Venture Funds Ranked🦄, Why Retention Is So Hard📉, Europe Gets Its Own TBPN🎙️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Harmonic — the complete startup database:

8VC, Arctern, Bedrock, DST, Emergence, Fintech Collective, First Round, Greyhound, GV, Insight, IVP, Mosaic, NEA, NGP, Pear, Precursor, Redpoint, Scale, Spark, Zetta. And hundreds more we can’t name in ads.

The world’s best VCs use Harmonic to find their fund returners:

In-Depth Insights 🔍

Why Retention Is So Hard 📉

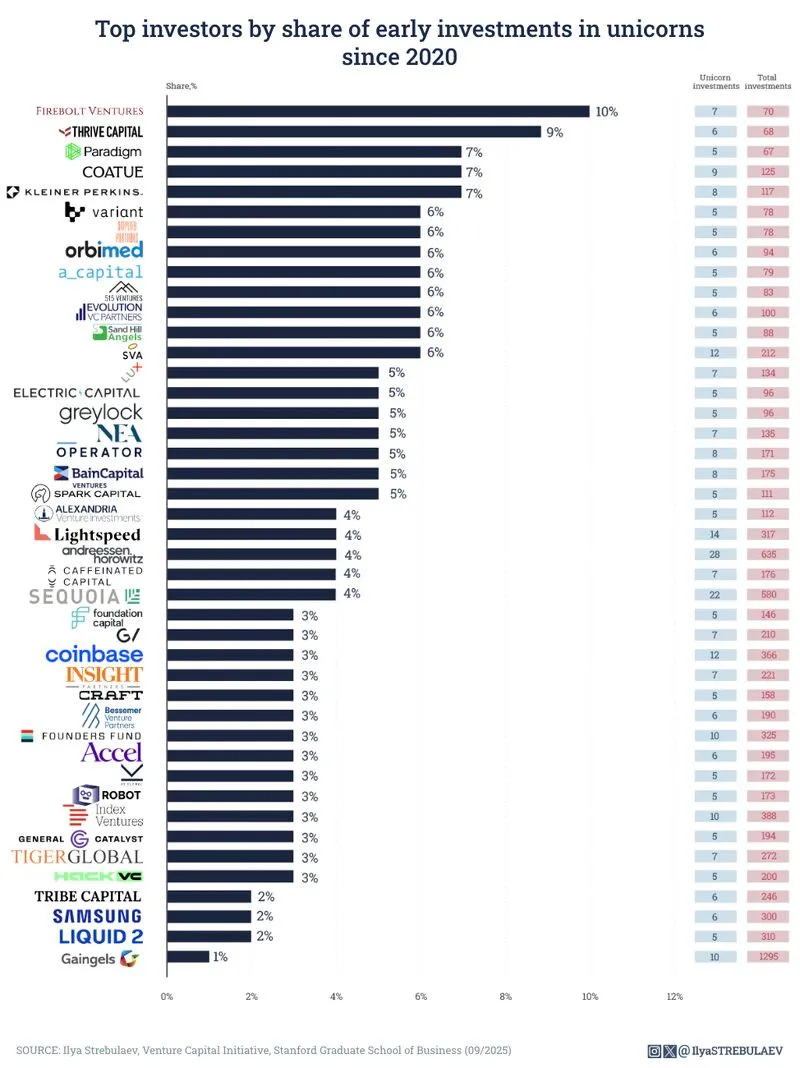

Andrew Chen’s data shows churn is almost impossible to fix and revenue retention can expand even as usage falls. For AI apps, retention must be strong from day one to reach product-market fit. [Andrew Chen]Venture Funds Ranked by Unicorn Hit Rates 🦄

Stanford research ranks VC firms on how often they back billion-dollar startups, from Firebolt’s 10% hit rate to Sequoia’s scale play. Smaller funds can thrive with one unicorn while mega-funds must chase decacorns. [Doug Dyer]The Expansion of Consumer AI Software 📱

Consumer AI apps are breaking churn models with revenue retention above 100%. Usage-based pricing, enterprise adoption, and early sales investment define the new playbook [Andreessen Horowitz]

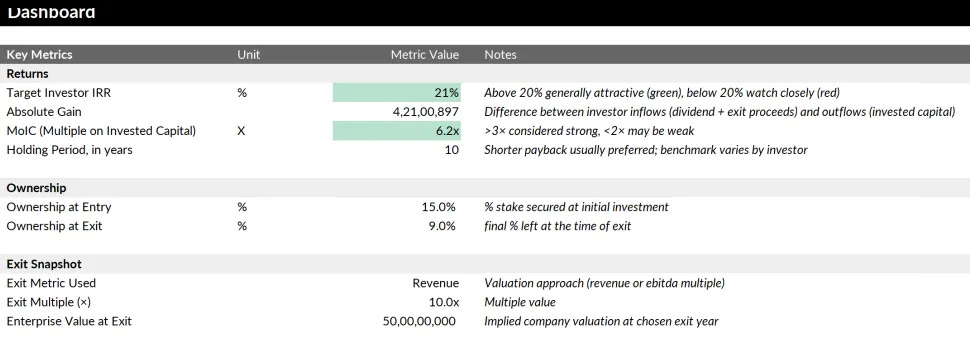

The Venture Capital Method 📊

VCs price startups by backsolving from exit scenarios using equity stakes, dilution math, and required returns. Founders who master this model can negotiate smarter and protect ownership across rounds

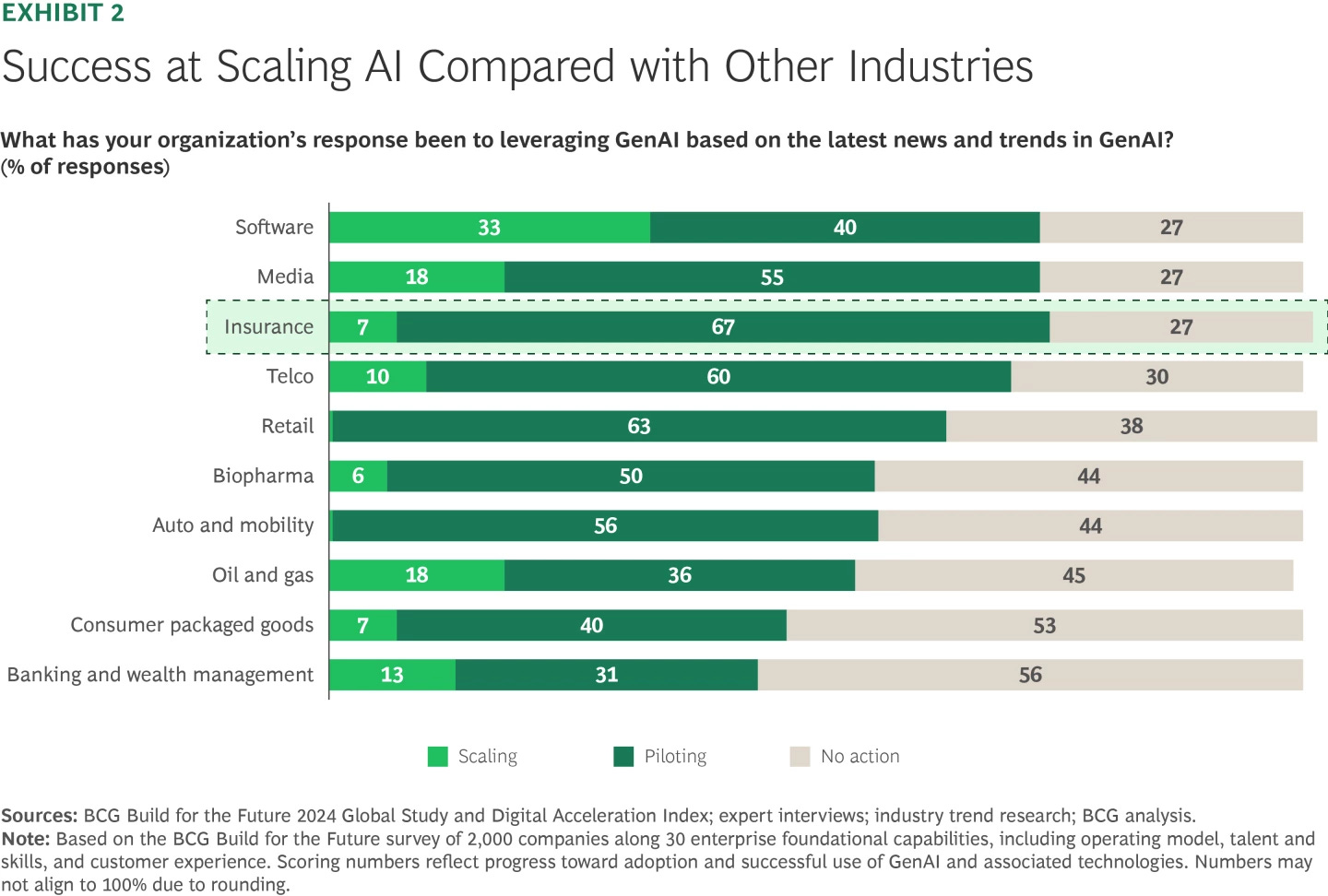

Insurance Leads in AI but Stalls at Scale 🏦

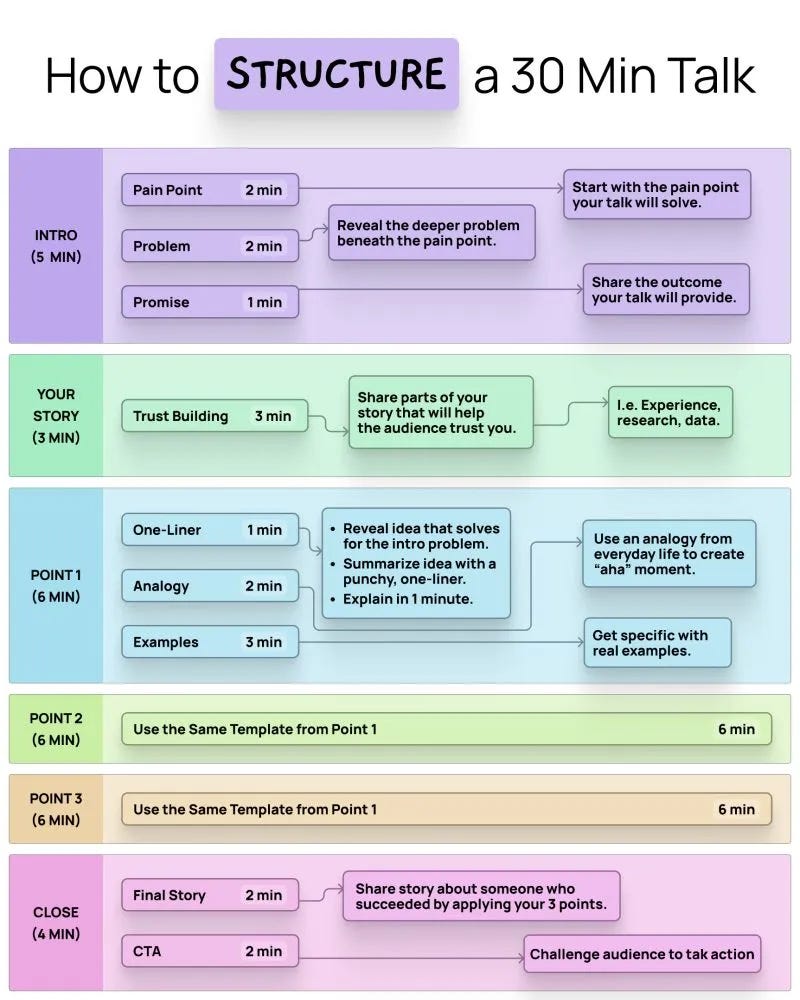

Only 7% of insurers have moved AI beyond pilots despite rich data and early adoption. Unlocking value requires cultural change, cross-functional execution, and enterprise-wide integration. [BCG]How to Nail a Big Talk ✨

Vince Pierri outlines a keynote framework built on pain, problem, promise, and three core points. The method reduces nerves, sharpens clarity, and leaves audiences ready to act [Vince Pierri]AI Co-Workers: The Future of Work 🤖

Anthropic and OpenAI are designing systems that function as co-workers, not just tools. These AI teammates handle reasoning-heavy tasks and force companies to rethink workflows and oversight [The Information]

Europe Gets Its Own TBPN 🎙️

Ronan Chambers and Luke Knight are raising $150k to launch ETN, a live European tech show modeled after US hit TBPN. With angel backing, they aim to fill the media gap left by TechCrunch Europe and TNW [Sifted]

📢 Want to get in front of +300k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn, email: ruben@thevccorner.com

Interesting Reports 📊

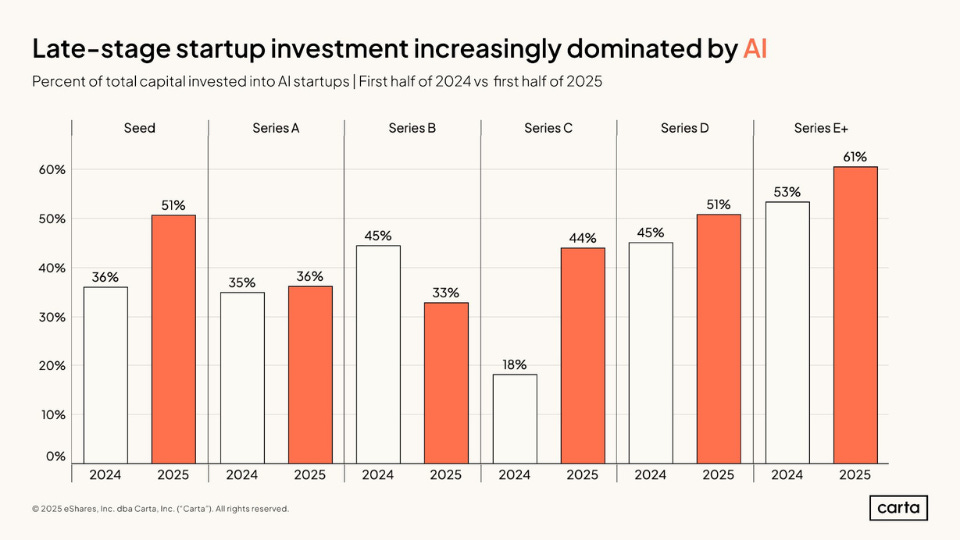

AI Fundraising Benchmarks from 2,000+ US Rounds 📊

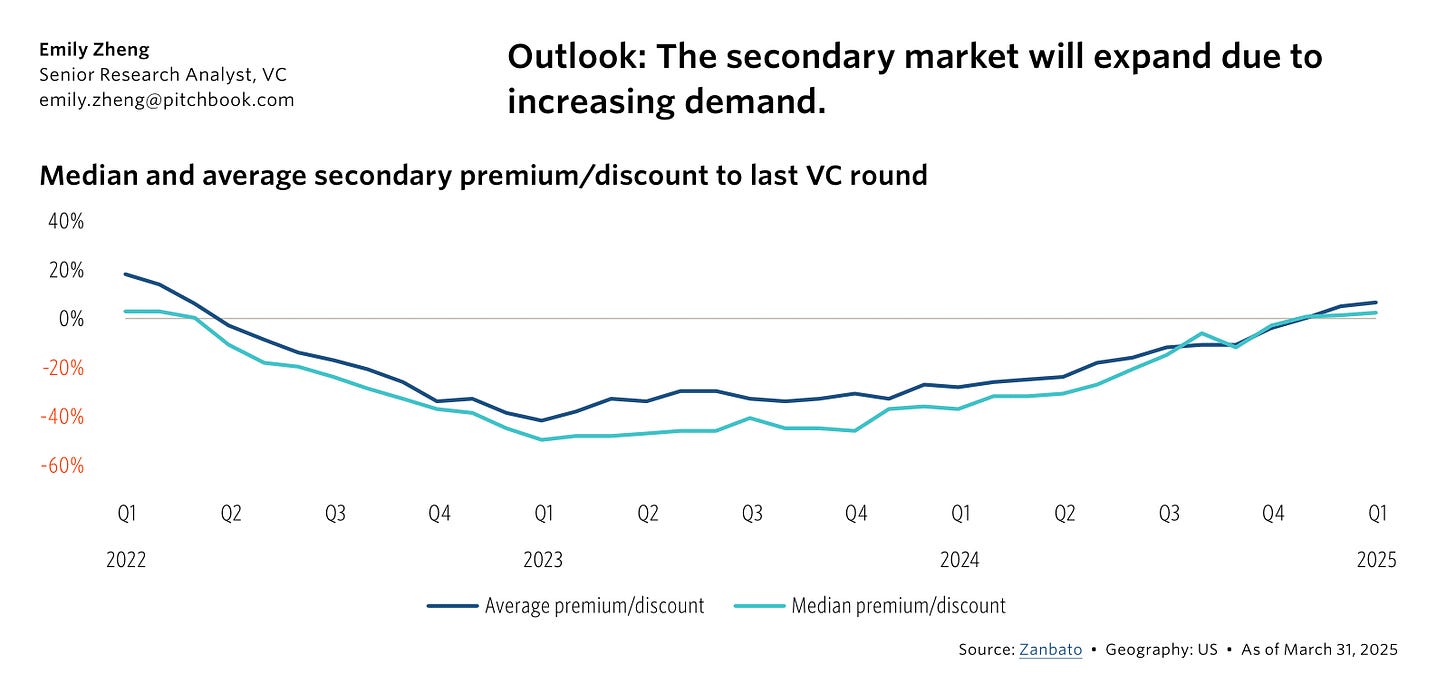

Carta analyzed Seed and Series A rounds to show trends in valuations, round sizes, dilution, and sector insights. Founders can use this data to plan raises and benchmark performance against peers.US VC Outlook Midyear 2025: Resilience Amid Tariffs & Exits 💼

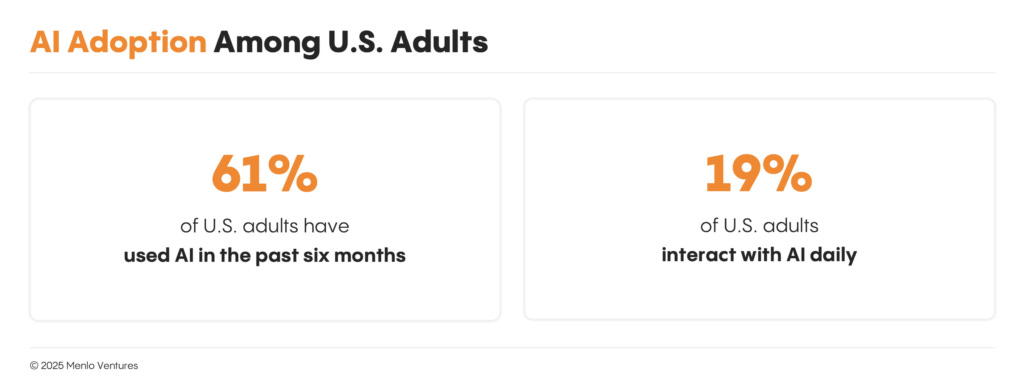

Six US companies reached billion-dollar valuations despite slower IPO activity. AI startups now lead 36% of M&A deals as selective exits and secondary markets shape investor confidence.2025 State of Consumer AI 📱

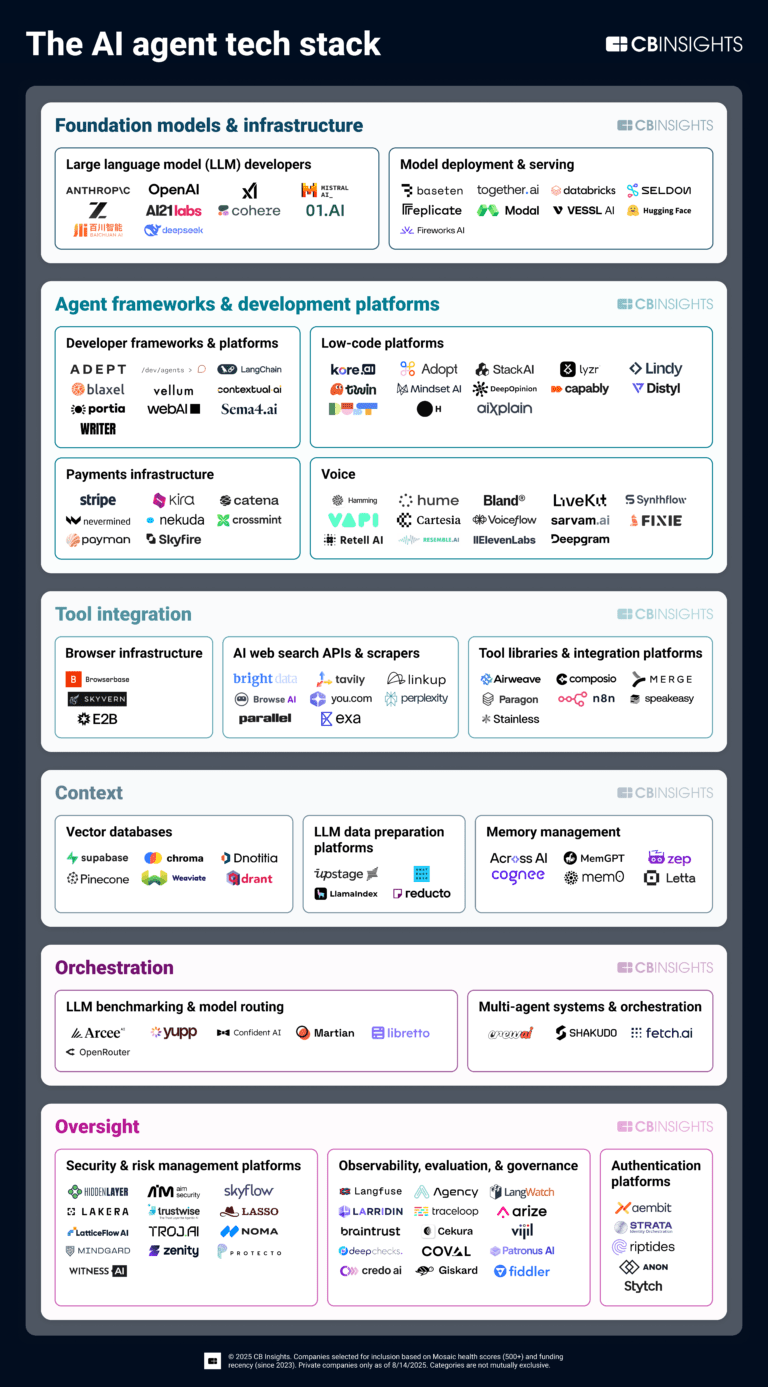

Menlo Ventures finds 61% of U.S. adults and 1.8B globally use AI while only 3% pay for it. Adoption is strongest among parents, students, and workers with opportunities in health, finance, logistics, and connection.The AI Agent Tech Stack: 135+ Startups Fuel the Next Wave 🤖

CB Insights maps the infrastructure behind AI agents across 17 emerging markets. Voice AI, security, and payments tech are attracting strategic bets from Meta, Okta, and Visa.

Recently Launched Funds 💸

BNVT Capital launches its debut $150M fund to back early-stage startups.

T.Rx Capital announces Fund I with $77.5M focused on healthcare innovation.

VoLo Earth closes Fund II at $135M to support climate tech and sustainability ventures.

OneWorld Alliance Airlines & Breakthrough Energy Ventures launch a joint fund to advance and commercialize sustainable aviation fuel technologies.

Summit Peak Ventures raising $150M for its fourth venture fund.

Crane Venture Partners launches its $135M APAC I fund targeting enterprise software startups.

Robinhood rolled out its first venture capital fund to back private companies, expanding beyond retail investing.

Glilot Capital closed a $500M fund to target investments in AI and cybersecurity, reinforcing its deep tech focus.

Octave Capital & Katapult Ocean launched Asia’s largest $75M ocean-focused impact fund during Impact Week 2025.

Vastpoint introduced an €18M Polish fund led by ex-entrepreneurs from ElevenLabs and Y Combinator to back early-stage startups.

Credit Saison unveiled a $50M blockchain-focused VC fund to support Web3 and decentralized finance innovation.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

VC Jobs 💼

Temasek (Paris, France): Associate (apply here)

Wildwood Ventures (Berlin, Germany): Principal (apply here)

Samsung Next (Amsterdam, Netherlands): Investor (apply here)

Four Cities Capital (Madrid, Spain): Associate (apply here)

Inovexus (Paris, France): Community and Events Intern (6 months) (apply here)

3VC (Vienna, Austria): Executive Assistant (apply here)

Newion (Amsterdam, Netherlands): Visiting Analyst Internship (4–6 months, Jan 2026 start) (apply here)

Juniper Square (Remote, US): Senior Associate – Fund Administration & Accounting (apply here)

Fudos Company (Remote, US): Deal Maker – Venture Capital (apply here)

Relentless Returns (Remote, Global): Venture Capital Scout Intern (apply here)

Hottest Deals 💥

Extend, secured $20M in new capital. (read more)

Numeral, raised $35M in Series B funding. (read more)

Cailabs, raised €57M in financing. (read more)

GRVT, raised $19M in funding. (read more)

Lingokids, raised $120M in funding. (read more)

ShopVision, raised $4.1M in seed funding. (read more)

Upscale AI, launched with over $100M in seed funding. (read more)

Vibranium Labs, raised $4.6M in seed funding. (read more)

Imagine Pediatrics, raised $67M in Series B funding. (read more)

Groq, raised $750M in new funding. (read more)

GridStrong, raised $10M in seed funding. (read more)

CodeRabbit, raised $60M in Series B funding. (read more)

PayNearMe, raised $50M in Series E funding. (read more)

Figure, exceeded $1B in Series C funding. (read more)

AltrixBio, raised $5M in Series A funding. (read more)

RESOURCES 🛠️

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox