We caught Barbara Corcoran for ten minutes at the Clover x Shark Tank Summit in Las Vegas:

She turned those ten minutes into a clinic on how to build, sell, and decide faster than most people can finish a coffee.

It wasn’t theory. It was operating wisdom from someone who has actually done it — the kind of perspective that only comes from taking big risks and winning just enough times to earn your scars.

“My best successes came on the heels of failure.”

— Barbara Corcoran

Brought to you by Vanta:

🚀 Are you ready for the EU AI act? Vanta’s EU AI Act Checklist helps startups cut through the noise and stay compliant without slowing down.

✅ Understand how the Act impacts your product

✅ Get clear, actionable steps for compliance

✅ Avoid common pitfalls early

Stay ahead:

Who Barbara Is, in One Breath

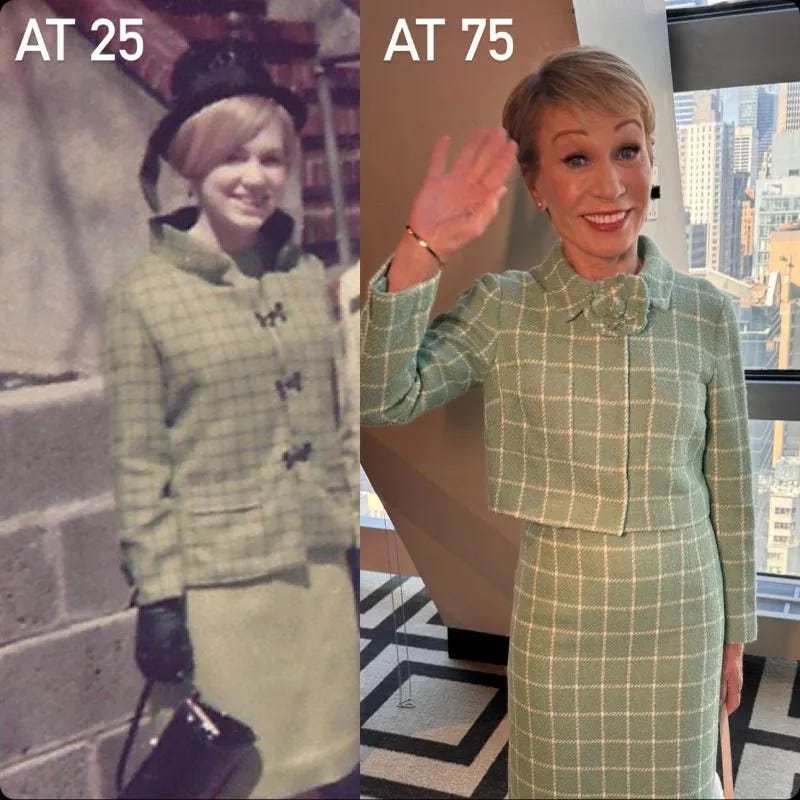

By 23, Barbara had already cycled through twenty different jobs.

Teacher. Waitress. Receptionist.

Then, in 1973, a boyfriend handed her a check for $1,000. She used it to open a tiny apartment brokerage in New York City and named it The Corcoran Group. No MBA. No grand plan. Just relentless work ethic, people skills, and the kind of scrappiness that scares competitors.

She reinvested every spare commission into hiring one more salesperson. She created The Corcoran Report to build credibility before content marketing even had a name. She fought for commissions others wrote off.

When the time came, she sold the company for $66 million after turning down a lower offer. Then she walked into what she calls “the luckiest seat in the world” — the investor chair on Shark Tank, where she has made over 100 on-air deals and learned, in public, how to back founders at scale.

That’s the résumé. But the operating system underneath is what really matters.

The interview:

Ten minutes. Two cameras. Vegas noise in the hallway.

Barbara walked in smiling and ready.

We asked about growth. We asked about investing. We asked about building teams when geography pulls people apart.

She answered with stories. Every story had a rule inside it that you can apply this week.

Below are the clips, the quotes, and the playbook:

1. Faces Beat Logos When Trust Is the Goal

“Use your faces. Go casual. There are not many young and good-looking people doing it. Take advantage.”

People follow people. Logos are polite but forgettable. The more your audience sees your eyes, your voice, your quirks, the more they decide whether to trust you. Barbara built an empire by elevating salespeople instead of hiding behind a brand. The same applies online.

Try this:

▫️ Record a short video intro before your content so people meet you first

▫️ Track saves and replies — they’ll tell you what’s working

2. Your Story Needs an Absurd Visual the Camera Cannot Ignore

We pitched a wild idea: stand outside McKinsey with a sign that says, Quit today and we’ll invest $10,000 in your startup.

Barbara smiled.

“That’s crazy. Not crazy enough.”

Her media playbook is simple. Identify your story, then stage it in a way that forces attention. Her best example: when New York co-ops began “interviewing” dogs, she invited the press to Central Park and hosted a class on “How a Dog Passes a Co-op Board.”

Reporters showed up. The city talked about it for weeks. The message spread because the visual carried the point.

Try this:

▫️ Write your core message in one sentence

▫️ Find five ways to make it visible in public

▫️ Pick one that’s surprising and human

▫️ Measure results in earned coverage, not just impressions

3. Recovery Speed Is a Business Metric

Barbara once spent $77,000 producing a VHS real estate series called Homes on Tape. Dealers refused to hand them out. The project died. That night, she heard about the internet.

She uploaded every tape online, registered competitor URLs, and made two sales by morning.

“It was the best thing I did because I recovered fast.”

Most teams treat speed like a feeling. Barbara treats it like a number.

The time between “this failed” and “this shipped better” is the metric that defines whether you win.

Try this:

▫️ Add a 24-hour pivot rule to one project

▫️ Move your content or offer to where your audience actually is

▫️ Write a two-line postmortem and relaunch

4. Use AI Like an Operator

Barbara doesn’t hype AI. She uses it.

“I use it for writing my articles, preparing speeches, brainstorming. I ask for fifteen ideas. Five are terrible. Ten are good. Then we brainstorm on the brainstorm.”

She doesn’t outsource creativity. She accelerates it.

The real leverage isn’t the tool — it’s your cadence. Ask more questions, keep the best answers, and move fast.

Try this:

▫️ Create a weekly cadence: ideas on Monday, drafts midweek, polish on Friday

▫️ Use AI to widen your options, not replace judgment

▫️ Keep a ledger of ideas that almost worked — they’ll spark your next win

5. Install a Six-Month Rule for Investing

“We give every business a report card every six months.”

Barbara scores every investment. She looks at momentum, cash, and what customers actually say. If a company drifts, she stops. Not later. Not “after one more quarter.” She stops.

Discipline is the difference between scaling capital and wasting it.

Try this:

▫️ Create a one-page scorecard for your own projects

▫️ Define the red lines before you start

▫️ Pair with someone who enjoys saying no — you’ll thank them later

6. Markets Fear Change, Then Normalize

When we asked her about the current situation of the New York real Estate market, she said:

“It’s choppy. People with money are afraid. Then they get used to it and move on. New York is great at change.”

Markets overprice fear and underprice adaptation.

When everyone freezes, patience becomes an edge.

Try this:

▫️ Find one market that feels overpriced in fear

▫️ Identify signs of normalization

▫️ Make your move before the crowd calms down

7. Remote Culture Needs Collisions You Schedule

“If people are going to work remotely, you have to create situations for them to come together every quarter. Laughter helps. An agenda helps. Mostly, they need to know each other.”

Slack doesn’t build culture. Shared memory does. A story from a dinner lasts longer than any company memo.

Try this:

▫️ Plan quarterly meetups with one unforgettable activity

▫️ Start one small ritual that repeats

▫️ Capture short recap videos so moments become lore

8. Hire Your Opposite and Barter If You Must

“Decide what you’re good at. Hire the opposite.”

Clones comfort you. Opposites scale you.

If cash is tight, barter. Share equity. Trade favors. The sooner your blind spots have owners, the faster you can build.

Try this:

▫️ List your strengths and weaknesses

▫️ Only hire from the weaknesses list for your first three roles

▫️ Tie each hire to a specific risk they eliminate

Why Barbara Still Lands in 2025

Barbara started when there were no female-owned real estate firms in New York.

A partner once told her she would never succeed without him. She proved him wrong.

She built her own company, hired people who believed, and fought for the commissions she earned.

When Shark Tank almost passed on her, she wrote the email that got her back into the room.

When projects failed, she turned them into launches.

She built credibility by publishing The Corcoran Report, years before “thought leadership” was a trend.

“I am looking for energy. I am looking for a salesman. I am looking for someone who gets up fast.”

That’s how she chooses who to back.

The Barbara Corcoran Playbook

Growth

▫️ People over polish

▫️ Visual stories that make people stop and look

▫️ Recovery speed as a north-star metric

Investing

▫️ Six-month report cards

▫️ Partners who balance optimism with restraint

▫️ Expect a few big wins to carry the rest

People

▫️ Plan real-life collisions

▫️ Hire to fill gaps, not mirror strengths

▫️ Build culture through stories, not slogans

Final Note

Barbara’s career looks like a highlight reel, but it’s really a habit:

Use what you have. Make it visible. Move quickly when something breaks.

Keep score. Hire the counterweight. Laugh often so work feels lighter.

The ten minutes we had in Vegas were enough to see the pattern.

It’s simple. It’s hard. And it’s available to anyone willing to try this week.

what would you ask her? how would you pitch you startup to Barbara in 30 seconds?

🛠️ RESOURCES you will love:

✅ The SaaS Financial Model Every Founder Should Use

✅The Venture Capital Method: How Investors Really Value Startups

✅IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox