Global AI Adoption📊, SaaS Multiples Compress📉, How People Use ChatGPT💬

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

brought to you by Attio

Here’s my 3-step playbook to uncover hidden deal flow:

Sign up for Attio, the AI CRM. Connect your email and calendar - it takes <3 minutes.

Watch Attio map your network, track portfolio companies, and qualify LPs.

Filter by sector, stage, geography, or any deal criteria that matters to you.

In no time you’ll have a list of qualified intros and portfolio insights you didn’t realize you had.

Ready to move faster?

In-Depth Insights 🔍

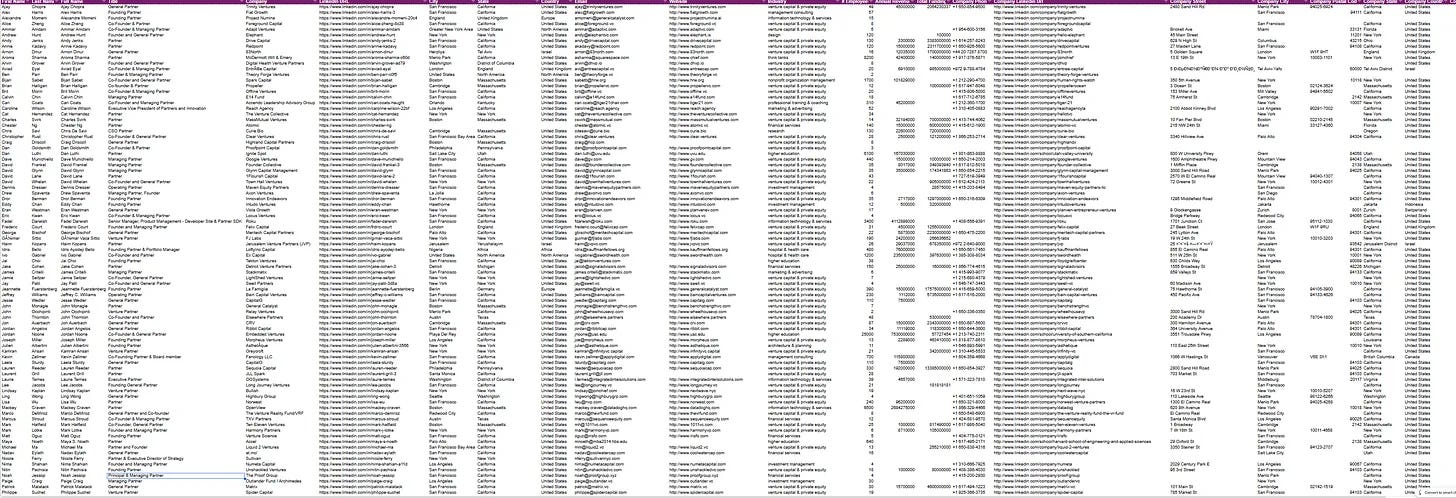

Direct access list targets leading 50 AI VCs📧

153 verified emails and profiles for partners at major venture firms. Outreach templates and sequencing aim to accelerate conversations without traditional referrals.

BREAKING: Senate control odds tighten ahead of 2026 midterms ⚖️

Prediction markets indicate shifting momentum as party probabilities adjust sharply. Trading volume suggests growing conviction around a potential power balance change. [Polymarket]

a16z says scaled venture platforms are evolution, not excess 💰

Supporters argue mega-firms reflect a market where category winners grow exponentially larger and remain private longer. Full-service ecosystems, brand gravity, and network effects now determine access to top founders. [Erik Torenberg]Public SaaS multiples compress as few remain above 10x 📉

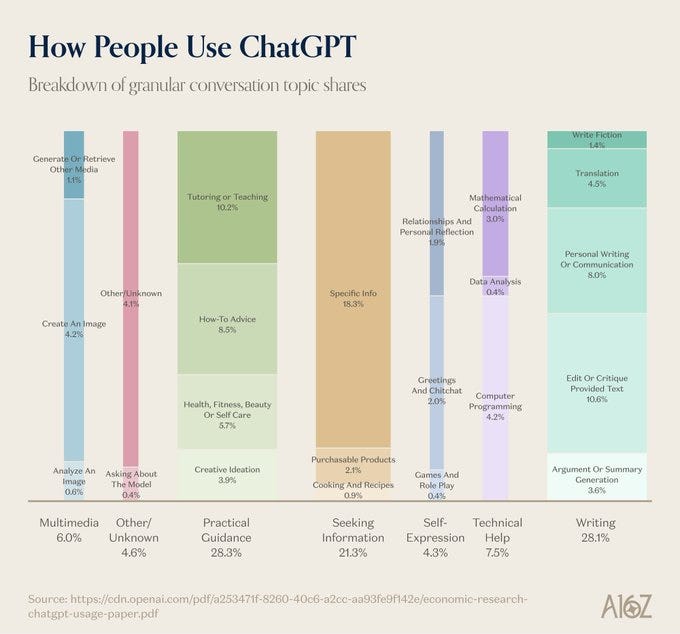

Only a small handful of listed software companies still command premium revenue valuations in 2026. Survivors tend to own infrastructure layers, solve mission-critical problems, and sustain growth at enterprise scale. [Jason Lemkin]ChatGPT usage skews toward practical information needs 💬

Conversation data shows research, coding help, and task guidance dominate interactions over creative experimentation. Everyday productivity use cases far outweigh multimedia or exploratory prompts. [a16z]General Catalyst bets on AI powered rollups in services 🔄

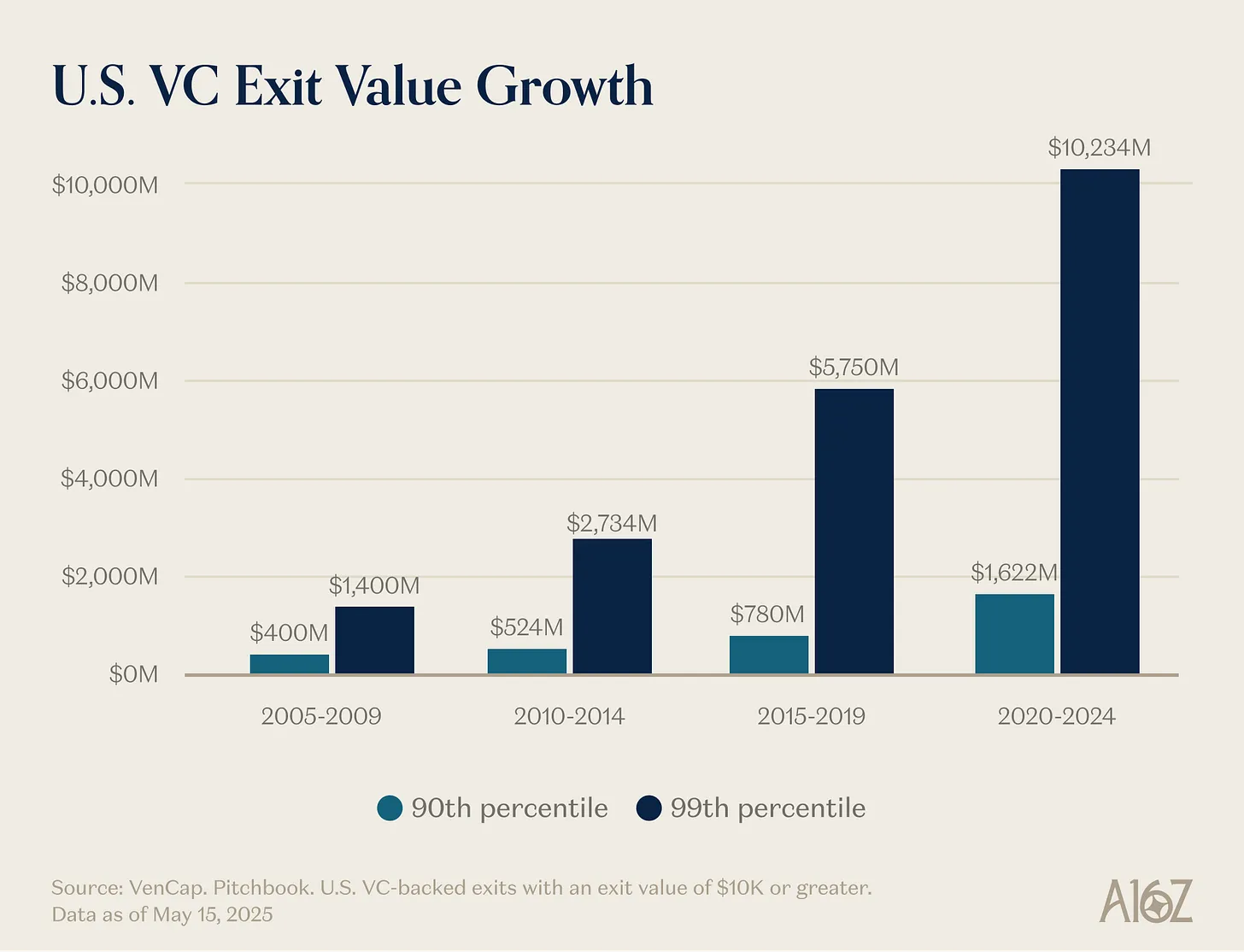

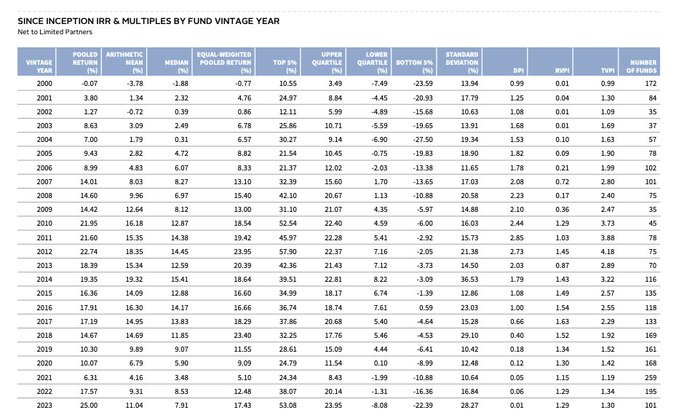

The firm is acquiring traditional service businesses and layering automation to expand margins and output. By combining consolidation with software leverage, it targets higher growth and profitability simultaneously.Venture benchmarks confirm power law dominance 📊

Performance data across recent vintages shows top quartile funds consistently outpacing median returns. Elite managers maintain advantage across cycles, reinforcing concentration of capital with repeat winners. [Trace Cohen]YC founder study shows team size outweighs pedigree 👥

Educational background and prior brand-name employment explain little variation in funding outcomes. Larger founding teams correlate strongly with higher capital raised across cohorts. [Arxiv]AI crosses from assistance into full task replacement 🤖⚡

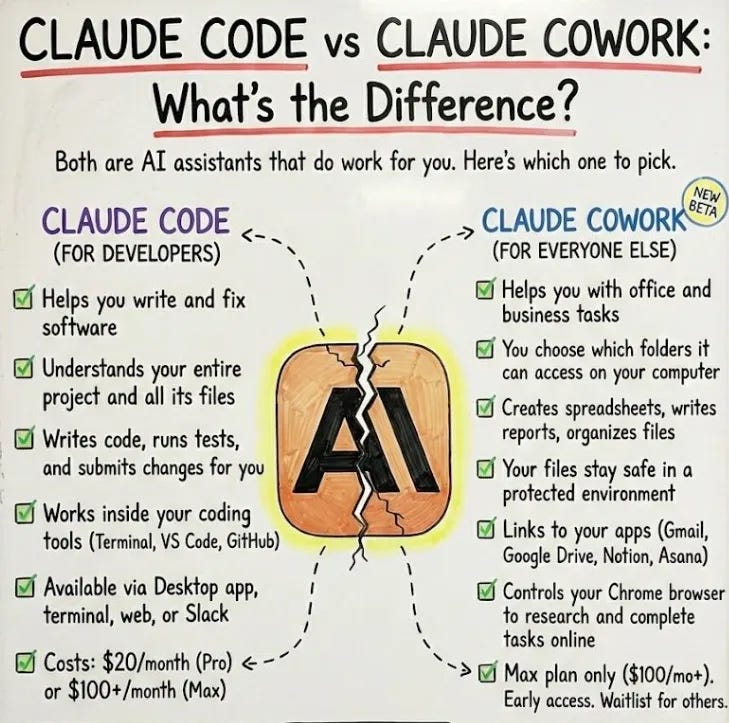

Recent model releases demonstrate sustained autonomous work beyond simple query response. Knowledge roles across industries face structural change within the next few years. [Matt Shumer10 Claude Cowork Workflows That Actually Work ⚙️

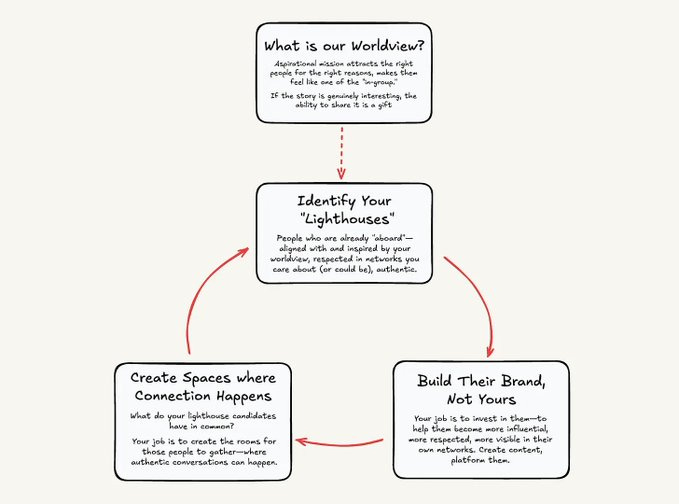

The desktop integration connects models directly to local files and daily tools for automated execution. Structured workflows can streamline research, audits, and scheduling without technical setup.The Lighthouse Playbook drives compounding startup growth 🤝

Founders identify aligned connectors who already influence concentrated audiences. Empowering those individuals to grow their own visibility creates reinforcing distribution loops. [a16z]

Tools 🧰

Free year (save $360) on Framer so you can launch a production-ready site

ISO 27001 Free compliance checklist by Vanta

20% Lovable discount for my audience

Attio, the CRM used by both startups and VCs (including me). Try it for free here

$1,000 off on your compliance, use it for ISO 27001 and SOC 2

📢 Want to get in front of +500k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn (290k followers), email: ruben@thevccorner.com

Interesting Reports 📊

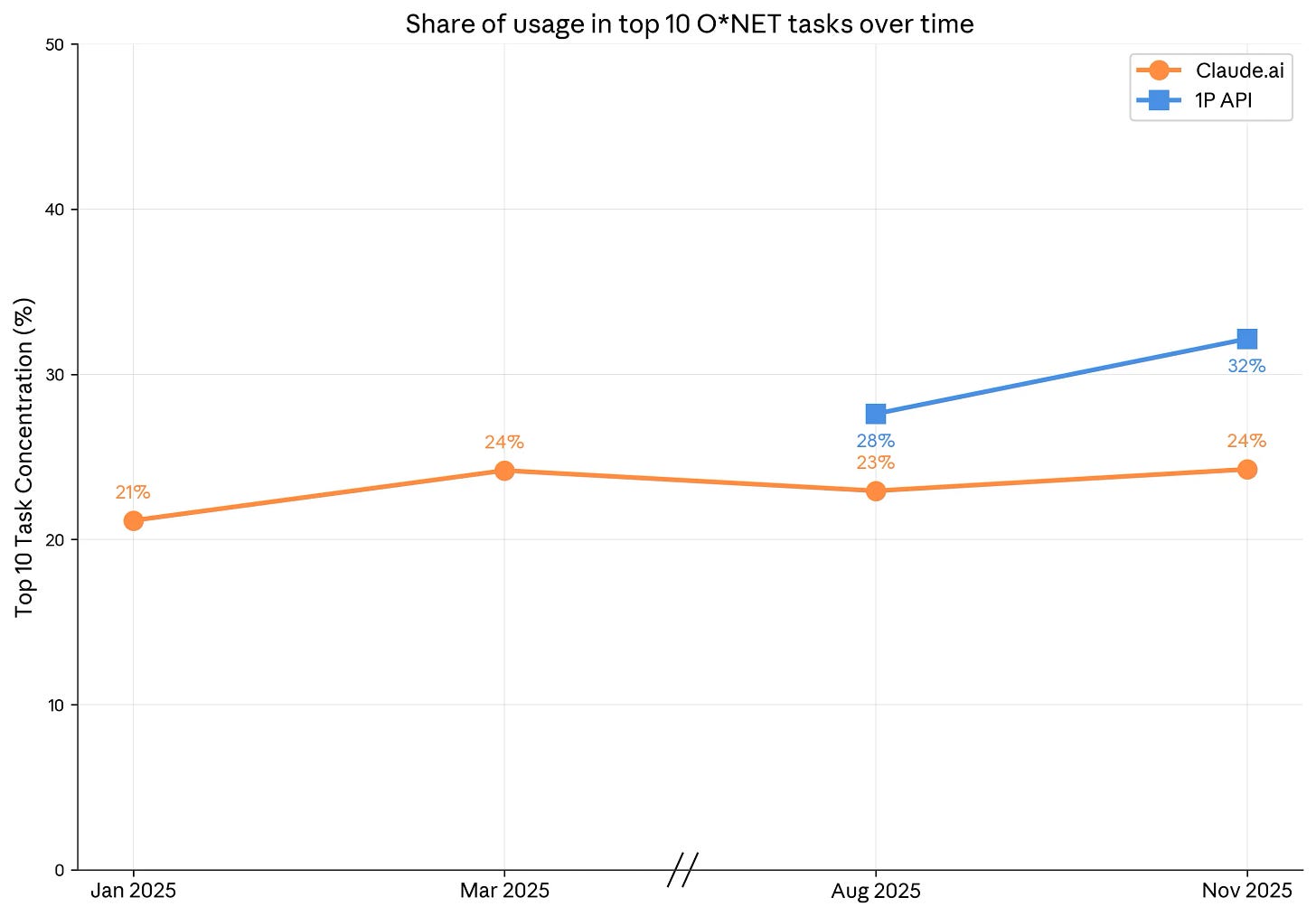

Anthropic Economic Index shows uneven global AI adoption 📊

New data indicates usage remains heavily concentrated in programming while varying sharply across income levels. Advanced economies deploy systems for professional collaboration, whereas emerging markets lean toward academic support and learning tasks. [Anthropic]Defence security and resilience startups accelerate across Europe 🛡️

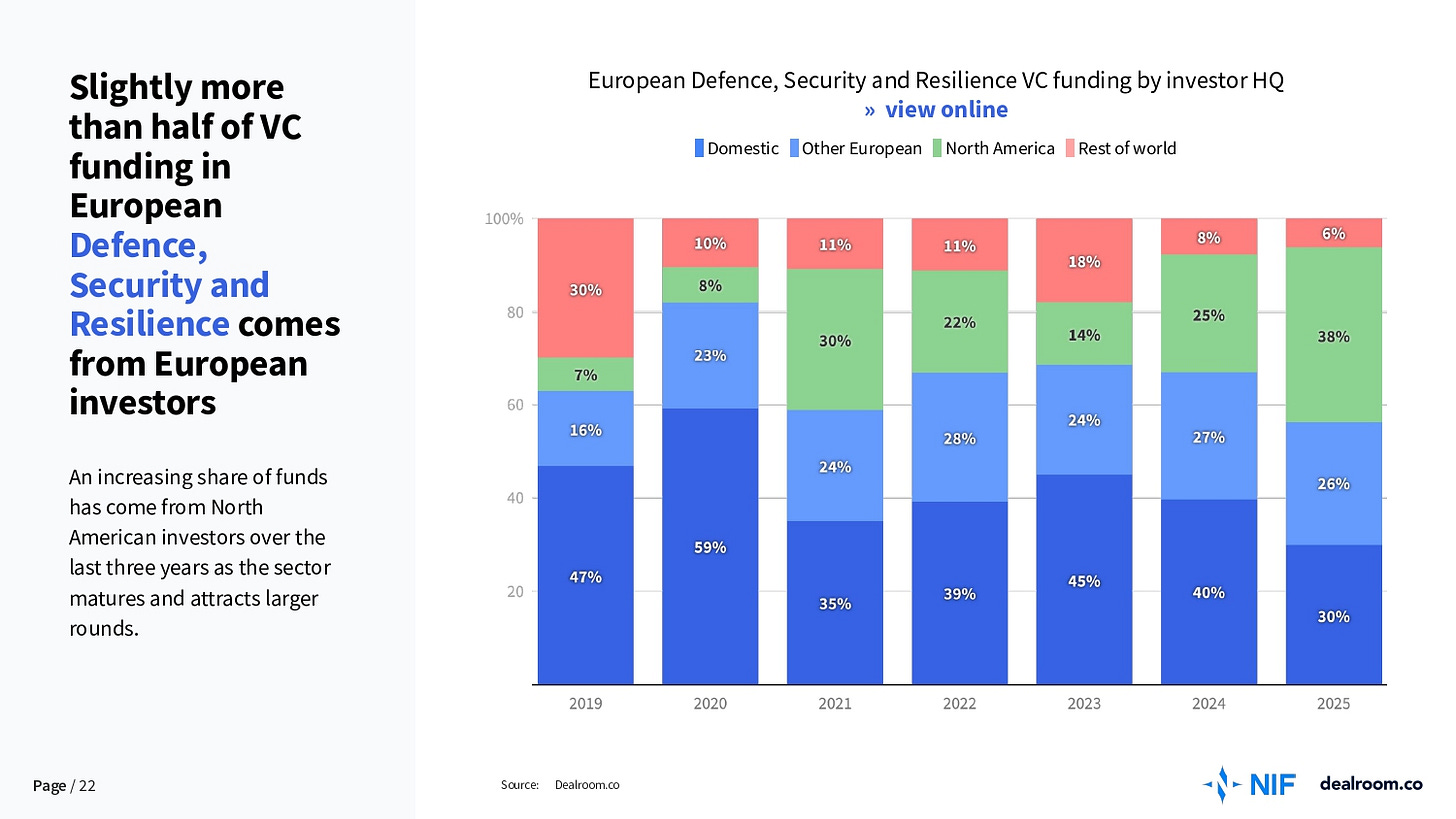

A comprehensive ecosystem review highlights rising venture flows into dual-use technologies amid geopolitical strain. Mapping across countries shows expanding founder activity and institutional backing in strategic sectors. [dealroom.co]UK consumer tech regains post pandemic momentum 📱

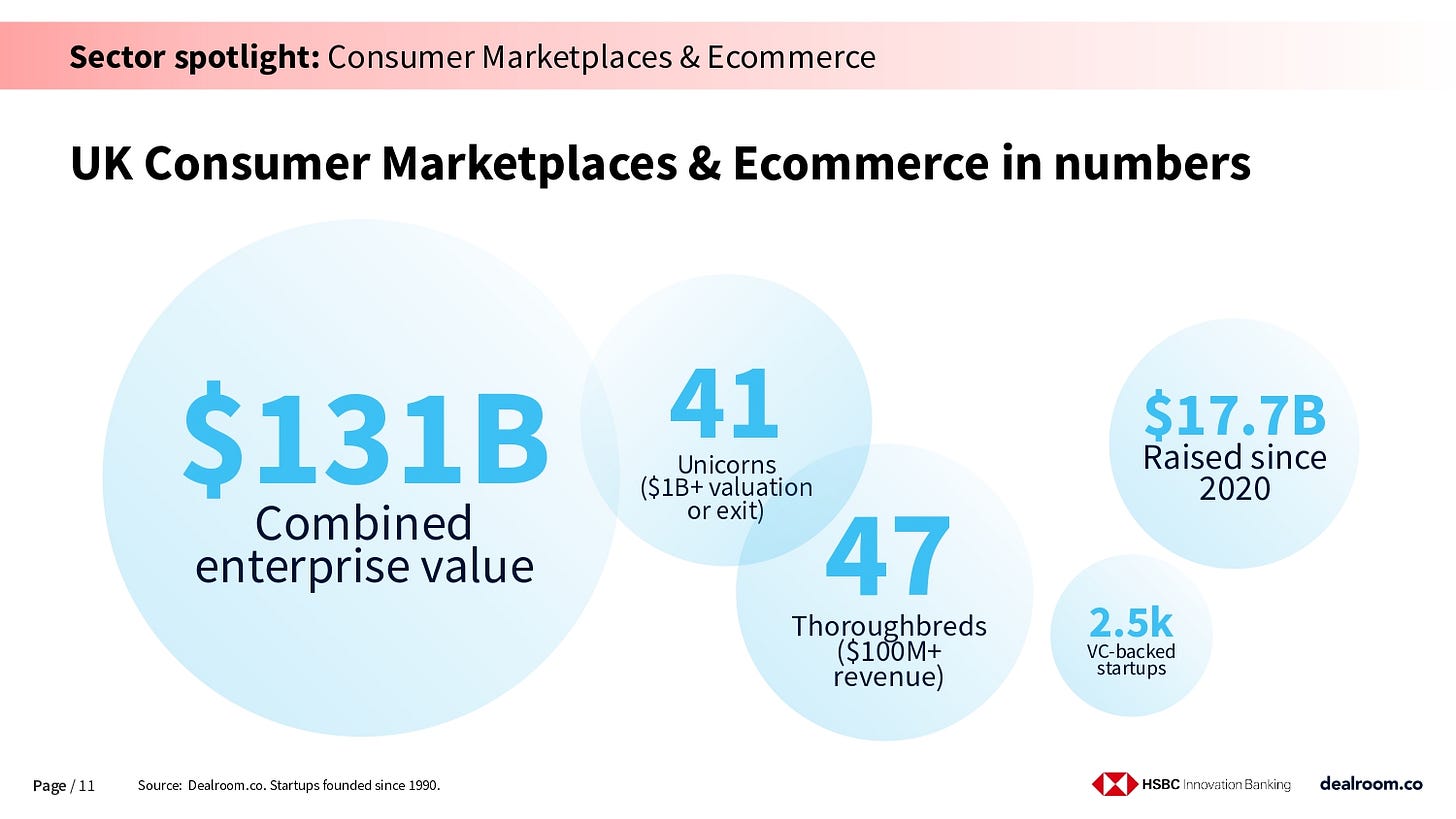

Fresh industry data signals renewed investment and product expansion after several muted years. Consumer-focused startups across commerce, finance, and digital services are rebuilding growth trajectories. [dealroom.co]

Recently Launched Funds 💸

Seligman Investments launched a $500M venture capital arm to back high-growth startups, expanding its platform into direct VC investing.

Union Capital Associates closed Fund IV at $450M, reinforcing its commitment to scaling middle-market and growth-stage companies.

Kindred Ventures raised approximately $227M across two funds to continue backing early-stage technology startups.

Shorooq established a $200M late-stage growth fund to support scaling technology companies across MENA and beyond.

Karmel Capital raised approximately $170M for a new AI-focused investment strategy targeting next-gen artificial intelligence startups.

Elaia held the first closing of its fifth digital venture fund at €120M, targeting European deep tech and digital startups.

Gerber Taylor closed a $111M co-investment vehicle to deepen participation alongside leading private market managers.

Masna Ventures launched a $100M defense-tech fund to invest in next-generation national security and dual-use technologies.

All Aboard Fund raised $99M for its maiden fund, focusing on supporting diverse and underrepresented founders.

Multimodal Ventures closed its first fund at $15M to invest in early-stage startups across multimodal and emerging tech sectors.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

DTCP (Hamburg, Germany): Visiting Analyst / VC Internship (apply here)

iGrow Venture Partners (Athens, Greece): Senior VC Analyst (apply here)

Ship2B Ventures (Barcelona, Spain): VC Manager (apply here)

Dragonfly (New York City, NY, USA): VC Investor (apply here)

DCG (Stamford, CT, USA): VC Analyst (apply here)

Erez Capital (Remote): VC Partner (apply here)

Amex Ventures (New York City, NY, USA): VC Manager (apply here)

Llama Ventures (San Francisco, CA, USA): VC Investor (apply here)

Plug and Play (Kissimmee, FL, USA): VC Analyst (apply here)

Lea Partners (Karlsruhe, Germany): VC Analyst (apply here)

Hottest Deals 💥

ElevenLabs, raised $500M in Series D funding to scale its AI voice technology platform and expand globally. (read more)

Inertia Enterprises, secured $450M in Series A funding to accelerate industrial innovation and expand operations. (read more)

NineDot Energy, received $431M in debt financing to expand its distributed energy storage portfolio. (read more)

Talkiatry, raised $210M in Series D funding to grow its nationwide psychiatry services platform. (read more)

Oxide Computer Company, closed $200M Series C funding round to expand its cloud-native infrastructure stack. (read more)

Tomorrow.io, raised $175M in equity financing to enhance its weather intelligence and climate resilience platform. (read more)

ICEYE, raised €150M in Series E funding and €50M in secondary placement to expand its SAR satellite constellation. (read more)

Solace, secured $130M in Series C funding to scale its healthcare navigation platform. (read more)

Vega, raised $120M in Series B funding to accelerate development of its space launch technology. (read more)

Garner Health, raised $118M in Series D funding to expand its data-driven healthcare platform. (read more)

Iliad Biotechnologies, secured $115M in Series B funding to advance its next-generation biologics pipeline. (read more)

Loyal, raised $100M in Series C funding to develop longevity therapies for companion animals. (read more)

Deep Fission, raised $80M in new funding to advance its underground nuclear reactor technology. (read more)

Bretton AI, closed $75M Series B funding round to expand its enterprise AI solutions. (read more)

TEM, raised $75M in Series B funding to accelerate growth of its digital health platform. (read more)

RESOURCES 🛠️

access all for the next year with a 50% limited discount

The Cash Runway Model Every Founder Needs

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox