Applied Intuition’s $15B Blueprint🚗, 2,500 Verified AI & SaaS Angels👼, Bitcoin Crash⚠️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Attio

Here’s my 3-step playbook to uncover hidden deal flow

Sign up for Attio, the AI CRM. Connect your email and calendar - it takes <3 minutes.

Watch Attio map your network, track portfolio companies, and qualify LPs.

Filter by sector, stage, geography, or any deal criteria that matters to you.

In no time you’ll have a list of qualified intros and portfolio insights you didn’t realize you had.

Ready to move faster?

In-Depth Insights 🔍

Microsoft’s $281B Single-Customer AI Gamble 🤖

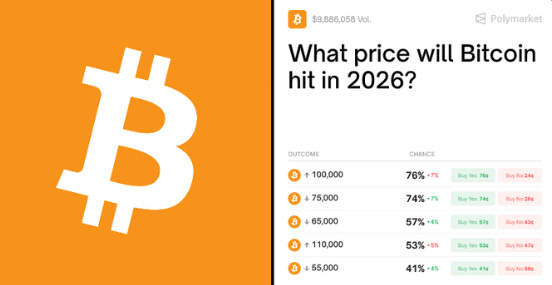

Microsoft’s Azure revenue surged 39 percent to $32.9 billion this quarter, but OpenAI alone represents $281 billion of the $625 billion commercial backlog. The company faces concentrated risk as AI demand outpaces infrastructure and capacity constraints grow through year-end. [Tomasz Tunguz]Bitcoin Crash More Likely Than Rally to $120K ⚠️

Polymarket odds show Bitcoin is more likely to fall below $55,000 in 2026 than reach $120,000.

Free AI Hiring Kit Packages a16z, Sequoia & YC Frameworks Into Notion 🎯

The VC Corner and Notion released a free AI-powered hiring kit with templates, scorecards, and trackers. It integrates frameworks from top VCs and prevents founders from making costly early-stage hiring mistakes.

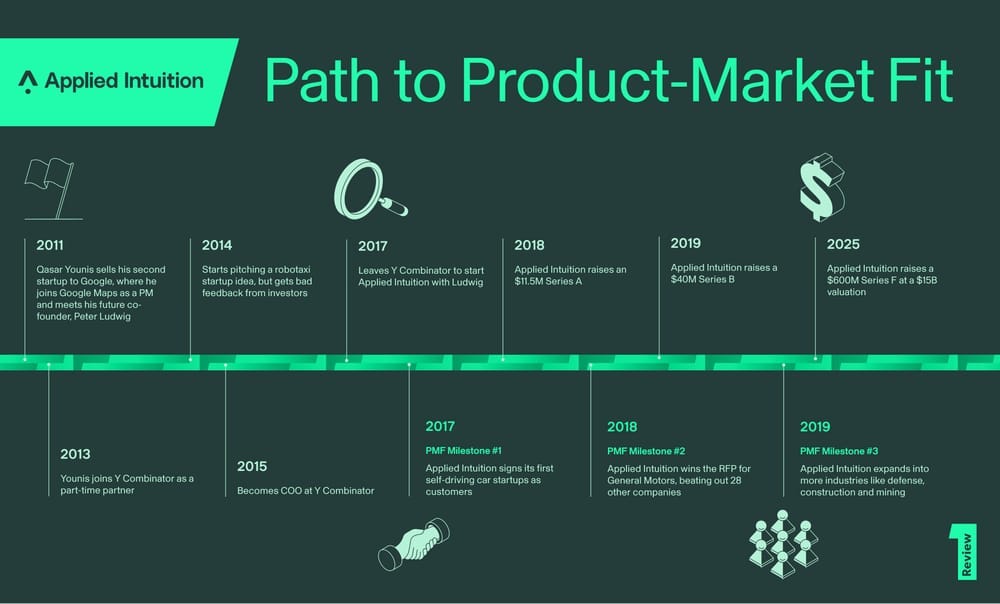

Applied Intuition’s $15B Blueprint: From Auto Worker’s Son to Physical AI Leader 🚗

Qasar Younis built Applied Intuition into a $15B company serving 18 of the top 20 automakers. The firm went multi-product within a year, won GM in an RFP, and preserved capital while rewarding long-term equity over inflated salaries. [FirstRound]2,500 Verified AI & SaaS Angels: The List That Cuts Fundraising From 6 Months to 6 Weeks 👼

The AI Corner compiled a global database of 2,500+ angels who invest in AI and SaaS startups. Founders report closing checks in weeks instead of months, leveraging warm intros and urgency to accelerate fundraising.

AI’s Adolescence: Dario Amodei’s Battle Plan Against Five Existential Threats 🛡️

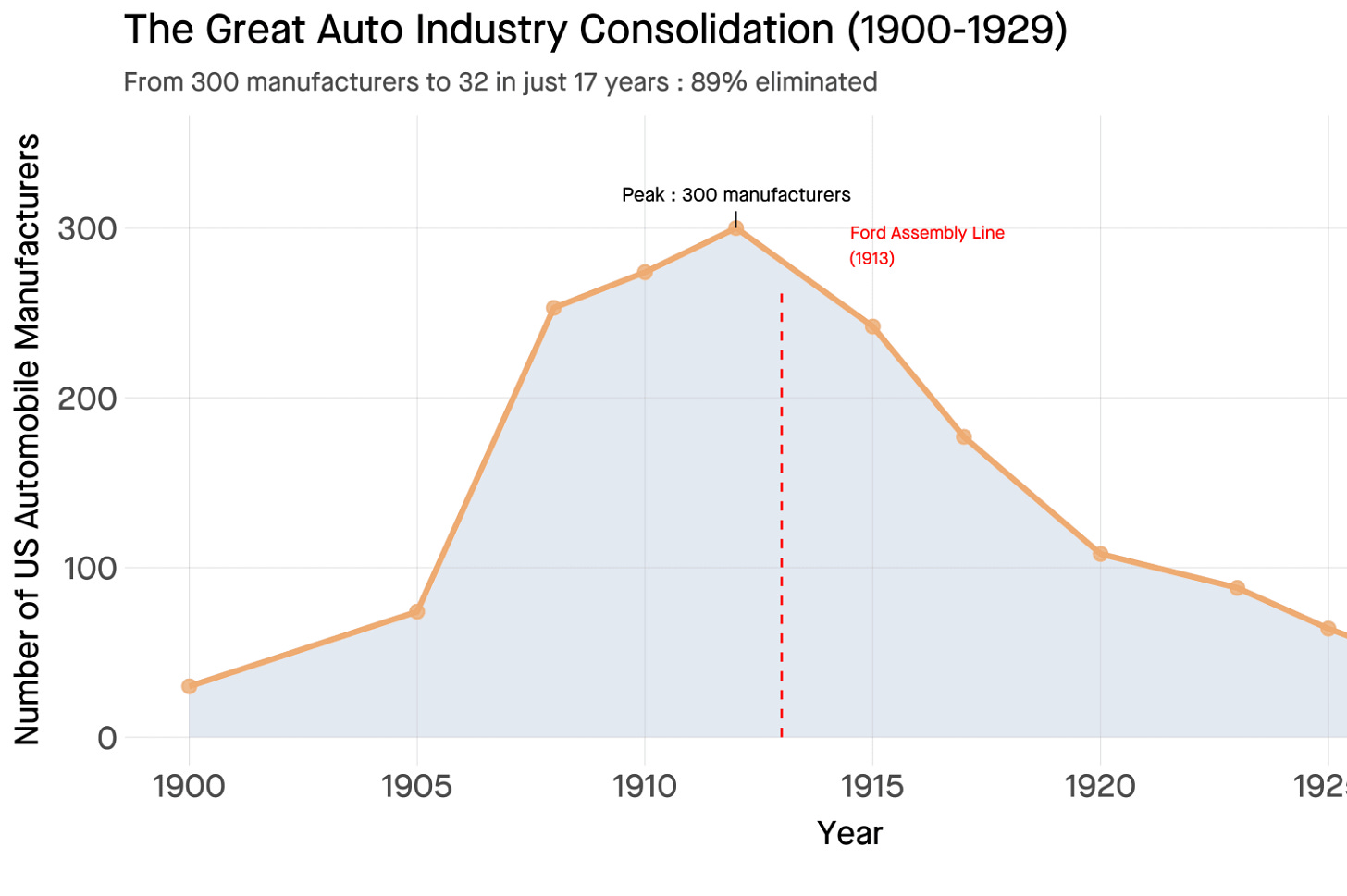

Anthropic CEO Dario Amodei warns that AI could trigger rebellion, bioterrorism, authoritarian takeover, mass unemployment, and destabilizing scientific leaps. His strategy combines Constitutional AI, interpretability, transparency laws, export controls, and progressive taxation. [Dario Amodei]AI's Assembly Line Moment: Why 83% Consolidation Won't Happen This Time 🏭

The auto industry consolidated sharply after Ford’s assembly line forced efficiency and crushed competitors, collapsing hundreds of manufacturers. AI coding assistants deliver similar 55-81% productivity gains but democratize access, letting any developer build at scale and driving new software businesses and supporting jobs. [Tomasz Tunguz]

AGI Arrived in 2026: Sequoia Declares Long-Horizon Agents Cross the Threshold 🎯

Sequoia defines AGI as the ability to figure things out using pre-training, inference reasoning, and long-horizon agents. Claude Code and similar tools nowfunction as all-day specialists in medicine, law, cybersecurity, and recruiting. [Sequoia]

Gates Foundation and OpenAI Launch Horizon1000 to Bring AI Healthcare to Africa 🏥

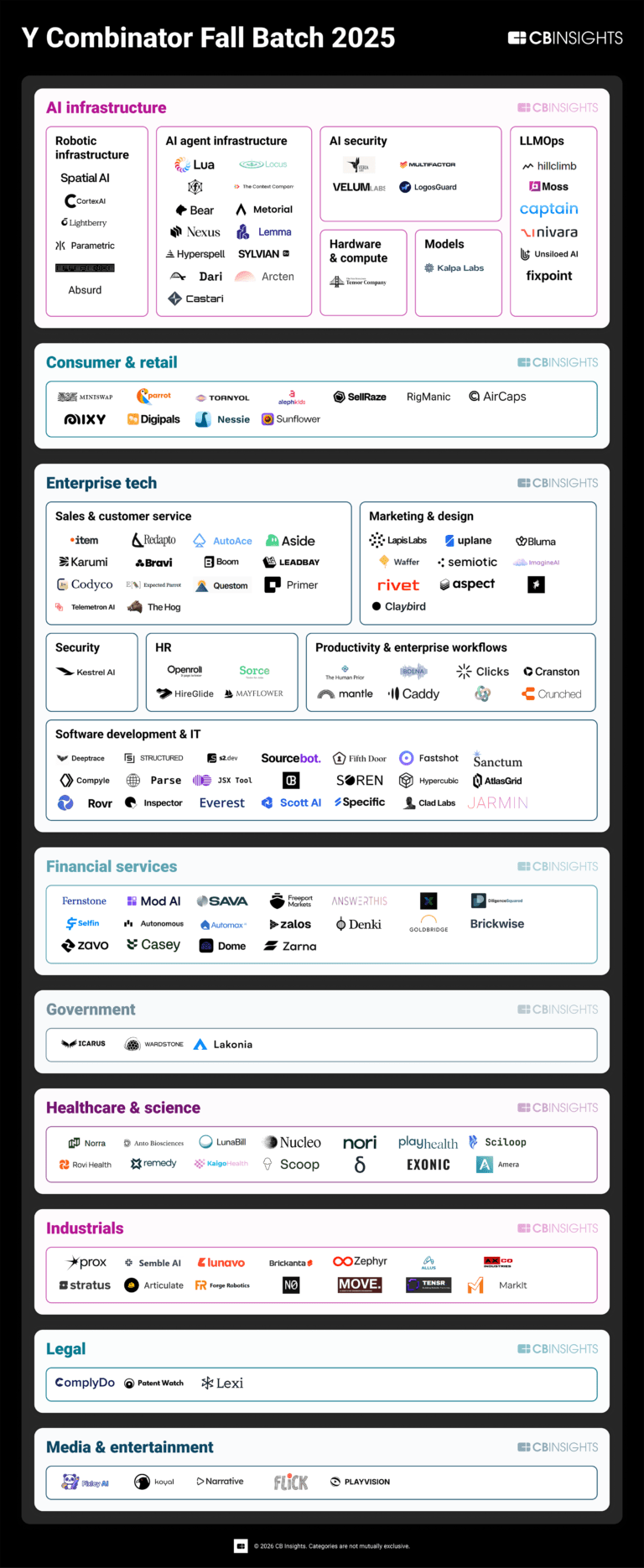

The $50 million initiative will roll out AI tools across 1,000 clinics in Africa by 2028, beginning in Rwanda. The program supports health workers with transcription, clinical guidance, and administrative automation to address a 6 million worker shortage. [Gates Notes]Y Combinator’s Fall 2025: The Infrastructure Layer Becomes the Battleground 🏗️

92 percent of the Fall 2025 batch uses AI, shifting the focus to building agent infrastructure for deployment and scale. Startups prioritize memory systems, physics simulations, workflow-specific coding tools, and end-to-end agent solutions. [CB Insights]

Tools 🧰

Free year (save $360) on Framer so you can launch a production-ready site

ISO 27001 Free compliance checklist by Vanta

20% Lovable discount for my audience

Attio, the CRM used by both startups and VCs (including me). Try it for free here

$1,000 off on your compliance, use it for ISO 27001 and SOC 2

📢 Want to get in front of +500k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn (290k followers), email: sponsorsthecorners@gmail.com

Interesting Reports 📊

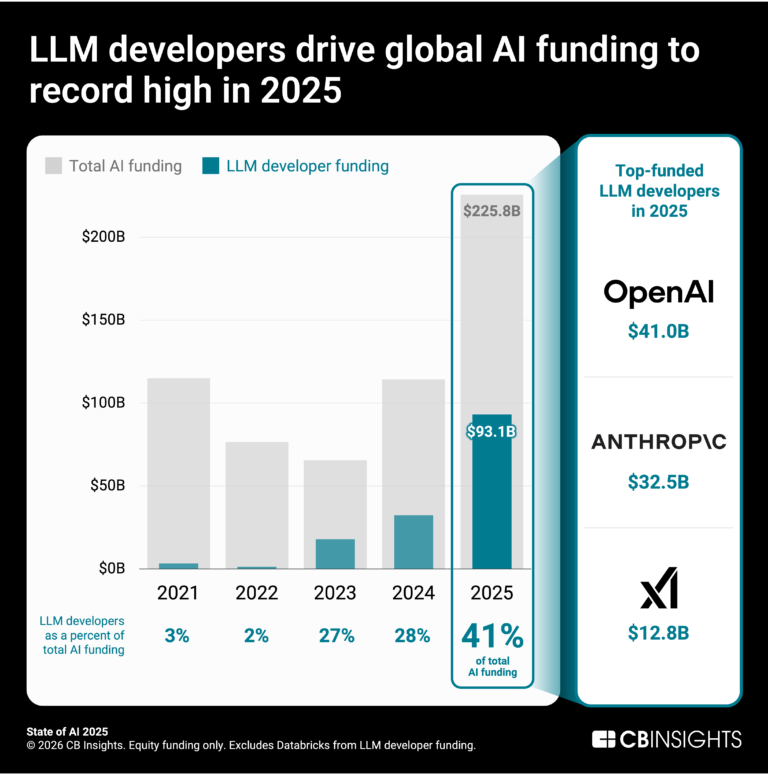

AI Venture Funding Hits Record $225.8B in 2025 Despite Deal Activity Decline 💰

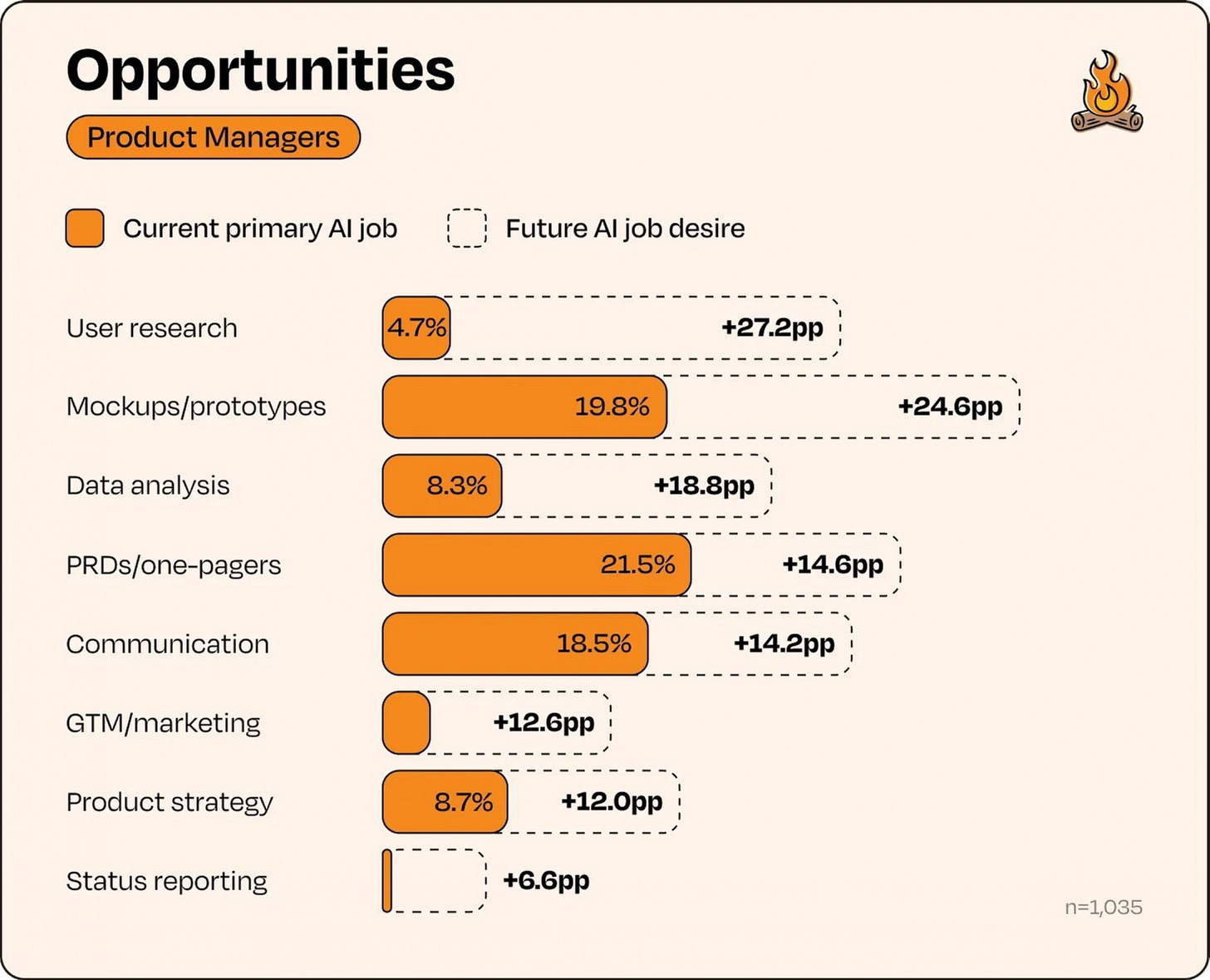

AI companies raised unprecedented capital in 2025 with mega-rounds making up 79 percent of total investment. OpenAI, Anthropic, and xAI captured 38 percent of funding while M&A surged with 782 acquisitions, led by robotics and corporate AI agent initiatives. [CB Insights]Product Teams Seek AI for Research and Strategy, Not Just Execution Tasks 🔍💡

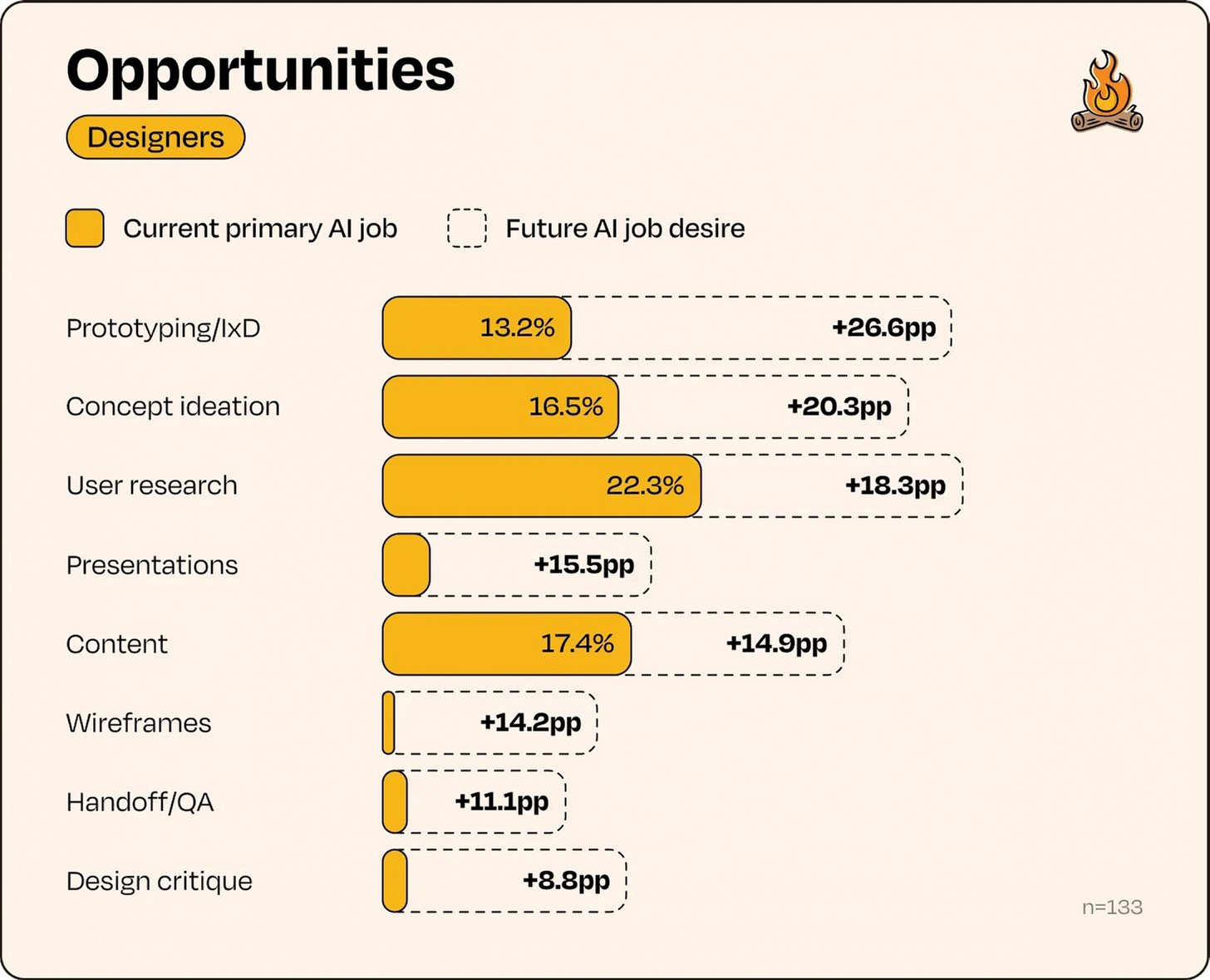

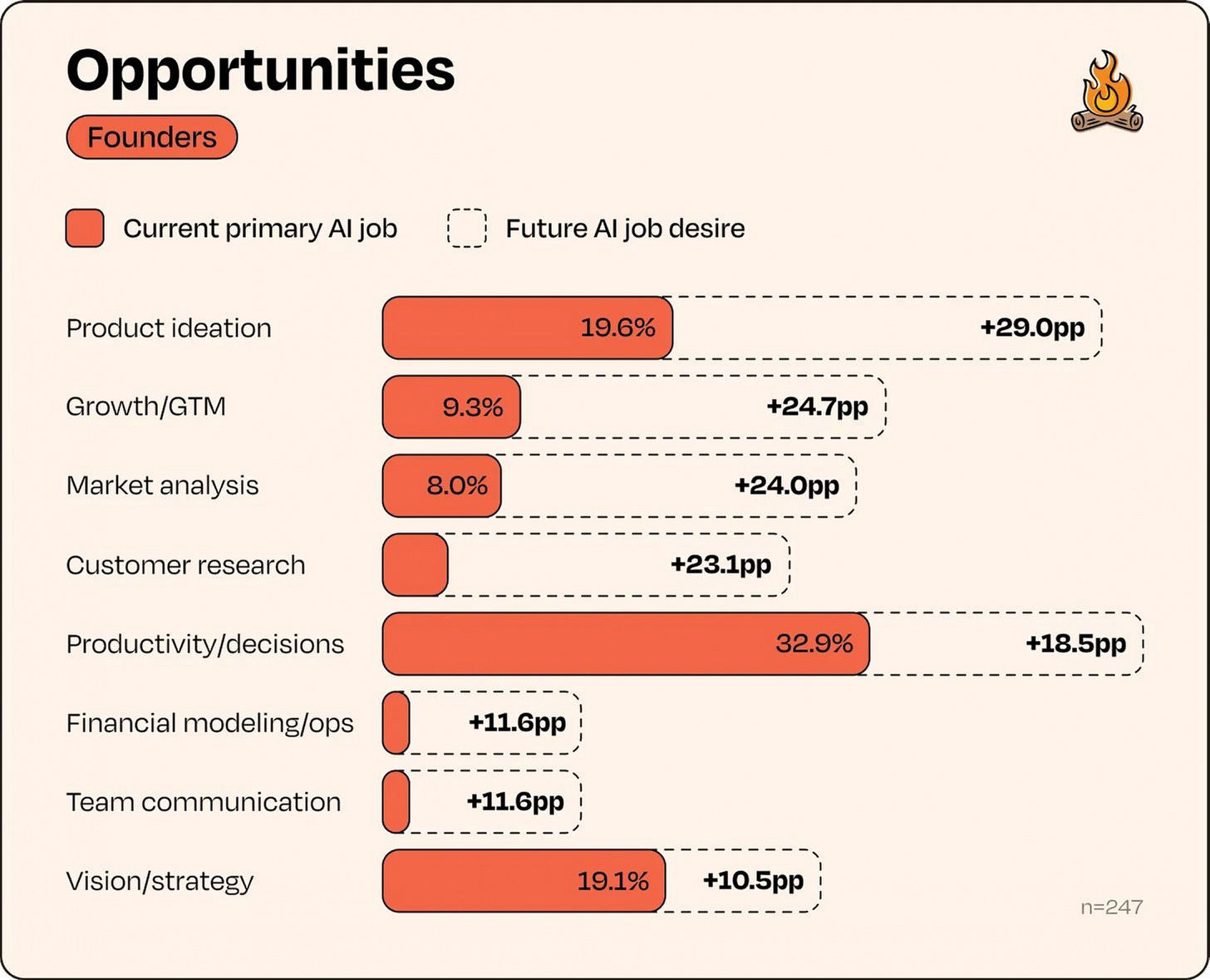

A survey of 1,750 tech professionals shows product managers want AI for research and founders want it for ideation, revealing a major gap in strategic applications. Engineers are shifting from coding to documentation, code review, and testing automation to make AI a thinking partner. [Lenny Rachitsky]High-Quality Prompts Separate AI Users From AI Multipliers in Startup Operations ⚡

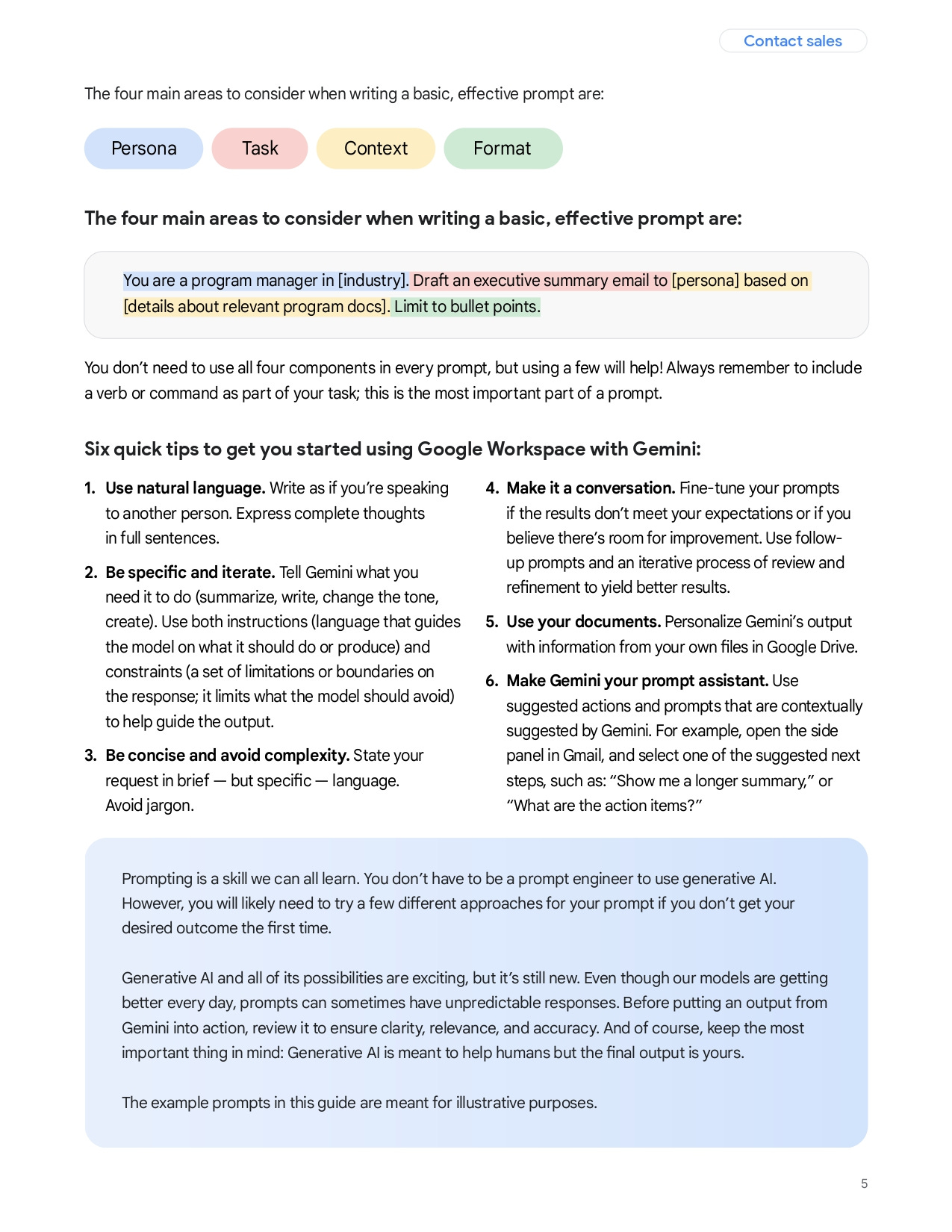

Startups that structure AI prompts with clear roles, formats, and objectives see compounding productivity gains across operations, marketing, and sales. Moving from casual interaction to deliberate prompt engineering transforms AI into a reliable engine that drives real business outcomes.

Recently Launched Funds 💸

Obvious Ventures closed its fifth core VC fund at $360M to invest in early-stage companies across climate, health, and economic resilience.

Voyager Ventures raised $275M for Fund II to back early-stage foundational and industrial technology startups.

Daphni final close of a €260M venture fund focused on deeptech and science-driven startups in Europe.

Basis Set Ventures closed Fund IV at $250M to support early-stage software and technically led companies.

2150 closed its second €210M VC fund to invest in climate-focused urban and built-environment technologies.

Epidarex Capital held the first close of Fund IV at over $145M targeting early-stage life sciences and biotech ventures.

The Footprint Firm closed a €76M debut VC fund backing sustainability and climate-driven startups.

Orion Industrial Ventures closed a $43M maiden venture fund focused on industrial and infrastructure technologies.

Navam Capital launched its first $34.3M VC fund to support early-stage deeptech startups

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

Primary Venture Partners (New York City, NY): Fintech Incubation Associate (apply here)

Chingona Ventures (Chicago, IL): Associate / Senior Associate (apply here)

Leonis Capital (San Francisco, CA): Full-Time VC Associate – Hire Partner Track (apply here)

Playfair (London, England): Visiting Analyst 2026 (apply here)

Reciprocal Ventures (New York City, NY): VC Associate (apply here)

Canaan Partners (San Francisco, OR / New York, NY): Analyst / Associate (apply here)

Village Global / Office of Reid Hoffman (Remote): Head of Comms (apply here)

6MV (Remote): Investment Team (apply here)

General Atlantic (Stamford, CT): Fund Operations Associate (apply here)

Plug and Play (West Windsor Township, NJ): Ventures Associate – Enterprise AI (apply here)

Hottest Deals 💥

Waabi, secured $750M in Series C funding to advance autonomous trucking technology powered by generative AI. (read more)

Genspark, closed a $300M Series B round to grow its AI-driven developer productivity and data intelligence platform. (read more)

Ricursive Intelligence, raised $300M in Series A funding to build advanced reasoning-focused artificial intelligence systems. (read more)

Corxel Pharmaceuticals, secured $287M in Series D1 funding to advance its late-stage cardiovascular drug pipeline. (read more)

Cellares, secured $257M in Series D funding to scale its automated cell therapy manufacturing platform. (read more)

Decagon, raised $250M in Series D funding to expand its AI-powered customer support and operations platform. (read more)

Upwind Security, closed a $250M Series B round to scale its cloud security and threat detection platform. (read more)

Tenpoint Therapeutics, raised $235M across Series B and a credit facility to advance clinical-stage ophthalmology treatments. (read more)

Synthesia, raised $200M in Series E funding at a $4B post-money valuation to expand its AI video generation platform. (read more)

Inferact, raised $150M in seed funding to accelerate development of its next-generation AI-driven enterprise automation platform. (read more)

PaleBlueDot AI, raised $150M in Series B funding to scale its AI infrastructure and large-model deployment capabilities. (read more)

Standard Nuclear, raised $140M in Series A funding to commercialize next-generation nuclear energy technologies. (read more)

Propy, secured a $100M credit facility to expand its blockchain-based real estate transaction infrastructure. (read more)

RobCo, raised $100M in Series C funding to scale its modular robotics platform for industrial automation. (read more)

Automata, closed a $45M Series C round to scale its robotic process automation solutions for global enterprises. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

The Cash Runway Model Every Founder Needs

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

The Applied Intuition story about going multi-product within a year and preserving capital while rewarding long-term equity over inflated salaries is such a masterclass in startup discipline. Most founders get this backwards and burn cash on huge salaries before finding PMF. The part about winning GM in an RFP is crazy too, like actually competing on merit in enterprise sales instead of just relying on warm intros. Also the Bitcoin crash odds being higher than rally to $120K is wild, shows how sentiment has totally flipped.