AI or Nothing💸, Replit founder on How to Keep Winning 💪, AI Superintelligence Bans⚔️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta:

🔒 Startup-friendly security, no spreadsheets required

Third-party vendors can introduce security risks—but managing them doesn’t have to slow you down.

Join Vanta’s live demo to learn how startups use Vanta’s Vendor Risk Management to assess vendors faster, reduce risk, and keep moving.

📅 November 5 at 11am GMT

In-Depth Insights 🔍

Breaking: US–Venezuela Conflict Likely in 2025 ⚠️

United States now projected to go to war with Venezuela this year. 62% chance. The standoff raises major risks for energy markets, trade, and regional stability. [Polymarket]

AI or Nothing: The VC Funding Divide of 2025 💸

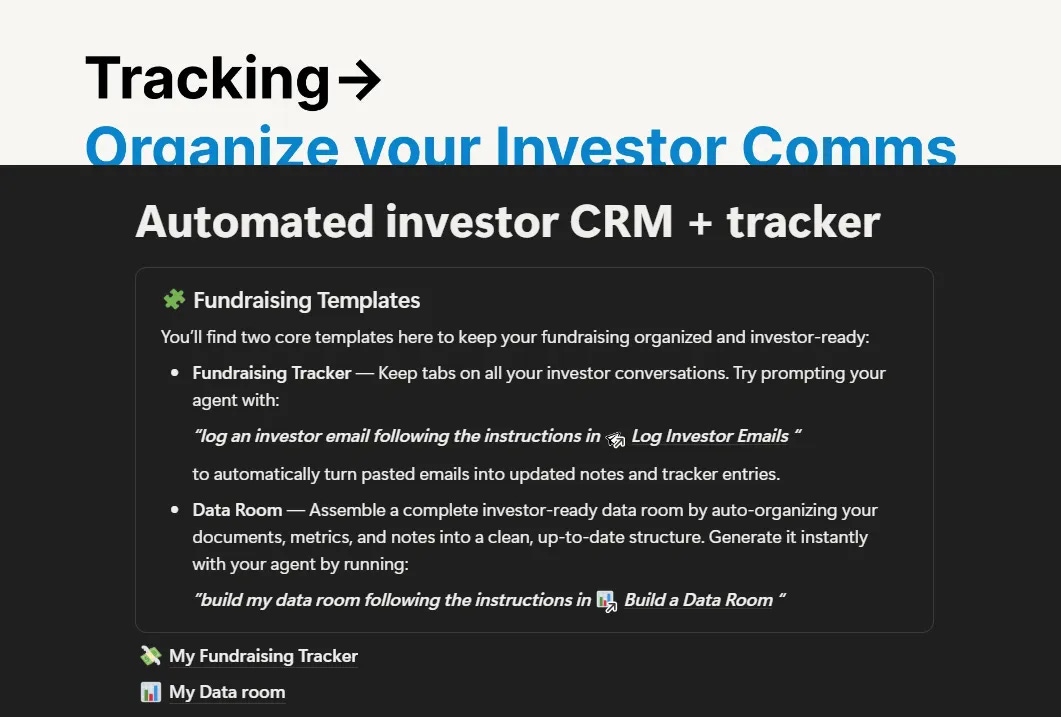

AI startups now take more than half of global venture capital, pulling in $192.7B so far this year, or 62.7% of U.S. VC funding. Non-AI founders are running dry as total startup count drops from 4,430 in 2022 to just 823, marking a clear “AI or bust” cycle. [Yahoo Finance]The Free AI Fundraising Kit for Founders 🤖

A Notion-based system to manage your raise, track investors, and automate outreach. It helps founders spend less time chasing capital and more time building.The First On-Chain Yield Engine for Everyone 🏦

Figure Markets’ Democratized Prime brings institutional-grade credit yields to retail investors through the Provenance Blockchain. It connects wallets directly to verified borrowers, offering real yield with transparency and no middlemen.Palantir CEO on AI Superintelligence Bans ⚔️

Alex Karp warns that restricting U.S. AI progress would hand influence to global rivals. He argues that America must build and govern AI leadership or risk importing both foreign tech and ideology.How to Keep Winning 💪

Replit CEO on 6 lessons on endurance, focus, and resilience from years of competing and refusing to lose. Progress compounds through clarity and consistency, not shortcuts or hype. [Amjad Masad]A16z Turns Venture Capital into a Network Effect Machine 🌐

David Booth joins Andreessen Horowitz as Partner and Head of Ecosystem to scale venture capital through connectivity. The firm is turning relationships into infrastructure, building a network designed to compound advantage over time. [David Booth]

Tools 🧰

Attio: the CRM built for startups and VCs (like me). Try it for FREE here

Harmonic: the AI agent made for VCs, then finds the startups that best fit your thesis and ranks them by relevance

live demo to learn how startups use Vanta’s Vendor Risk Management

Notion: work faster with your AI team

get compliant with Delve

build you website with Framer and their FREE full year Launch Plan

Carta - discover how VCs evaluate funds in their Q2 2025 VC Fund Performance Report

Kalshi - Prediction Market for Trading the Future

hire a world-class executive assistant for $3,000/month with Oceans

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

Perplexity’s Ultimate AI Playbook 🤖

A behind-the-scenes look at how Perplexity’s team uses AI for research, meeting prep, and creative problem-solving. The guide focuses on precision and workflows that turn curiosity into clarity and execution. [Awais Khan]Sequoia’s Pitch Deck Blueprint 💼

A step-by-step framework behind iconic raises from Airbnb, YouTube, and PayPal. It helps founders build decks that communicate vision, traction, and strategy with investor-level sharpness.

Recently Launched Funds 💸

Burnt Island Ventures closed Fund II at $50M to back early-stage water innovation startups.

Polaris Partners aims to raise $500M for its 11th fund, continuing its focus on healthcare and tech.

HighVista Strategies closed a $270M venture capital fund to invest in early-stage and growth opportunities.

BoxGroup closed two new funds totaling $550M to double down on pre-seed and seed investments.

MTX Group launched MTX Ventures, a new fund to support AI, cloud, and public-sector innovation.

Lifeline Ventures introduced €400M Fund VI to invest in bold early-stage founders across Europe.

Asymmetric Capital Partners closed Fund II at $137M to continue backing frontier tech and infrastructure plays.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Investing?

THESE are the companies raising right now

VC Jobs 💼

H/L Ventures (Remote): VC Fellowship (apply here)

Amex Ventures (New York City, NY): VC Manager (apply here)

Unity Growth (Washington, DC): VC Partner (apply here)

BDC (Toronto, Canada): Associate / VC Principal (apply here)

Lightbank (Chicago, IL): VC Associate (apply here)

Curiosity VC (Amsterdam, Netherlands): VC Principal (apply here)

FinTech (Remote): VC Analyst (apply here)

Primo Capital (Milan, Italy): VC Analyst (apply here)

Flare Capital Partners (Remote): VC Internship (apply here)

Caltech (Los Angeles, CA): Senior VC Associate (apply here)

Hottest Deals 💥

Neolix, raised over USD $600M in Series D funding. (read more)

CipherOwl, raised $15M in seed funding. (read more)

UnifyApps, raised $50M in Series B funding. (read more)

Elevara Medicines, raised $70M in Series A funding. (read more)

ENA Respiratory, raised US$22.4M in Series B financing. (read more)

Arbor Energy, raised $55M in Series A funding. (read more)

ChipAgents, raised $21M in Series A funding. (read more)

Bronto, raised $14M in seed funding. (read more)

Pleopharma, closed $36M in Series B financing. (read more)

Defakto, secured $30.75M in Series B funding. (read more)

Moniepoint, raised over US$200M in Series C funding. (read more)

Logic, raised $4.3M in seed funding. (read more)

Andel, raised $4.5M in funding. (read more)

Adsgency, raised $12M in seed funding. (read more)

Entry, raised $1M in pre-seed funding. (read more)

RESOURCES 🛠️

✅ Synthesia’s deck (got them $180M)

✅ FREE AI Fundraising Kit for founders

✅ 129 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Great recap thanks! Saturday is great time to see what happens each week.