Why Pre-Empted Rounds Exist💰, Master Customer Interviews🗣️, Trump’s Nobel Odds🏛️

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Attio

The CRM used by both startups and VCs (including me)

I use Attio to manage deal flow, track founder conversations, and sync everything across my team — no clunky setup required.

Startups use it as a sales CRM from day one

VCs use it for deal tracking, LPs, and intros

Fully customizable and updates automatically

It’s fast, flexible, and built for how we actually work.

In-Depth Insights 🔍

Fund vs Firm Thinking 🏗️

Most investors optimize for short term carry, but enduring institutions are built by compounding competitive advantage over decades. The strongest firms behave like product companies, decentralizing decisions, building moats, and scaling systems beyond any single fund or partner. [David Haber, GP a16z]Trump’s Nobel Odds 🏛️

Trump’s proposed Board of Peace has reignited attention on Middle East diplomacy and global optics. Prediction markets now assign a 13% chance of a Nobel Peace Prize, reflecting cautious skepticism. [Polymarket]

2026: This Is AGI 🤖

AGI is no longer theoretical, it is emerging through long horizon agents that reason, iterate, and act autonomously. These systems turn AI from a talker into a doer, letting founders hire AI teammates and compress years of work into minutes. [Inference by Sequoia ]

Why Pre-Empted Rounds Exist 💰

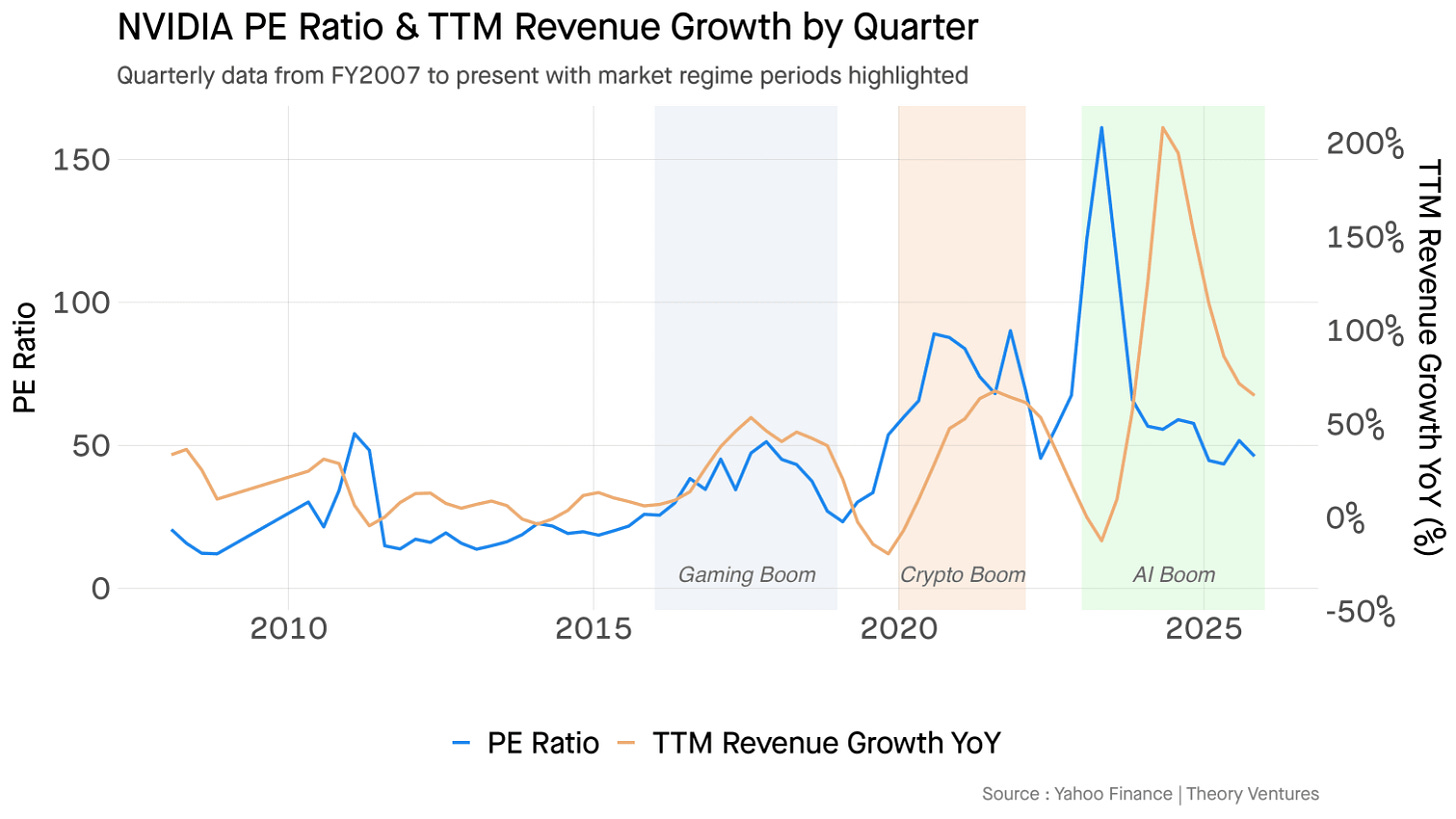

Pre-emptions look expensive on paper, but in breakout companies speed and access often matter more than price. For the top one percent of outcomes, paying early can still be cheap because the real edge is backing the right founders. [James Heath]NVIDIA’s Third Growth Cycle ⚙️

NVIDIA is entering a familiar expansion phase, with AI following gaming and crypto as a new growth engine. Past cycles show valuations rise before revenues, and the current AI wave suggests this run still has momentum. [Tomasz Tunguz]2026 Predictions: Big Deals, Bigger Shifts 🤖

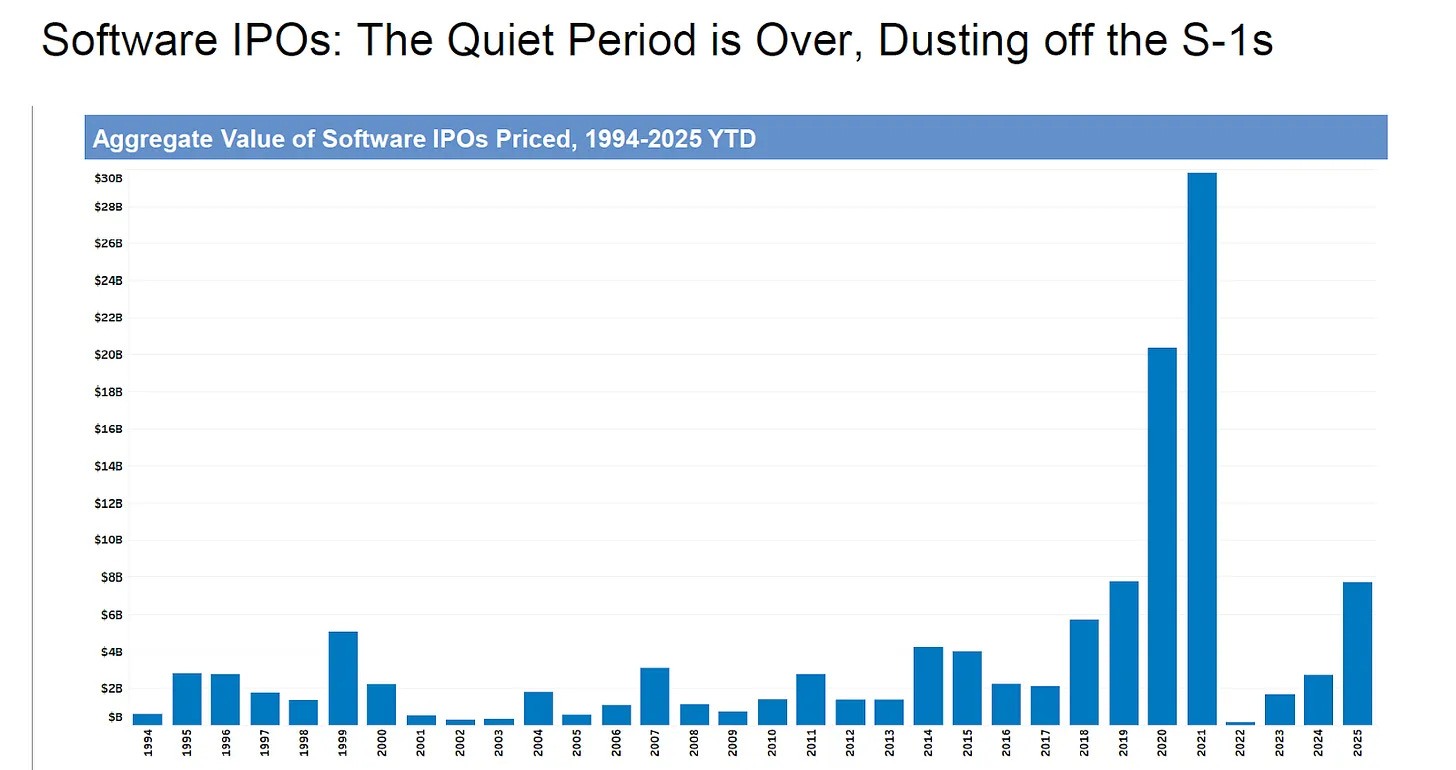

Public markets, defense innovation, and AI infrastructure are converging into a defining year for technology. From IPO reopenings to embodied AI competition, experimentation is giving way to scaled real world impact. [Janelle Teng Wade]

Lovable turns your deck into a web app. And it looks unfair.

How Venture Capital Wins in 2026 🎯

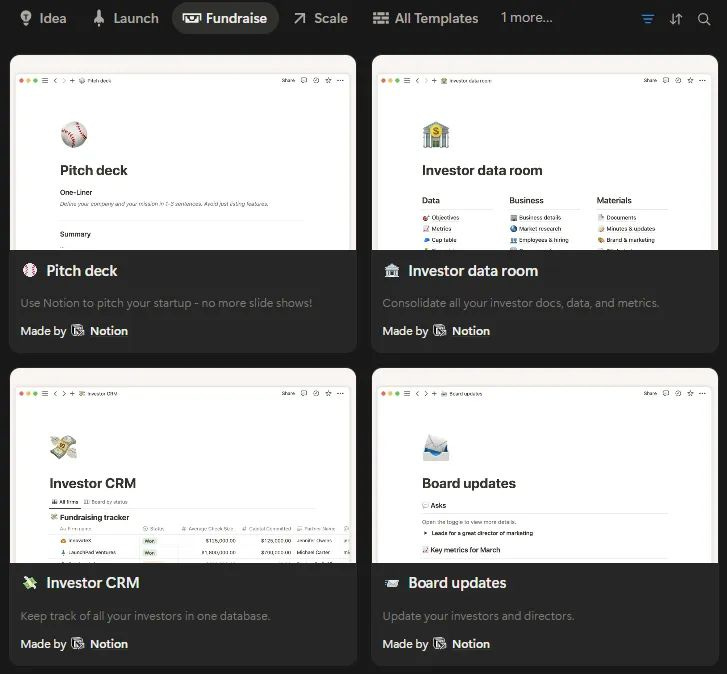

Winning in venture is no longer about fund size or structure, but about where durable edge comes from. The best firms compound insight, access, value add, and reputation into strategies that drive real DPI. [Forbes]How Serious Builders Co-Work With Claude 🤖

Claude is most powerful when work is messy, evolving, and high stakes, acting as a thinking partner. Used continuously, it helps founders structure ideas, reflect deeply, and compound insight over time.Cash Is the Startup’s Oxygen 💸

Most startups fail because they run out of money, not because the product is bad. A clear runway model turns hiring, burn, and funding timelines into calm, informed decisions before panic sets in.Pitch Decks That Created Unicorns 🦄

Iconic startups raised early rounds with clarity, not polish, using simple stories investors instantly understood. Studying these original decks reveals repeatable patterns founders can use to raise smarter and faster.The Financial Model That Rewires Your Business 📈

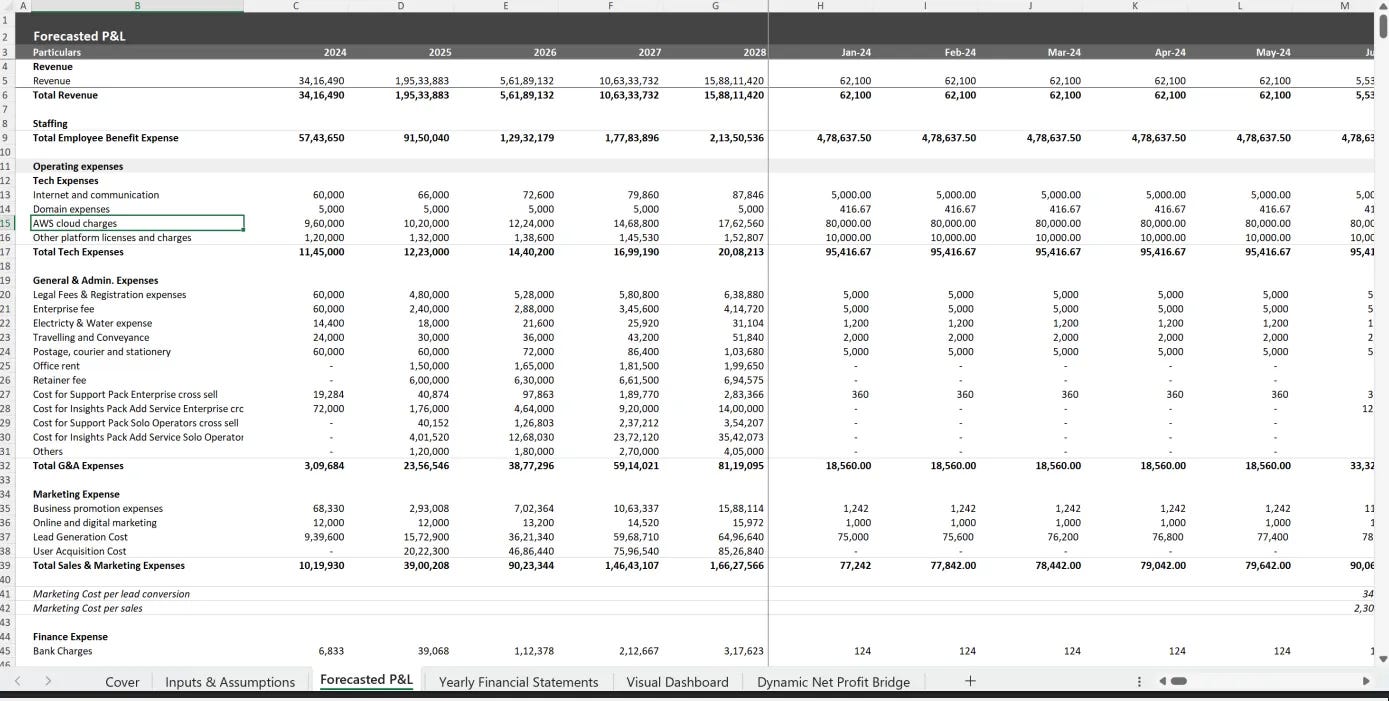

This model connects growth, pricing, headcount, and profitability into one coherent operating view. It gives founders real clarity on revenue, burn, and EBITDA through levers that actually move outcomes.

Tools 🧰

📋 ISO 27001 Free compliance checklist by Vanta

20% Lovable discount for my audience

Attio, the CRM used by both startups and VCs (including me). Try it for free here

FREE Startup in a Box with everything founders actually use (59 templates + 10k investor list):

Join Vanta for a live walkthrough, expert Q&A, and learn how to stay audit-ready while saving time, cost, and effort ✨

📢 Want to get in front of +500k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn (290k followers), email: sponsorsthecorners@gmail.com

Interesting Reports 📊

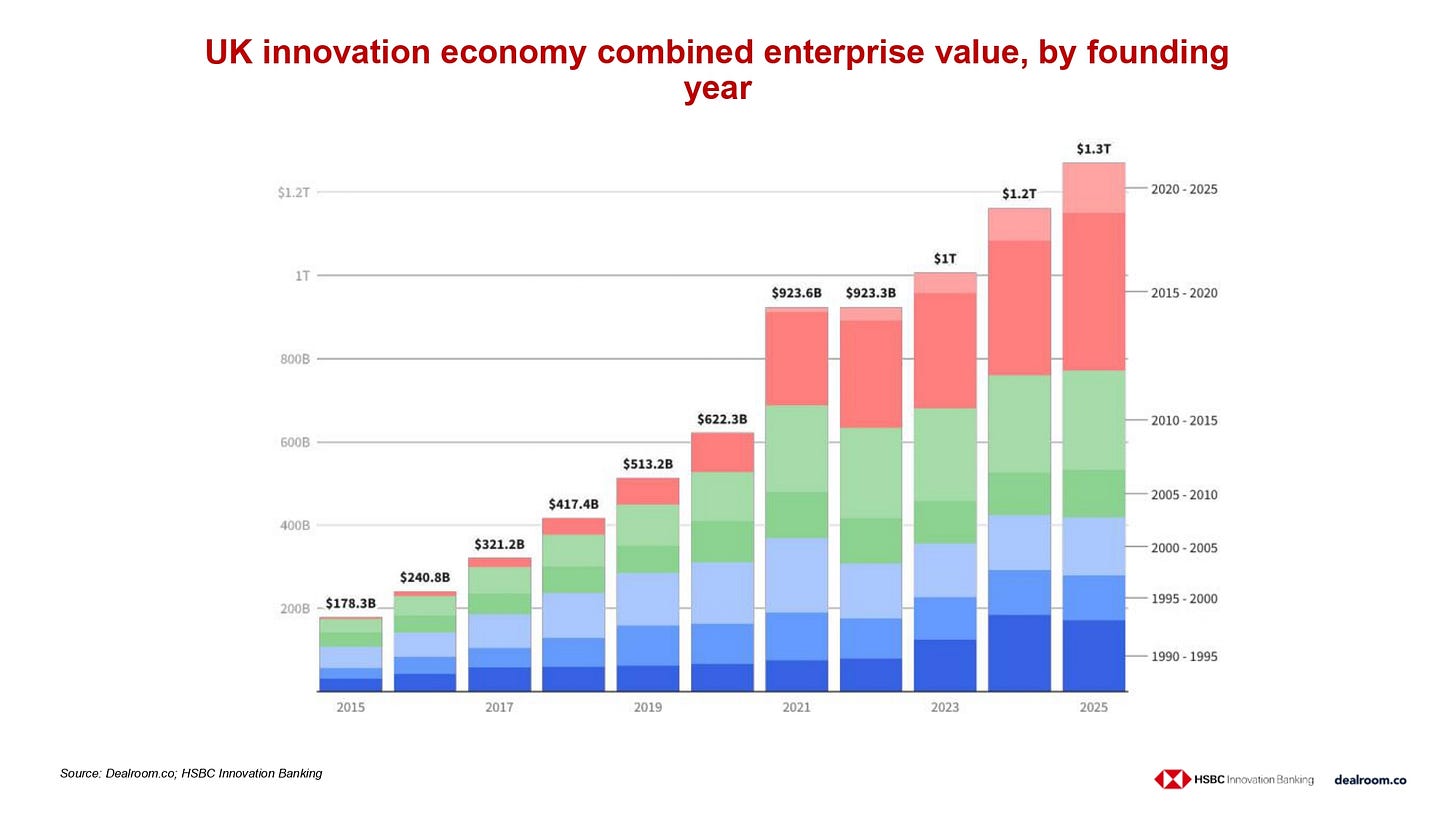

UK Venture Capital Roars Back 🚀

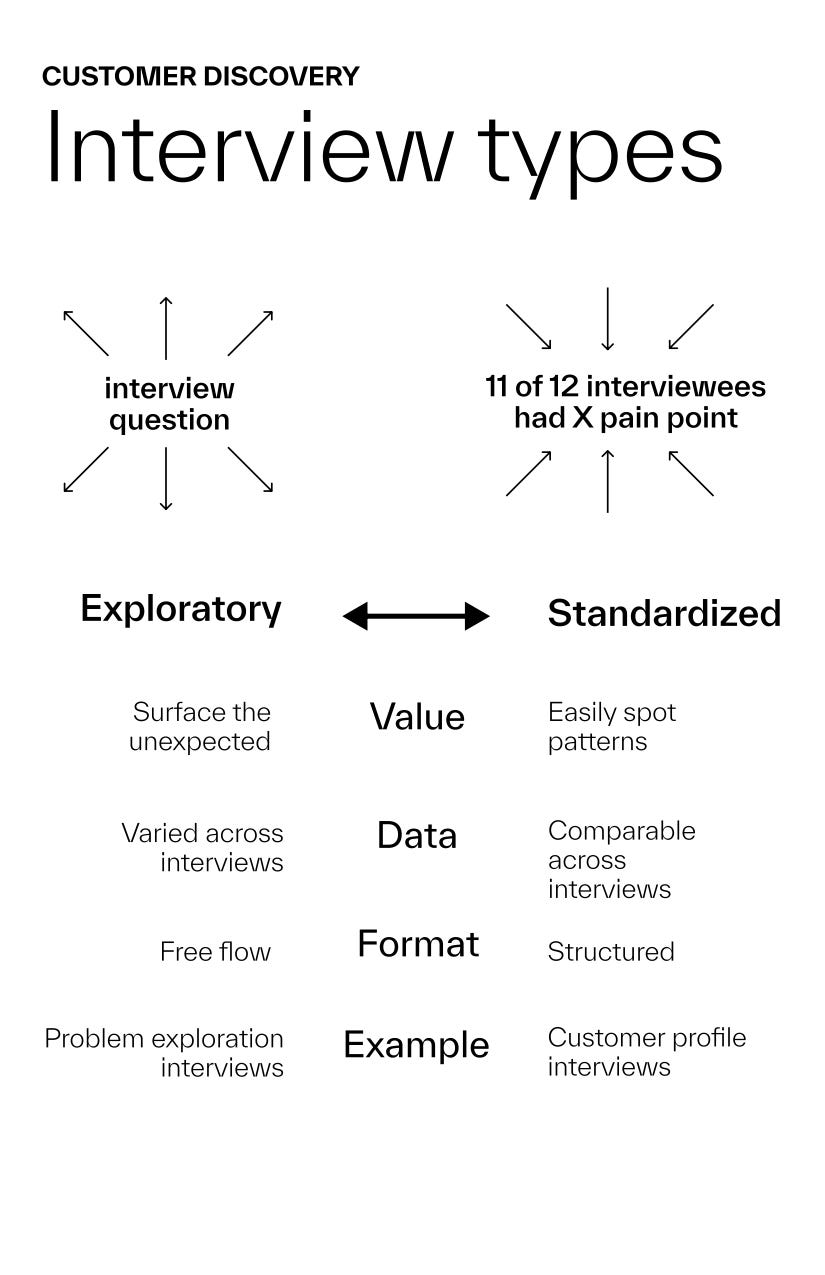

UK venture funding climbed to $23.6bn in 2025, fueled by mega rounds and category leaders like Revolut. With a $1.3T innovation economy spanning Fintech, Health, and Deep Tech, the ecosystem enters 2026 with renewed confidence. [Glen Waters]Master World-Class Customer Interviews 🗣️

Learn a proven customer profile interview method used by top strategists to uncover real insights, not surface opinions. Join Strategyzer’s early adopter group for hands-on guidance, early access, and a chance to help shape the playbook. [Kurt Bostelaar]

Recently Launched Funds 💸

Andreessen Horowitz, raised $15B across five funds spanning AI, growth, infrastructure, and American dynamism themes.

Catalio Capital Management, closed its second credit fund at over $325M, focused on life sciences financing.

TrueBridge Capital Partners, raising up to $275M for a direct fund targeting mid- to late-stage technology companies.

Dharana Capital, closed a $250M second growth fund to support scalable businesses in emerging markets.

Semcap Food & Nutrition, closed its inaugural $125M fund dedicated to food, nutrition, and health-focused investments.

Arkin Capital, closed a $100M fund targeting biotechnology and life sciences opportunities.

Rosberg Ventures, closed Fund III at $100M to continue investing in early-stage technology startups.

Company Ventures, raising up to $80M for its third fund focused on early-stage, founder-led companies.

UPenn, BioNTech & Oxford University Press, launched a $50M life sciences fund to commercialize academic and biotech research.

Superorganism, closed a $25.9M maiden fund focused on early-stage consumer and technology startups.

Arya Ventures, raised £400K for an early-stage fund focused on backing Indian-diaspora founders building tech-enabled startups.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

First Round Capital (San Francisco, CA): Investor (apply here)

Plug and Play (West Windsor Township, NJ): Ventures Associate, Enterprise AI (apply here)

General Atlantic (Stamford, CT): Fund Operations Associate (apply here)

Primary VC (New York City, NY): Healthcare Incubations Associate (apply here)

Comcast Ventures (New York City, NY): Associate (apply here)

Polychain Capital (San Francisco, CA): Head of Capital Formation (apply here)

Adverb Ventures (San Francisco, CA): Chief of Staff and Executive Assistant (apply here)

Hello World (Remote): VC Analyst (apply here)

Santander (Madrid, Spain): VC Associate (apply here)

Blue Forest (Remote): VC Associate (apply here)

Hottest Deals 💥

Skild AI, raised close to $1.4B at a valuation north of $14B to advance general-purpose robotics AI. (read more)

Mirador, secured $250M in Series B funding to accelerate growth across its investment platform. (read more)

DC BLOX, received $240M in HoldCo financing to expand its digital infrastructure and data center footprint. (read more)

Onebrief, raised $200M in Series D funding and acquired Battle Road Digital to scale military planning software. (read more)

Aspen Power, received a $200M strategic capital commitment from Deutsche Bank to expand its renewable energy portfolio. (read more)

Jetzero, raised approximately $175M in Series B financing to develop blended-wing aircraft technology. (read more)

Alpaca, secured $150M in Series D funding to expand its brokerage infrastructure and global reach. (read more)

X Square Robot, raised $140M in Series A funding to advance intelligent robotics solutions. (read more)

Defense Unicorns, closed $136M in Series B funding at a valuation above $1B to scale defense software platforms. (read more)

Mytra, raised $120M in Series C funding to expand its AI-powered logistics technology. (read more)

Caldera Therapeutics, launched with $112.5M in total capital to advance novel therapeutics. (read more)

osapiens, secured $100M in Series C funding to scale its sustainability and compliance platform. (read more)

Proxima, raised $80M in seed funding to build next-generation space and defense capabilities. (read more)

Inquis Medical, closed $75M in Series C funding to advance its medical device pipeline. (read more)

Accelsius, raised $65M in Series B funding to expand advanced cooling solutions for data centers. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

The Cash Runway Model Every Founder Needs

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox