AI’s Fastest Growth Cycle Yet⚡, The VC Fund Trap📉, State of AI 2025🤖

Another week, another pulse check on venture.

From top insights and reports to new funds, VC jobs, resources, and the hottest deals, here’s everything you need to stay ahead.

Let’s dive in 👇

Brought to you by Vanta

Unlock Effortless Compliance for Startups 🔐

Don’t let compliance be a blocker for growth…

Vanta’s solution automates up to 90% of the work for ISO 27001, SOC 2, and more, making it easier for startups to maintain continuous compliance and build trust with customers.

Explore how Vanta’s platform can save you time and accelerate growth 👇

In-Depth Insights 🔍

The VC Fund Trap: Stuck in the Middle 📉

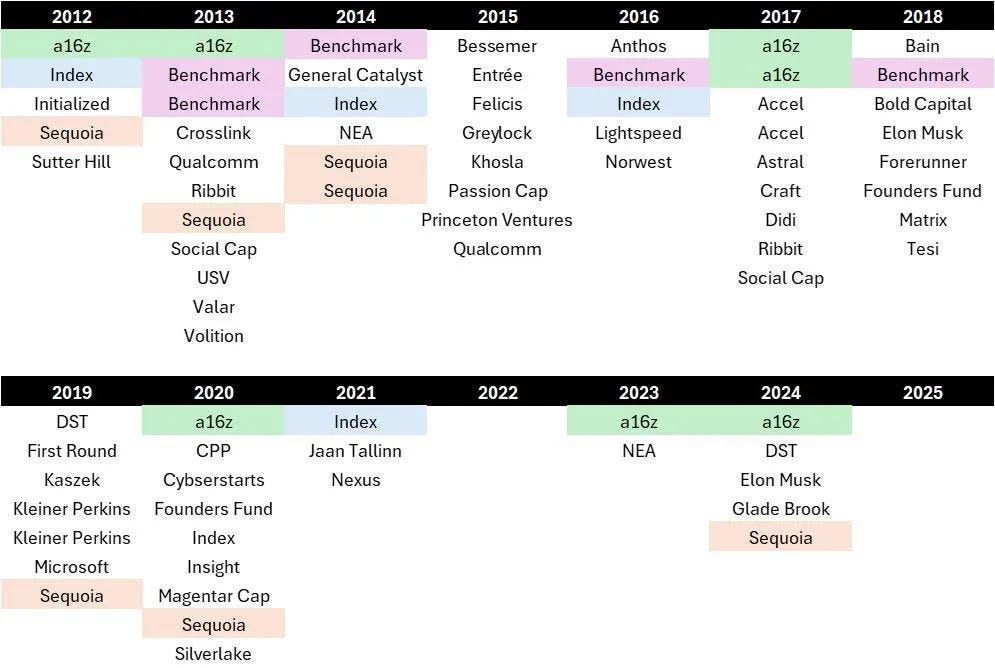

Venture returns are polarizing and funds that are neither small and disciplined nor elite and access-driven face a structural squeeze. Without ownership efficiency or top-tier deal flow, the middle risks drifting into irrelevance between 2025 and 2030. [James Heath]AI’s Fastest Growth Cycle Yet⚡

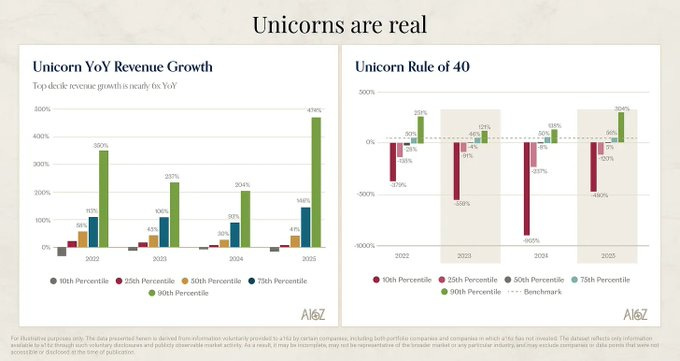

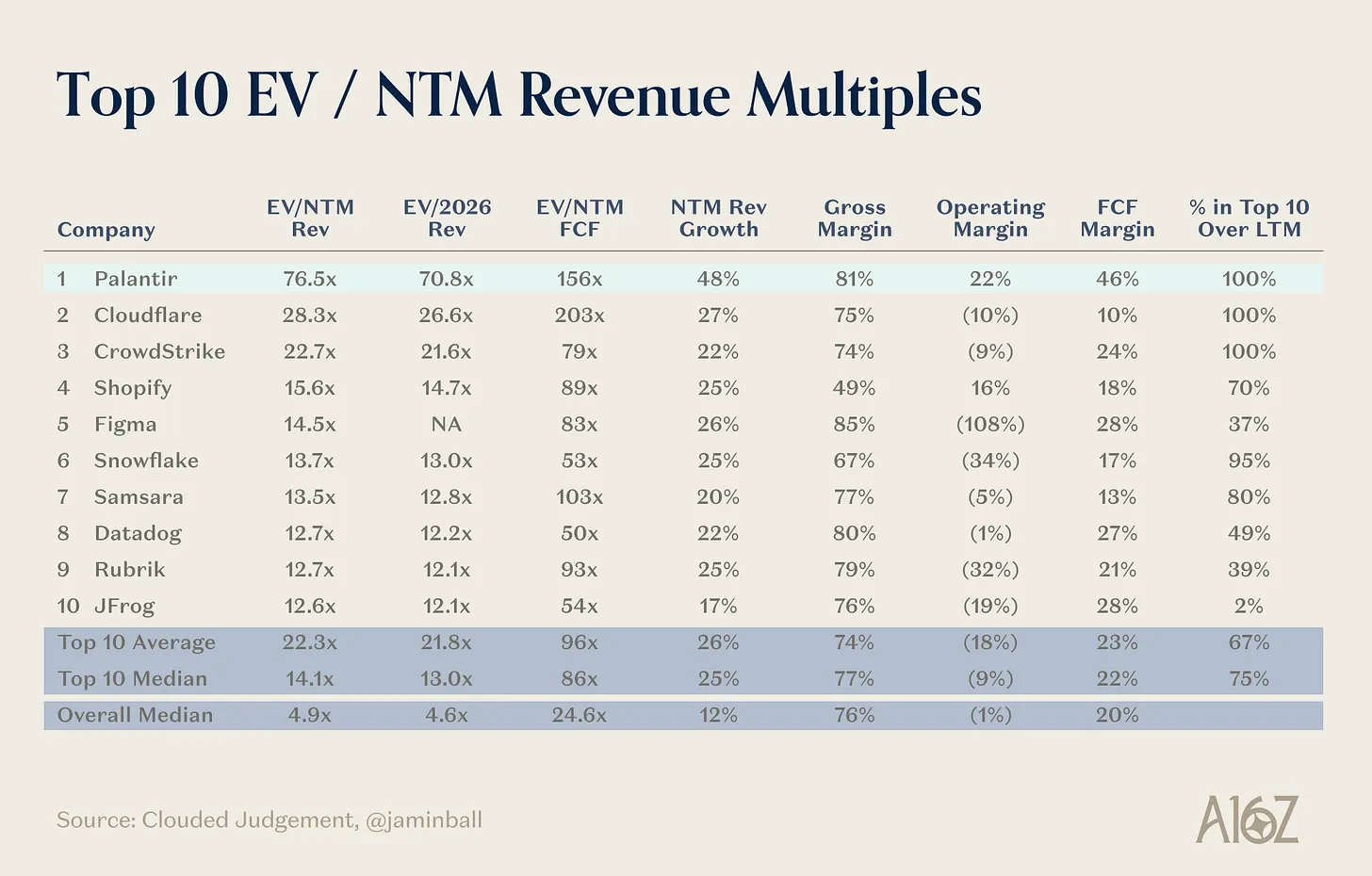

Top AI companies are scaling revenue at multiples the market has never seen before, pulling far ahead of peers. Market definitions are shifting as scale concentrates quickly, forcing incumbents into defensive positions and redefining leadership. [David George]AI Breaks Into the Top 1% of Global Forecasters 🔮

Crazy. An automated system ranked fourth out of nearly 500 competitors, outperforming almost all human participants. The edge came from disciplined data sourcing, multi-step reasoning, and calibrated uncertainty rather than chasing headlines. [Polymarket]How Elad Gil Built a One-Person Venture Machine Worth Billions 🧠

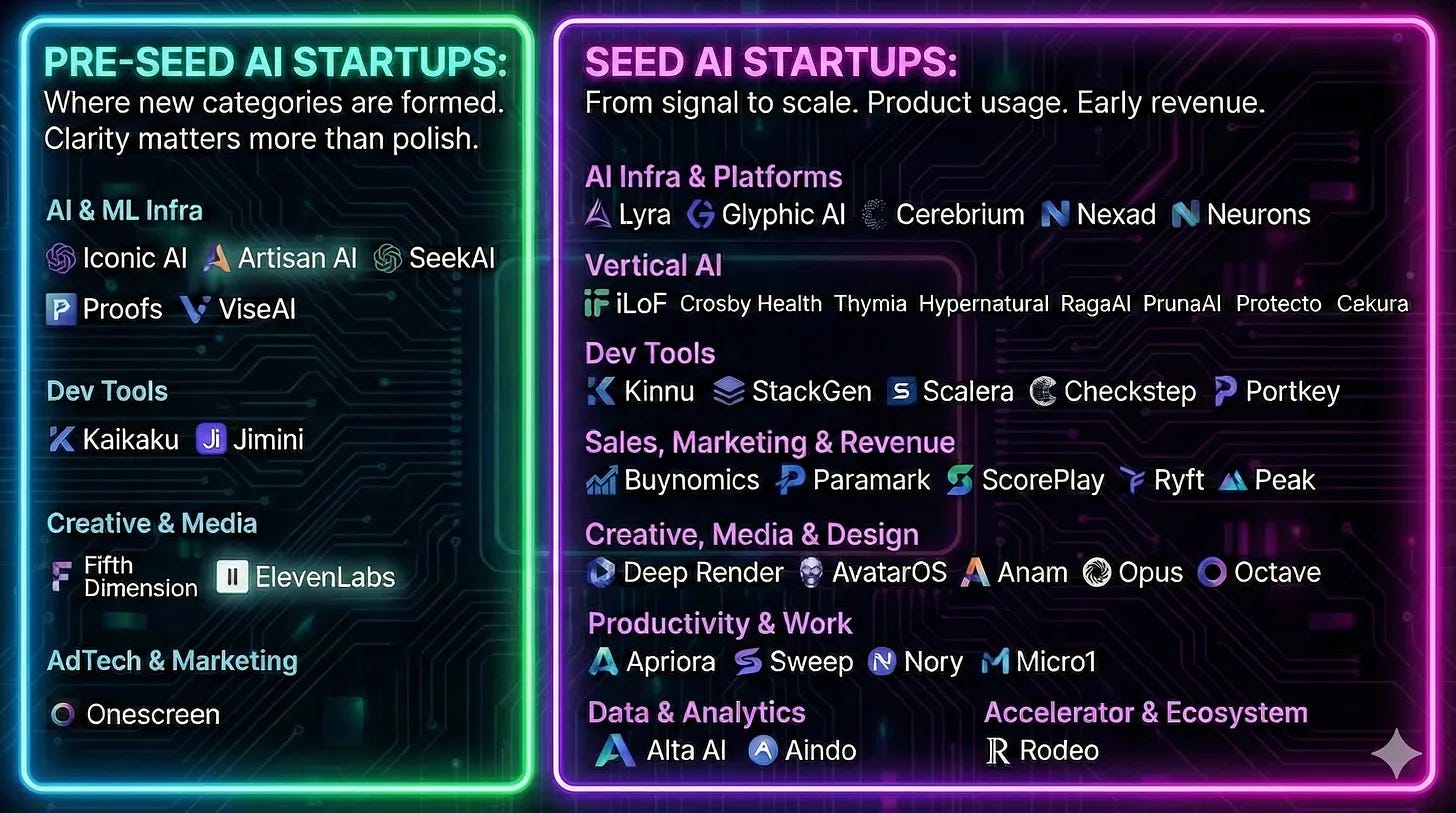

Quiet conviction, operating scars, and long-term thinking turned Elad Gil into a solo investor with billions under management. From Google and Twitter to AI and defense, his playbook shows how judgment-led venture generates outsized results.The AI Pitch Decks Defining the Next Wave 🤖📊🚀🧠

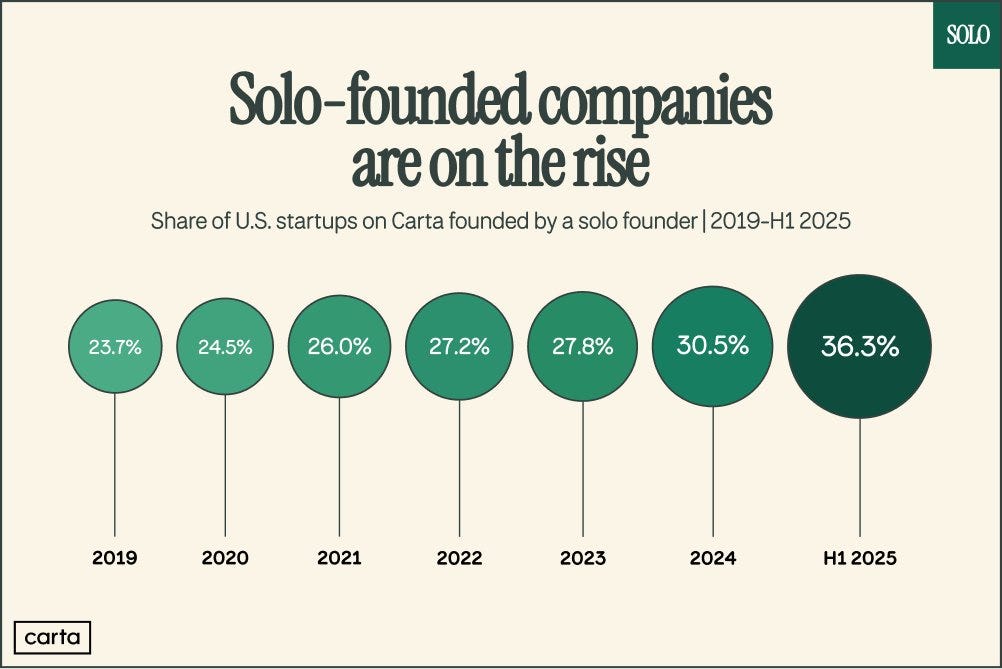

A collection of 46 real Pre-Seed and Seed decks (including Eleven Labs) reveals how founders frame moats, distribution, and timing before outcomes are obvious. The patterns show how AI-native teams position clarity, data, and go-to-market in tight capital markets.Why Solo Founders Are the New Normal 🚀

Solo founders now start over a third of all new startups, enabled by AI tools and the authorship advantage. One person can ship what previously required a full team, transforming how companies are built and funded. [Solo Founders]The Palantirization Trap: When Software Meets High-Touch Delivery 🛠️

Copying Palantir’s forward-deployed engineer model can backfire for most startups, explains Marc Andrusko. Knowing what to adopt and what to avoid is key to building scalable enterprise platforms. [Marc Andrusko]The Future of Enterprise Software in an AI-First World 🤖

AI agents will turn systems of record into critical infrastructure for agent-driven work. Aaron Levie highlights how agentic users expand markets and create new opportunities for both incumbents and startups. [Aaron Levie]

Tools 🧰

Free year (save $360) on Framer so you can launch a production-ready site

ISO 27001 Free compliance checklist by Vanta

20% Lovable discount for my audience

Attio, the CRM used by both startups and VCs (including me). Try it for free here

$1,000 off on your compliance, use it for ISO 27001 and SOC 2

📢 Want to get in front of +500k founders and investors?

For sponsorship opportunities across this newsletter and LinkedIn (290k followers), email: sponsorsthecorners@gmail.com

Interesting Reports 📊

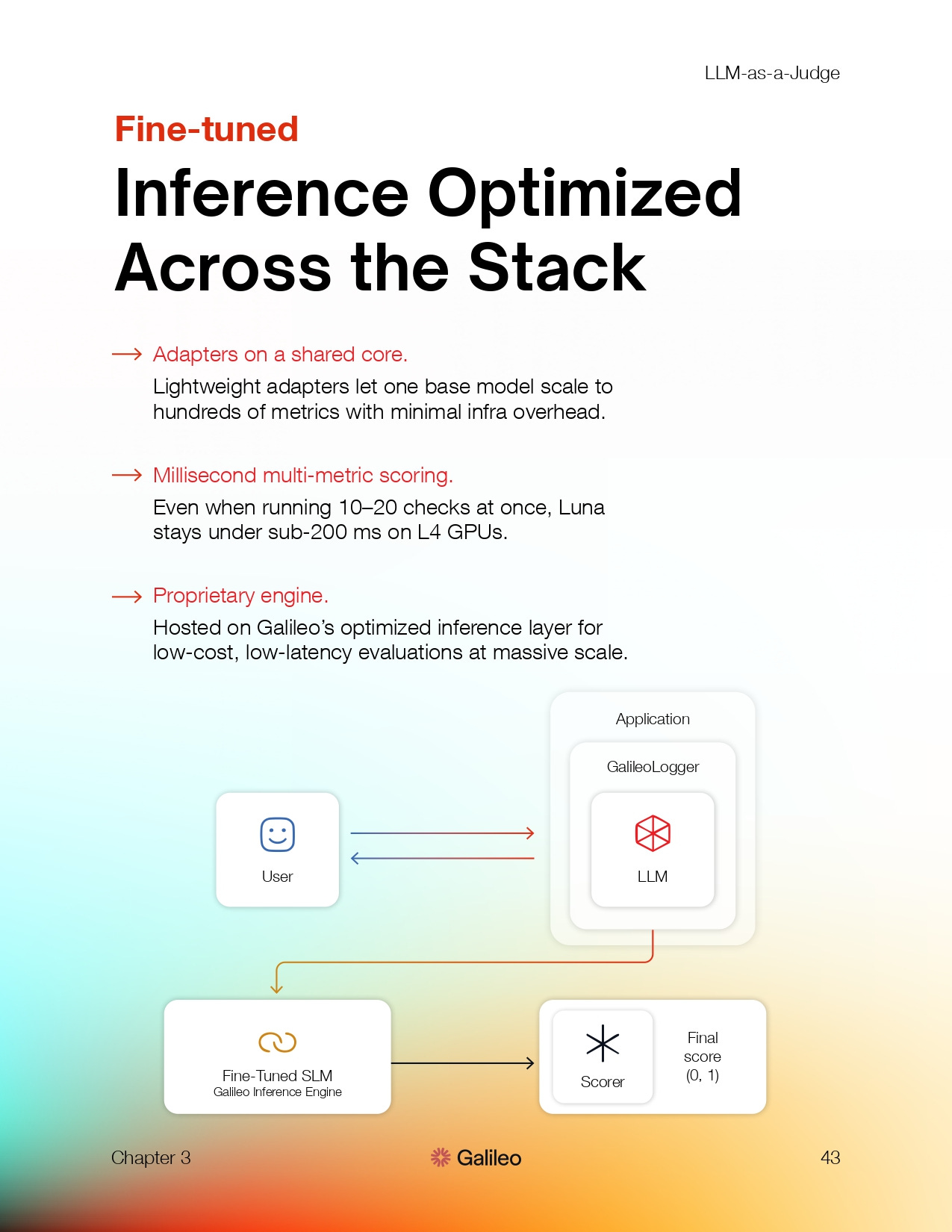

Stop Paying $200/Month for AI QA 🛑

Alex Cinovoj demonstrates how to replace slow, expensive human QA with automated LLM evaluation. This method can run 10,000 checks in minutes instead of spending $15K and days of work.State of AI 2025: Funding, Unicorns & M&A 🤖

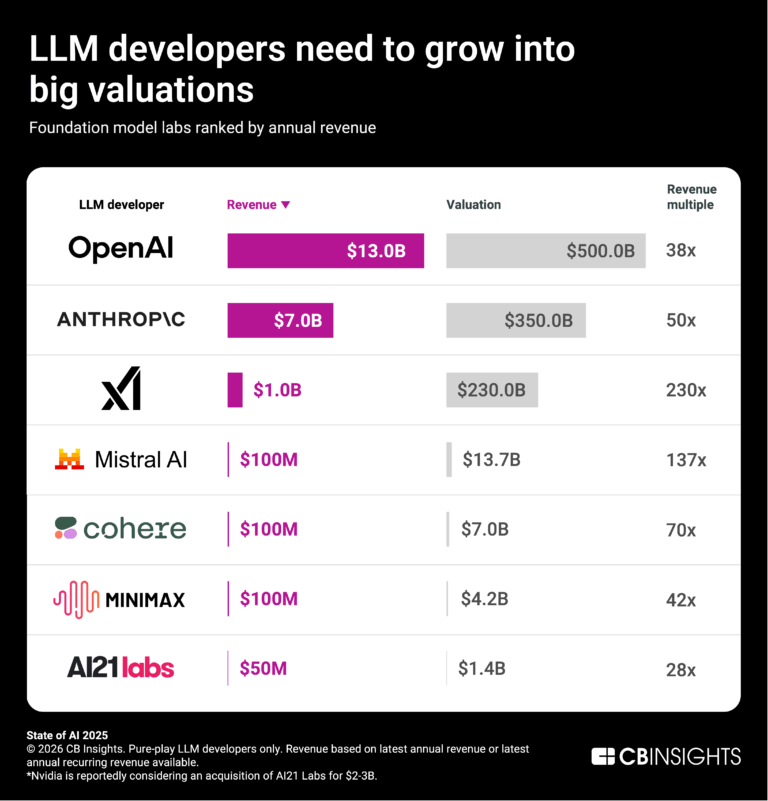

CB Insights reports over $200B in AI funding alongside a surge in robotics deals and 75 new AI unicorns. These insights are essential for investors and founders tracking market momentum. [CB Insights]AI That Does, Not Just Advises ⚡

Tyllen Bicakcic highlights how AI in finance is moving from recommendations to executing actions. Systems now manage portfolios, pay bills, and must remain traceable and auditable for compliance. [Tyllen Bicakcic]

Recently Launched Funds 💸

DTCP launched a €500M fund backing defense and security tech in Europe.

Blueprint Equity closed $333M Fund III to scale profitable software and tech-enabled services companies.

Healthier Capital closed its debut $220M Fund I focused on health, wellness, and prevention.

VI Partners held a first close of CHF 150M for its latest Swiss and European tech fund.

Flashpoint reached first close on its second direct secondaries vehicle.

Social Leverage raised $85M for its fifth seed-stage fund.

Ananda Impact Ventures held a €73M first close for its fifth impact-focused core fund.

Epidarex Capital secured a £50M commitment from the British Business Bank for life sciences investing.

Demium (Mission) rebranded as Mission and launched a new early-stage venture fund.

Vanagon Ventures closed its €20M debut fund for early-stage European startups.

PureTerra Ventures launched its second fund focused on global water technology solutions.

Fundraising?

If you're raising a round, Luis Llorens and I can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators.

Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

These are the startups raising NOW

VC Jobs 💼

Struck Capital (Los Angeles, USA): Investment Team Member (apply here)

Open Core Ventures (Remote): Business Operations (apply here)

Ibex Investors (Denver OR / Silicon Valley, USA): Investment Team – Mobility VC (apply here)

Mento VC (Remote): Investor Associate (apply here)

Saints Capital (New York City, USA): Analyst / Associate (apply here)

The Sovereign AI Fund (UK): Managing Partner (apply here)

6MV (Remote): Investment Team (apply here)

Village Global / Office of Reid Hoffman (Remote): Head of Comms (apply here)

Voy Ventures (San Francisco, USA): Corporate VC - Investment Director (apply here)

Wittington Ventures (Toronto, Canada): Growth Fund Director (apply here)

NBA Investments (New York City, USA): Principal (apply here)

Hottest Deals 💥

RenewA, raised $502M in funding to expand large-scale renewable energy infrastructure projects. (read more)

Humans, raised $480M in seed funding at a $4.48B valuation to build an AI-powered digital workforce. (read more)

Mews, raised $300M in Series D funding to scale its global hospitality management platform. (read more)

OpenEvidence, raised $250M in Series D funding to expand AI-driven clinical decision support tools. (read more)

Noveon Magnetics, raised $215M in Series C funding to scale rare-earth magnet manufacturing in the U.S. (read more)

Duetti, raised $200M in funding to acquire and scale music intellectual property catalogs. (read more)

Beast Industries, received a $200M investment from BitMine Immersion Technologies to expand digital infrastructure operations. (read more)

Claroty, raised $150M in Series F funding to strengthen its industrial cybersecurity platform. (read more)

Preply, raised $150M in Series D funding to grow its global online language learning marketplace. (read more)

Zanskar, raised $115M in Series C funding to scale geothermal energy exploration and development. (read more)

Neurophos, raised $110M in Series A funding to advance photonic computing technologies. (read more)

LiveKit, raised $100M in Series C funding at a $1B valuation to accelerate real-time audio and video infrastructure. (read more)

Railway, raised $100M in Series B funding to scale its developer-first cloud infrastructure platform. (read more)

DealHub.io, secured $100M in new funding to accelerate growth in revenue operations and CPQ software. (read more)

Sage Geosystems, raised over $97M in Series B funding to advance geothermal energy storage solutions. (read more)

RESOURCES 🛠️

access all for the next year with a 25% limited discount

The Cash Runway Model Every Founder Needs

✅ FREE Startup Kit for founders (10k investor list + 59 templates)

✅ The 100 Most Important Pension Funds in the World

✅ 350+ verified platforms where you can post your startup

✅ 153 Startups Fundraising Right Now (And Their DECKS)

✅ RIP SEO: the GEO Playbook for 2025

✅ The Venture Capital Method: How Investors Really Value Startups

✅ IRR vs Return Multiple Explained + Template

✅ The Headcount Planning Module

✅ Synthesia’s deck (got them $180M)

✅ CLTV vs CAC Ratio Excel Model

✅ 100+ Pitch Decks That Raised Over $2B

✅ VCs Due Diligence Excel Template

✅ SaaS Financial Model

✅ 10k Investors List

✅ Cap Table at Series A & B

✅ The Startup MIS Template: A Excel Dashboard to Track Your Key Metrics

✅ The Go-To Pricing Guide for Early-Stage Founders + Toolkit

✅ DCF Valuation Method Template: A Practical Guide for Founders

✅ How Much Are Your Startup Stock Options Really Worth?

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 2,500+ Angel Investors Backing AI & SaaS Startups

✅ Cap Table Mastery: How to Manage Startup Equity from Seed to Series C

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox