apply here)

Foundation Capital (San Francisco or Palo Alto, CA): Business Development Manager (apply here)

Playfair (London, England): Visiting Analyst 2026 (apply here)

Overlap Holdings (San Francisco, CA): Investment Associate (apply here)

Reciprocal Ventures (New York City, NY): VC Associate (apply here)

Village Global Office of Reid Hoffman (Remote): Head of Comms (apply here)

6MV (Remote): Investment Team (apply here)

Mento VC (Remote): Investor Associate (apply here)

Hottest Deals 💥

Bedrock Robotics, raised $270M in Series B funding to advance autonomous construction robotics. (read more)

Fundamental, raised $255M in Series A funding to scale its industrial technology platform. (read more)

Lunar Energy, raised $232M across Series C and Series D rounds to expand its clean energy storage systems. (read more)

Positron AI, raised $230M in Series B funding to accelerate AI compute infrastructure development. (read more)

Goodfire, raised $150M in Series B funding to scale AI safety and interpretability research. (read more)

Kindred, raised $125M to expand its AI-powered robotics and automation platform. (read more)

Machina Labs, raised $124M in Series C funding to scale AI-driven manufacturing technology. (read more)

Overland AI, raised $100M to advance autonomous navigation for off-road and defense vehicles. (read more)

SynthBee, raised $100M to scale its AI-powered synthetic biology platform. (read more)

Newcleo, raised $85M to support next-generation nuclear energy development. (read more)

Connect Music, raised $80M to grow its music rights and royalty infrastructure. (read more)

Accrual, raised $75M to expand its accounting and financial operations platform. (read more)

Fieldguide, raised $75M in Series C funding to scale audit and assurance automation. (read more)

Osmo, raised $70M in Series B funding to expand digital scent technology. (read more)

Urban SDK, raised $65M in growth funding to scale urban mobility and transportation analytics. (read more)

RESOURCES 🛠️

access all for the next year with a 50% limited discount

The Cash Runway Model Every Founder Needs

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox